43 affordable care act worksheet form

Affordable Care Act Worksheet - windsorkulturgintza.com Feb 24, 2022 · Free Affordable Care Act Worksheet - This is a Research and Development (R&D) with the ADDIE model the place 12 energetic students of chemistry division Safe Harbors Help Prevent ACA Penalties - The ACA Times 2021-05-06 · If you have questions about entering ACA affordability codes on Form 1095-C, check out our post, The Codes on Form 1095-C Explained. For the 2020 tax year, additional codes were added for use on Form 1095-C. These new codes specify HRAs integrated with individual health insurance coverage or Medicare, subject to certain conditions.

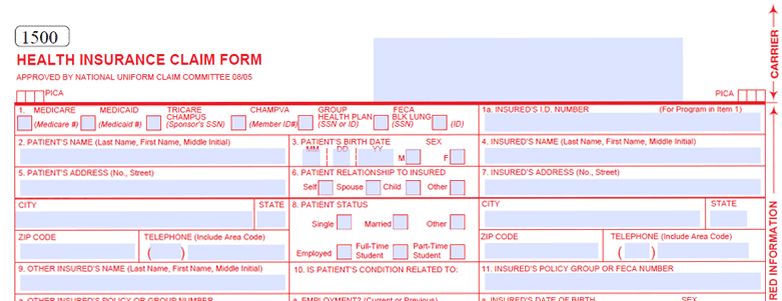

Forms - benefitsboard Several forms are now interactive and can be filled out online. You can then print the form and mail it to the Benefits Board. The interactive Application Form and the Investment Selection Form can be submitted electronically. If you have any questions feel free to call us toll-free at (877) 478-7190, or send an e-mail to: info@benefitsboard.com.

Affordable care act worksheet form

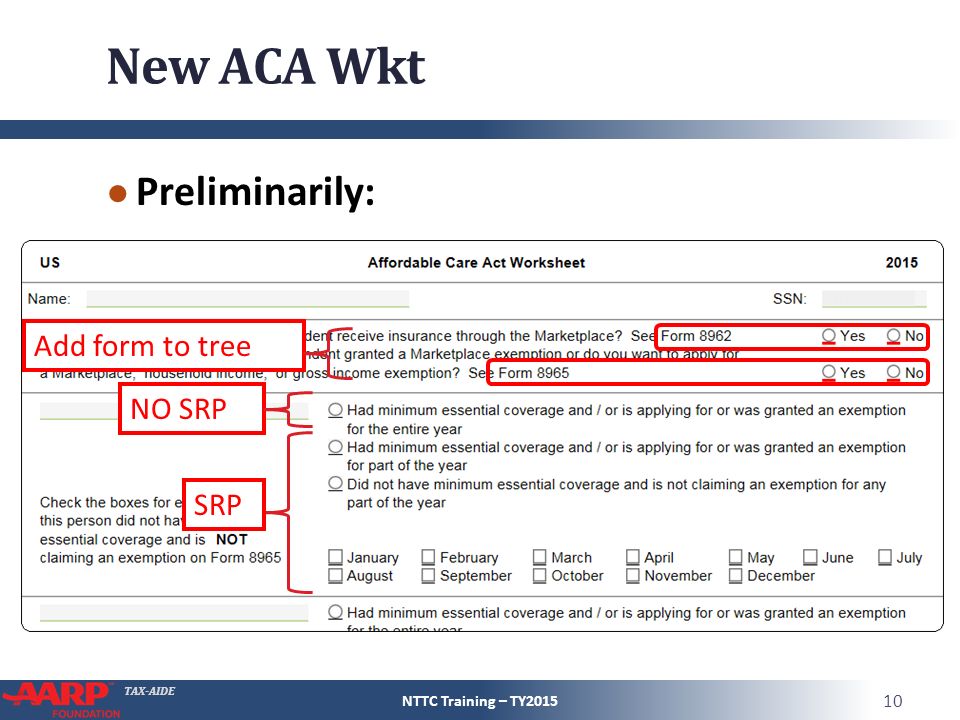

ACA Individual Shared Responsibility Provision Exemptions ... The individual shared responsibility provision of the Affordable Care Act requires taxpayers to have qualifying health coverage (also known as minimum essential coverage), qualify for a coverage exemption, or make an individual shared responsibility payment when filing their federal income tax return.. For tax year 2019 and 2020 returns. Under the Tax Cuts and Jobs Act, the … Affordable Care Act - Oregon VITA & Taxaide Affordable Care Act Select the appropriate year for associated forms, worksheets, instructions, and tools. ... How-To's. What: 2019: 2018 When Cols B&C are blank on 1095-A: PDF: PDF What to put in Schedule A Medical: PDF: PDF Form 1095-A: Health Insurance Marketplace Statement: Affordable Care Act Consulting | American Fidelity The reporting requirement is effective for taxable years beginning after December 31, 2012. W-2 Reporting Worksheet: Determine the benefits coverage a particular employee has selected, including both the plans (e.g., PPO, health Flexible Spending Account) and coverage levels (e.g., individual, family) 2. Enter the total cost of each benefit ...

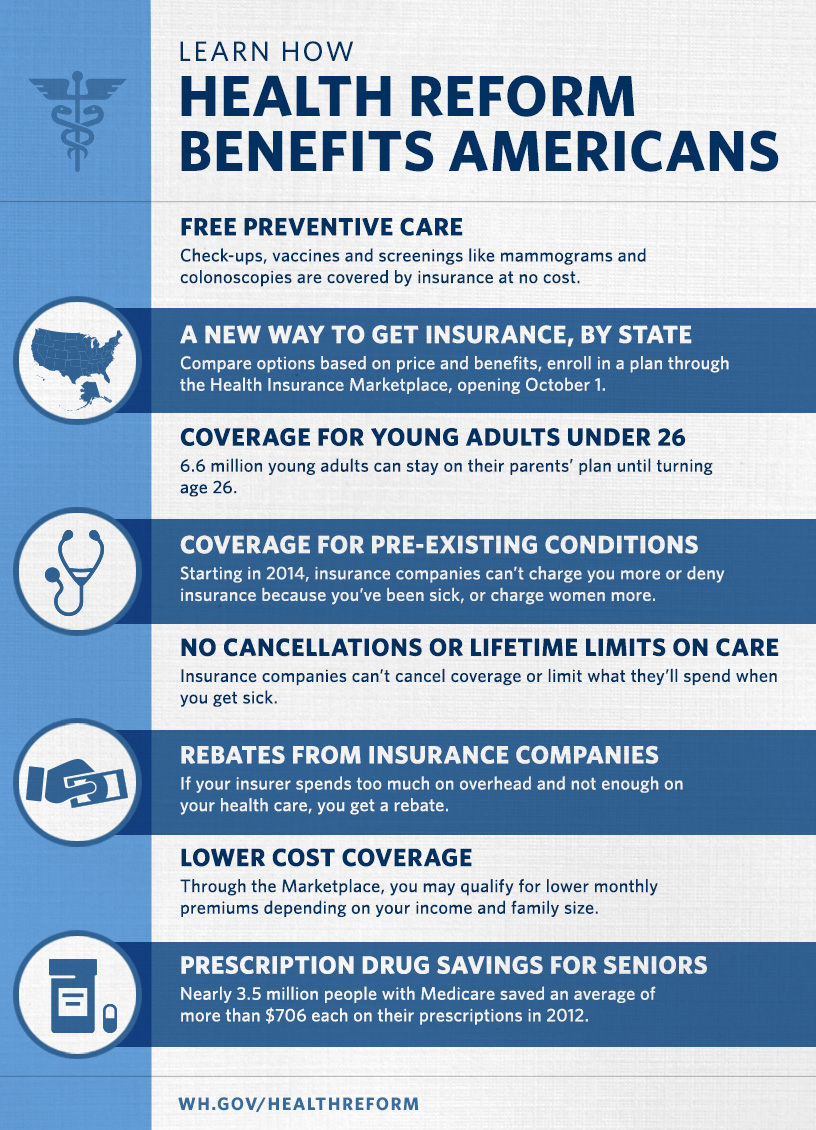

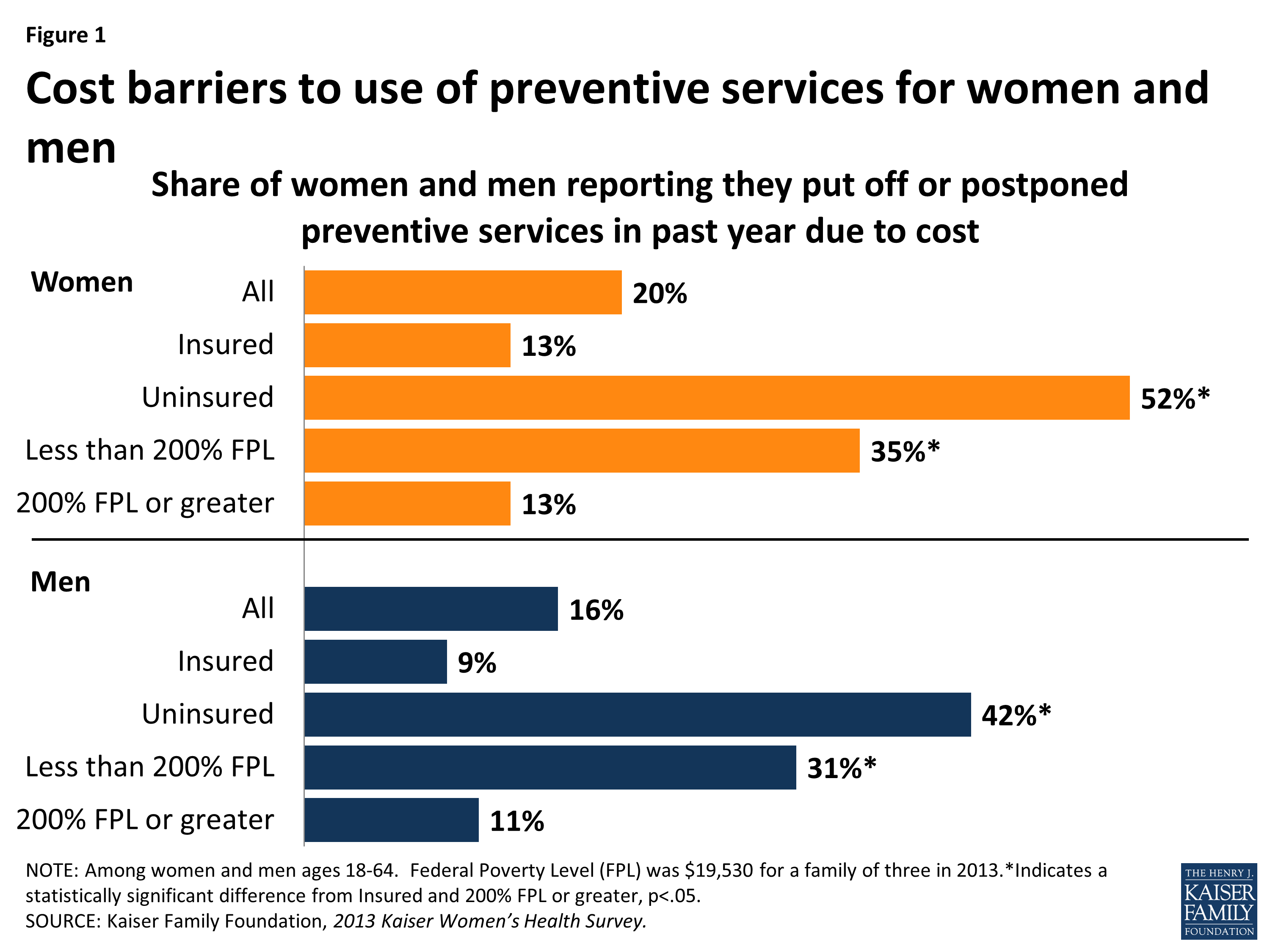

Affordable care act worksheet form. Key Features of the Affordable Care Act by Year - The ... OVERVIEW OF THE HEALTH CARE LAW. 2010: A new Patient's Bill of Rights goes into effect, protecting consumers from the worst abuses of the insurance industry. Cost-free preventive services begin for many Americans. 2011: People with Medicare can get key preventive services for free, and also receive a 50 percent discount on brand-name drugs in the Medicare “donut … PDF Affordable Care Act - IRS tax forms Affordable Care Act . Time Required: 15 minutes . Introduction Objectives Topics The lesson covers some of the tax provisions of the Affordable Care Act (ACA). You will learn ... and TIN on the Form 1040 or Form 1040-NR the taxpayer files for the year. Family coverage: Health insurance that covers more than one individual. Viewpoint Help - Processing - Affordable Care Act Processing Form 1095-C is used by employers that are required to report their offers of health coverage to the IRS and employees. It is issued to an individual by an employer subject to 'employer shared responsibility' for providing minimum essential health coverage to any of its employees. PDF Affordable Care Act Reporting - Manual - Skyward SKYWARD DOCUMENTATION - AFFORDABLE CARE ACT REPORTING MANUAL Revised: 01/11/17 Page 5 of 102 Version 05.16.10.00.09 The browse will open allowing the additional 2.00 hours to be added to the correct day. ACA Hours can also be added outside this worksheet's specified date range. This is helpful if an employee is late submitting a time sheet.

Form 8965 - Affordability Worksheet - Support Form 8965 - Affordability Worksheet Beginning with the 2019 tax year (for which tax returns are filed in early 2020), the Shared Responsibility Payment or penalty for not having minimum essential health coverage no longer applies. Community Care Home - Veterans Affairs 2021-11-15 · Community care is based on specific eligibility requirements, availability of VA care, and the needs and circumstances of individual Veterans. Learn about Veteran community care VA also provides health care to Veterans’ family members and dependents through programs like the Civilian Health and Medical Program of the Department of Veterans Affairs (CHAMPVA). Affordable Care Act - 2022 ACA Compliance Form Filing ... Affordable Care Act - 2022 ACA Compliance Form Filing Submission Worksheet . Attach this worksheet to the Compliance Checklist and Certification. Provide the following information (all entries are required and must be populated): 1. Company name: _____ 2. NAIC number: _____ 3. Form H1801, SNAP Worksheet - Texas Health and Human Services Identify documentation whether on Form H1801 or additional sheets, referring to the step and item number on the form, such as "Step 2, Item 2a" followed by a description of the verification used. Page 4. Document Changes — Document changes in gross income, allowable deductions, or household circumstances during the certification period.

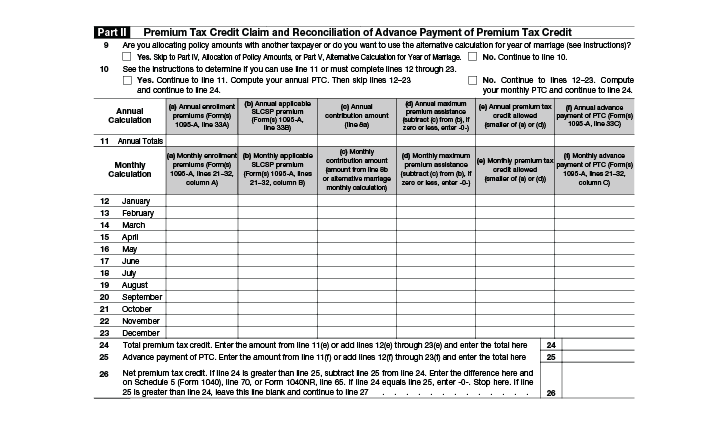

PDF Types of Coverage Exemptions - IRS tax forms Medicaid expansion under the Affordable Care Act. ... except in Connecticut. See the Instructions for Form 8965 to claim the exemption. ... Keep for Your Records Worksheet: Resident of a State That Didn't Expand Medicaid Exemptions (Code G) Taxpayer(s) Household Income (Click on "Summary/Print" in the Menu to see Form 1040) 1. AGI (Form ... Affordable Care Act | Internal Revenue Service - IRS tax forms The Affordable Care Act contains comprehensive health insurance reforms and includes tax provisions that affect individuals, families, businesses, insurers, tax-exempt organizations and government entities. These tax provisions contain important changes, including how individuals and families file their taxes. The law also contains benefits and ... Individual Shared Responsibility Provision - IRS tax forms Under the Tax Cuts and Jobs Act, the amount of the individual shared responsibility payment is reduced to zero for months beginning after December 31, 2018. Beginning in Tax Year 2019, Forms 1040 and 1040-SR will not have the "full-year health care coverage or exempt" box and Form 8965, Health Coverage Exemptions, will no longer be used. Health Insurance Care Tax Forms, Instructions & Tools ... This form includes details about the Marketplace insurance you and household members had in 2021. You’ll need it to complete Form 8962, Premium Tax Credit. Get a quick overview of health care tax Form 1095-A — when you’ll get it, what to do if you don’t, how to know if it’s right, and how to use it. See a sample 1095-A (PDF, 132 KB).

Affordable Care Act Estimator Tools | Internal Revenue Service 2021-11-23 · The Taxpayer Advocate Service has developed several tools for individuals and employers to help determine how the Affordable Care Act might affect them and to estimate ACA related credits and payments.. Under the recently enacted Tax Cuts and Jobs Act, taxpayers must continue to report coverage, qualify for an exemption, or pay the individual shared …

Viewpoint Help - Setup - Affordable Care Act Setup Getting Ready for the Affordable Care Act. One of the requirements of the Affordable Care Act is that large employers file a Form 1095-C. Viewpoint recommends gathering this information throughout the course of the year, rather than waiting until the Form 1095-C due date. Key data and information required to fill out the 1095-C

Reconciliation and Repayment of Premium Tax Credit - H&R Block Form 1040EZ is generally used by single/married taxpayers with taxable income under $100,000, no dependents, no itemized deductions, and certain types of income (including wages, salaries, tips, taxable scholarships or fellowship grants, and unemployment compensation). Additional fees apply with Earned Income Credit and you file any other returns such as city or local income tax …

Affordable Care Act - IRS tax forms The Affordable Care Act calls for all taxpayers to do at least one of three things: Have qualifying health insurance coverage for each month of the year; Have an exemption from the requirement to have coverage; Make an individual shared responsibility payment when filing federal income tax return.; Under the Tax Cuts and Jobs Act, taxpayers must continue to report coverage, qualify for an ...

PDF REQUIRED FORM - churchwelltax.com The Affordable Care Act forms you may receive: If you had health insurance through a State Exchange you must provide us Form 1095A and/or CA Form 3895. We cannot file your tax return without this form. Form 1095‐A & CA Form 3895 Health Insurance Marketplace Statement

PDF Affordable Care Act: PUBLICATION What You ... - IRS tax forms Under the Affordable Care Act, the federal government, state governments, insurers, employers, and ... would have filed Form 8965, Health Care Exemptions, to claim a coverage exemption. Beginning in tax year 2019 and beyond, Forms 1040 and 1040-SR will not have the "full-year health care coverage or exempt"

1040-US: Affordable Care Act - Form 1095-A, 1095-B, and ... If you leave these fields blank, UltraTax/1040 will automatically calculate Form 1040, line 61, Health care: individual responsibility, for all family members for the entire year. To view a summary of this calculation, view the Health Care: Individual Responsibility Worksheet. Related topic: Affordable Care Act FAQs. Share This

Entering Affordable Care Act (ACA) information (1040) The tax application includes the following input screens for entering Affordable Care Act information. Screen Coverage - Health Coverage Exemptions and Individual Responsibility (Health Care folder): Use this screen to complete Form 8965, Health Coverage Exemptions, and Health Care: Individual Responsibility Worksheet.; Screen PTC - Premium Tax Credit (Health Care folder): Use this screen to ...

Modified Adjusted Gross Income under the Affordable Care ... 2013-11-05 · Part of the Labor Center’s Covid-19 Series: Resources, Data, and Analysis for California Originally published July 2014; Updated March 2021 . Under the Affordable Care Act, eligibility for income-based Medicaid [1] and subsidized health insurance through the Marketplaces is calculated using a household’s Modified Adjusted Gross Income (MAGI). The …

PDF Affordable Care Act Worksheet - cnccpa.com Affordable Care Act Worksheet Are you required to comply with the Act? How many employees does your Company employ: 200 or more fulltime (FT) employees. (Continue to Step 2. You are required to comply with the Act and must automatically enroll all FT employees in health insurance.)

Affordable Care Act - IRS tax forms Affordable Care Act 3-1 Introduction This lesson covers some of the tax provisions of the Affordable Care Act (ACA). You will learn how to deter-mine if taxpayers are eligible to receive the premium tax credit. A list of terms you may need to know is ... The form includes information about the coverage, who was covered, and when.

Affordable Care Act - University of Texas System The 1095-C forms show information about health insurance coverage for you and your family members during each month of the past year. Because of the Affordable Care Act, every person must obtain health insurance or pay a penalty to the IRS, and this form shows your health insurance coverage under UT SELECT. 3.

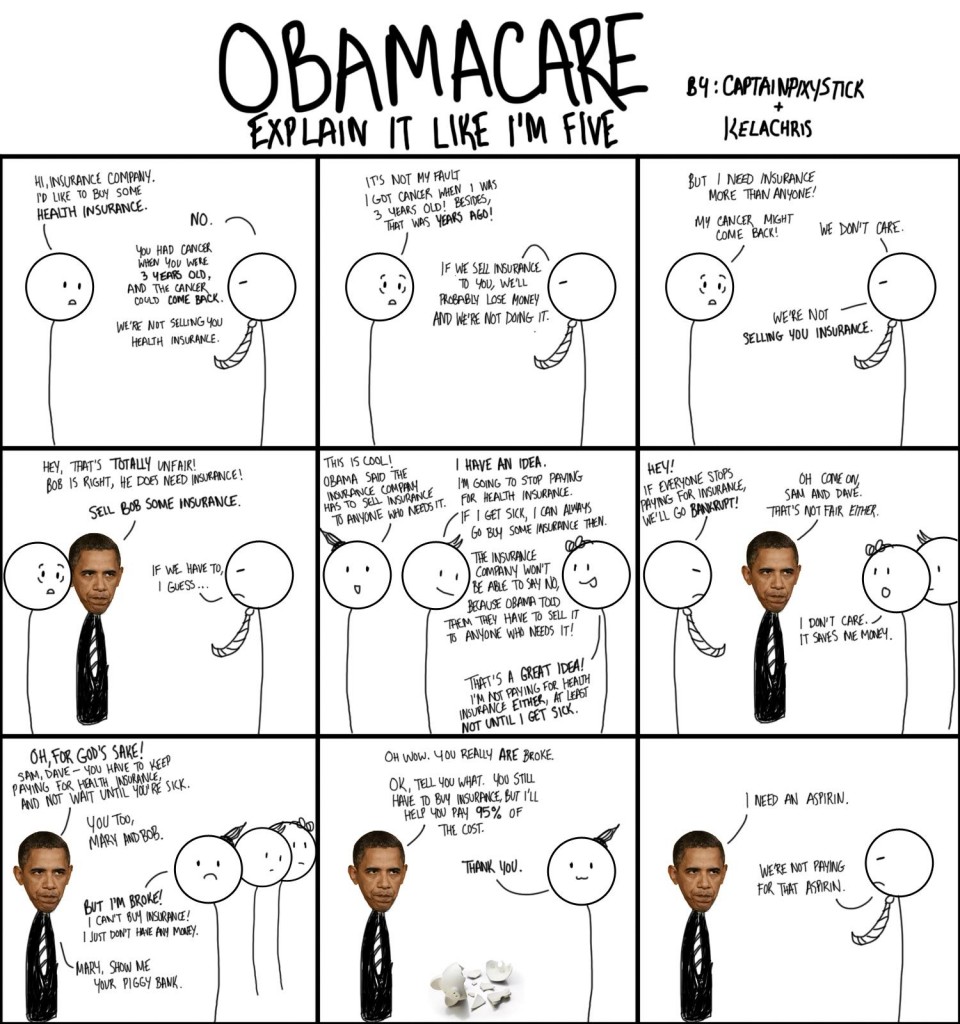

Essential Tax Forms for the Affordable Care Act (ACA ... The Affordable Care Act (ACA), also referred to as Obamacare, affects how millions of Americans will prepare their taxes in the new year. The Internal Revenue Service (IRS) has introduced a number of essential tax forms to accommodate the ACA: Form 1095-A, Form 1095-B, Form 1095-C, and Form 8962.

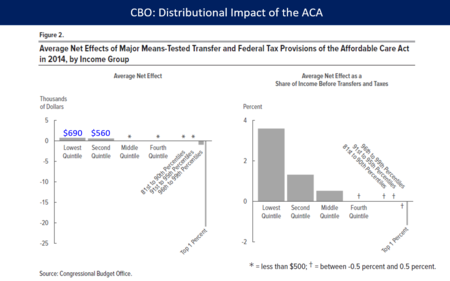

Affordable Care Act (ACA) - HealthCare.gov Glossary ... The comprehensive health care reform law enacted in March 2010 (sometimes known as ACA, PPACA, or "Obamacare"). The law has 3 primary goals: Make affordable health insurance available to more people. The law provides consumers with subsidies ("premium tax credits") that lower costs for households with incomes between 100% and 400% of ...

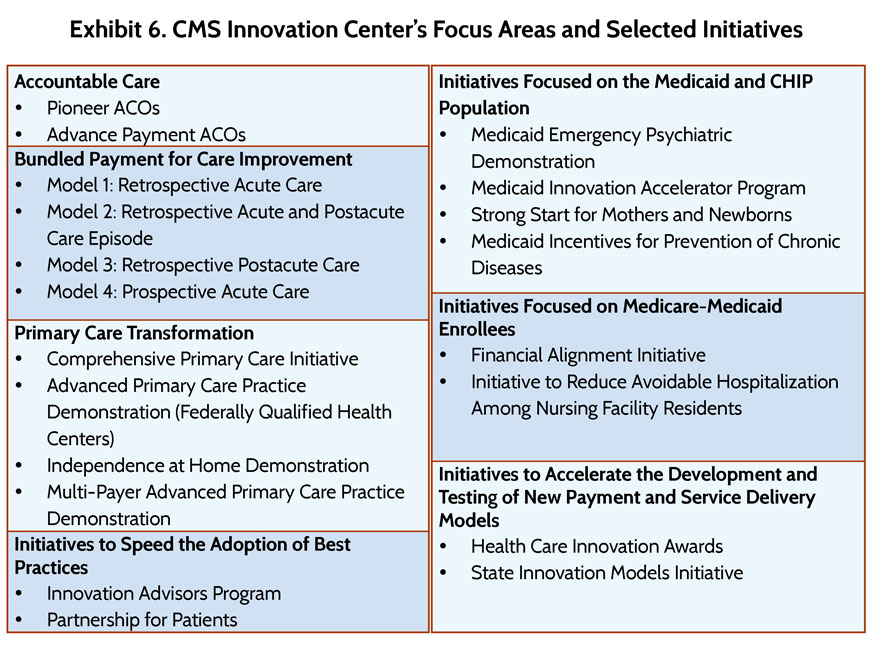

Affordable Care Act - Tax Guide • 1040.com - File Your ... Affordable Care Act. The Affordable Care Act (ACA) is a health care reform law that was passed in 2010. The ACA has three main goals: Make affordable health insurance available to more people. Expand the Medicaid program. Lower the costs of healthcare by supporting innovative methods of medical care. When you hear about the ACA (or "Obamacare ...

Fillable Welcome to the Affordable Care Act Worksheet for ... Aug 17, 2021 · Use Fill to complete blank online FLIGHTAX pdf forms for free. Once completed you can sign your fillable form or send for signing. All forms are printable and downloadable. Welcome to the Affordable Care Act Worksheet for (Flightax) On average this form takes 16 minutes to complete.

PDF Affordable Care Act Reporting - Manual - Skyward SKYWARD DOCUMENTATION - AFFORDABLE CARE ACT REPORTING MANUAL Revised: 11/24/2021 Page 6 of 104 Version 05.21.10.00.05 The browse will open allowing the additional 2.00 hours to be added to the correct day. ACA Hours can also be added outside this worksheet's specified date range. This is helpful if an employee is late submitting a time sheet.

City of Chicago :: Affordable Requirements Ordinance (ARO) The revised ARO also encourages the production of more affordable and family-sized units, while also maintaining much-needed funding for current programs that support thousands of low-income renters. Additionally, the revised ARO: Allows off-site units to be built in any part of the city lacking in affordable housing or threatened with displacement

PDF OR Affordable Care Act (ACA) Newly Hired Temporary Employee Offer of Coverage Worksheet This worksheet is used to document the agency's reasonable expectations regarding the "full-time" status of a newly hired temporary employee. PLACE A COPY OF THIS COMPLETED FORM IN THE EMPLOYEE FILE 1.AGENCY NAME: 2. EMPLOYEE NAME: 2. DATE OF HIRE: 3.

affordable care act worksheet for taxes - Word Worksheet Toggle search form. Search for: Tag: affordable care act worksheet for taxes Affordable Care Act Worksheet. Posted on September 10, 2021 August 13, 2021 By admin Click on this angel to see a complete assets table. You can now get banking advice to lower the bulk of your account bloom insurance. ... Read More "Affordable Care Act Worksheet ...

Affordable Care Act (ACA) reporting - Thomson Reuters The Patient Protection and Affordable Care Act (PPACA), commonly referred to as the Affordable Care Act (ACA), is a United States federal statute signed into law on March 23, 2010. The Affordable Care Act includes numerous provisions that take effect between 2010 and 2020. One of the most significant provisions is the employer mandate, which ...

Affordable Care Act Consulting | American Fidelity The reporting requirement is effective for taxable years beginning after December 31, 2012. W-2 Reporting Worksheet: Determine the benefits coverage a particular employee has selected, including both the plans (e.g., PPO, health Flexible Spending Account) and coverage levels (e.g., individual, family) 2. Enter the total cost of each benefit ...

Affordable Care Act - Oregon VITA & Taxaide Affordable Care Act Select the appropriate year for associated forms, worksheets, instructions, and tools. ... How-To's. What: 2019: 2018 When Cols B&C are blank on 1095-A: PDF: PDF What to put in Schedule A Medical: PDF: PDF Form 1095-A: Health Insurance Marketplace Statement:

ACA Individual Shared Responsibility Provision Exemptions ... The individual shared responsibility provision of the Affordable Care Act requires taxpayers to have qualifying health coverage (also known as minimum essential coverage), qualify for a coverage exemption, or make an individual shared responsibility payment when filing their federal income tax return.. For tax year 2019 and 2020 returns. Under the Tax Cuts and Jobs Act, the …

/universal-health-care-4156211_final-acaaba54a20345308fd5b1de611eec62.png)

/obamacare_taxes-51d679e83961433f838888af858e0692.jpg)

0 Response to "43 affordable care act worksheet form"

Post a Comment