42 fannie mae rental income worksheet excel

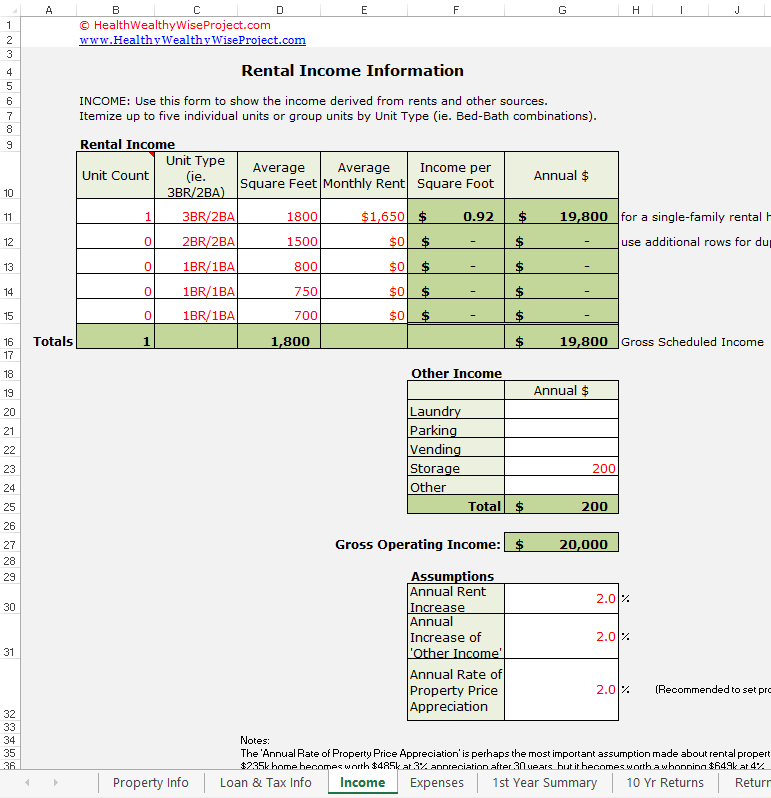

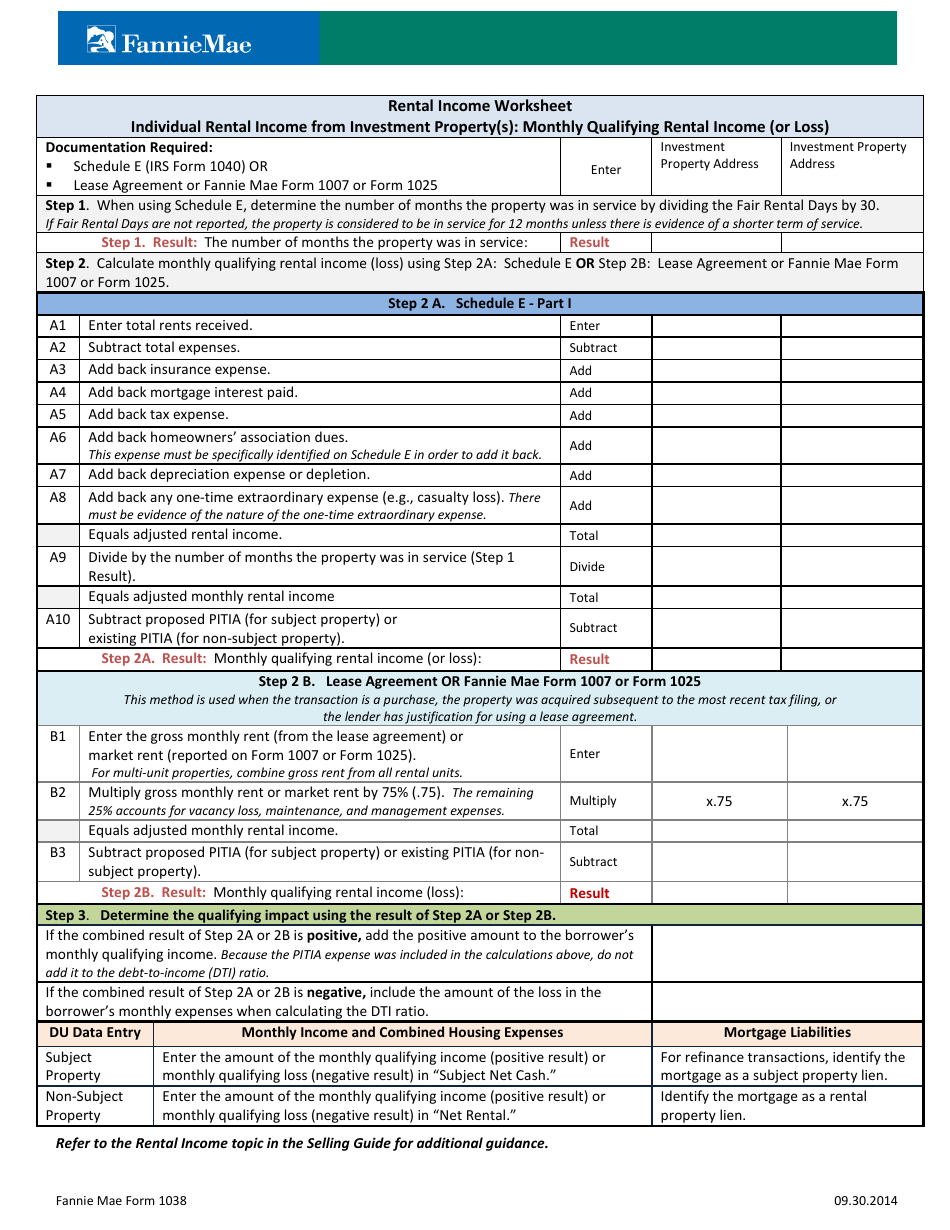

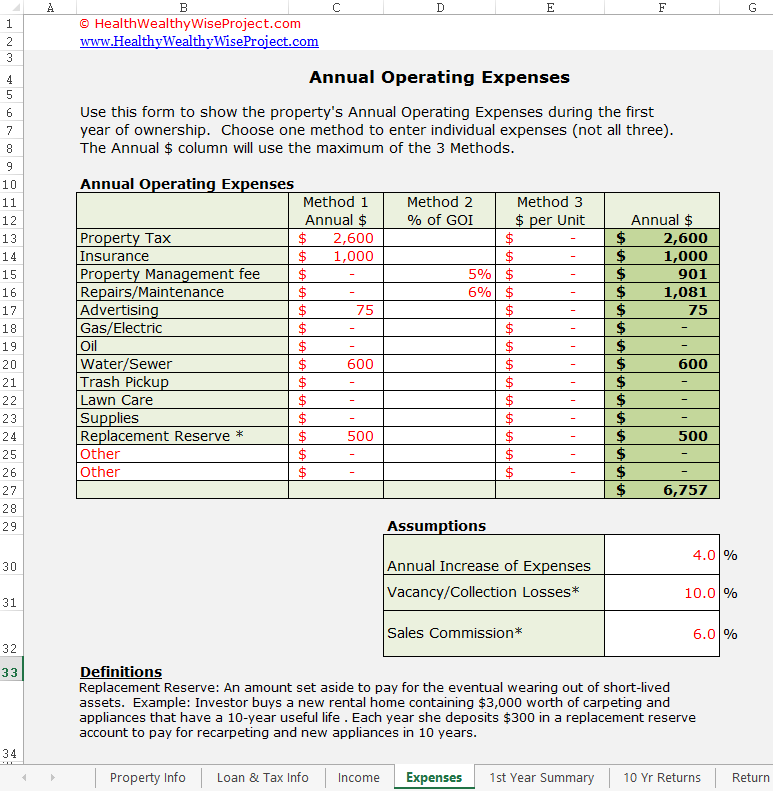

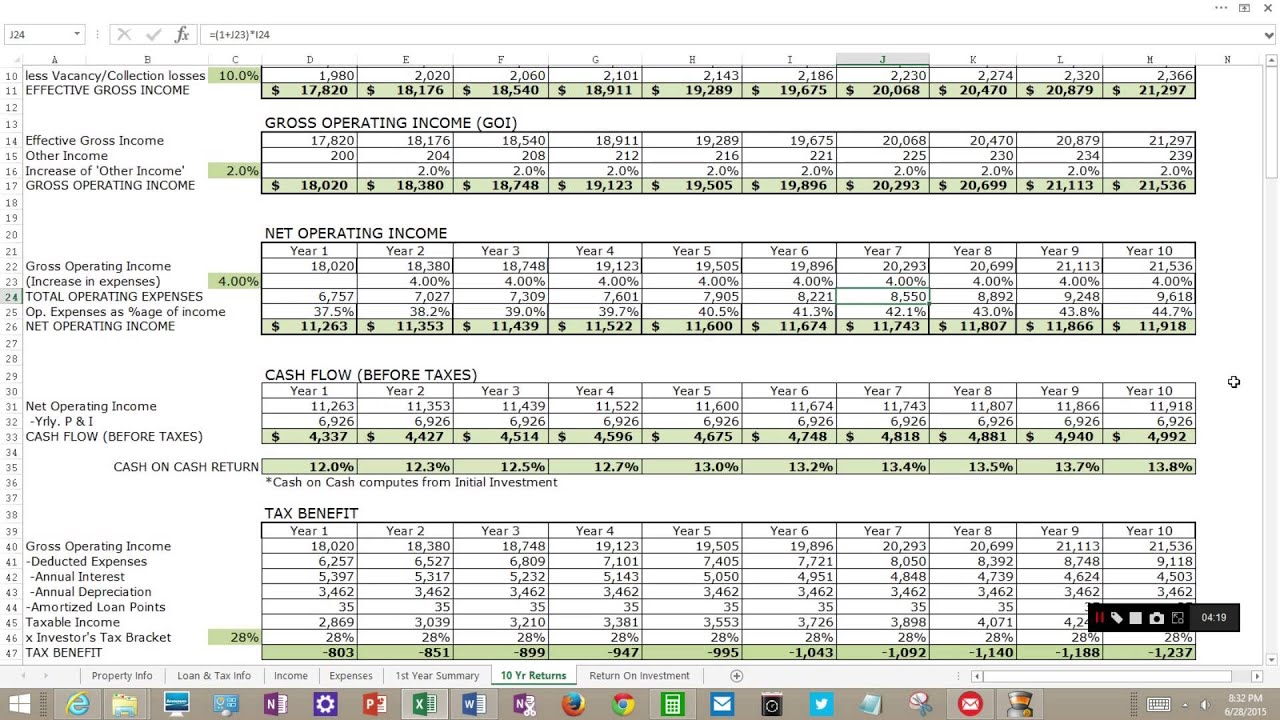

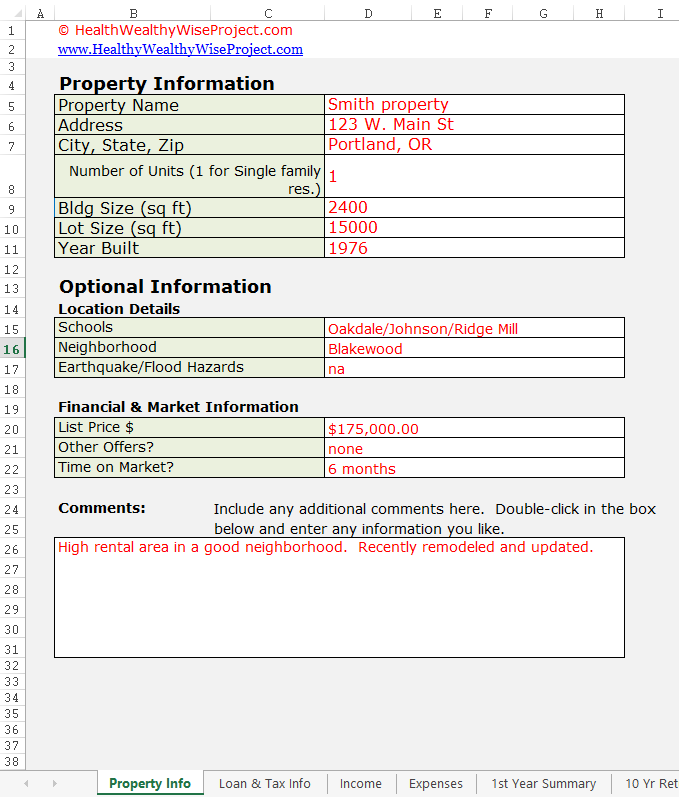

Dec 15, 2021 · Rental Income Worksheet – Business Rental Income from Investment Property(s) . Reporting of Gross Monthly Rent Eligible rents on the subject property (gross monthly rent) must be reported to Fannie Mae in the loan delivery data for all two- to four-unit principal residence properties and investment properties, regardless of whether the borrower is using rental income to qualify for the loan. Fannie mae rental income worksheet excel. And are credit enhanced by fannie mae excel spreadsheet in 4 app income. Calculate monthly qualifying rental income loss using step 2a. Fannie mae form 1037 022316. A lender may use fannie mae rental income worksheets form 1037 or form 1038 to calculate individual rental income loss reported on schedule e.

Hello! A question for the home loan savvy among you, though the wind-up is long. I'm working with a credit union to get pre-approved for a conventional home loan as a first time home buyer, applying jointly with my partner. We just sent in what we thought was the final batch of financial docs today, and we were told that because my income is part time and less than two years old, we can only use my partner's income, due to "Fanny Mae" income restrictions. It doesn't completely price us out of t...

Fannie mae rental income worksheet excel

Lunafi is a comprehensive accounting tool for freelancers and independent contractors. Professionals can use it to calculate their taxable income, understand deductions, and save money on taxes. [https://www.lunafi.co/post/basics-of-1099-income-for-new-freelancers](https://www.lunafi.co/post/basics-of-1099-income-for-new-freelancers) YTD P&L and Business Statement Analysis. Use our flow chart to guide you in applying temporary COVID-19 agency guidelines and determining a stable monthly income. Download Worksheet (PDF) Ask 2. Save 10. Handout. Here are two simple questions to ask self-employed borrowers, so you can save 10. Download Worksheet (PDF) Fannie Mae Rental Income Worksheet . the transaction is a purchase or the property was acquired subsequent to the most receIf Fair Rental Days are not reported, the property is considered to be in serviceCalculate the monthly qualifying rental income using Step 2A: Schedule Eetermine the number of months the property was in service byEnter the amount of the monthly qualifying income in-time ...

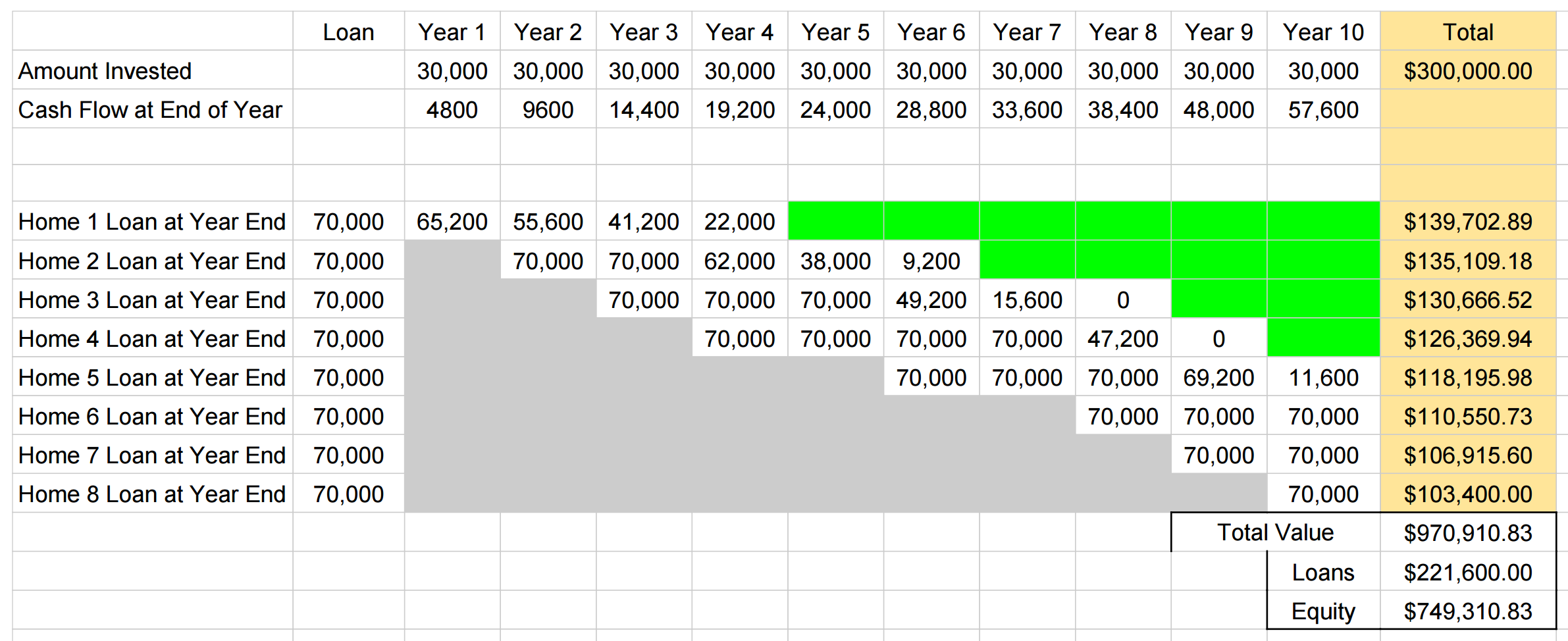

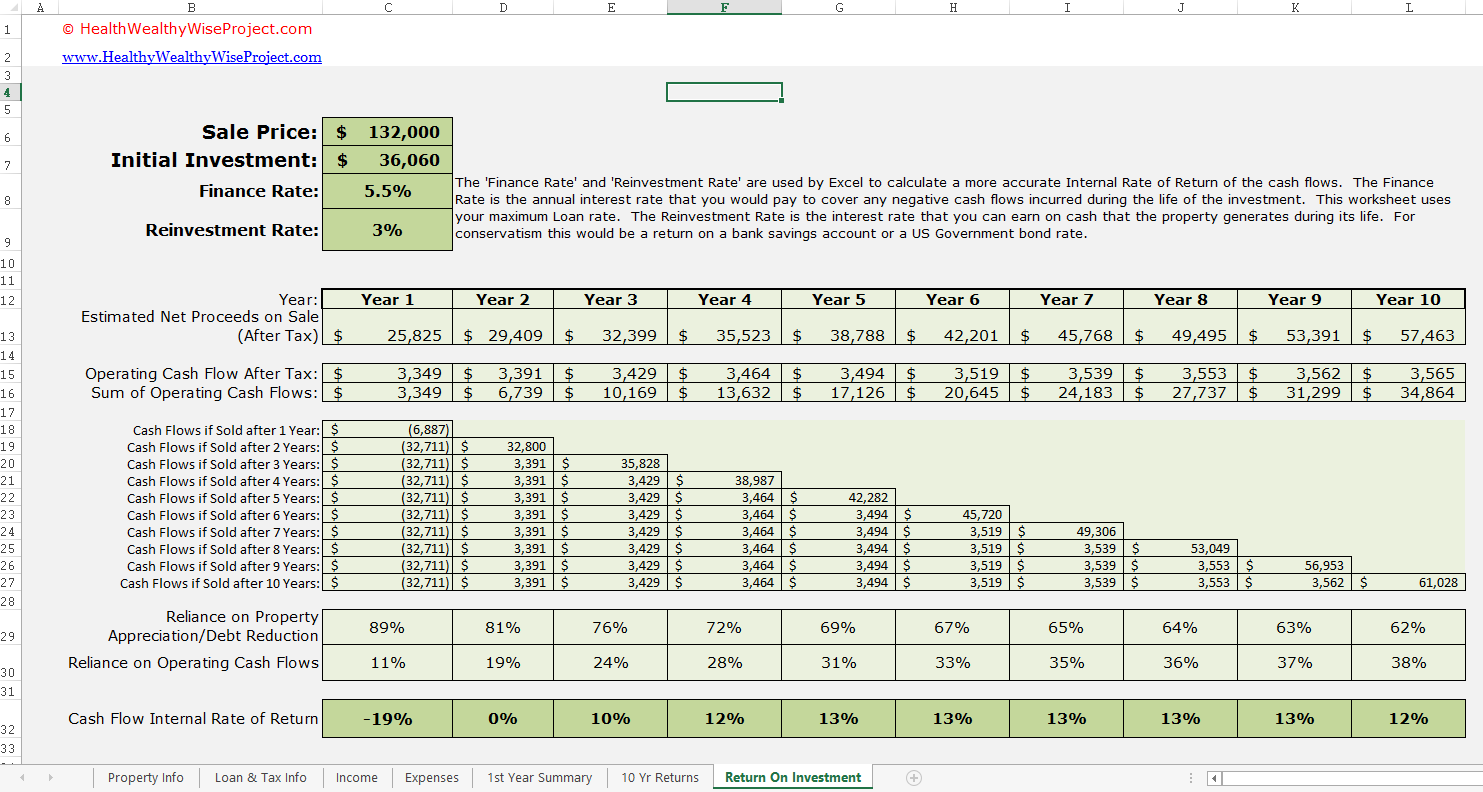

Fannie mae rental income worksheet excel. /r/news https://www.cbsnews.com/news/fannie-mae-rental-payment-history-credit-score-mortgage-lending/ Schedule E - Supplemental Income and . Loss. Note: Use Fannie Mae Rental Income Worksheets (Form 1037 or Form 1038) to evaluate individual rental income (loss) reported on Schedule E. Refer to . Selling Guide, B3-3.1-08, Rental Income, for additional details. Partnerships and S corporation income (loss) reported on Schedule E is addressed below. Rental Income Calculation Worksheets. Fannie Mae publishes four worksheets that lenders may use to calculate rental income. Use of these worksheets is optional. The worksheets are: Rental Income Worksheet - Principal Residence, 2- to 4-unit Property , More › 146 People Used More Info ›› Visit site Fannie mae income calculation worksheet excel Hey, So I'm 19 y/o and looking into investing in real estate and I love the aspect of flipping and renting. I would ideally love to buy one of those houses for like 40k-60k on homepath in north Georgia and flip it myself. So I ran all the numbers from everything like the material cost to property tax and I'm getting a cash flow that is good, But I'm scared that I am forgetting something or not adding something and that the moment I buy into something it's going to go south. I'm just scared that...

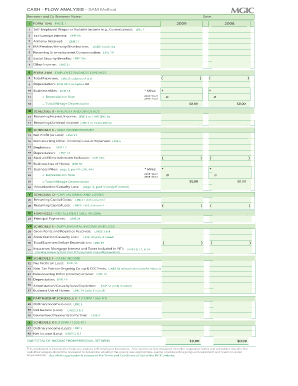

Fannie Mae Form 1039 02/23/16 Rental Income Worksheet Documentation Required: Enter If Fair Rental Days are not reported, the property is considered to be in service for 12 months unless there is evidence of a shorter term of service. Result A1 A2 Subtract A3 Add A4 A5 A6 A7 A8 Equals adjusted rental income. Total A9 Divide Note: A lender may use Fannie Mae Rental Income Worksheets (Form 1037 or Form 1038) or a comparable form to calculate individual rental income (loss) reported on Schedule E. a. A lender may use Fannie Mae Rental Income Worksheets (Form 1037 or Form 1038) or a comparable form to calculate individual rental income (loss) reported on Schedule E. a. Royalties Received (Line 4) b. Total Expenses (Line 20) c. Depletion (Line 18) Subtotal Schedule E Schedule F – Profit or Loss from Farming a. Net Farm Profit or Loss I really do think these rules will help consumers. Especially those with equity in their homes and, private loans, Parent plus or even grad plus debt that aren't eligible for PSLF. But like all financial decisions, these choices should not be made lightly. There are pros and cons to moving this debt around - not the least being increasing your mortgage payment and therefore running the risk of foreclosure. For those using IDR plans and contemplating buying a home, these rules will certain...

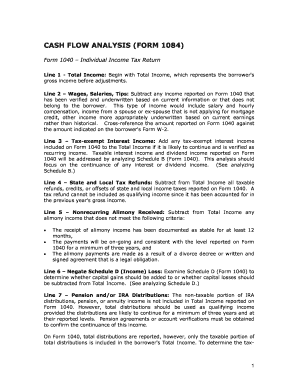

The following is a list of forms for the Income Analysis Guidelines: Form Number Name of Form Publication Date COR 0602 Rental Income/Schedule E Calculation Worksheet 10/02/2015 COR 1404 Salaried/Hourly Income Calculation Worksheet 08/07/2020 Fannie Mae Form 1084 Fannie Mae Cash Flow Analysis 06 /20 1 9 Freddie Mac Form 91 Freddie Mac Income ... Get and Sign. Fannie Mae Rental Income Worksheet 2014-2022 Form. To be in service for 12 months unless there is evidence of a shorter term of service. Step 1. Result: The number of months the property was in service: Result Step 2 Calculate the monthly qualifying rental income using Step 2A: Schedule E OR Step 2B: Lease Agreement or Form 1025. Fnma self employed income calculation worksheet. If the borrower is the business owner or is self-employed the business ownerself-employed indicator must be checked along with the percentage of ownership. Use our PDF worksheets to total numbers by hand or let our Excel calculators do the work for you. Monthly qualifying rental income (or loss): B1 Enter the gross monthly rent (from the lease agreement) or market rent (reported on Form 1007 or Form 1025). For multi-unit properties, combine gross rent from all rental units. B2 Multiply x.75 Equals adjusted monthly rental income. B3 Subtract Step 2B. Result: Monthly qualifying rental income (loss): DU Data Entry

Monthly qualifying rental income (loss): Step 2. Calculate monthly qualifying rental income (loss) using Step 2A: Schedule E OR Step 2B: Lease Agreement or Fannie Mae Form 1007 or Form 1025. Step 1. When using Schedule E, determine the number of months the property was in service by dividing the Fair Rental Days by 30. Step 2A. Schedule E - Part I

Equals adjusted rental income. Total A9 Divide by the number of months the property was in service (Step 1 Result). Divide Equals adjusted monthly rental income Total A10 Subtract proposed PITIA (for subject property) or existing PITIA (for non-subject property). Subtract Step 2A. Result: Monthly qualifying rental income (or loss): Result

Excel Details: Fannie mae income calculation worksheet excel.Excel Details: Sep 2, 2016 - Download a Rental Property Cash Flow Analysis worksheet for Excel.This worksheet derives only the self-employed income by analyzing Schedule C, F, K-1 (E), and 2106.Fannie.16.The taxes on the imputed income are deducted from your biweekly paycheck.

Get And Sign Fannie Mae Income Worksheet 2014-2021 Form Months unless there is evidence of a shorter term of service. Step 1. Result The number of months the property was in service Result Step 2. Calculate monthly qualifying rental income loss using Step 2A Schedule E OR Step 2B Lease Agreement or Fannie Mae Form 1007 or Form 1025.

Schedule E - Supplemental Income and Loss . Note: Use Fannie Mae Rental Income Worksheets (Form 1037 or Form 1038) to evaluate individual rental income (loss) reported on Schedule E. Refer to Selling Guide, B3-3.1-08, Rental Income, for additional details. Partnerships and S corporation income (loss) reported on Schedule E is addressed below.

Please use the following calculator and quick reference guide to assist in calculating rental income from IRS Form 1040 Schedule E. It provides suggested guidance only and does not replace Fannie Mae or Freddie Mac instructions or applicable guidelines.

Income Mae Rental Worksheet Excel Fannie – Lakelachamber – PDF Loan Number Property Address Calculator and Quick Reference. – A lender may use fannie mae rental Income Worksheets (Form 1037 or Form 1038) to calculate individual rental income (loss) reported on Schedule E.. Fannie Mae Form 1038 02/23/16.

Result: Net Rental Income(calculated to a monthly amount) 4 (Sum of subtotal(s) divided by number of applicable months = Net Rental Income) $_____ / _____ = $_____ 1. Refer to Section 5306.1(c)(iii) for net rental Income calculation requirements . 2. This expense, if added back, must be included in the monthly payment amount being used to ...

Hey, So I'm 19 y/o and looking into investing in real estate and I love the aspect of flipping and renting. I would ideally love to buy one of those houses for like 40k-60k on homepath in north Georgia and flip it myself. So I ran all the numbers from everything like the material cost to property tax and I'm getting a cash flow that is good, But I'm scared that I am forgetting something or not adding something and that the moment I buy into something it's going to go south. I'm just scared ...

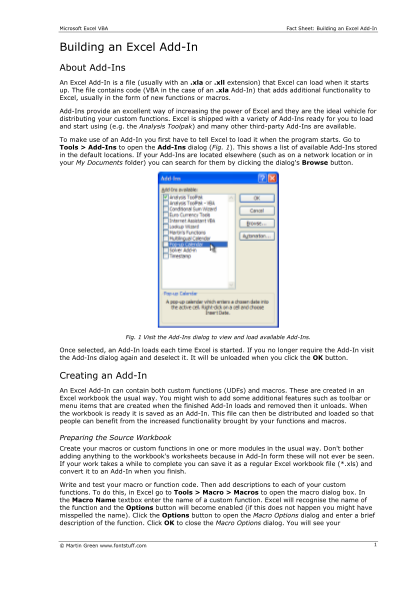

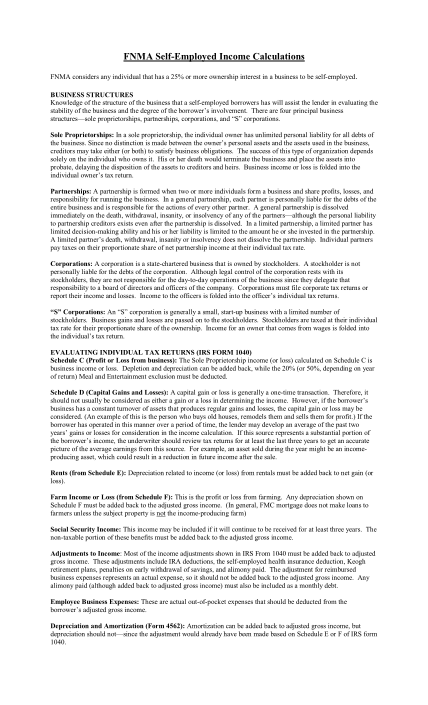

Excel Details: Excel Details: Excel Details: Analyze self - employed borrower cash flow, income from employment and non- employment sources, and rental income using our editable, auto-calculating worksheets.Cash flow analysis worksheets, tax year 2020 Self - employed SAM Cash Flow Analysis with P&L (02/19/2021) Download the worksheet.

- This specific image (fannie Mae Rental Income Worksheet Beautiful Mortgage Excel Template Fustar) over is usually classed with:put up by means of Vincent Carpenter on 2017-11-02 00:00:24. To find out just about all pictures throughout Luxury Fannie Mae Rental Income Worksheet pictures gallery make sure you comply with this particular hyperlink.

Fannie Mae. Calculate monthly qualifying rental income (loss) using Step 2A: Schedule E OR Step 2B: Lease Agreement or Fannie Mae Form 1007 or Form 1025. Step 1. When using Schedule E, determine the number of months the property was in service by dividing the Fair Rental Days by 30.

Enter the amount of the monthly qualifying income “Subject Net Cash.” Enter the amount of the monthly qualifying income “Net Rental.” Include as the borrower’s primary housing expense. For refinance transactions, identify the mortgage as a subject property lien. Include as the borrower’s primary housing expense. 3A Add the monthly qualifying rental income to the borrower’s monthly qualifying income. 3B

Use Fannie Mae Rental Income Worksheets (Form 1037 or Form 1038) to evaluate individual rental income (loss)reported on Schedule E. Refer to Selling Guide, B3-3.1-08, Rental Income, for additional details. Line 5a – Royalties Received: Include royalty income which meets eligibility standards. Line 5b – Total Expenses:

https://www.wsj.com/articles/freddie-mac-joins-rental-home-boom-1534604401?mod=e2tw

Publication of Fillable Rental Income Worksheets Fannie Mae has recreated its Rental Income worksheets (forms 1037, 1038 and 1039) as microsoft excel fillable spreadsheets to enable Sellers to download and complete them electronically. Monthly qualifying rental income (loss): Step 2. More › 259 People Used More Info ›› Visit site

Fannie Mae Rental Income Worksheet . the transaction is a purchase or the property was acquired subsequent to the most receIf Fair Rental Days are not reported, the property is considered to be in serviceCalculate the monthly qualifying rental income using Step 2A: Schedule Eetermine the number of months the property was in service byEnter the amount of the monthly qualifying income in-time ...

YTD P&L and Business Statement Analysis. Use our flow chart to guide you in applying temporary COVID-19 agency guidelines and determining a stable monthly income. Download Worksheet (PDF) Ask 2. Save 10. Handout. Here are two simple questions to ask self-employed borrowers, so you can save 10. Download Worksheet (PDF)

Lunafi is a comprehensive accounting tool for freelancers and independent contractors. Professionals can use it to calculate their taxable income, understand deductions, and save money on taxes. [https://www.lunafi.co/post/basics-of-1099-income-for-new-freelancers](https://www.lunafi.co/post/basics-of-1099-income-for-new-freelancers)

0 Response to "42 fannie mae rental income worksheet excel"

Post a Comment