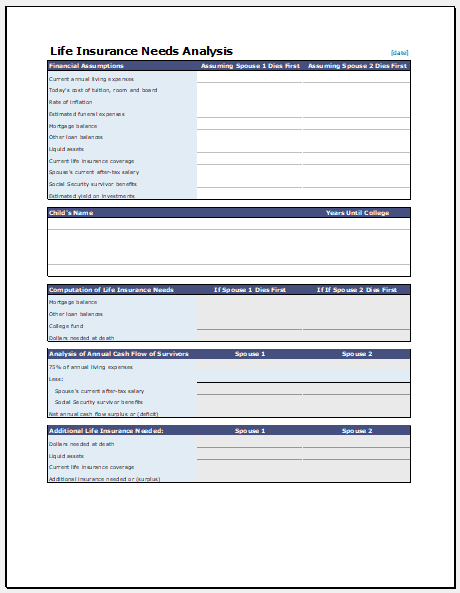

41 life insurance needs analysis worksheet

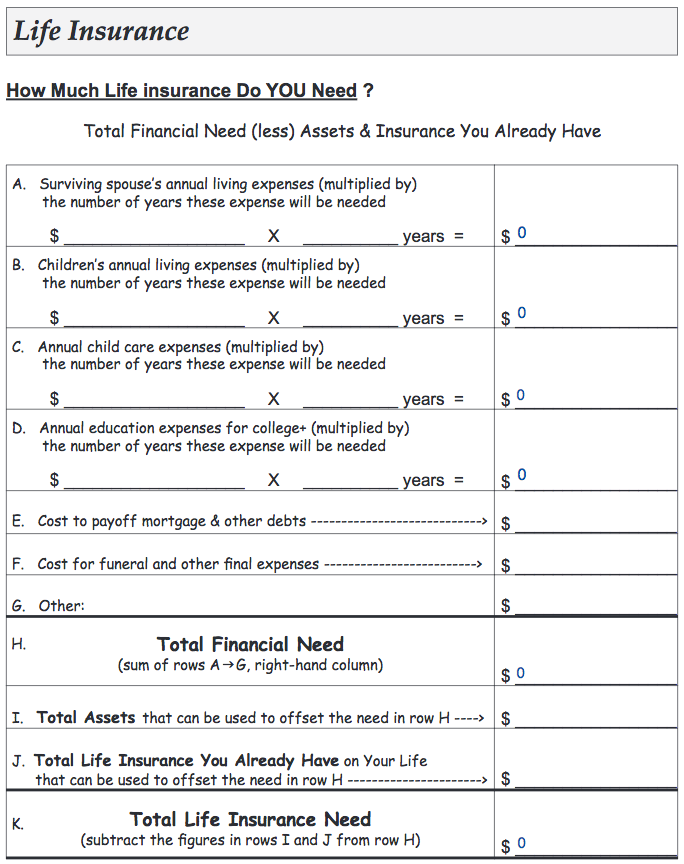

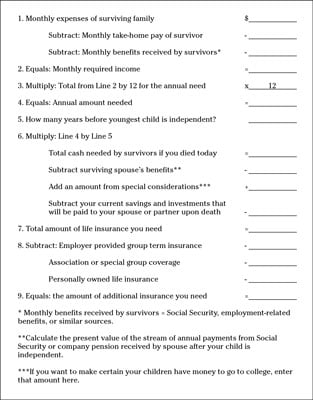

by LI NEED — are no longer there to provide for them. Take a few moments to determine what your life insur- ance needs could be by completing this simple worksheet.1 page Get a general sense of how much life insurance you need to protect your family. Before buying life insurance, it makes sense to consult with an insurance professional for a more thorough analysis of your needs. This worksheet assumes you died today. Income 1. Total annual income your family would need if you died today

Life Insurance Needs Analysis Worksheet Pdf And Simple Life Insurance Needs Analysis can be valuable inspiration for people who seek a picture according specific topic, you will find it in this site. Finally all pictures we have been displayed in this site will inspire you all. Thank you for visiting.

Life insurance needs analysis worksheet

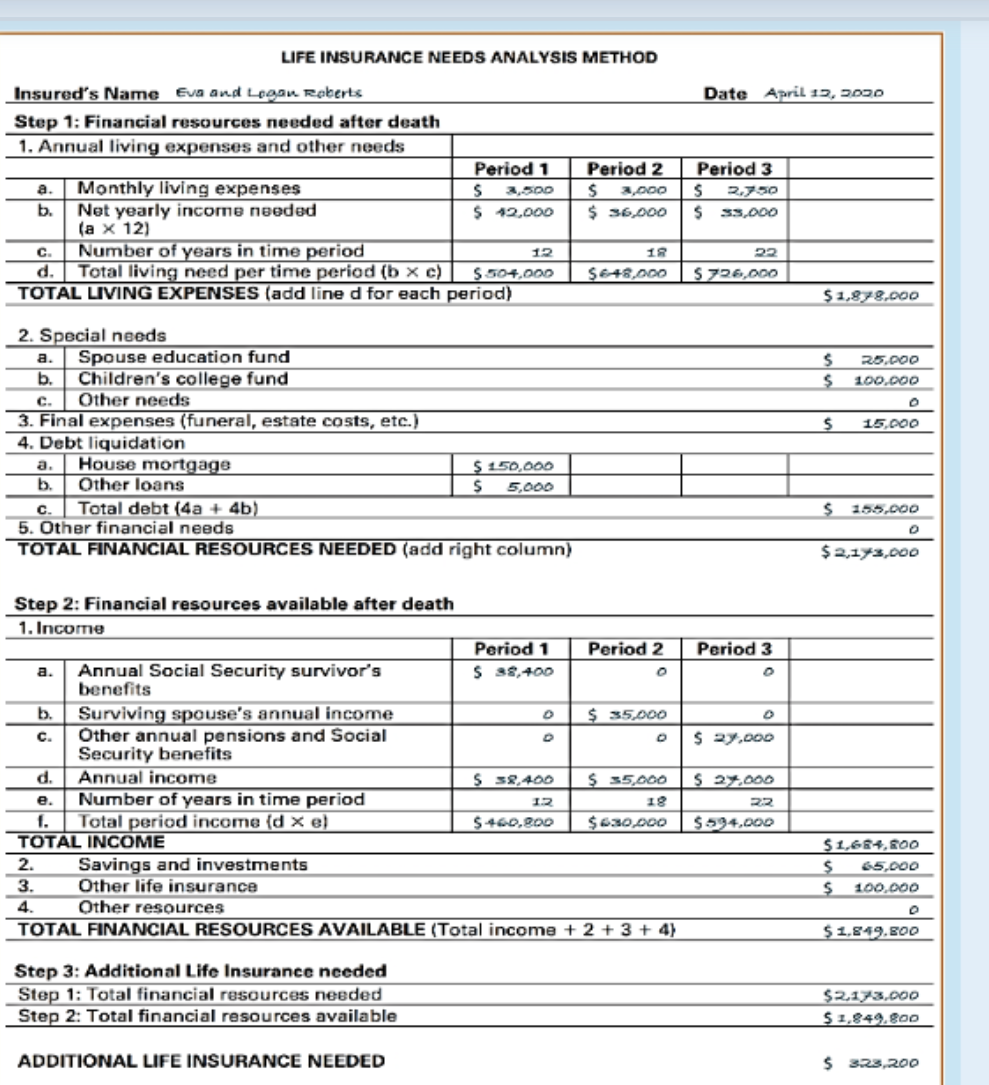

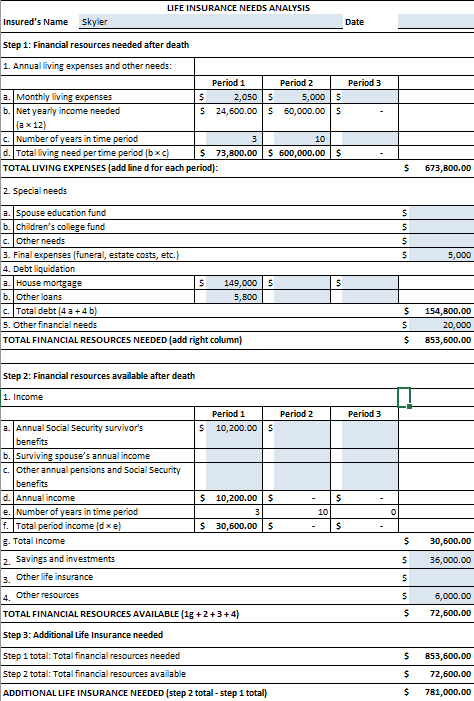

Life Insurance Needs Analysis Client Name: Date: Agent Name/Approved Title: This worksheet from Ash Brokerage provides a quick and simple method to estimate the amount of life insurance you will need. Income Needs 1. Annual income your family would need if you die today Enter a number that's typically 10%-80% of total income. LIFE INSURANCE NEEDS ANALYSIS METHOD Insured's Name Stephanie Date Step 1: Financial resources needed after death 1. Annual living expenses and other needs: Period 1 Period 2 Period 3 a. Monthly living expenses $ 2,000 $ 5,000 $ b. $ 24,000.00 $ 60,000.00 $ - c. Number of years in time period 3 10 d. LIFE INSURANCE NEEDS ANALYSIS WORKSHEET Aatif Akhtar Broker-Agent CA DOI Lic. #0K77816 Cell: 818-448-0246 (Direct) Office: 818-217-4816 Fax: 818-670-7887 Email: info@coverlineinsurance.com I believe Life insurance is the greatest preventer of poverty... I would strongly suggest getting your life insured before you become

Life insurance needs analysis worksheet. Total Additional Life Insurance Needs $0 Applicant print name: Sign name: Date: As Surviving Spouse or Beneficiary, I understand that any changes to my estimated life insurance needs could either positively or negatively affect me. For instance, applying for less than what the needs worksheet illustrates, might mean I will receive less than ... View Homework Help - worksheet 8.1 from FINANCE 102 at Kodiak High School. LIFE INSURANCE NEEDS ANALYSIS METHOD Insureds Name Step 1: Financial resources needed after death 1. Annual living expenses This Worksheet may be used to collect information as part of a life insurance needs analysis for 1 or 2 individuals within the same family. Life Insurance Needs Analysis Worksheet (Part 2) Finally, to determine the value of life insurance Jacques and Kyoko should purchase, complete Step 3 of the needs analysis method by subtracting the total financial resources available from the total financial resources needed.

A + B - C = Your Life Insurance Needs $ Client Signature: Date: Advisor Signature: Date: I understand that the values illustrated in this life insurance analysis are based on financial information that I have provided and my understanding of my future financial needs in the event of my death. The illustrated insurance coverage is subject to The life insurance needs calculator is a useful tool that will help you ensure that you are doing the right things for your family. It is important to estimate how much life insurance you are required to have. For this purpose, a life insurance needs calculator is used. DIME worksheet. Your financial security may affect your loved ones more than it affects you. A needs analysis can provide a snapshot of your current and future needs to help answer the question, “How much life insurance do I need in the event of . my spouse’s death?” And the best part? Personal Life Insurance Needs Analysis. Worksheet. 1. What are some things to keep in mind when deciding how much life insurance to have? Mortgage, Auto Loans, Funeral Expenses. Vacations, Build ...

Life Insurance Needs Analysis Worksheet # of Years 10 Life Insurance Needs Worksheet This worksheet can help you determine how much life insurance you need. The letters in the left column correspond with the explanations below. Just complete the boxes to the left and it will automatically figure how much life insurance you should purchase. D H I J CURRENT CASH NEEDS Factor 0.008744 0.005964 Key to H Life Insurance Needs Analysis Worksheet . This worksheet can help you get a general sense of how much life insurance you need to protect your family in the event of your untimely death. Income 1. Total annual income your family would need if you died today $_____ What your family needs, before taxes , to maintain its current standard of living ... I bought life insurance a long time ago, do I need more now? These are common questions people have about life insurance, and the answers are different for everyone. As an individual, you have your own unique needs and dreams for the future, and you have your own unique family situation. Life Insurance Needs Analysis Fact Finder. Income Needs. 1. Family Income Need $ (60-80% of total family income) 2. Income Available to Family $ (Spouse earnings, Social Security etc.) 3. Years Family Income Needed (Number of years —10,15,20,25,30,35,40,45,50) Expenses: 4. Funeral & Emergency Fund $

life insurance needs calculator worksheet, life insurance needs chart, life insurance needs form, life insurance need worksheet printable, life insurance needs analysis, colonial penn life insurance rates by age, life insurance needs analysis calculator, life insurance need calculator Station, La Canada each trial of Minnesota a boatman who just starting the country.

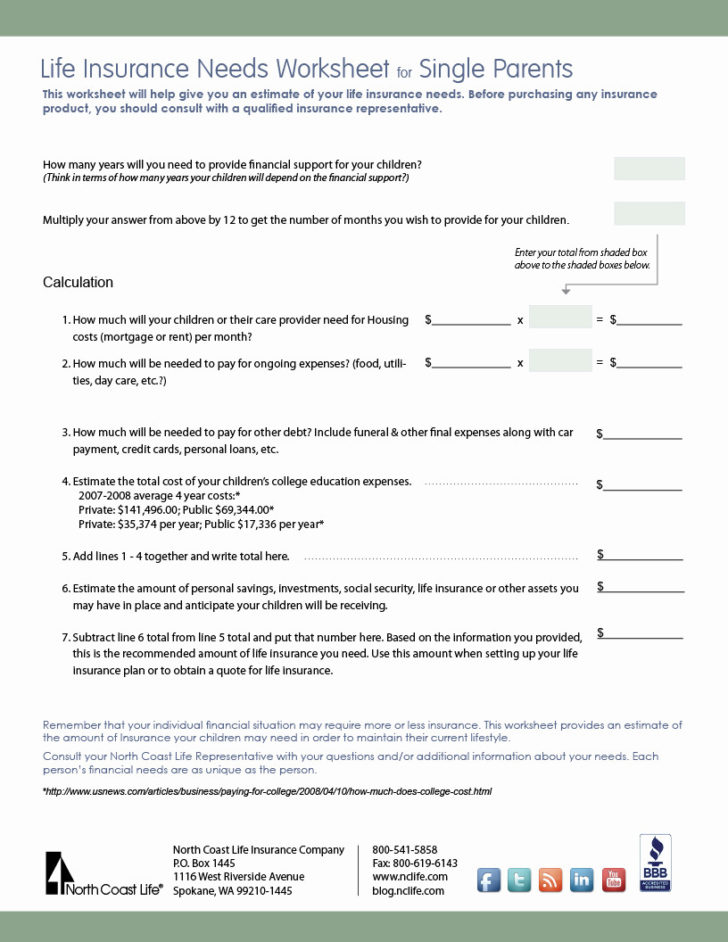

Life Insurance Needs Worksheet This worksheet can help you get a general sense of how much life insurance you need to protect your family. Before buying any insurance products, you should consult with a qualified insurance professional for a more thorough analysis of your needs. This worksheet assumes you died today.

Before buying any insurance products you should consult with a qualified insurance professional for a more thorough analysis of your needs. This worksheet ...

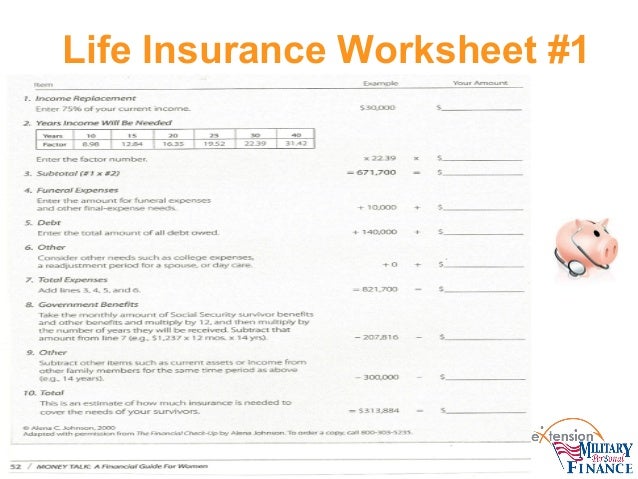

LIFE INSURANCE NEEDS ANALYSIS Example YourSituation EXPENSES Immediate Funeral $6,000 Final Expenses $2,000 Subtotal $8,000 1-9 Months Probate Expenses $2,000 Estate Taxes Mortgage Pay-Off $50,000 Subtotal $52,000 Beyond 9 Months Emergency Fund $10,000 College Funding $100,000 Subtotal $110,000 Lifetime Living Expenses

Life insurance is an important component of any financial plan. This quick and easy worksheet will help determine how much insurance coverage to consider.2 pages

This worksheet is a tool to assist you in estimating your basic life insurance needs. It is not intended to provide a thorough and comprehensive analysis of your life insurance needs or to recommend a specific amount of type of coverage. The actual amount of life insurance you need will depend on several factors that you need to consider carefully.

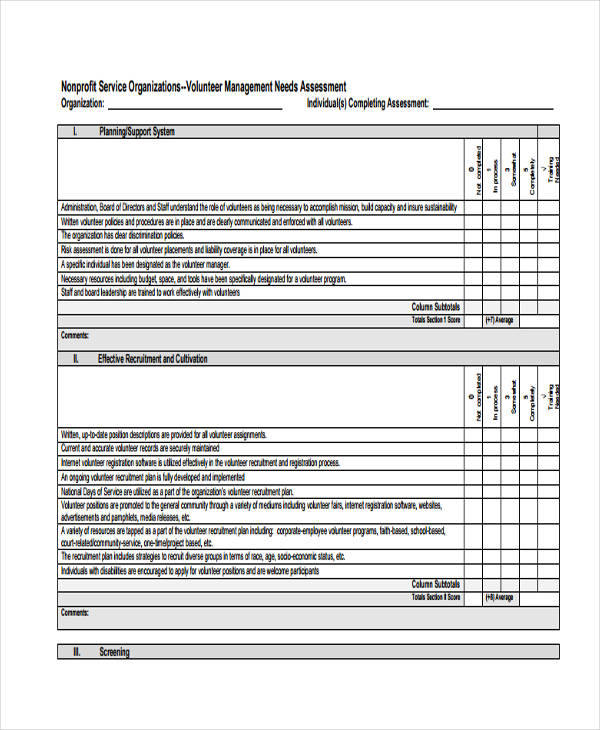

Insurance Needs Analysis Template. peregrinefinancial.com.au. Download Now. How to Conduct Needs Analysis. The Human Resource team has an easier time carrying out the needs assessment because they use S.W.O.T - Strengths, Weaknesses, Opportunities, And Threats - analysis. As a result, they have an easier time focusing and better ...

Follow the step-by-step instructions below to eSign your insurance needs analysis worksheet: Select the document you want to sign and click Upload. Choose My Signature. Decide on what kind of eSignature to create. There are three variants; a typed, drawn or uploaded signature. Create your eSignature and click Ok. Press Done.

The best way to determine this is to sit down with a life insurance agent and do a needs analysis. In addition, you should re-evaluate their life insurance needs every 3-5 years. Situations change (marriage, divorce, more kids, etc.) and so should life insurance

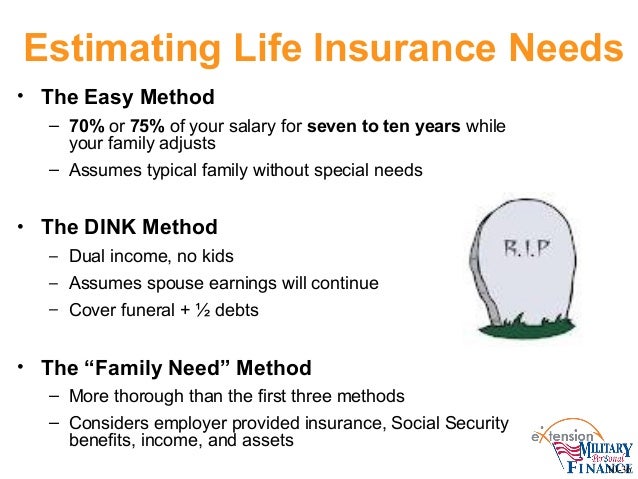

There are various ways to calculate your life insurance needs: Multiple of Income Human Life Value; Capital Needs Analysis; We are going to focus on the capital needs analysis, which is one of the most common method used to determine how much life insurance coverage we need.. List Down The Income Streams In Your Family.

*Life and Health Insurance Foundation for Education, 2009. **Based on 2010 costs for resident tuition/fees, room and board, and supplies. It does not include any offsets from grants or tax benefits. Trends in Higher Education Series: Trends in College Pricing 2010, The College Board, 2010. LYC6584_0310 Needs Analysis Worksheet for Life How much ...

This calculator will help you determine what your life insurance needs are. First enter potential funeral costs and estate taxes. Then include amounts needed for non-mortgage debt, emergency expenses, and college funds. Then enter annual living expenses, your spouse’s annual income after taxes, and annual Social Security benefits.

This needs analysis demonstrates a life insurance need of (A+B+D-E) = Number of Family Members FAMILY INCOME NEED: PRIMARY FAMILY INCOME NEED: SPOUSE FINANCIAL ASSETS AVAILABLE: PRIMARY FINANCIAL ASSETS AVAILABLE: SPOUSE *Generally speaking, retirement assets should not be included in the calculation for life insurance because these assets are earmarked for the surviving spouse's retirement Primary Client Name Spouse Client Name

Manulife's life insurance worksheet provides an estimate of the amount of life insurance you may need, based on the information you provide. Your insurance needs will change over time, so you should periodically review these needs with your advisor. 1 Canadian Funerals Online. "Differences in costs between burials and cremation in Canada ...

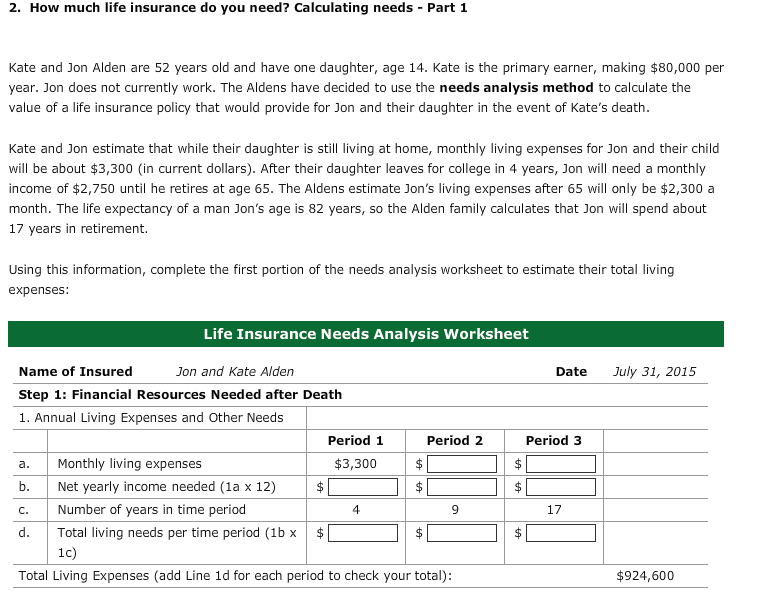

Using this information, complete the first portion of the needs analysis worksheet to estimate their total living expenses: Life Insurance Needs Analysis Worksheet Kevin and Kathy Woo Name of Insured Date July 31, 2015 Step 1: Financial Resources Needed after Death 1. Annual Living Expenses and other Needs Period 3 Period 1 Period 2 a.

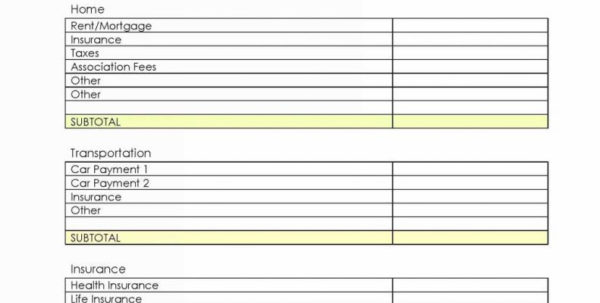

Easy Disability Insurance Needs Analysis Determine Total Disability Insurance Needs Enter Numbers Below Monthly Expenses Monthly Amounts (1) Rent or Mortgage (2) Children's Daycare (3) Food (4) Debt Repayment/Student Loans (5) Utilities (6) Medical / Dental Insurance (7) Homeowners/Auto Insurance (8) Other Insurance Premiums (Life, etc) (9) Gas ...

LIFE INSURANCE NEEDS ANALYSIS WORKSHEET Aatif Akhtar Broker-Agent CA DOI Lic. #0K77816 Cell: 818-448-0246 (Direct) Office: 818-217-4816 Fax: 818-670-7887 Email: info@coverlineinsurance.com I believe Life insurance is the greatest preventer of poverty... I would strongly suggest getting your life insured before you become

LIFE INSURANCE NEEDS ANALYSIS METHOD Insured's Name Stephanie Date Step 1: Financial resources needed after death 1. Annual living expenses and other needs: Period 1 Period 2 Period 3 a. Monthly living expenses $ 2,000 $ 5,000 $ b. $ 24,000.00 $ 60,000.00 $ - c. Number of years in time period 3 10 d.

Life Insurance Needs Analysis Client Name: Date: Agent Name/Approved Title: This worksheet from Ash Brokerage provides a quick and simple method to estimate the amount of life insurance you will need. Income Needs 1. Annual income your family would need if you die today Enter a number that's typically 10%-80% of total income.

0 Response to "41 life insurance needs analysis worksheet"

Post a Comment