42 schedule c worksheet 2017

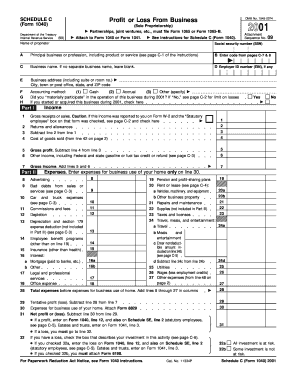

Schedule C is the tax form filed by most sole proprietors. As you can tell from its title, "Profit or Loss From Business," it´s used to report both income and losses. Many times, Schedule C filers are self-employed taxpayers who are just getting their businesses started. In addition to those who do well at the start, this group can also ...

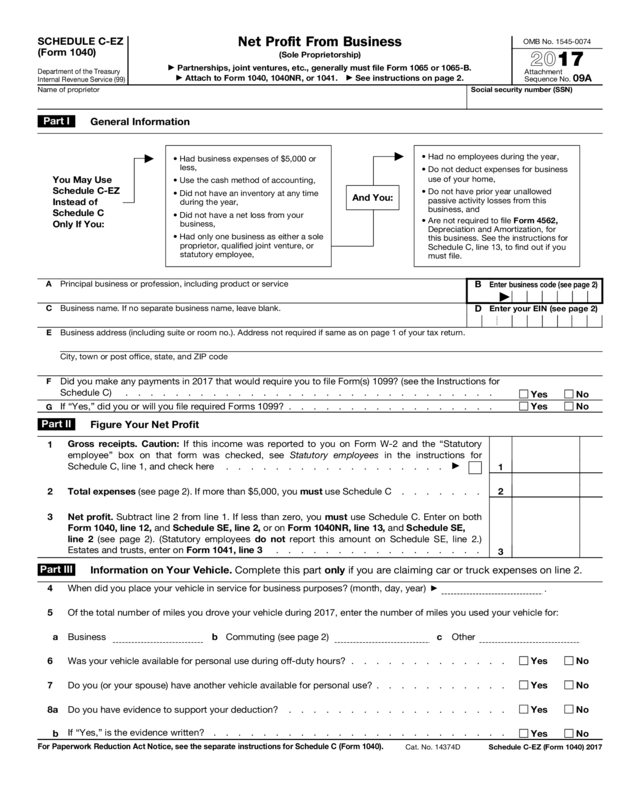

Is there a downloadable/fillable version of Schedule C-7 (Form 886-A) (May 2017). Travel, Meals and Entertainment Expenses? I don't know if anyone will be familiar with those forms in this forum, but you can wait and see what responses you get during the day when more folks familiar with audits will be around.

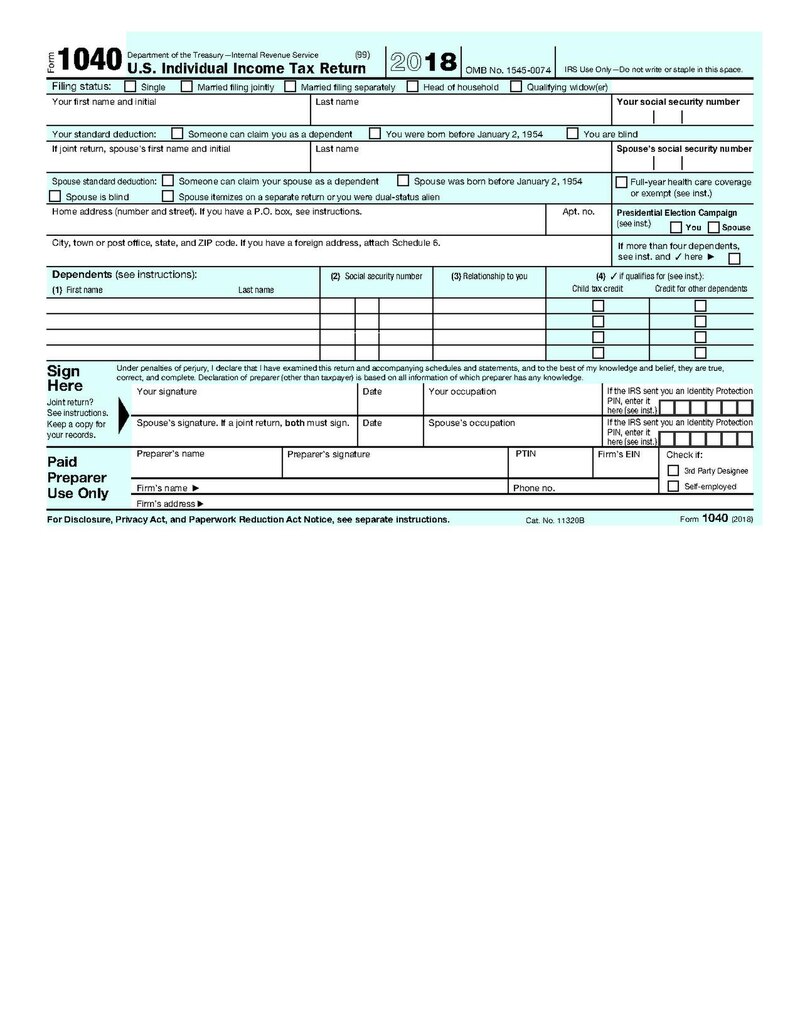

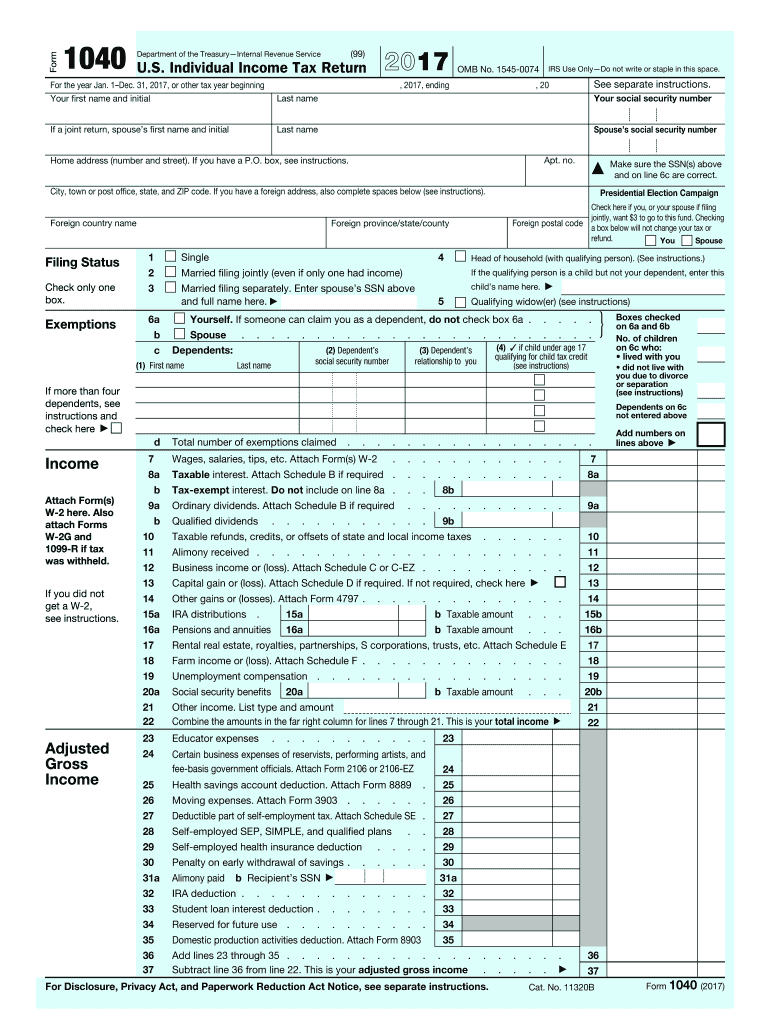

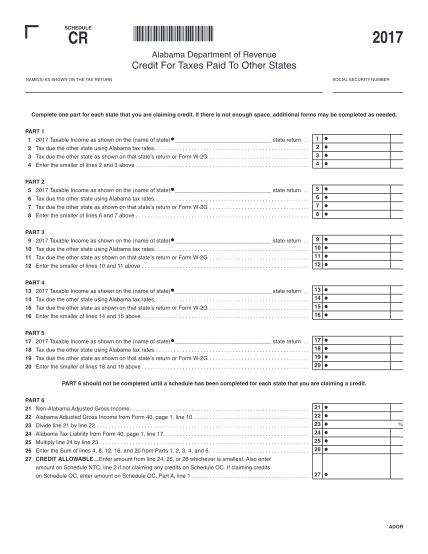

SCHEDULE D (Form 1040) Department of the Treasury Internal Revenue Service (99) Capital Gains and Losses. . Attach to Form 1040 or Form 1040NR.

Schedule c worksheet 2017

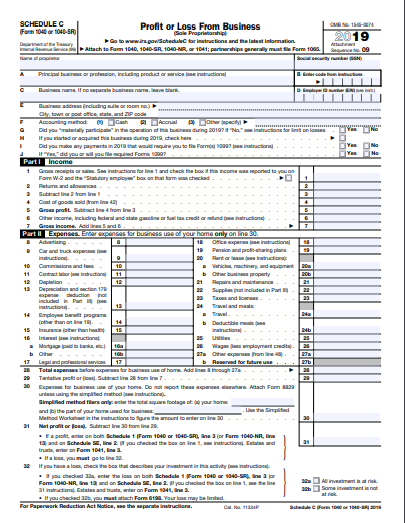

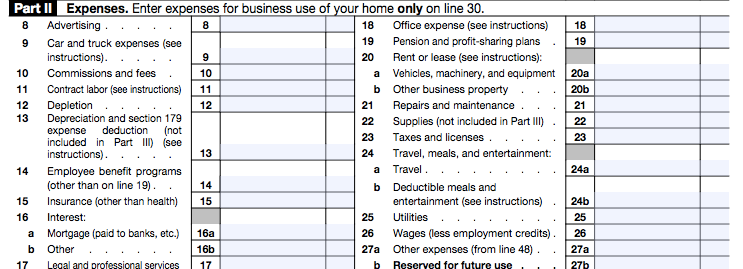

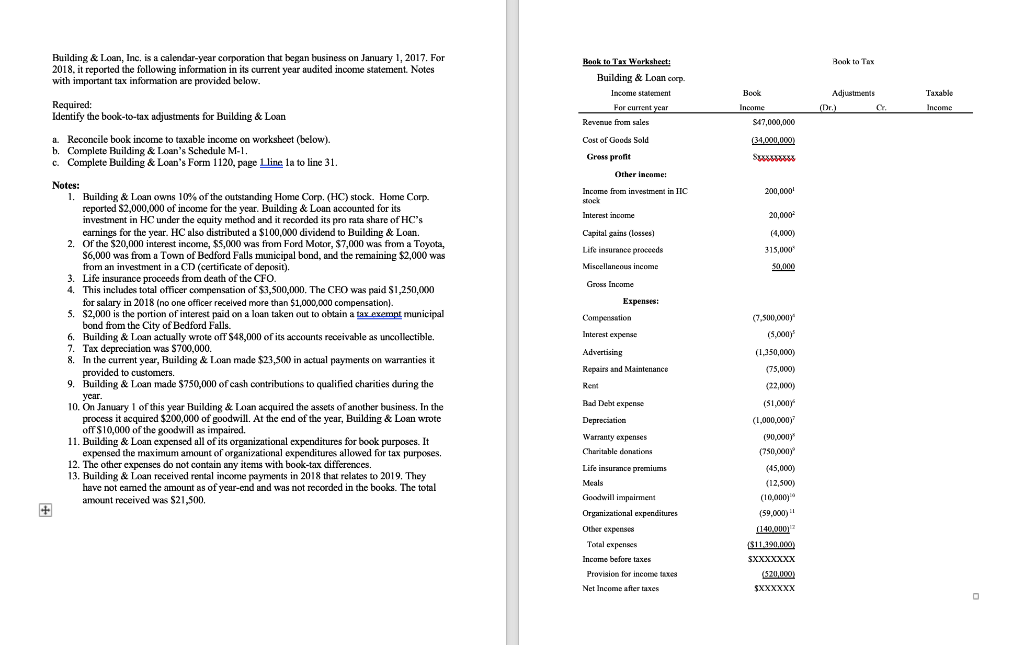

Use Schedule C (Form 1040) to report income or loss from a business you operated or a profession you practiced as a sole proprietor. An activity qualifies as a business if: Your primary purpose for engaging in the activity is for income or profit. You are involved in the activity with continuity and regularity. Current Revision

Get and Sign About Schedule C Form 1040 Or 1040 Sr, Profit Or Loss From 2020-2021 . Service 99 Attach to Form 1040 1040-SR 1040-NR or 1041 partnerships generally must file Form 1065. Attachment Sequence No* 09 Name of proprietor Social security number SSN A B Enter code from instructions Principal business or profession including product or service see instructions C Business name.

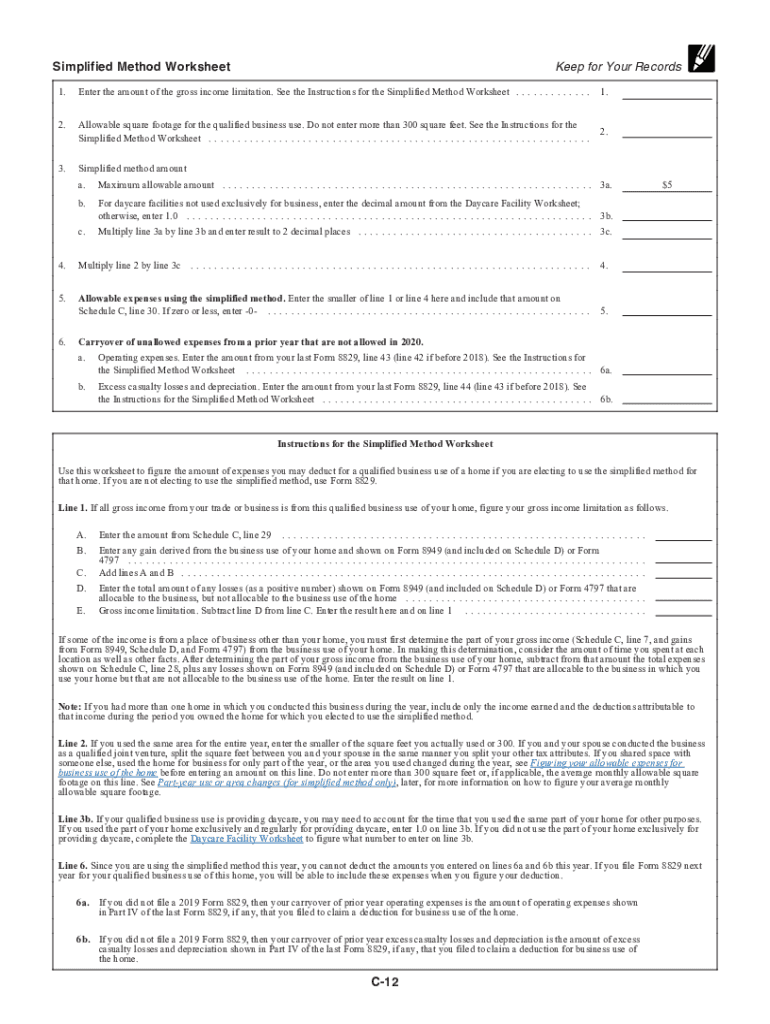

Usually, people who file a Schedule C Tax Form will also have to file a Schedule SE Tax Form: Self-Employment Tax. You may also need Form 4562 to claim depreciation or Form 8829 to claim actual expenses from business use of your home. Get Help With Small Business Taxes and Filing IRS Schedule C. Business tax forms, like the IRS Schedule C, can ...

Schedule c worksheet 2017.

ADOR 1064 (2/20) Worksheet C SALE OF MOTOR VEHICLE TO NONRESIDENT UNDER A.R.S. § 42-5061(U) Automatic worksheet to compute Arizona Transaction Privilege Tax (adjusted to state tax rate of nonresident), County Excise Tax, and Form TPT-2 Deductions.

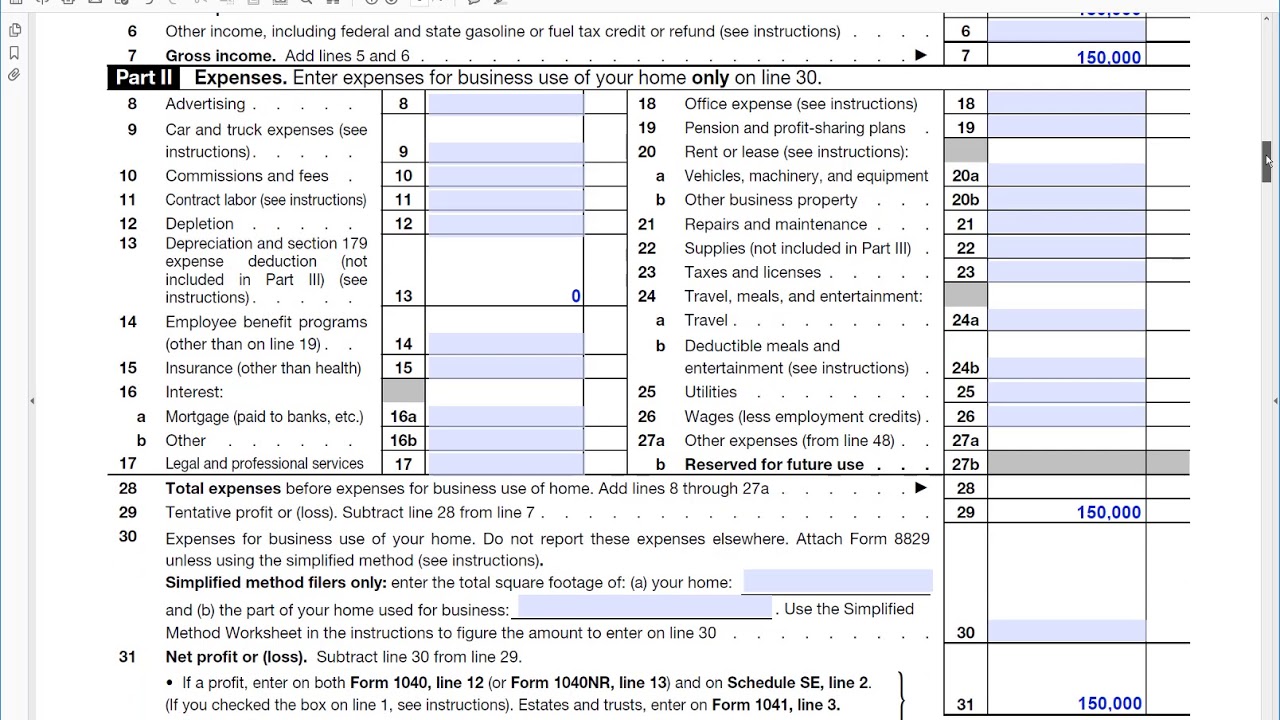

Method Worksheet in the instructions to figure the amount to enter on line 30 . . . . . . . . . 30 31 . Net profit or (loss). Subtract line 30 from line 29. • If a profit, enter on both . Schedule 1 (Form 1040), line 3, and on . Schedule SE, line 2. (If you checked the box on line 1, see instructions). Estates and trusts, enter on . Form 1041 ...

SCHEDULE C (Form 1040) Department of the Treasury ... Method Worksheet in the instructions to figure the amount to enter on line 30 . . . . . . . . . 30 . ... Schedule C (Form 1040) 2017 . Schedule C (Form 1040) 2017. Page 2 Part III Cost of Goods Sold (see instructions) 33 .

Subtract line 9 from line 2. Student loan interest adjustment. If line 1 is less than line 10, enter the difference here and on Schedule CA (540), line 33, column C. Line 34 (Reserved) - The tuition and fees deduction that was taken on this line on the 2016 federal Form 1040 has expired and does not apply for 2017.

Schedule C — Profit or Loss from Business (Sole Proprietorship) (Chapter 5304) ... Form 8829 or Simplified Method Worksheet) + Business Miles (Page 2, Part IV, Line 44a or Related 4562, Line 30) x Depreciation Rate (2019-26¢ and 2018-25¢) $ $ = Total Mileage Depreciation + $ $

Our cash flow worksheets are the industry standard for excellence in analyzing self-employed borrower income. Bulletin #14-2021 Announces alignment with Agencies' loan limit changes for MGIC Go! loans. Dismiss Alert. Bulletin #15-2021 Announces increases to loan limits for Non-GSE loans.

X Depreciation Rate (2017 and 2018-25¢) = Total Mileage Depreciation + Subtotal Schedule C = 4 Schedule D - Capital Gains and Losses a. Recurring Capital Gains (from Self-Employment) + 5 Schedule E - Supplemental Income and Loss Note: A lender may use Fannie Mae Rental Income Worksheets (Form 1037 or Form 1038) or a comparable

You should be able to edit/delete any transferred-in 2017 expenses there on the Worksheet. Then check the Schedule C, Part V to be sure your changes flowed correctly to the Schedule C, Part V. The other way (and the preferable method) would be to use the interview mode (step-by-step) to edit the 2017 transferred expenses.

Also, use Schedule C to report (a) wages and expenses you had as a statutory em-ployee, (b) income and deductions of certain qualified joint ventures, and (c) certain amounts shown on a Form 1099, such as Form 1099-MISC, Form 1099-NEC, and Form 1099-K. See the instructions on your Form 1099 for more information about what to report on Schedule C.

Follow these simple guidelines to get Schedule C Worksheet ready for sending: Select the form you require in our library of legal forms. ... 2017 Schedule 8812 (Form 1040A or 1040) - Internal... C For the third dependent identified with an ITIN and listed as a qualifying child for...

Schedule C 2019. Fill Out, Securely Sign, Print or Email Your 2019 Instructions for Schedule C. 2019 Instructions for Schedule C, Profit or Loss from Business Instantly with SignNow. the Most Secure Digital Platform to Get Legally Binding, Electronically Signed Documents in Just a Few Seconds. Available for PC, iOS and Android. Start a Free Trial Now to Save Yourself Time and Money!

Form NOL, Nebraska Net Operating Loss Worksheet Tax Year 2017. Form. Form 1040N-ES, 2018 Nebraska Individual Estimated Income Tax Payment Voucher. Form. Form 2210N, 2017 Individual Underpayment of Estimated Tax. Form. Form 1310N, Statement of Person Claiming Refund Due a Deceased Person.

The 2017 tax law (effective for 2018 taxes and beyond) made several changes that affect your business income tax and the way you file Schedule C. You may be able to use the cash method of accounting and to be exempt from counting inventory and deduct certain expenses instead of depreciating them.

Schedule 1 C Ez 2017. Fill out, securely sign, print or email your schedule c ez form 2017-2020 instantly with SignNow. The most secure digital platform to get legally binding, electronically signed documents in just a few seconds. Available for PC, iOS and Android. Start a free trial now to save yourself time and money!

Also, use Schedule C to report (a) wages and expenses you had as a statutory employee, (b) income and deductions of certain qualified joint ventures, and (c) certain amounts shown on a Form 1099, such as Form 1099-MISC, Form 1099-NEC, and Form 1099-K. See the instructions on your Form 1099 for more information about what to report on Schedule C.

In addition, with our service, all the data you provide in the Schedule C Worksheet is well-protected from loss or damage with the help of top-notch file encryption. The tips below will allow you to complete Schedule C Worksheet quickly and easily: ... 2017 Schedule 8812 (Form 1040A or 1040) - Internal...

2017 Instructions for Schedule CProfit or Loss From Business Use Schedule C (Form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. An activity qualifies as a business if your primary purpose for engaging in the activity is for income or profit and you are

Schedule C is part of Form 1040. It's used by sole proprietors to let the IRS know how much their business made or lost in the last year. The IRS uses the information in Schedule C to calculate how much taxable profit you made—and assess any taxes or refunds owing. You can find the fillable form here: IRS Schedule C: Profit or Loss From ...

The Schedule C form is generally published in October of each year by the IRS. Schedule C instructions follow later usually by the end of November. If published, the 2020 tax year PDF file will display, the prior tax year 2019 if not. Last year, many of the federal income tax forms were published late in December, with instructions booklet ...

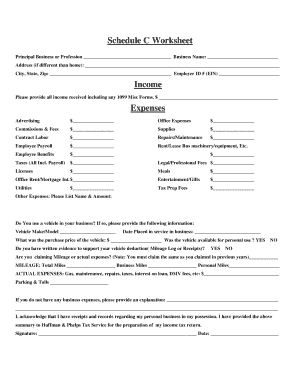

Schedule C Worksheet for Self Employed Businesses and/or Independent Contractors IRS requires we have on file your own information to support all Schedule C's Business Name (if any)_____ Address (if any) _____ Is this your first year in business? Yes

(Schedule C) Self-Employed Business Expenses Worksheet for Single member LLC and sole proprietors. Use separate sheet for each business. Use a separate worksheet for each business owned/operated. Do not duplicate expenses. Name & type of business: _____ Owned/Operated by: Client Spouse

of Schedule HC Full-year MCC. Fill in this oval if you had health insurance that met MCC requirements for the en-tire year of 2017 and go to line 4. Part-year MCC. Fill in this oval if you had health insurance that met MCC requirements for only part of 2017 and go to line 4. This means for the other parts of 2017, you had no health insurance

2017 Inst 1040 (Schedule C) Instructions for Schedule C (Form 1040), Profit or Loss From Business (Sole Proprietorship) 2017 Form 1040 (Schedule C) Profit or Loss from Business (Sole Proprietorship) 2016 Inst 1040 (Schedule C) Instructions for Schedule C (Form 1040), Profit or Loss From Business (Sole Proprietorship) ...

0 Response to "42 schedule c worksheet 2017"

Post a Comment