42 qualified dividends and capital gain tax worksheet

Qualified Dividends and Capital Gain Tax Worksheet—Line 11a Qualified Dividends and Capital Gain Tax Worksheet—Line 11a. Keep for Your Records. See the earlier instructions for line 11a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 through line 10. 39 1040 qualified dividends worksheet - Worksheet Resource Use the qualified dividends and capital gain tax worksheet in the instructions for form 1040 or 1040a to figure your total tax amount. 1 don t churn your portfolio you want to pay the long term capital gains rate and pay that as infrequently as possible. Do the job from any device and share docs by email or fax.

Qualified Dividends And Capital Gain Tax Worksheet 2021 ... 2020 qualified dividends and capital gain tax worksheetreate electronic signatures for signing a qualified dividends and capital gain tax worksheet 2021 in PDF format. signNow has paid close attention to iOS users and developed an application just for them.

Qualified dividends and capital gain tax worksheet

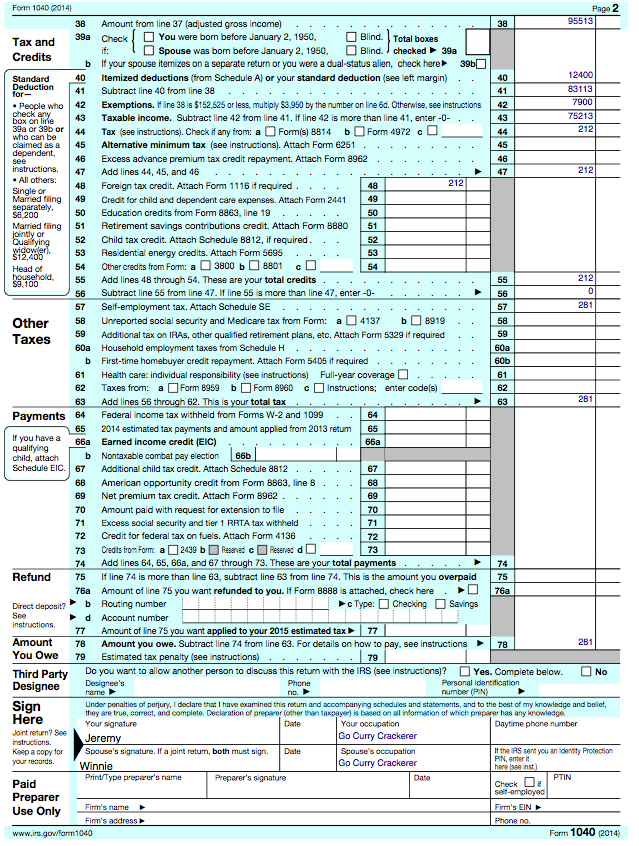

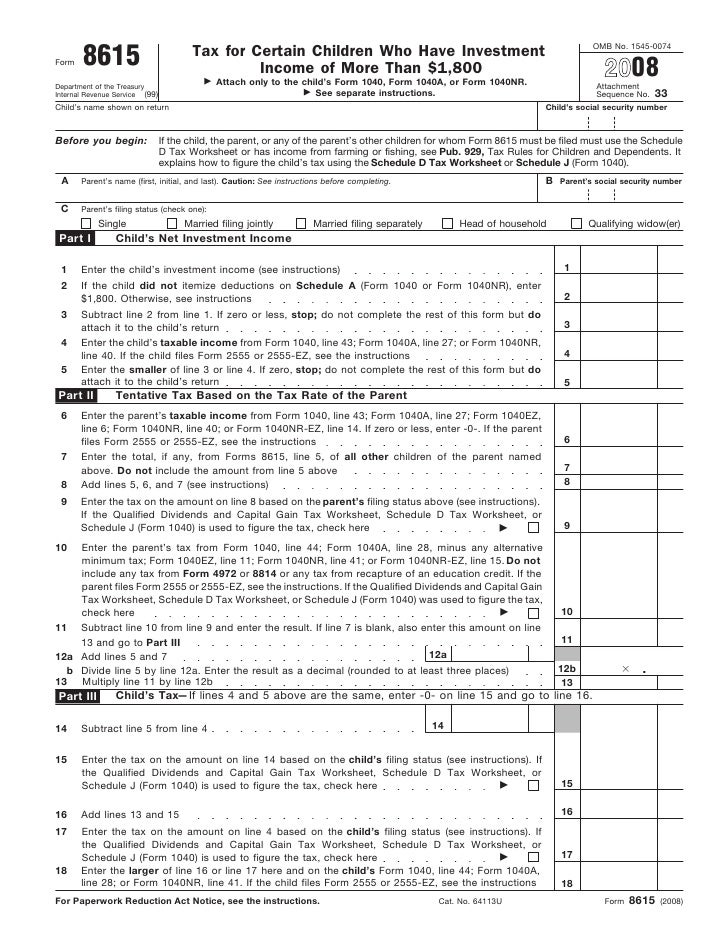

How Your Tax Is Calculated: Qualified Dividends and ... For this reason, the first step of the Qualified Dividends and Capital Gain Tax Worksheet is to split those two separate types back out. Lines 1-5: Qualified Income & Ordinary Income. Lines 1-5 of this worksheet calculate your total qualified income (line 4) and your total ordinary income (line 5), so they can be taxed at their different rates. Qualified Dividends and Capital Gain Tax Worksheet. - CCH Schedule D Tax Worksheet If you have to file Schedule D, and line 18 or 19 of Schedule D is more than zero, use the Schedule D Tax Worksheet in the Instructions for Schedule D to figure the amount to enter on Form 1040, line 44. Qualified Dividends and Capital Gain Tax Worksheet. Why doesn't the tax on my return (line 16) match the Tax ... When you have qualified dividends or capital gains, you do not use the tax table. Instead, you will need to use the Capital Gains Worksheet to figure your tax. 1040 Instructions Line 16 , Qualified Dividends and Capital Gains Worksheet. The program has already made this calculation for you.

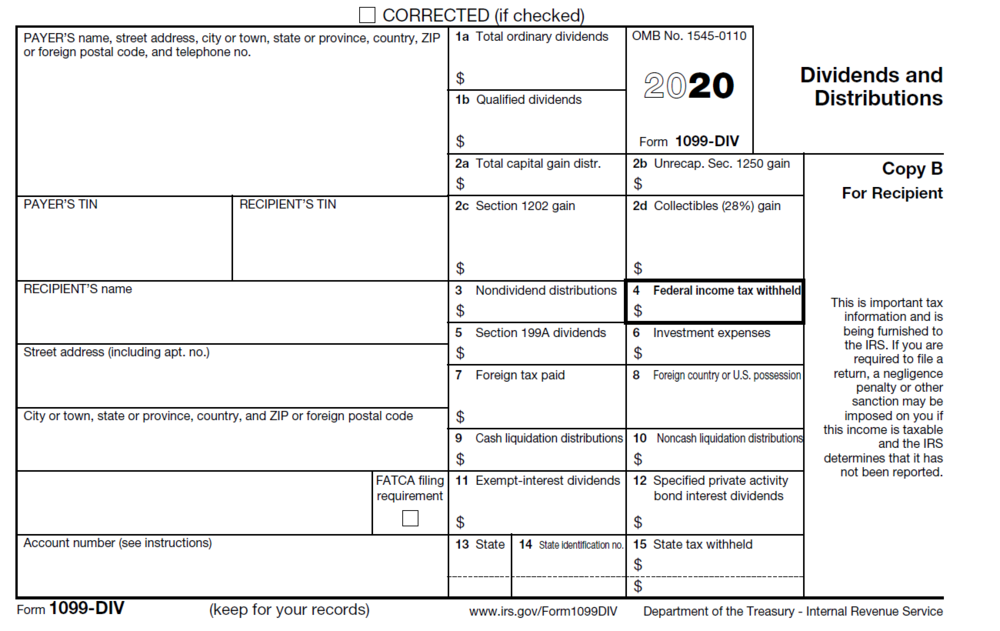

Qualified dividends and capital gain tax worksheet. Qualified Dividends and Capital Gains ... - The Tax Adviser It takes 27 lines in the IRS qualified dividends and capital gain tax worksheet to work through the computations (Form 1040 Instructions (2013), p. 43). With a good understanding of the mechanics, preparers can spot opportunities to advise clients to take advantage of the 0% rate and minimize the 20% rate. 38 Qualified Dividends And Capital Gain Tax Worksheet ... Use the qualified dividends and capital gain tax worksheet in the instructions for form 1040 or 1040a to figure your total tax amount. 1 don t churn your portfolio you want to pay the long term capital gains rate and pay that as infrequently as possible. Do the job from any device and share docs by email or fax. Where Is The Qualified Dividends And Capital Gain Tax ... It is important to note that "qualified dividends" are ordinary dividends that meet specified criteria and are taxed at the lower long-term capital gains tax rates, rather than the higher tax rates for individuals' ordinary income. Qualified dividends are taxed at rates ranging from 0% to 23.88%. 2021 Qualified Dividends And Capital Gains Worksheet and ... Qualified Dividends and Capital Gain Tax Worksheet for Forms 1040 and 1040-SR, line 12a (or in the instructions for Form 1040-NR, line 42). This worksheet derives only the self-employed income by analyzing Schedule C, F, K-1 (E), and 2106. 6%) were subject to the maximum long-term capital gains and qualified dividends rate (20%).

How Your Tax Is Calculated: Understanding the Qualified ... Instead, 1040 Line 44 "Tax" asks you to "see instructions." In those instructions, there is a 27-line worksheet called the Qualified Dividends and Capital Gain Tax Worksheet, which is how you actually calculate your Line 44 tax. The 27 lines, because they are so simplified, end up being difficult to follow what exactly they do. Qualified Dividends And Capital Gains Worksheet Calculator ... The qualified dividends and capital gain tax worksheet can be separated into different lines in order to make it easier for you. Lines 1 7 are for ordinary income and qualified income. Per the form 1116 instructions if the qualified dividends and capital gain tax worksheet is generated and the taxpayer is not required to file schedule d an ... When To Use Qualified Dividends And Capital Gain Tax ... Capital gains tax rates are commonly used to compute qualified dividend taxes. If your taxable income falls below a certain threshold in 2021, qualifying dividends will be taxed at 0%. $80,801 - $501,600 for married couples filing jointly or widow(er)s who qualify to file. 2021 Instructions for Schedule D (2021) - IRS tax forms Complete this worksheet only if line 18 or line 19 of Schedule D is more than zero and lines 15 and 16 of Schedule D are gains or if you file Form 4952 and you have an amount on line 4g, even if you don't need to file Schedule D. Otherwise, complete the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Forms 1040 and ...

Qualified Dividends and Capital Gain Tax Explained — Taxry Dividend income is paid out of the profits a corporation makes to the stockholders. It is considered income for the tax year instead of a capital gain. However, qualified dividends are taxed as capital gains instead of income. Since there is a lot of confusion about capital gains tax, a tax manager can help you with this part of your taxes and ... Qualified Dividends and Capital Gain Tax Worksheet - Drake ... Qualified Dividends and Capital Gain. Tax Worksheet - Line 16 (Form 1040). 2020. Before you begin: FOR ALT MIN TAX PURPOSES ONLY.2 pages Fillable Form 1040 Qualified Dividends and Capital Gain ... Form 1040 Qualified Dividends and Capital Gain Tax Worksheet 2018 . On average this form takes 7 minutes to complete. The Form 1040 Qualified Dividends and Capital Gain Tax Worksheet 2018 form is 1 page long and contains: 0 signatures; 2 check-boxes PDF Qualified Dividends and Capital Gain Tax Worksheet (2020) Tools or Tax ros ea Qualified Dividends and Capital Gain Tax Worksheet (2020) • See Form 1040 instructions for line 16 to see if the taxpayer can use this worksheet to compute the taxpayer's tax. • Before completing this worksheet, complete Form 1040 through line 15.

1040 (2021) | Internal Revenue Service - IRS tax forms Schedule D Tax Worksheet. Qualified Dividends and Capital Gain Tax Worksheet. Schedule J. Foreign Earned Income Tax Worksheet. Foreign Earned Income Tax Worksheet—Line 16; Qualified Dividends and Capital Gain Tax Worksheet—Line 16; Line 19. Nonrefundable Child Tax Credit and Credit for Other Dependents. Form 8862, who must file. Payments

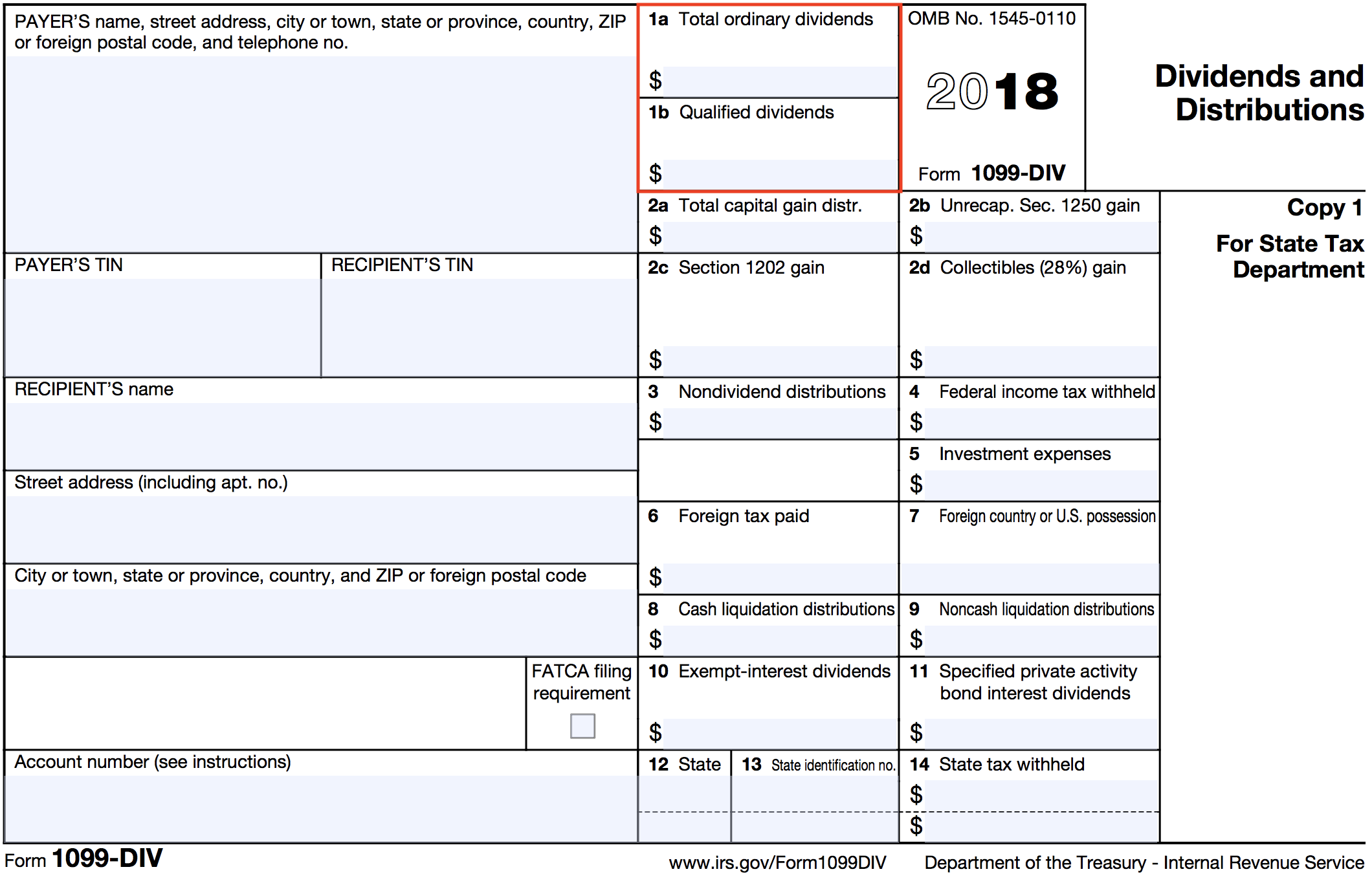

How to Figure the Qualified Dividends on a Tax Return ... Report your qualified dividends on line 9b of Form 1040 or 1040A. Use the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Form 1040 or 1040a to figure your total tax amount.

What is a Qualified Dividend Worksheet? - Money Inc IRS introduced the qualified dividend and capital gain tax worksheet as an alternative to Schedule D and added the qualified dividends and new rates to the capital gains worksheet in 2003. The Forms 1040 and 1040A, therefore, help investors to take advantage of lower capital gains rates without having to fill out the Schedule D.

PDF Qualified Dividends and Capital Gain Tax Worksheet -Line ... Qualified Dividends and Capital Gain Tax Worksheet -Line 44 (Form 1040) Line 28 (Form 1040A) 2016 Before you begin: 1. 1. 2. 2. 3. Yes. 3. No. 4. 4. 5. 5. 6.

Qualified Dividends Tax Worksheet ≡ Fill Out Printable PDF ... Qualified Dividends Tax Worksheet - Fill Out and Use. If you wish to acquire the qualified dividends tax worksheet PDF, our editor is what you need! By pressing the orange button below, you'll access the page where it's possible to edit, save, and print your document. Experience the simplicity of navigation and interface the tool boasts.

ACC 330 Qualified Dividends and Capital Gain Tax Worksheet ... Qualified Dividends and Capital Gain Tax Worksheet—Line 11a Keep for Your Records See the earlier instructions for line 11a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 through line 10.

Qualified Dividend And Capital Gains Worksheet 2020 and ... The Qualified Dividend & Capital Gain worksheet is used to calculate the Federal Income Tax when either of these two items are present and as per instruction on Form 1040 and schedule D. Self-employment tax It takes 27 lines in the IRS qualified dividends and capital gain tax worksheet to work through the computations (Form 1040 Instructions ...

Creative Qualified Dividends And Capital Gains Tax ... Qualified dividends and capital gains tax worksheet. IRS Form 1040 Qualified Dividends Capital Gains Worksheet Form 1040 Form is an IRS needed tax form needed from the US government for federal income taxes filed by citizens of United States. The difference between the two means that the tax rate can be substantial.

Qualified Dividends and Capital Gain Tax Worksheet - 2021 ... Qualified Dividends and Capital Gain Tax Worksheet - Line 16 1. Enter the amount from Form 1040 or 1040-SR, line 15. 118,915 2. Enter the amount from Form 1040 or 1040-SR, line 3a* 2,000 3. Are you filing Schedule D? ☐ Yes. Enter the smaller of line 15 or 16 of Schedule D. If either line 15 or 16 is blank or a loss, enter -0-.

How can I find the " Qualified Dividends and Capital Gain ... Click Forms in the upper right (upper left for Mac) and look through the "Forms In My Return" list and open the Qualified Dividends and Capital Gain Tax Worksheet. The "Line 44 worksheet" is also called the Qualified Dividends and Capital Gain Tax Worksheet. View solution in original post. 0. 3. 2,226. Reply.

Fillable 2020 QUALIFIED DIVIDENDS and CAPITAL GAIN TAX ...

Why doesn't the tax on my return (line 16) match the Tax ... When you have qualified dividends or capital gains, you do not use the tax table. Instead, you will need to use the Capital Gains Worksheet to figure your tax. 1040 Instructions Line 16 , Qualified Dividends and Capital Gains Worksheet. The program has already made this calculation for you.

Qualified Dividends and Capital Gain Tax Worksheet. - CCH Schedule D Tax Worksheet If you have to file Schedule D, and line 18 or 19 of Schedule D is more than zero, use the Schedule D Tax Worksheet in the Instructions for Schedule D to figure the amount to enter on Form 1040, line 44. Qualified Dividends and Capital Gain Tax Worksheet.

How Your Tax Is Calculated: Qualified Dividends and ... For this reason, the first step of the Qualified Dividends and Capital Gain Tax Worksheet is to split those two separate types back out. Lines 1-5: Qualified Income & Ordinary Income. Lines 1-5 of this worksheet calculate your total qualified income (line 4) and your total ordinary income (line 5), so they can be taxed at their different rates.

:max_bytes(150000):strip_icc()/1099-DIV-ffc2266fbad34acd9de5359089733572.jpg)

0 Response to "42 qualified dividends and capital gain tax worksheet"

Post a Comment