41 itemized deduction worksheet 2015

The calculation is done on the Iowa Itemized Deductions Worksheet, form IA104. If one spouse itemizes deductions, then both spouses must itemize, even if separate Iowa returns are filed. Deductions for the following are taken on line 27 of the Iowa Schedule A: Expenses incurred for care of a disabled relative 4 2021. Form 1040 (Schedule A) Itemized Deductions. 2021. Inst 1040 (Schedule A) Instructions for Schedule A (Form 1040 or Form 1040-SR), Itemized Deductions. 2020. Form 1040 (Schedule A) Itemized Deductions.

Worksheet For Net State Income Taxes, Line 9 of Missouri Itemized Deductions 2015 TAX CHART If Missouri taxable income from Form MO-1040A, Line 10, is less than $9,000, use the chart to figure tax;

Itemized deduction worksheet 2015

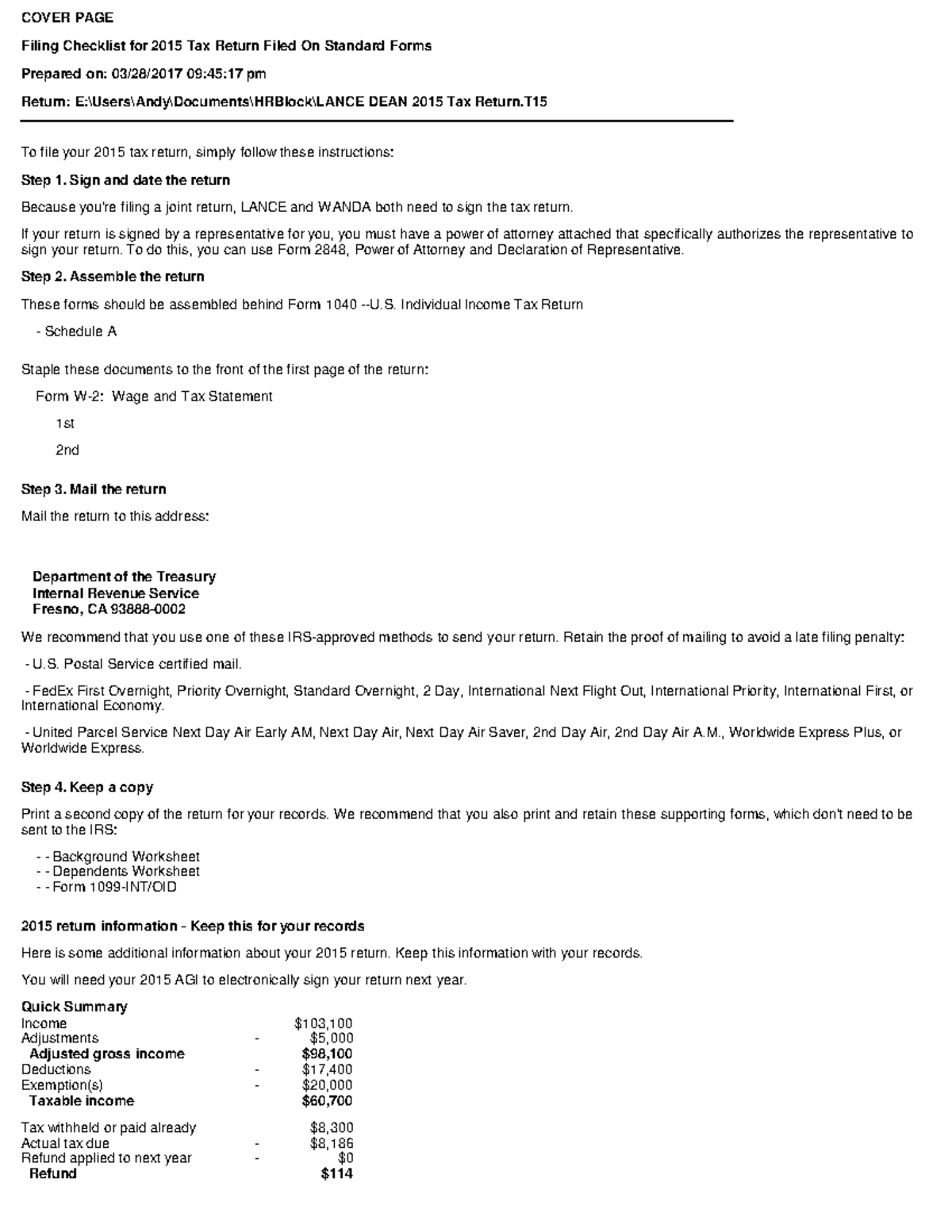

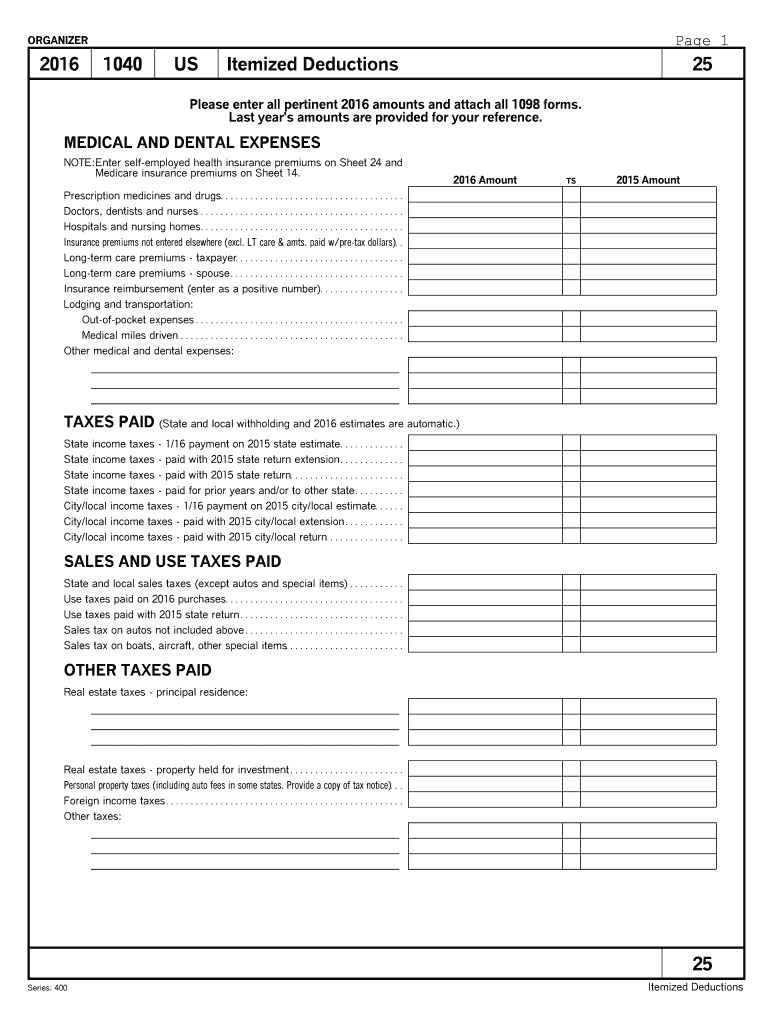

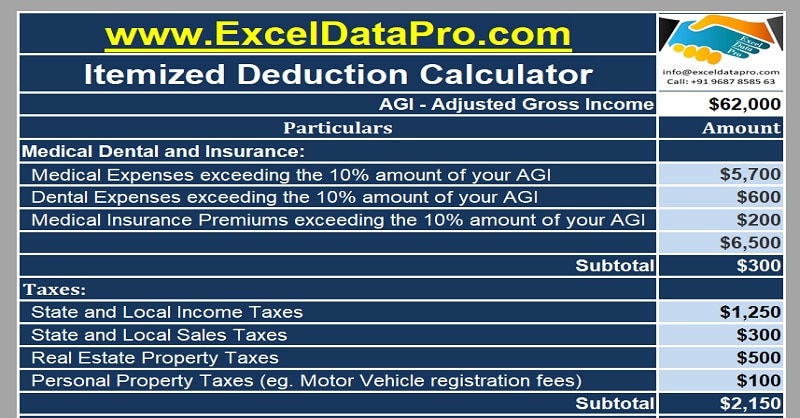

2015 ITEMIZED DEDUCTIONS WORKSHEET For 2015 the "Standard Deduction" is $12,600 on a Joint Return, $9,250 for a Head of Household, and $6,300 if you are Single. If you normally itemize your personal deductions or even think that itemized deductions might benefit you this year, we will need to know the following expenses. An itemized deduction is exactly what it sounds like: an itemized list of the deductions that qualify for tax breaks. You choose between the two based on whether your standard deduction is higher or lower than your itemized deduction list. If the standard deduction is higher, you will opt for that one since it gives you the biggest break. Refer to your federal itemized deductions worksheet, in your federal 1040 instruction book, not the Federal Schedule A. 1) Divide line 11* of the Federal Itemized Deductions Worksheet by line 3* of that worksheet (cannot exceed 100%). 2) Enter the amount from line 5 of federal

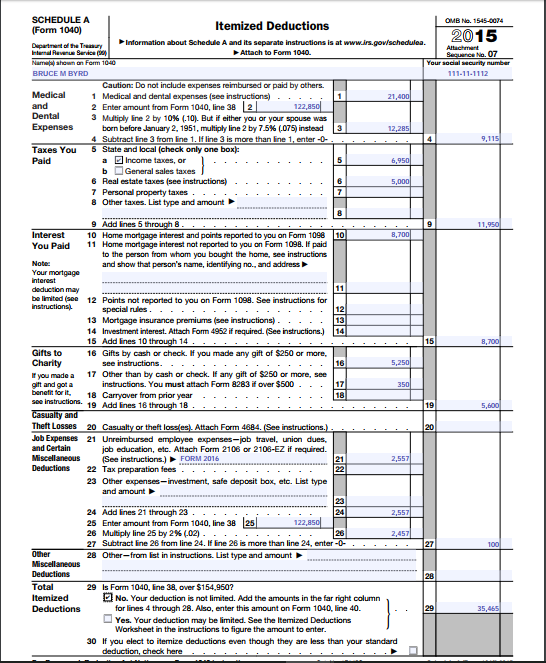

Itemized deduction worksheet 2015. And College Tuition Itemized Deduction Worksheet Name(s) and occupation(s) as shown on Form IT-203 Your social security number Complete all parts that apply to you; see instructions (Form IT-203-I). Submit this form with your Form IT-203. Schedule A - Allocation of wage and salary income to New York State Nonworking days included in line 1a: When we talk about Itemized Tax Deduction Worksheet, we have collected various related photos to give you more ideas. 1040 forms itemized deductions worksheet 2015, tax refund calculator and schedule c tax deduction worksheet are some main things we will present to you based on the post title. Itemized Deductions Worksheet You will need. Utilize this tax expense spreadsheet to keep a. Utilizing itemized deduction worksheet 2015 for Excel worksheets can help raise efficiency. The Tax Deduction Template is specially. Select Use Standard or Itemized De-duction then select the option. It can be extremely difficult. Your deduction is not limited. Add the amounts in the far right column for lines 4 through 28. Also, enter this amount on Form 1040, line 40.}.. Yes. Your deduction may be limited. See the Itemized Deductions Worksheet in the instructions to figure the amount to enter. 30 . If you elect to itemize deductions even though they are less than your ...

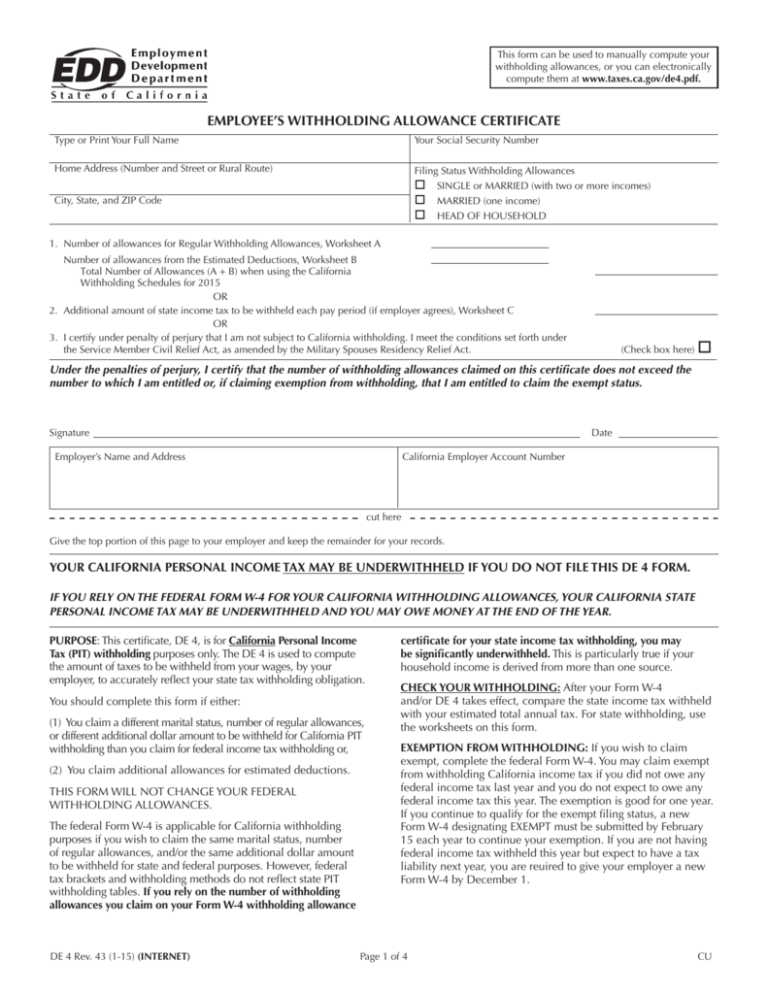

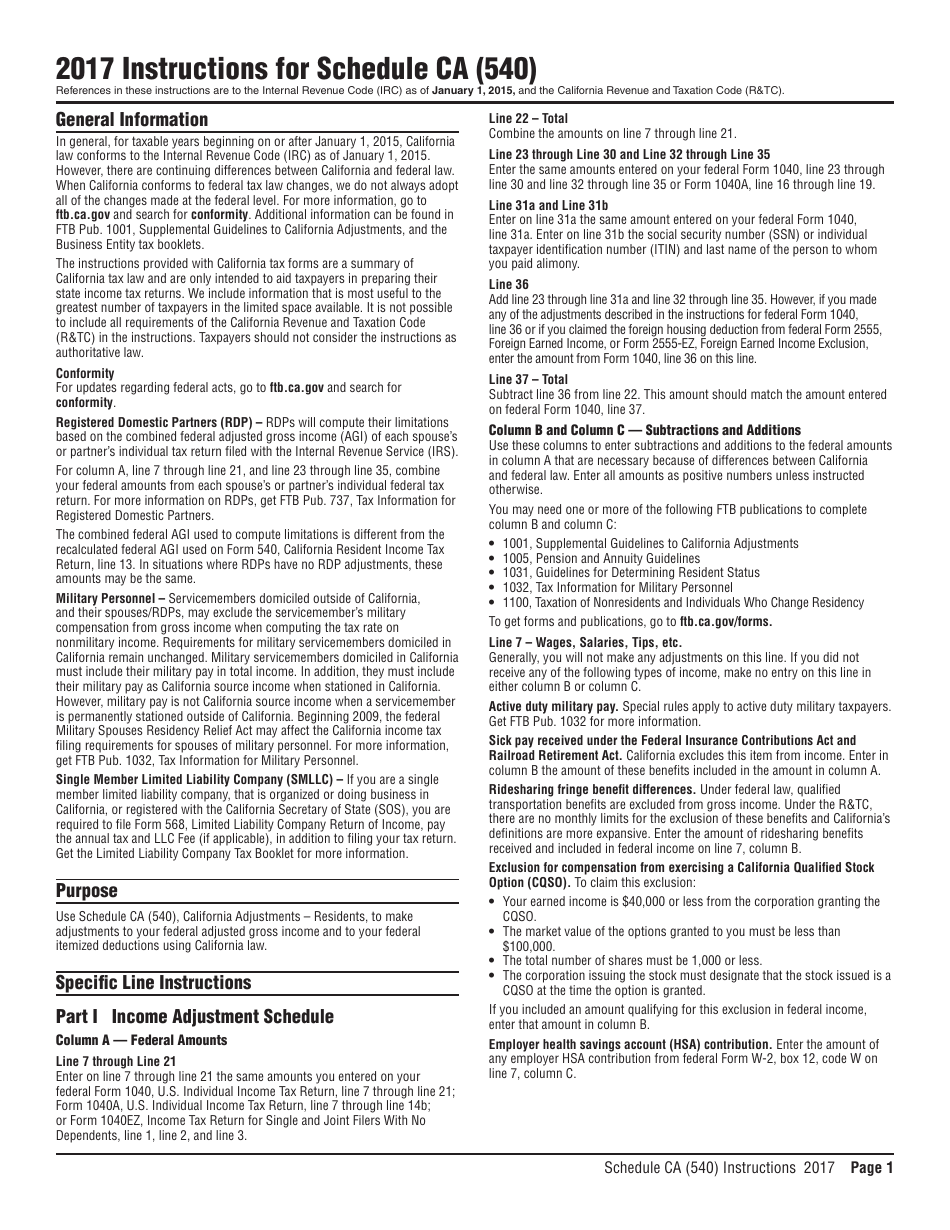

2018 IA 104 Iowa Itemized Deductions Worksheet https://tax.iowa.gov This worksheet computes the amount of itemized deductions to enter on line 26 of the IA Schedule A for high income taxpayers. Step 1 Complete the IA 1040 Schedule A, lines 1-25. Step 2 Re-compute the federal Itemized Deduction Worksheet: 1. Beside that, we also come with more related things like itemized deductions worksheet, schedule c tax deduction worksheet and 1040 forms itemized deductions worksheet 2015. We have a great hope these 2014 Itemized Deductions Worksheet pictures collection can be a hint for you, give you more examples and of course make you have a great day. 2015 California Adjustments — Nonresidents or Part-Year Residents SCHEDULE CA (540NR) Important: Attach this schedule behind Long Form 540NR, Side 3 as a supporting California schedule. Name(s) as shown on tax return . SSN or ITIN. Part I Residency Information Complete all lines that apply to you and your spouse/RDP for taxable year 2015 ... Deductions and Adjustments Worksheet Note. Use this worksheet only if you plan to itemize deductions or claim certain credits or adjustments to income. 1. Enter an estimate of your 2015 itemized deductions. These include qualifying home mortgage interest, charitable contributions, state and local taxes, medical expenses in excess of 10% (7.5% ...

There is a limitation on the amount of itemized deductions that can be claimed for certain high-income taxpayers. The calculation is done on the Iowa Itemized Deductions Worksheet, form IA104. If one spouse itemizes deductions, then both spouses must itemize, even if separate Iowa returns are filed. Schedule A - Itemized Deductions (continued) To enter multiple expenses of a single type, click on the small calculator icon beside the line. Enter the first description, the amount, and Continue. Enter the information for the next item. They will be totaled on the input line and carried to Schedule A. If taxpayer has medical insurance Schedule A - Itemized Deductions (continued) Select for mortgage interest reported on Form 1098. Enter amount from Form 1098F, box 1 (and box 2, if applicable). See Tab EXT, Legislative Extenders for Private Mortgage Insurance (if extended) Note: The deduction for home equity debt is dis-allowed as a mortgage interest deduction unless Schedule CA (540) 2015 Side 1 TAXABLE YEAR 2015 California Adjustments — Residents SCHEDULE CA (540) Important: Attach this schedule behind Form 540, Side 5 as a supporting California schedule. Name(s) as shown on tax return. SSN or ITIN. Part I. Income Adjustment Schedule Section A - Income. A

Itemized Deductions Worksheet You will need: Tax information documents (Receipts, Statements, Invoices, Vouchers) for your own records. Otherwise, reporting total figures on this form indicates your acknowledgement that such figures are accurate and that you vouch for their accuracy as reported on your Federal and/or State return.

Wisconsin itemized deduction credit must be determined by using the federal adjusted gross income computed on line 6 of Part I. See the listing under Section B of ITEMS REQUIRING ADJUSTMENT for other itemized deductions that require adjustment. 2015 HSA Worksheet 1. Balance of HSA as of December 31, 2010, less amount distributed in 2011-2014.

Itemized Deductions Worksheet 2015 State and Local Sales Tax Deduction Health Coverage Exemptions Where to File 2015 Form 1040, 1040A, 1040EZ Where to File Form 1040-ES for 2016 Where to File Form 4868 for 2015 Return Tab 4 2015 Form 1040—Line-By-Line Line-By-Line Quick Reference to 2015 Form 1040

Miscellaneous itemized deductions in cluding the deduction for unreimbursed job expenses. 2015 itemized deductions worksheet for 2015 the standard deduction is 12600 on a joint return 9250 for a head of household and 6300 if you are single. Itemized deduction worksheet 2015. Itemized deductions also reduce your taxable income.

IRS Standard Deduction: Federal Standard Deductions; Oklahoma Income Tax Forms. Oklahoma State Income Tax Forms for Tax Year 2021 (Jan. 1 - Dec. 31, 2021) can be e-Filed in conjunction with a IRS Income Tax Return. Details on how to only prepare and print an Oklahoma 2021 Tax Return. Below are forms for prior Tax Years starting with 2020. These back taxes …

Jan 09, 2022 · Itemized deduction worksheet 2015. Schedule A - Itemized Deductions (continued) To enter multiple expenses of a single type, click on the small calculator icon beside the line. Enter the first description, the amount, and Continue. Enter the information for the next item. They will be totaled on the input line and carried to Schedule A.

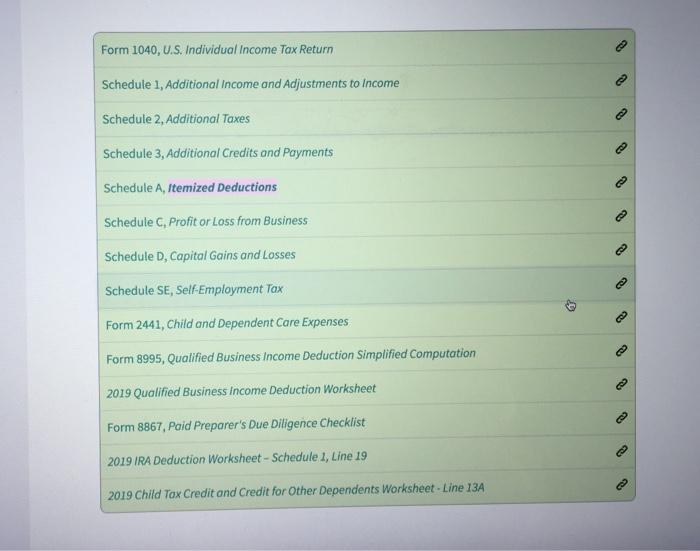

2015 Instructions for Schedule A (Form 1040)Itemized Deductions Use Schedule A (Form 1040) to figure your itemized deductions. In most cases, your federal income tax will be less if you take the larger of your itemized deductions or your standard deduction. If you itemize, you can deduct a part of your medical and dental expenses and unre-

Irs itemized deduction worksheet. If you itemize you can deduct a part of your medical and dental expenses and. In most cases your federal income tax will be less if you take the larger of your itemized deductions or your standard deduction. Names shown on Form 1040 or 1040-SR.

USE YOUR 2020 FORM 1040, 1040-SR, 1040-NR, OR 1041 TO COMPLETE THIS WORKSHEET: 1. Enter as a positive number your NOL deduction for the NOL year entered above from Schedule 1 (Form 1040) or Form 1040-NR, line 8; or Form 1041, line 15b _____ 2. Enter your taxable income without the NOL deduction for 2020. See instructions _____ 3.

charitable deduction amount included in your itemized deductions on Form 1040, Schedule A. To calculate the amount of the charitable deduction to add back, click the button next to line 4, on the PIT-ADJ page, and complete the Charitable Deduction Worksheet.

Itemized Deductions Schedule 80108208.pdf Reset Form Form 80-108-20-8-1-000 (Rev. 08/20) Print Form Mississippi Adjustments And Contributions 2020 801082081000 Taxpayer Name Page 1 SSN PART I: SCHEDULE A - ITEMIZED DEDUCTIONS (ATTACH FEDERAL FORM 1040 SCHEDULE A) In the event you filed using the standard deduction on your federal return and wish to itemize for Mississippi purposes, use Federal ...

Itemized Deductions Checklist Medical Expenses Medical expenses are generally deductible if they exceed 10% of your income or 7.5% of your income if you are over the age of 65. Some common medical expenses: Doctor/Dentist Fees Drug/Alcohol Treatment Cost of Guide Dogs Handicap Access Devices for Disabled Hospital Fees

You must have been a Kansas resident for ALL of 2015. K-40 2015. 114515 (Rev. 7/15) KANSAS INDIVIDUAL INCOME TAX . DO NOT STAPLE . Your First Name Initial Last Name Spouse's First Name Initial Last Name Mailing Address (Number and Street, including Rural Route) School District No. City, Town, or Post Ofice State Zip Code County Abbreviation

Line 4 was smaller than line no the Itemized Deduction Worksheet in your 1996 Form 1040 instructions. State customer Local Refunds Taxable Worksheet Intuit. You must we Form R-6410 2015 Legislation Recovery Worksheet. For 3 surtax purposes NII is investment income less deductions properly. Itemized Deduction Recoveries The following discussion ...

Refer to your federal itemized deductions worksheet, in your federal 1040 instruction book, not the Federal Schedule A. 1) Divide line 11* of the Federal Itemized Deductions Worksheet by line 3* of that worksheet (cannot exceed 100%). 2) Enter the amount from line 5 of federal

An itemized deduction is exactly what it sounds like: an itemized list of the deductions that qualify for tax breaks. You choose between the two based on whether your standard deduction is higher or lower than your itemized deduction list. If the standard deduction is higher, you will opt for that one since it gives you the biggest break.

2015 ITEMIZED DEDUCTIONS WORKSHEET For 2015 the "Standard Deduction" is $12,600 on a Joint Return, $9,250 for a Head of Household, and $6,300 if you are Single. If you normally itemize your personal deductions or even think that itemized deductions might benefit you this year, we will need to know the following expenses.

0 Response to "41 itemized deduction worksheet 2015"

Post a Comment