41 social security disability worksheet

Checklist: Use one of the two following checklists to get ready for your appointment or when filing online: If your appointment is in-person or by telephone, use the Checklist—Adult Disability Interview. When filing online, use the Checklist For Online Adult Disability Application. Worksheet: "Medical and Job Worksheet - Adult.". Social Security Administration. Publication No. 64-112 (formerly SSA-1171) | ICN 474000 | Unit of Issue — PG of 25. January 2018 (Recycle prior editions) Medical and School Worksheet – Child. Produced and published at U.S. taxpayer expense . M. Medicine(s) the child takes, and the doctor’s name if it is a prescribed medication. Name of Medicine. Prescribed by. N. All medical …

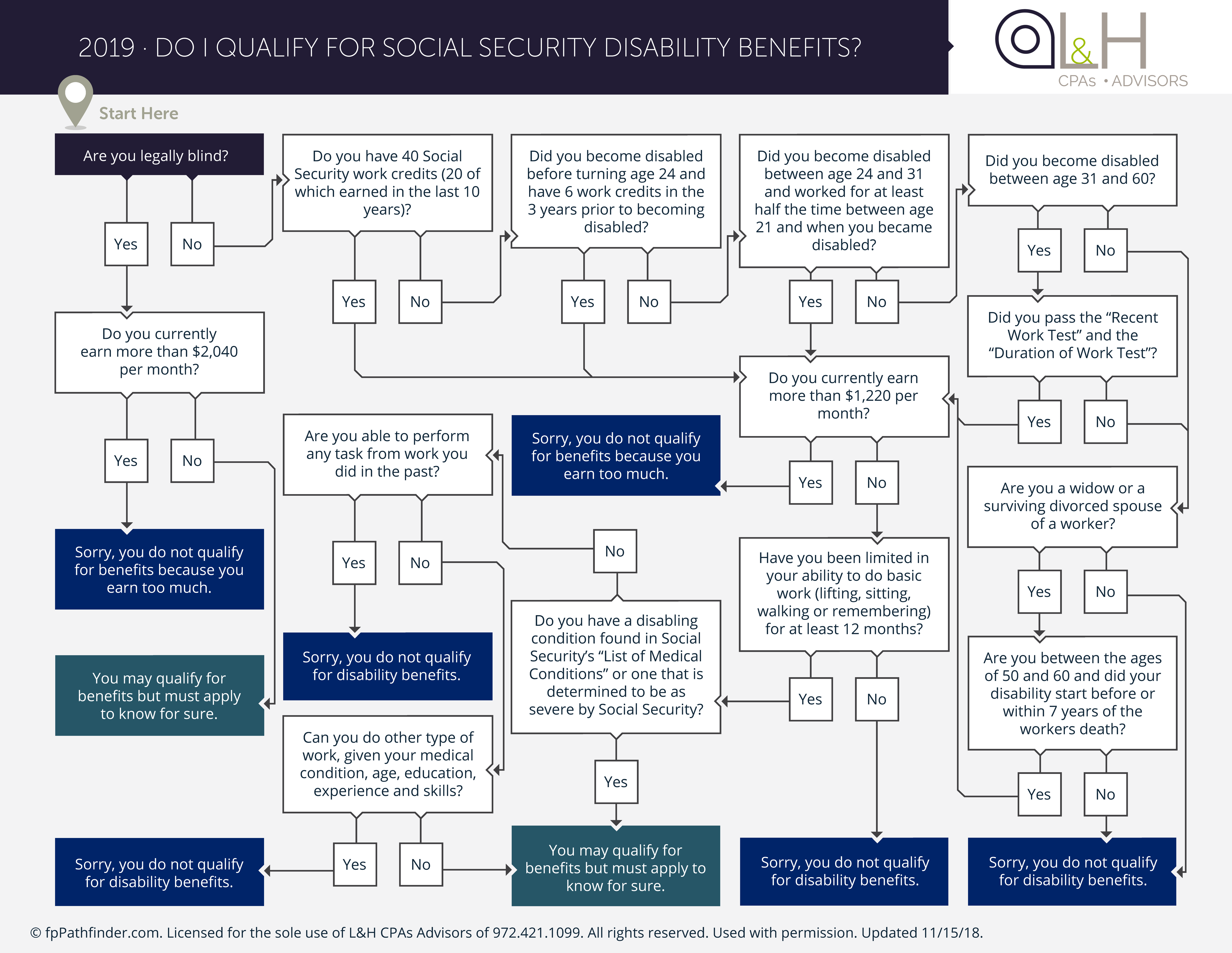

Social Security's Ticket to Work (Ticket) Program supports career development for people ages 18 through 64 who receive Social Security disability benefits (SSDI/SSI) and want to work. If you qualify for this free and voluntary program, you work with service providers to receive the supports and services you need to find and maintain employment.

Social security disability worksheet

Complete this worksheet to get ready for the appointment or when filing online. This worksheet is not the application for Social Security disability benefits. You should bring this worksheet to your appointment or have it with you if your appointment is by telephone. A. Medical Conditions Information on Publication 915, Social Security and Equivalent Railroad Retirement Benefits, including recent updates and related forms. Publication 915 explains the federal income tax rules for Social Security and equivalent tier 1 railroad retirement benefits. Worksheet: "Medical and School Worksheet - Child." The worksheet can help you to prepare for the disability interview or complete the Child Disability Report on the Internet. It lists the information that we will ask you about your child and provides space to write down this information.

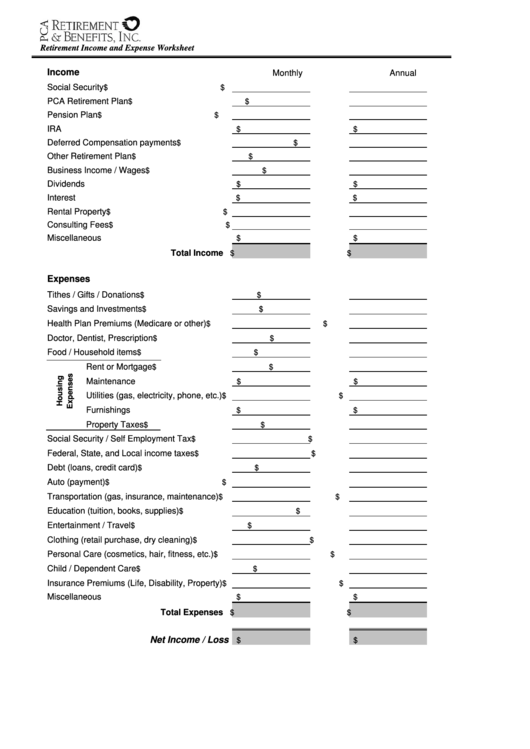

Social security disability worksheet. To figure the total of one-half of your benefits plus your other income, use Worksheet A, discussed later. If the total is more than your base amount, part of your benefits may be taxable. In 2019, she applied for social security disability benefits but was told she was ineligible. She appealed the decision and won. In 2020, she received a lump-sum payment of $6,000, of which $2,000 was for 2019 and $4,000 was for 2020. Jane also received $5,000 in social security benefits in 2020, so her total benefits in 2020 were $11,000. If so, this worksheet may help you call, email or visit Employment Networks (EN) to find one that is right for you. This worksheet gives you a list of questions to ask and space to write your answers, which may help you with your decision to assign your Ticket. Topics: choosing a provider, employment network. Categories: Fact Sheets & Resources. Although the Social Security Disability application process can be long and complicated, disability payments are often worth the inconveniences. Increase your chances of approval by staying persistent and organized. For more information about applying for disability benefits, contact your local Social Security Administration office:

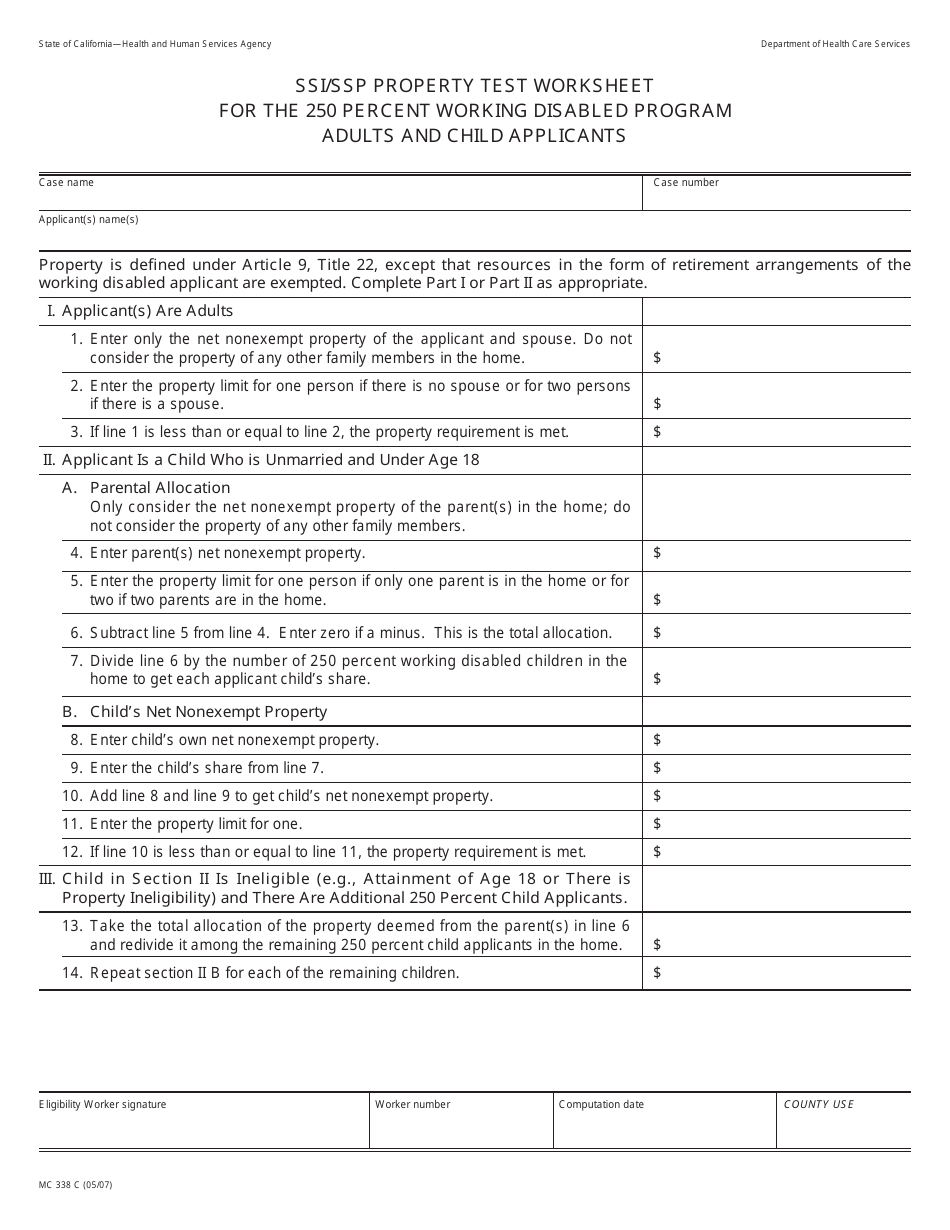

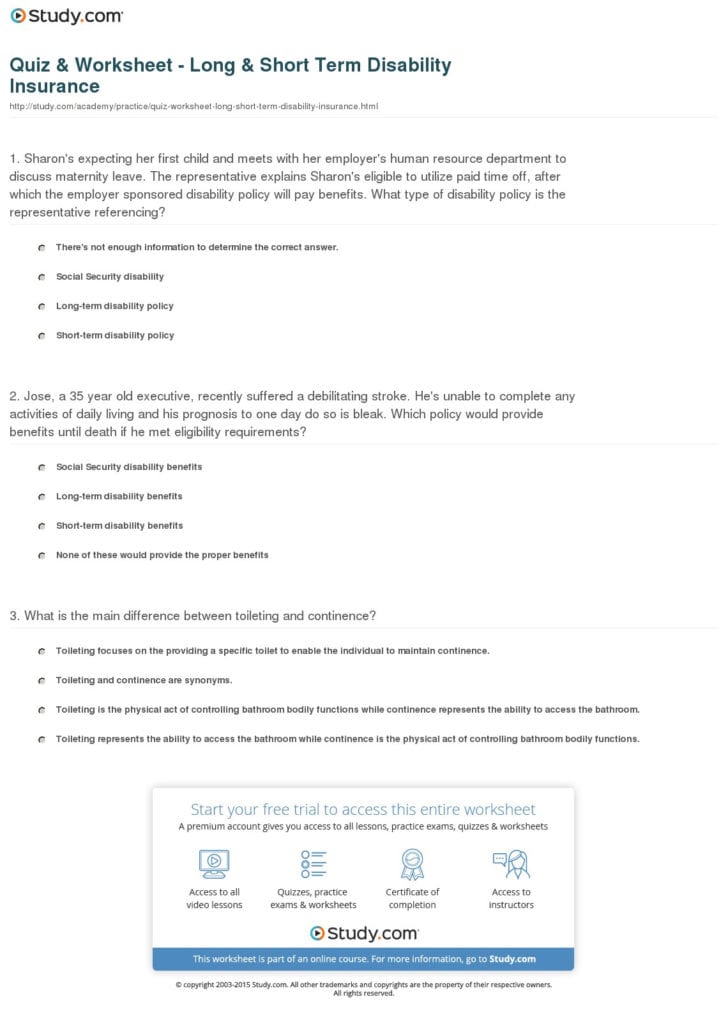

Worksheet. 1. To qualify for Social Security Disability Insurance, an individual must be able to demonstrate all of the following EXCEPT: They have a severe medical condition. They are unable to ... It includes a checklist and a worksheet to help you gather the information you need. ... How does Social Security decide if a child can get SSI?7 pages Complete this worksheet to get ready for the appointment or when filing online. This worksheet is not the application for Social Security disability benefits. You should bring this worksheet to your appointment or have it with you if your appointment is by telephone. A. Medical Conditions Security Income (SSI) due to a disability. If you receive SSI, Social Security will deduct the IRWE from your gross income when they determine your payment amount. The deduction is applied after applicable general and work exclusions. If you receive SSDI, the IRWE will be deducted from your gross earnings when Social Security determines if your

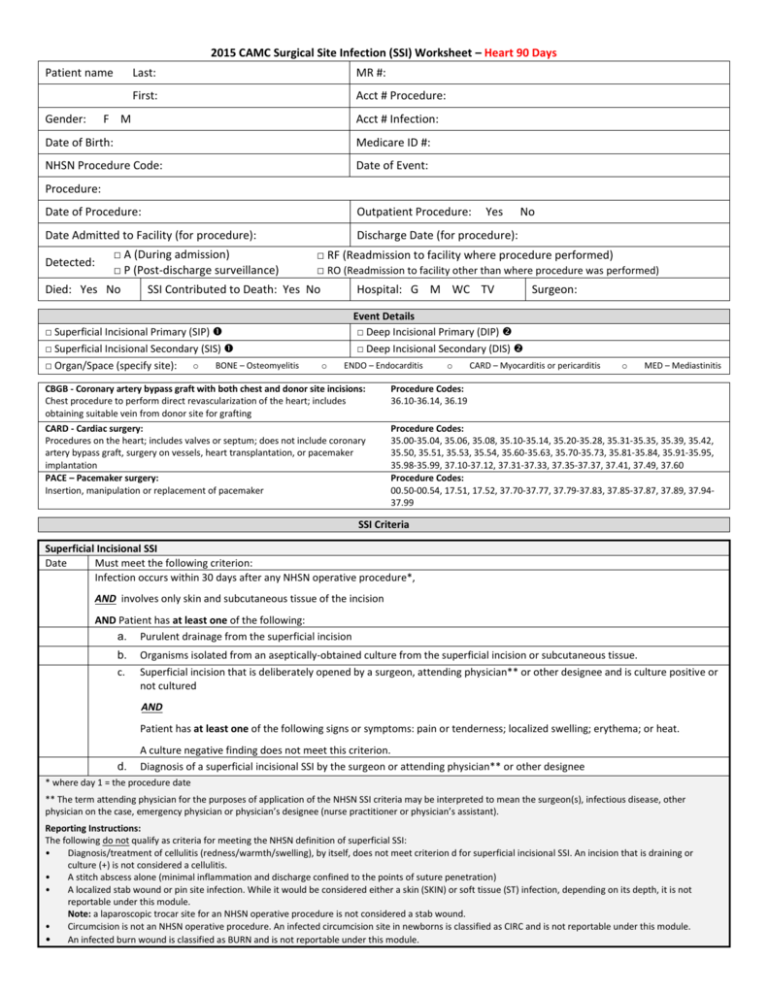

Social Security Disability Fibromyalgia Worksheets Prepared by Richard Podell, M.D., MPH WORKSHEET 1A: Diagnosing Fibromyalgia Using the 1990 American College of Rheumatology Criteria (ACR). This method is acceptable for SSR 12-2p According to the 1990 ACR Criteria to diagnose Fibromyalgia the patient should have: 1. Many people who rely on monthly social security disability payment as their sole source of income won't owe taxes. 2 However, reporting the lump sum as income for one tax year can result in owing taxes. You could end up paying more than you need to pay if you don't get the right advice. If you make between $25,000 and $34,000 each year, you ... The Social Security Disability application is long and complex. To improve the chance of enjoying a successful result, avoid making mistakes. For instance, don't collect unemployment while you're waiting for the outcome of a Social Security Disability Income (SSDI) application. Social Security Benefits Worksheet—Lines 5a and 5b. Keep for Your Records. Figure any write-in adjustments to be entered on the dotted line next to Schedule 1, line 36 (see the instructions for Schedule 1, line 36). If you are married filing separately and you lived apart from your spouse for all of 2018, enter "D" to

If you receive Social Security disability benefits (SSDI/SSI) and are considering returning to work, or working for the first time, you may be wondering how your earnings will affect your benefits. Benefits counseling is a free service offered by many Ticket to Work service providers to explain how working will affect your federal and state ...

Electronic Worksheet (EWS) When an applicant submits a claim for Social Security Disability benefits and that applicant is a disabled adult worker, the applicant must fill out what is called a Medical and Job Worksheet.

Social Security Benefits Worksheet (2019) Caution: Do not use this worksheet if any of the following apply. 1) If the taxpayer made a 2019 traditional IRA contribution and was covered (or spouse was covered) by a qualified retirement plan, see IRA Deduction and Taxable Social Security on Page 14-6.

19.03.2021 · Social Security benefits are factored into the majority of American retirement plans. They start paying out at age 62 if at least 40 credits, or 10 years, were earned from the years spent working. But is Social Security income taxable? The short answer is yes, but the long answer is a bit more complicated. In fact, about 40% of people who get Social Security have …

The Disability Starter Kit will help you get ready for your disability ... and; Worksheet to help you gather and organize the information you will need.

The Social Security Administration also makes annual Cost of Living Adjustments, even as you collect benefits. That means the retirement income you collect from Social Security has built-in protection against inflation. For many people, Social Security is the only form of retirement income they have that is directly linked to inflation.

Social Security and Equivalent Railroad Retirement Benefits. 2020. 02/03/2021. Publ 957. Reporting Back Pay and Special Wage Payments to the Social Security Administration. 0113. 09/16/2017. Publ 1693. Social Security Administration/Internal Revenue Service (SSA/IRS) Reporter.

Complete this worksheet to get ready for the appointment or when filing online. This worksheet is not the application for Social Security disability benefits. You should bring this worksheet to your appointment or have it with you if your appointment is by telephone. A. Medical Conditions

Information about Notice 703, Read This To See If Your Social Security Benefits May Be Taxable, including recent updates, related forms and instructions on how to file. Complete this worksheet to see if any of your social security and/or SSI (supplemental security income) benefits may be taxable.

1 For DWB Medicare-only claims in which the widow(er) alleges amyotrophic lateral sclerosis, enter the month of entitlement to "D" or "E" benefits.. In a remarried widow(er)'s claim, the controlling date will be established as of the date of remarriage (line 7), if the remarriage occurred after the attainment of age 50, and the date of remarriage is earlier than the controlling date ...

Worksheet: "Medical and Job Worksheet - Adult." The worksheet can help you prepare for your disability interview. It lists information that we will ask you and provides space to write down this information. We will ask for this information during your disability interview. Printable version of the entire Adult Starter Kit in PDF Format

*Applying for Disability Benefits* To apply for SSI and SSDI 1. Call Social Security at 1-800-772-1213 to schedule an appointment to apply for SSI and SSDI.. 2. Look over the Disability Starter Kit that is attached to this packet and

Adult Disability Starter Kit Fact Sheet. ... Checklist - Child Disability Interview ... The enclosed Medical and School Worksheet will help you collect

social security benefits and equivalent tier 1 railroad retire-ment benefits. It is prepared through the joint efforts of the Internal Revenue Service (IRS), the Social Security Ad-ministration (SSA), and the U.S. Railroad Retirement Board (RRB). Social security benefits include monthly retirement, sur-vivor, and disability benefits.

Supplemental Security Income (SSI) for Children. SSI provides monthly cash payments to help meet the basic needs of children who have a physical or mental ...

DI 52170.010 Form SSA-2455 (Offset Worksheet-Disability Insurance Benefits) A. Purpose of the Form SSA-2455 Use the SSA-2455 to compute the amount of workers' compensation/public disability benefits (WC/PDB) offset. You may use the e2455+, a new tool for calculating amounts payable after WC/PDB offset, instead of the paper Form SSA-2455.

Worksheet: "Medical and School Worksheet - Child." The worksheet can help you to prepare for the disability interview or complete the Child Disability Report on the Internet. It lists the information that we will ask you about your child and provides space to write down this information.

Information on Publication 915, Social Security and Equivalent Railroad Retirement Benefits, including recent updates and related forms. Publication 915 explains the federal income tax rules for Social Security and equivalent tier 1 railroad retirement benefits.

Complete this worksheet to get ready for the appointment or when filing online. This worksheet is not the application for Social Security disability benefits. You should bring this worksheet to your appointment or have it with you if your appointment is by telephone. A. Medical Conditions

0 Response to "41 social security disability worksheet"

Post a Comment