43 saving and investing worksheet answers

Created Date: 1/3/2000 6:27:43 PM

12-H the Rule of 72 12-I bonds 12-J mutual funds 12-K stocks 12-L real estate 12-M retirement plans 12-N individual retirement accounts (IRAs)—an example of return on investment 12-O comparing savings and investment plans 12-P avoiding investment fraud student activities 12-1 Setting and Prioritizing Your Financial Goals Have students complete the "Setting Financial Goals" worksheet.

of saving and investing by following this advice: always pay yourself or your family first. Many people find it easier to pay themselves first if they allow their bank to automatically re-move money from their paycheck and deposit it into a savings or investment account. Likely even better, for tax purposes, is to participate in an

Saving and investing worksheet answers

50 Saving and Investing Worksheet one of Chessmuseum Template Library - free resume template for word education on a resume example ideas, to explore this 50 Saving and Investing Worksheet idea you can browse by Template and . We hope your happy with this 50 Saving and Investing Worksheet idea.

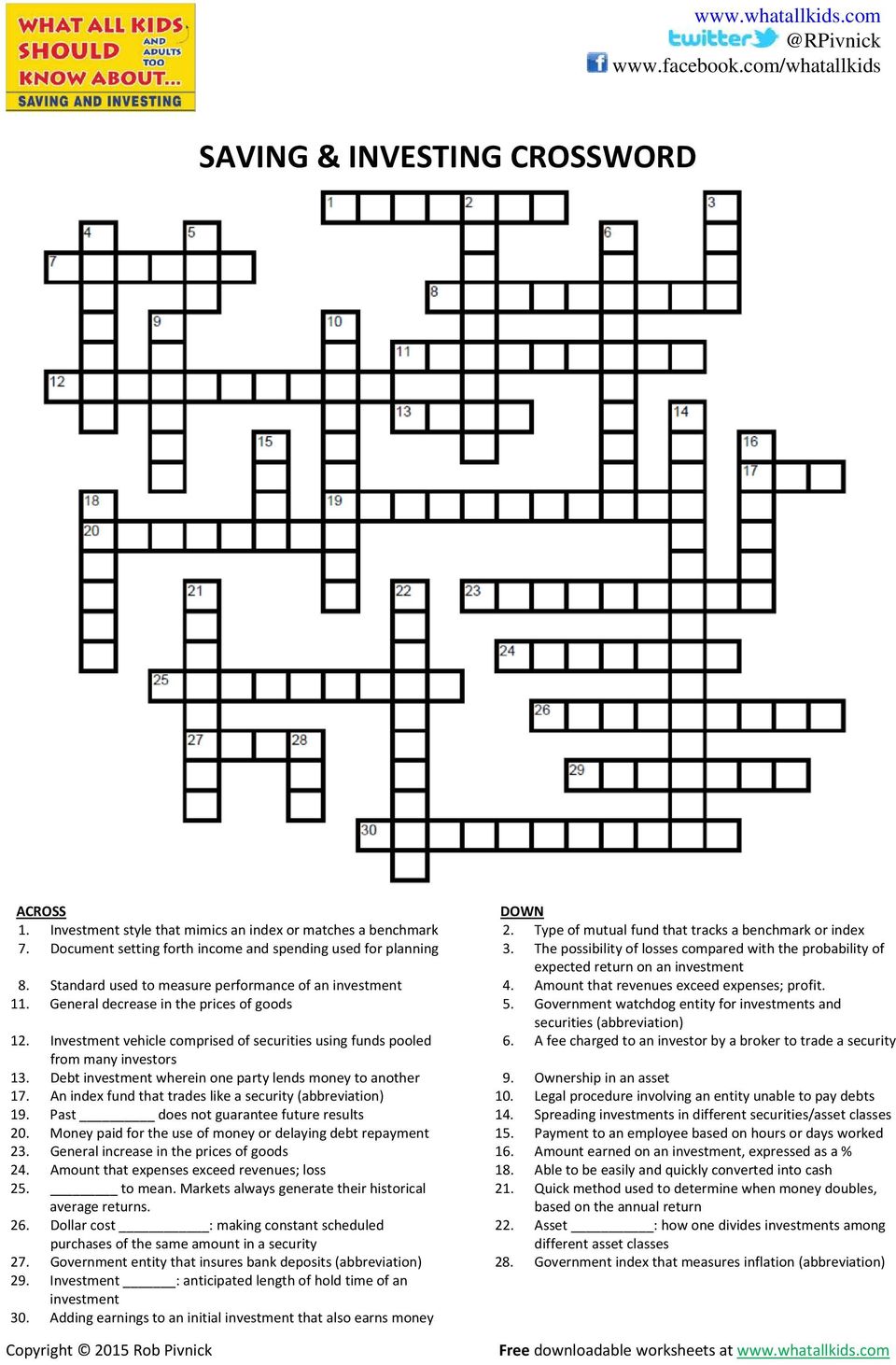

saving and investing . websites. Saving and investing are cornerstones of financial management. To be effective money managers, students need to: establish and maintain a budget; set clear, ... Have students complete the "Calculating Interest" worksheet. Review the answers and, as needed, show the calculations on the board.

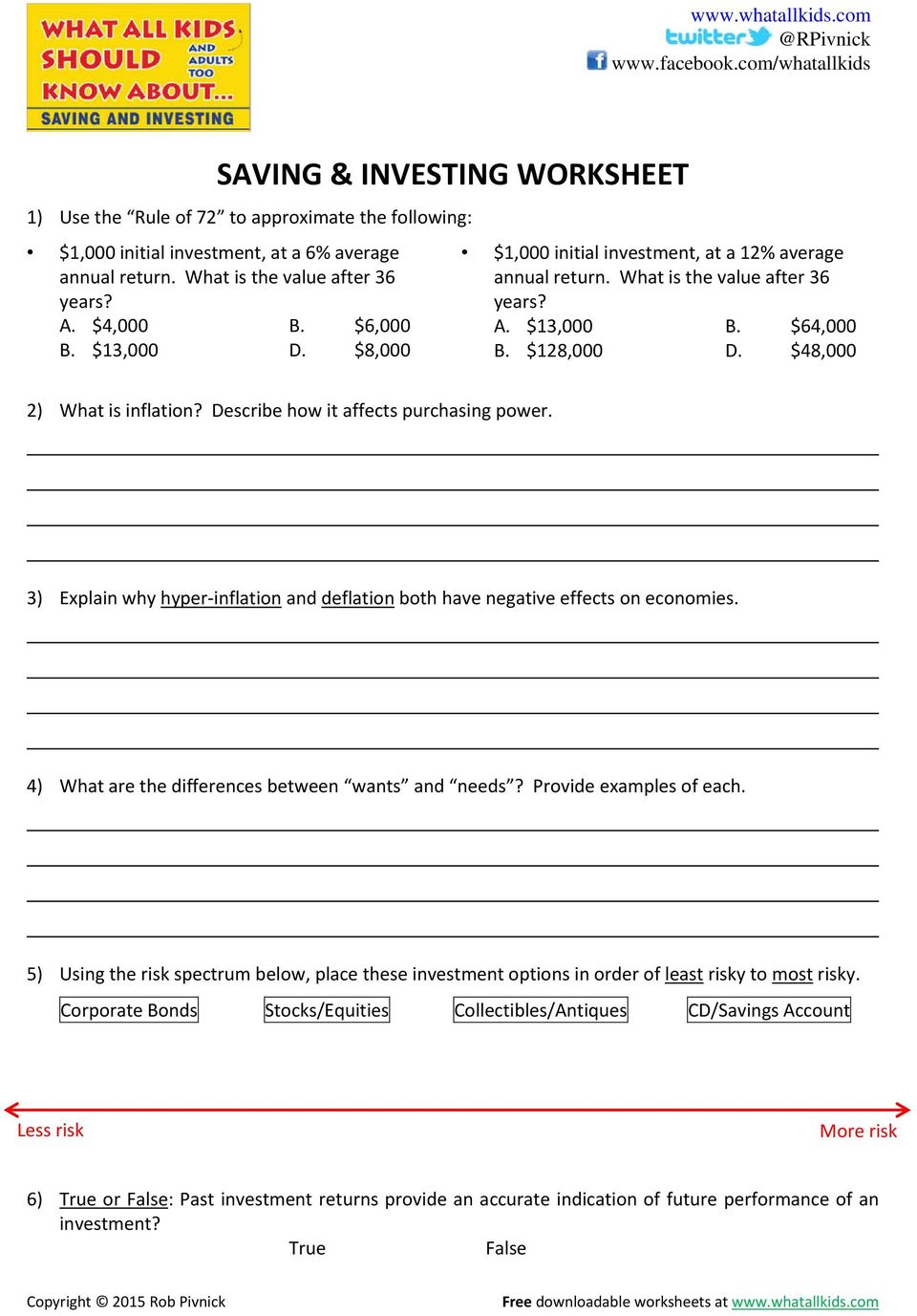

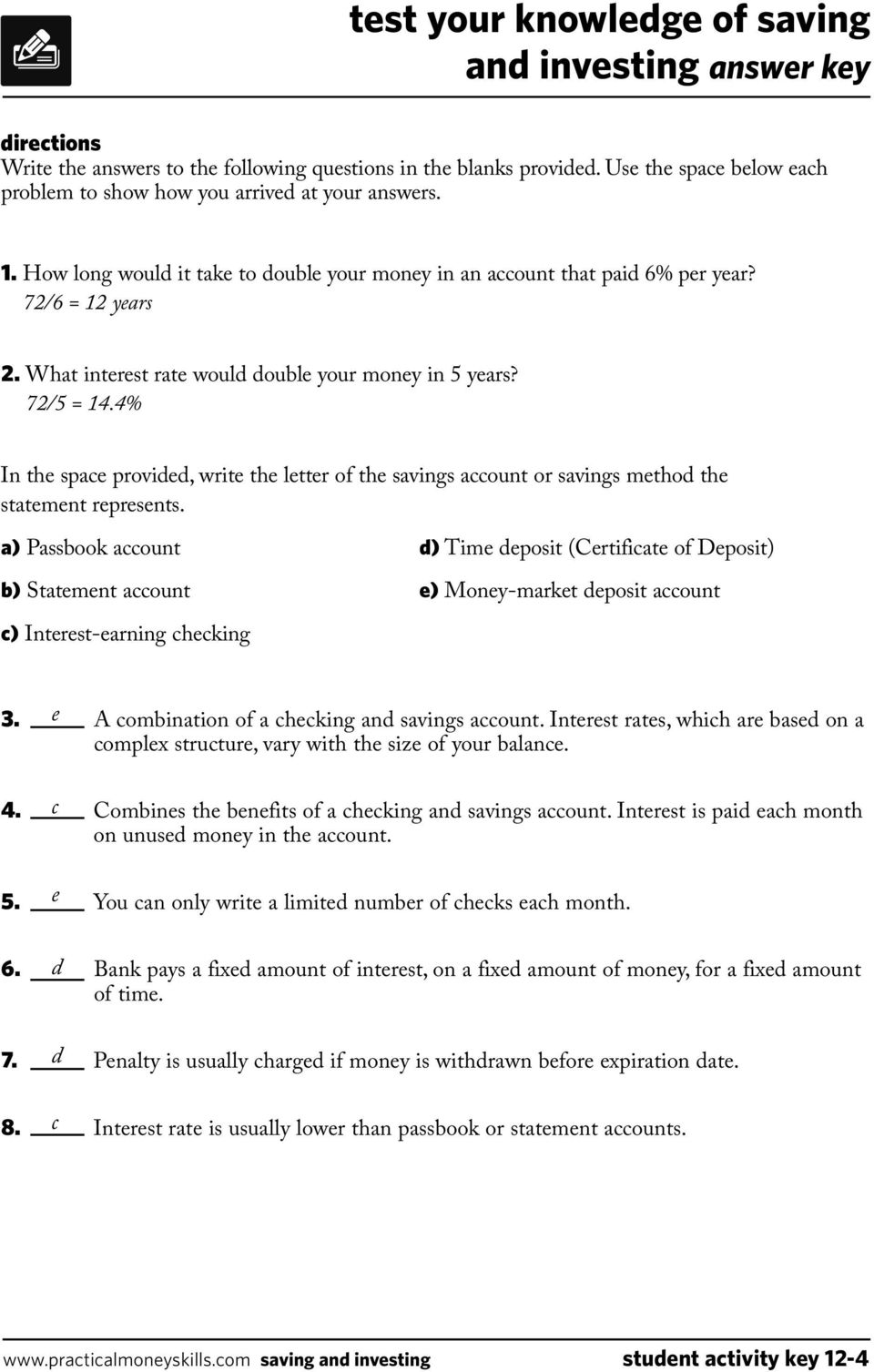

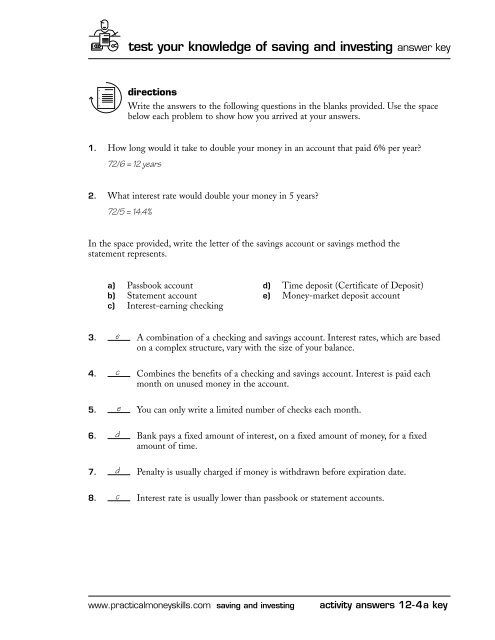

SAVING & INVESTING WORKSHEET ANSWER KEY 1) D ; B 2) Inflation is the general increase in the price of goods and services. Inflation has the effect of lowering the purchasing power of money that does not increase in value at the same rate of inflation.

Saving and investing worksheet answers.

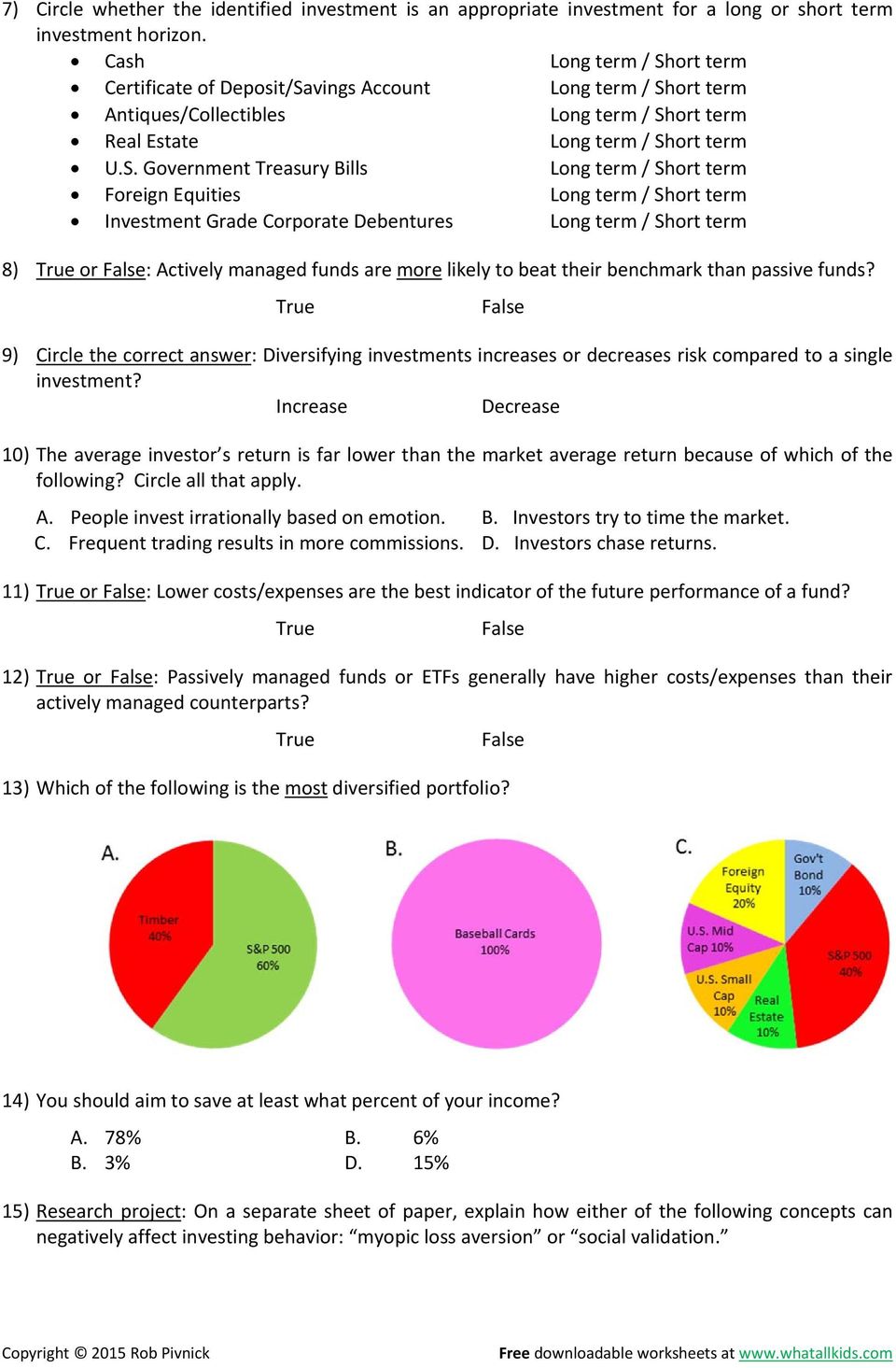

§ Comparing saving and investing (worksheet) cfpb_building_block_activities_comparing-saving-investing_worksheet.pdf. Exploring key financial concepts. There are important differences between saving and investing. Generally, people use savings for short-term financial goals such as a vacation or a down payment on a car. They often put

June 2001 NATIONAL SAVING Answers to Key Questions GAO-01-591SP. Page 1 GAO-01-591SP National Saving Contents Preface 5 Summary of Major Sections 9 ... Figure 3.1:Overview of Saving, Investment, Output, and Income Flows 59 Figure 3.2:National Saving, Domestic Investment, and Net Foreign

Save regularly and start saving early. Learn more about the importance of saving, savings goals, the 4 steps to saving and ways to increase your savings.http...

test your knowledge of saving and investing answer key. In the space provided, write the letter of the investment vehicle the statement represents.. a) Bonds d) Real estate. b) Mutual funds e) Keogh plan. c) Stocks. 9. d This type of investment offers an excellent protection against inflation.. 10. e A retirement plan for the self-employed.

Saving and Investing—evaluate saving and investment options to meet short-and long-term goals, including knowledge of presents and future value of money Link to Nebraska Standards 12.4.25 Students will explain the impact of monetary and fiscal policy in achieving local, state, and national economic goals.

FY-7.05 - Investing in Funds. In this lesson, students will be able to: Explain the difference between active investing and passive investing. Identify a variety of popular investment funds including mutual funds, index funds, exchange traded funds, and target date funds.

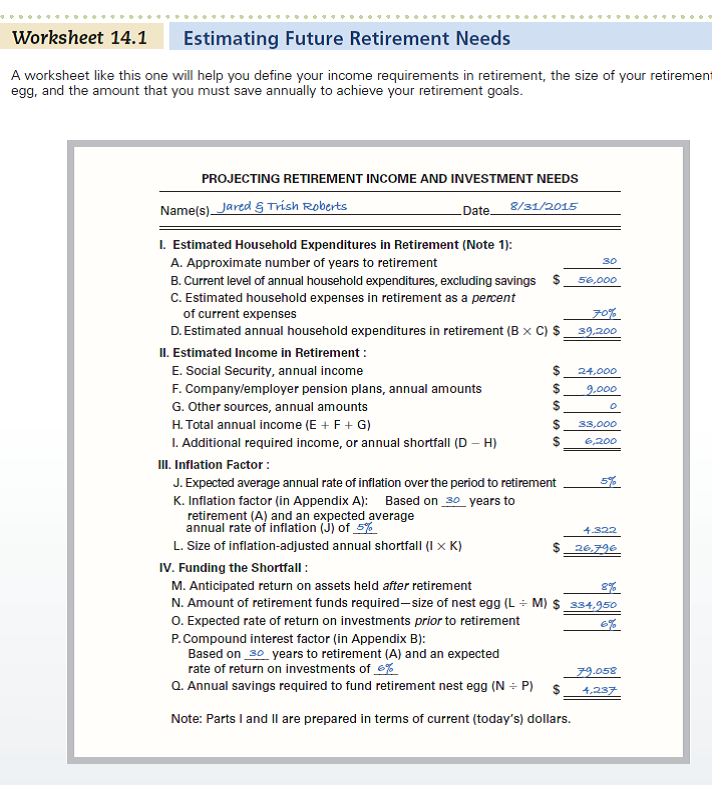

Use our savings calculator to see how a consistent approach to saving can make your money grow. Use our college savings calculator to determine the amount you must invest each year to have enough money to cover the cost of college. Our loan calculator can help you determine the monthly payment for a fixed-rate loan such as a car loan or mortgage.

Start studying Economics Chapter 8: Money, Banking, Saving and Investing. Learn vocabulary, terms, and more with flashcards, games, and other study tools.

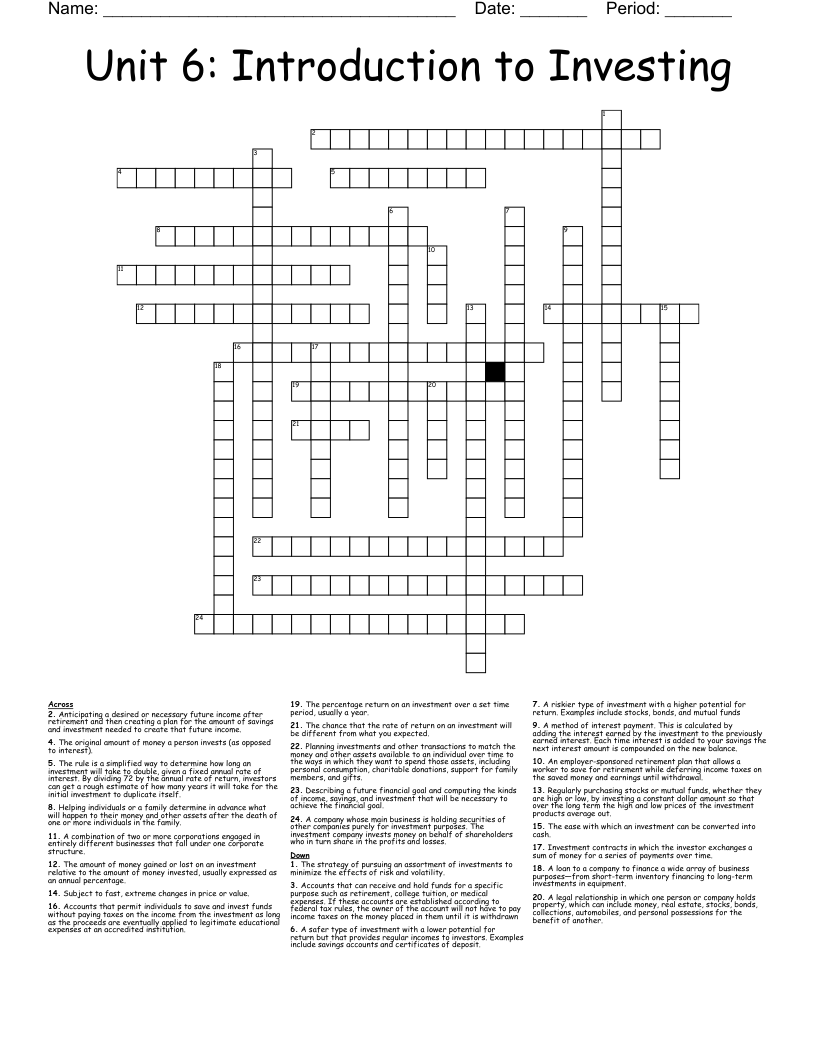

1 THE BASICS 1 I 2 2020 UNIT INVESTOR EDUCATION Unit Teaching Aids LESSON 1: Investing in the Real World (Handout) LESSON 2: Saving and Investment Products (Handout) Comparing Saving and Investment Products (Worksheet) LESSON 3: Pyramid of Investment Risk (Overhead and Worksheet) Investment Risk (Quiz and Answer Key) Time Value of Money (Chart and Worksheet)

3. Determine whether saving or investing would be the ideal way to try to meet each goal. 4. Answer the reflection question. Overview There are important differences between saving and investing. Generally, people use savings for short-term financial goals such as a vacation or a down payment on a car. They often put their savings in financial ...

Saving and InvestingSaving and Investing Money Lessons. Saving and Investing. Learn how to write a check, make checking account deposits and withdrawals, manage and balance your checkbook, and perform bank reconciliation with your monthly bank checking account statement. Worksheets, lessons, and exercises are appropriate for both students ...

How does investment promote economic growth and contribute to a nation's wealth? People deposit money in savings => Banks lend money to businesses => Businesses invest money in new plants and equipment to increase production. The growth of businesses creates new and better products and jobs.

Saving and Investing Strategies Standard 5 The student will analyze the costs and benefits of saving and investing. Lesson Objectives Examine different types of savings and investment strategies. Compare the costs (risk) and benefits (rate of return) of different savings and investment strategies. Personal Financial Literacy Vocabulary

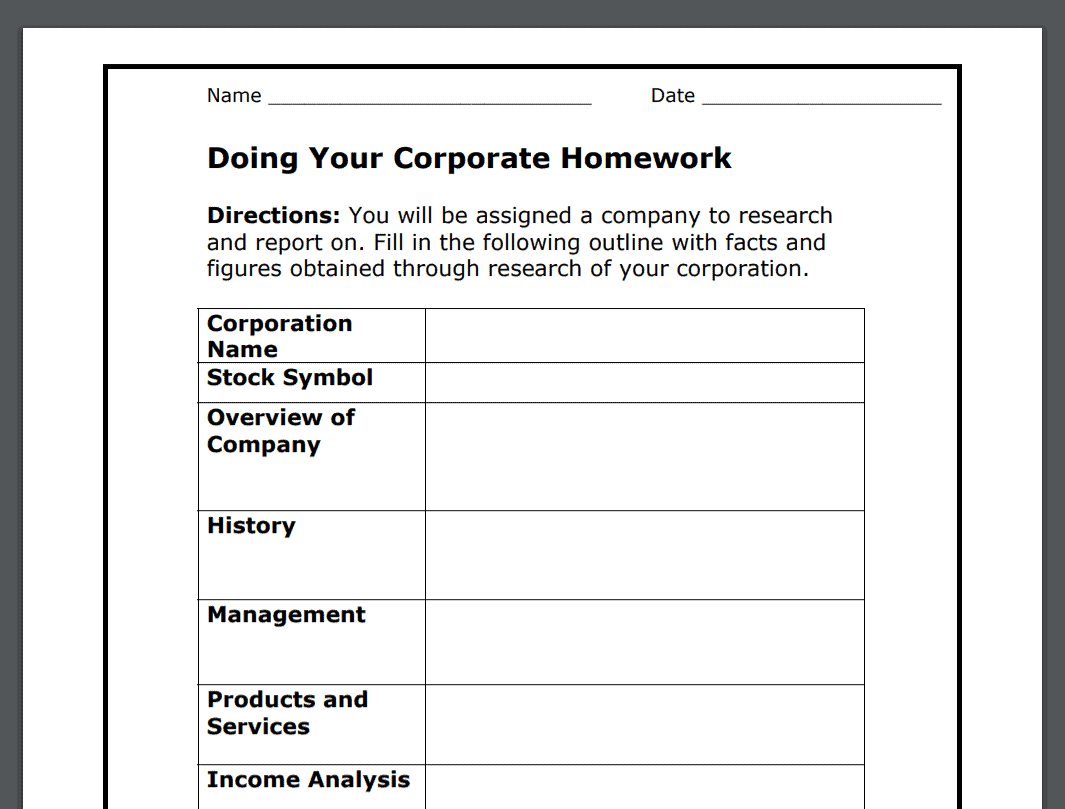

Worksheet that includes questions about the importance of making a financial plan and why saving and investing is important. The worksheet includes five questions that encourage students to think about ways you can invest money, what stocks are, and how to decide if an investment is right for you.Th

Comparing saving and investing" ... cfpb_building_block_activities_investigating-investing_worksheet.pdf § Computers or tablets (if available) Exploring key financial concepts When people save money for short-term financial goals (such as ... Answer guide. Type of investment Definition.

• How do I decide which type of investment is best for me? • Long-Term Savings Plan Worksheets (1 per student, 2-sided) • Calculators • 4 Corners cards printed out • 4 Corners statement pages printed for you to read aloud • Which Investment is Best? Worksheets (1 per student) Materials • Investing - when you purchase a

ID: 1572262 Language: English School subject: mathematic Grade/level: form 3 Age: 13+ Main content: Types of saving and investment Other contents: Add to my workbooks (0) Download file pdf Embed in my website or blog Add to Google Classroom

This stock market vocabulary worksheet is very simple and straightforward, and will help you to reinforce a lesson on understanding how to maneuver the stock exchange (links to the worksheets are all the way at the bottom). Psst: don't forget to download the answer key - that has all the definitions on it. 6. Price to Earnings Ratio Worksheet

LESSON 2: Saving and Investment Products,(Handout, page 1.14) Comparing Savings and Investment Products(Worksheet, page 1.15) LESSON 3: Pyramid of Investment Risk(Overhead and Worksheet, page 1.18 and 1.19) Investment Risk(Quiz, page 1.20; Answer Key, page 1.21) Time Value of Money(Chart and Worksheet, page 1.22 and 1.23) Rule of 72(Worksheet ...

23 Unique Saving and Investing Worksheet thonda from saving and investing worksheet answers , source:T-honda.com. Informal together with feedback sessions help do away with minor splinters that may hamper the practice of achieving the vision. Adhere about what to edit to the directions. The estimating worksheet is designed to direct you.

ID: 1565918 Language: Malay School subject: math Grade/level: form 3 Age: 13+ Main content: Saving and investment Other contents: Add to my workbooks (4) Download file pdf Embed in my website or blog Add to Google Classroom

To introduce the five stages of saving and investing, read the descriptions below: The Five Stages of Saving and Investing. Step One: Put-and-Take Account This is the first savings instrument you should establish when you begin making money. For most people, the put-and-take account is a checking account.

8-H the Rule of 72 8-I bonds 8-J mutual funds 8-K stocks 8-L real estate 8-M retirement plans 8-N individual retirement accounts (IRAs)—an example of return on investment 8-O comparing savings and investment plans 8-P avoiding investment fraud student activities 8-1 Setting and Prioritizing Your Financial Goals Have students complete the "Setting Financial Goals" worksheet.

0 Response to "43 saving and investing worksheet answers"

Post a Comment