40 convert accrual to cash basis worksheet

Home » Bookkeeping » How to convert cash basis to accrual basis accounting Jun 9, 2020 Bookkeeping by Adam Hill This contrasts accrual accounting, which recognizes income at the time the revenue is earned and records expenses when liabilities are incurred regardless of when cash is received or paid. If so, perhaps converting to accrual should be a goal for the future. Attempting to convert to GAAP accounting with messy data is a recipe for stress and insomnia. In cases where the data is in bad enough shape, you won't even be able to convert from cash to accrual retrospectively.

Sep 27, 2008. #2. I haven't seen anything - although you should be able to make your own worksheet and plug in number pretty easily for a quick answer. You may find something on the web by searching for keywords accrual cash convert (or conversion ). If nothing else, you'll hit some sites to lay out the steps and you can build your own ...

Convert accrual to cash basis worksheet

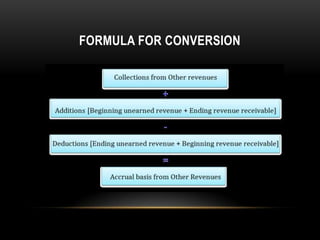

The cash to accrual conversion calculator works out the cost of goods sold for the period on an accruals basis. Cash to Accrual Conversion Calculator Download The cash to accrual conversion worksheet is available for download in Excel format by following the link below. Cash to Accruals Conversion Calculator v 1.01 Download Link Therefore, to find cash flows from operations, one need to convert accrual basis income statement figures to cash basis by making adjustments. By way of adjustments, earned revenues will be converted into cash received from sales or customers and incurred expenses will be converted into cash expended, i.e., expenses actually paid in cash. Jan 13, 2020 · Accrual to Cash Conversion Formula. In general the following accrual to cash conversion formulas can be used to convert each revenue and expense income statement account from the accrual basis to the cash basis of accounting. In each formula the terms used have the following meanings. AR = Accounts receivable; AP = Inventory accounts payable ...

Convert accrual to cash basis worksheet. Converting from cash to accrual basis may be prompted by one or more of the following: A legal requirement, e.g. nonprofits in California with annual revenues exceeding $2 million are generally required to follow the accrual basis. I normally convert the accrual financials to cash basis by reversing out end of year balances in our payables/accruals accounts. See the accompanying PDF file for the worksheet and an example for converting cash to accrual net farm income. Often this is the most readily available data about revenue and costs generated each year. To convert this balance sheet to the cash basis method of accounting you would reverse the accounts receivable and accounts payable into net income. The accounts receivable is increasing sales by $30,0000 and the accounts payable is increasing the expenses by $35,000. This nets out to a $5,000 accrual to cash difference. With this, income statement will convert from accrual to cash basis accounting. We also deduct advance incomes from liabilities side of balance sheet. With this, our balance sheet will convert from accrual to cash basis. 6th Step : Add Advance Expenses in Financial Statements.

For accrual basis taxpayers, IRC 986 generally calls for the conversion of foreign taxes into U.S. dollars based on the average exchange rate for the year of the actual payment. Special spot rate conversion rules apply to accrual basis taxpayers where: 2021-07-10 · Using cash basis accounting, income is To convert from accrual basis to cash basis accounting, follow these steps: Subtract accrued expenses. If an expense has been accrued because there isn't a supplier invoice for this, remove it through the financial statements. The perfect source of these records is the acquired liabilities account from the balance sheet. By making a series of adjustments to entries an accrual basis balance sheet can be converted to a cash basis balance sheet. Eliminate accounts receivable. Accounts receivable are billings that have been earned but have not yet been paid. Convert Accrual To Cash Basis Worksheet - Worksheet List. Cash to accrualaccrual to cash conversion i havent seen anything although you should be able to make your own worksheet and plug in number pretty easily for a quick answer. In a cash basis system a company records revenues when cash is received and expenses when they are paid.

Any nontaxable amounts that you roll over into your traditional IRA become part of your basis (cost) in your IRAs. To recover your basis when you take distributions from your IRA, you must complete Form 8606 for the year of the distribution. See Form 8606 under Distributions Fully or Partly Taxable in Pub. 590-B.. To convert from accrual basis to cash basis accounting, follow these steps: Subtract accrued expenses. If an expense has been accrued because there is no supplier invoice for it, remove it from the financial statements. The easiest source of this information is the accrued liabilities account in the balance sheet. Having mentioned how complicated accrual to cash adjustments can be, below are a few more formulas that can help. Sales Revenue + (Beginning Balance x Accounts Receivable) - (Ending Balance x Accounts Receivable) = Cash Sales To be written as: Sales Revenue + BB AR - EB AR = Cash Sales It is often accountants are called upon to convert cash basis accounting records to the accrual basis. This post describes how to convert cash basis accounting record into accrual basis. GAAP requires the use of the accrual basis, yet cash flow information is also important to financial statement readers.

Nov 28, 2017 · Learn how to convert your books from cash basis to accrual accounting. But, first, take a look at the differences between the two accounting methods. Difference between cash basis and accrual. There are several key differences between cash basis and accrual. Depending on which method you use, you recognize transactions at different times. Cash ...

Dec 30, 2021 · The accrual basis is used to record revenues and expenses in the period when they are earned, irrespective of actual cash flows. To convert from cash basis to accrual basis accounting, follow the steps noted below. Add Accrued Expenses. Add back all expenses for which the company has received a benefit but has not yet paid the supplier or employee.

To arrive at cash flows from operations, it is necessary to convert the income statement from an accrual basis to the cash basis of accounting. TRUE Cash flows from investing activities, as part of the statement of cash flows, include receipts from the sale of land.

The attached download is a very simple spreadsheet to convert accrual basis net income to cash basis. Many financial statement preparers simply zero out the ending balance sheet accounts relative to income and expenses in an attempt to arrive at the adjusted net income amount. The beginning balances for these accounts must also be considered.

Cash basis accounting had a good run. Now you are stepping up your finance game and it is time to switch your accounting method. Whatever the reason to change your reporting method, know that cash to accrual conversion is intricate. We developed this guide to ease the process. In this article you will learn:

This section of the accrual to cash conversion excel worksheet is used to convert expenses incurred to cash payments by adjusting for movements on accrued expenses payable, and prepayments. Step 1 Enter the beginning accrued expenses payable. This adds expenses relating to the previous period. Step 2

Sep 14, 2013 - Detailed example for converting from cash basis to accrual basis acccounting by deteriming the change in balance sheet accounts for cash sales, revenues othe...

Use the Conversion Tables below to experiment with converting accrual amounts to cash basis amounts, and vice versa. All you need to do is enter amounts in the boxed cells and select whether the item increased or decreased during the period. The Applicable Calculations column (in green) will reveal the appropriate outcomes. ...

In this video, I cover Converting Cash to Accrual. Converting cash to accrual Accounting is a topic that is covered on the CPA exam. Are you a CPA candidate...

Additionally, to change specific line items in the financial statements from accrual basis to the cash basis of accounting, the following formulas are used: Cash Sales = Sales Revenue + Beginning Balance of Accounts Receivables - Ending Balance of Accounts Receivables

Accrual to cash conversion excel worksheet under the accruals basis of accounting revenue is recorded when earned and expenses are recorded when incurred. The accrual to cash conversion excel worksheet works out the cash payments for inventory purchases based on the cost of goods sold for the period.

Convert Accrual To Cash Basis Worksheet - Worksheet List. Cash to accrualaccrual to cash conversion i havent seen anything although you should be able to make your own worksheet and plug in number pretty easily for a quick answer. In a cash basis system a company records revenues when cash is received and expenses when they are paid.

The following formulas represent the conversion of accrual to the cash basis income statement. The terminology used in the formulas is shown below: BB - Beginning balance EB - Ending balance AR- Accounts receivable AP - Accounts payable MI - Merchandise inventory PE - Prepaid expenses AE - Accrued expenses Sales revenue + BB AR - EB AR = Cash sales

Mar 10, 2020 · 3 Golden rules of accounting. It’s no secret that the world of accounting is run by credits and debits. Debits and credits make a book’s world go ‘round.. Before we dive into the golden principles of accounting, you need to brush up on all things debit and credit.

Jan 13, 2020 · Accrual to Cash Conversion Formula. In general the following accrual to cash conversion formulas can be used to convert each revenue and expense income statement account from the accrual basis to the cash basis of accounting. In each formula the terms used have the following meanings. AR = Accounts receivable; AP = Inventory accounts payable ...

Therefore, to find cash flows from operations, one need to convert accrual basis income statement figures to cash basis by making adjustments. By way of adjustments, earned revenues will be converted into cash received from sales or customers and incurred expenses will be converted into cash expended, i.e., expenses actually paid in cash.

The cash to accrual conversion calculator works out the cost of goods sold for the period on an accruals basis. Cash to Accrual Conversion Calculator Download The cash to accrual conversion worksheet is available for download in Excel format by following the link below. Cash to Accruals Conversion Calculator v 1.01 Download Link

0 Response to "40 convert accrual to cash basis worksheet"

Post a Comment