43 Truck Driver Expenses Worksheet

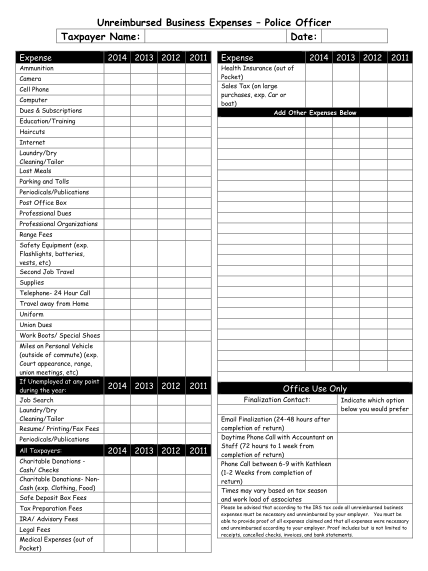

PDF Over-the-road Trucker Expenses List - Pstap received as a taxicab driver, or bonuses received as a truck driver in cash, are taxable income. And the sale of any of your equipment or work-related purchases also constitute taxable income (i.e.: sales of tires, radios, etc.). If you are self-employed (unincorporated) and your net earnings after all legitimate deductions are taken are $400 or Tax Deductions for Truck Drivers - Support Truck drivers who are independent contractors can claim a variety of tax deductions while on the road. Mileage, daily meal allowances, truck repair (maintenance), overnight hotel expenses, and union dues are some of the tax deductions available. However, local truck drivers typically cannot deduct travel expenses.

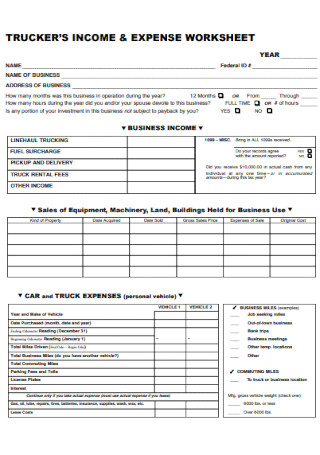

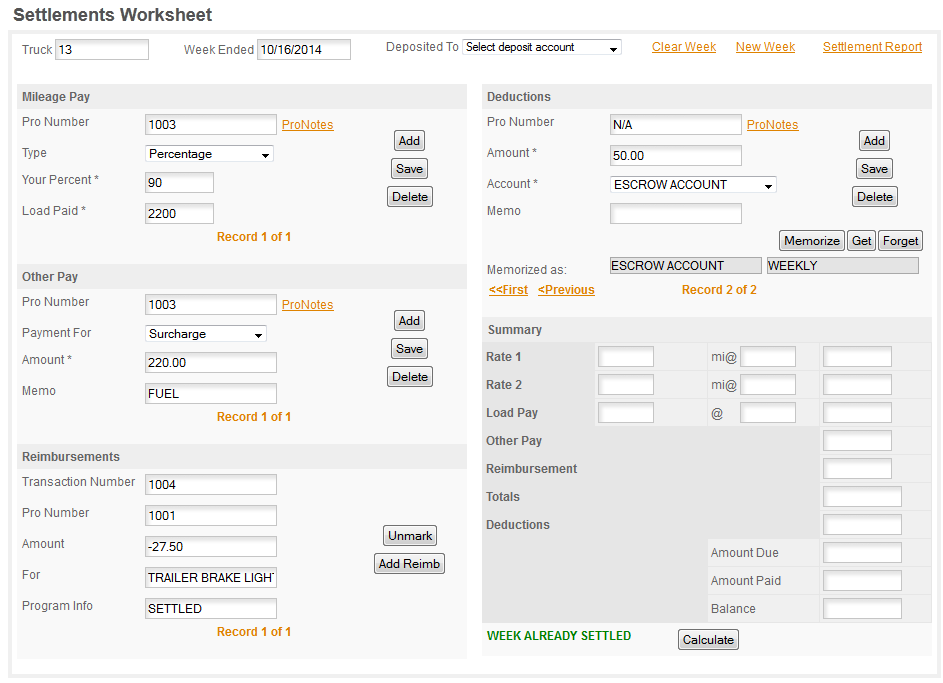

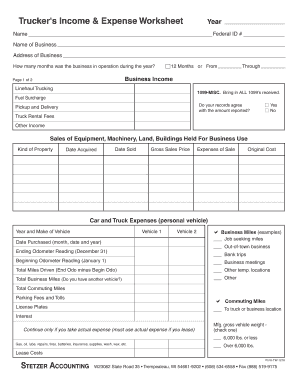

PDF Trucker'S Income & Expense Worksheet Truck loans Equipment loans Business only credit card LEGAL & PROFESSIONAL: Attorney fees for business, accounting fees, bonds, permits, etc. OFFICE EXPENSE: postage, stationery, office supplies, bank charges, pens, faxes, etc. PENSION/PROFIT SHARING: Employees only RENT/LEASE: Truck lease Machinery and equipment Other bus. property, locker fees

Truck driver expenses worksheet

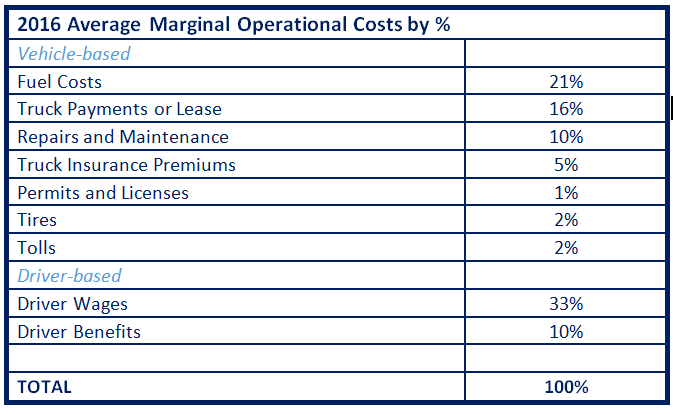

Tax Deduction List for Owner Operator Truck Drivers Owner Operator and company drivers alike can lower their tax liability by creating a truck driver tax deductions worksheet that includes all of the expenses you incur in the course of doing business. For more trucking industry news, information and high paying trucking jobs, continue to visit CDLjobs.com for up-to-date information and job postings. Trucking Profit And Loss Spreadsheet - Elcacerolazo Calculating Projected Expenses as a Truck Driver. Using the trucking cost per mile spreadsheet Start by entering your total annual mileage actual or estimated for all the vehicles in your fleet even if its only one. It offers a synopsis of a business or persons financial condition in both brief and long duration. Truck Driver Tax Deductions - H&R Block As a truck driver, you must claim your actual expenses for vehicles of this type. So, you can't use the standard mileage method. To deduct actual expenses for the truck, your expenses can include (but aren't limited to): Fuel Oil Repairs Tires Washing Insurance Any other legitimate business expense

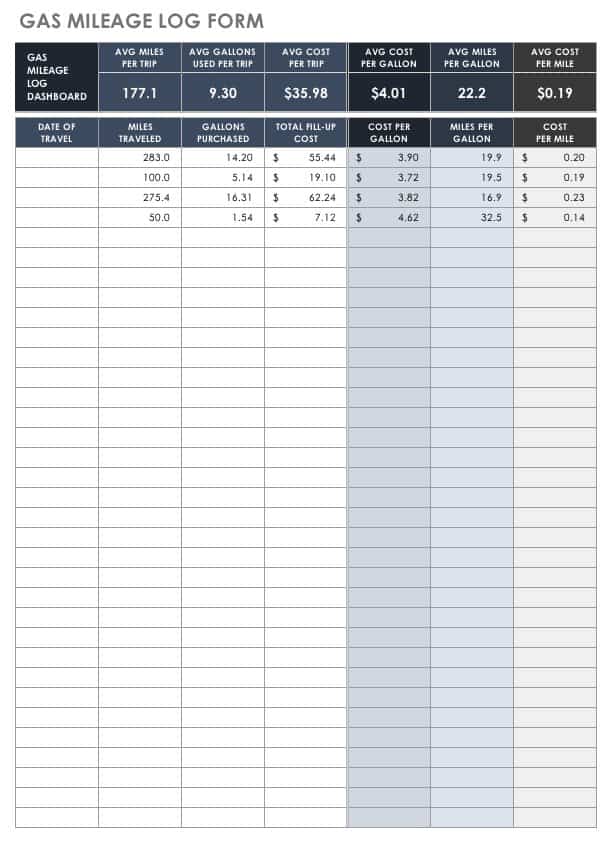

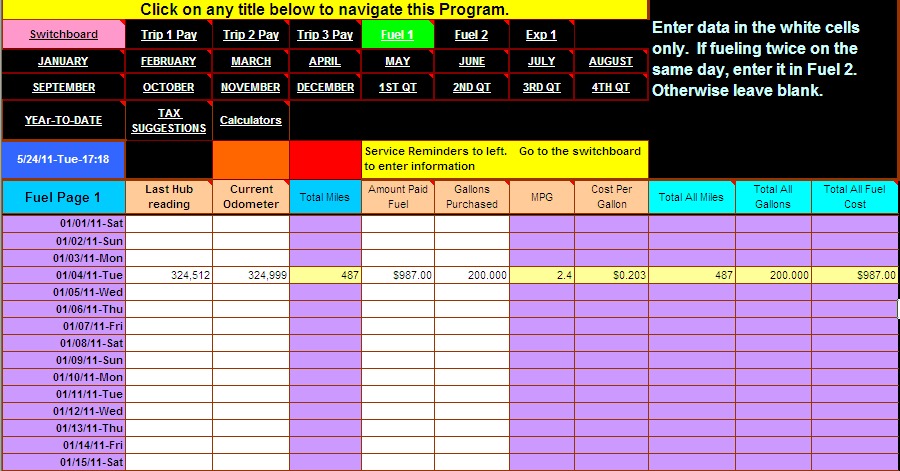

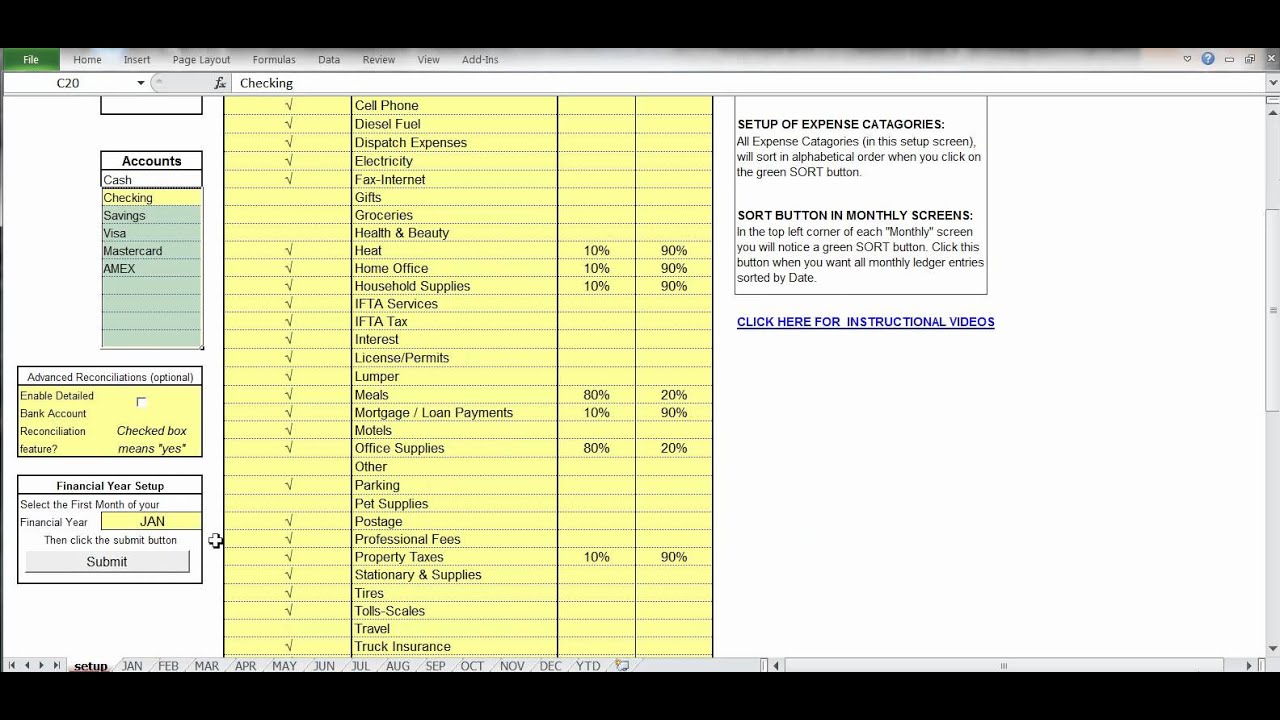

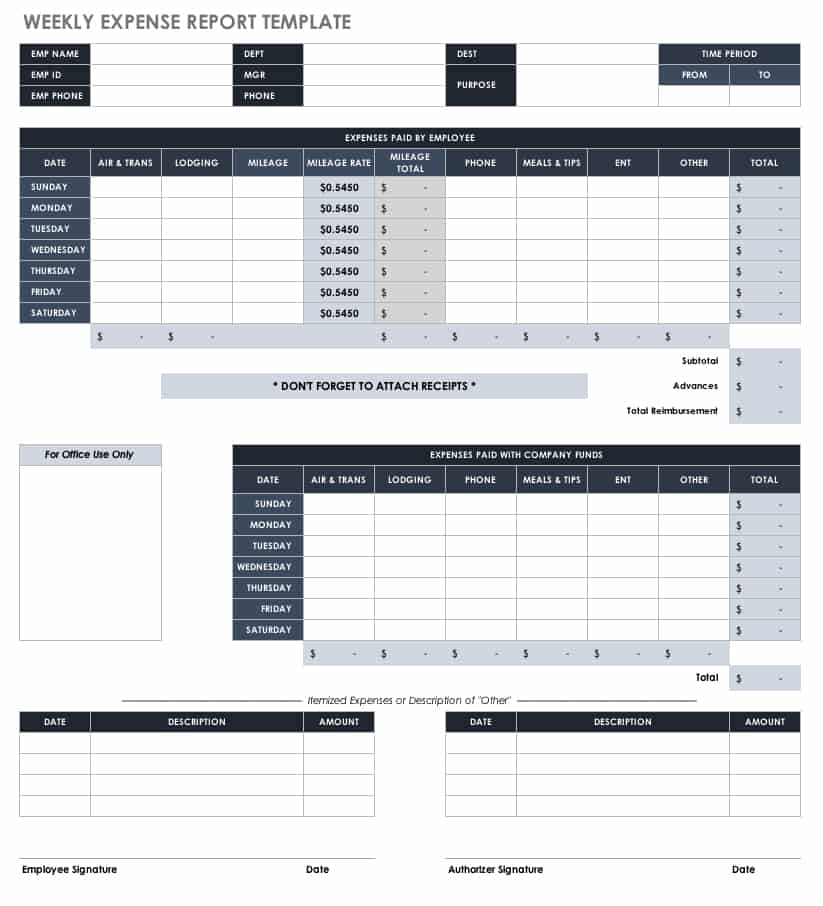

Truck driver expenses worksheet. Truck driver accounting software spreadsheet program from ... 2021 and 2022 Driver Accounting Software Program Spreadsheets (easy expense-tracking and trucker accounting spreadsheets) (NOTE: if you pay IFTA, try the Accounting PLUS IFTA using the menu above) This is the truck driver accounting spreadsheet program. Free Apps and Excel Templates for Truck Drivers and ... Truck and delivery drivers give 'on-the-go' a whole new meaning. In any 7-day period in the U.S., some drivers are on the road for up to 77 hours. Some drivers contract out work, some work for a company, and some own their own businesses. What's the one thing they all have in common, aside from their profession? 15 Tax Deductions Every Truck Driver Should Consider In short, without a tax home, you will not be allowed to deduct business and travel expenses. Truck Driver Tax Deductions. Remember, you can only claim deductions on unreimbursed expenses. Travel Expenses - Includes hotels, meals, and more. There are different methods for recording these expenses. Check out IRS Publication 463 for more details. Truck Driver Income Worksheet - CrossLink Tax Tech Truck Driver Expense Worksheet . VEHICLES FOR HIRE MUST USE ACTUAL EXPENSES. Business Miles Driven Other Than While Hauling Loads: _____ Vehicle Expense: (Standard Mileage Rate) Business Miles Only [From . Mileage Log Worksheet] _____ total business miles x 57.5¢ per mile = _____

Printable Truck Driver Expense Owner Operator Tax ... The car and truck expenses worksheet is used to determine what the deductible vehicle expenses are, using either the standard mileage rate vehicle expense worksheet. If the trucker cannot itemize then none of the employee business expenses or travel expenses including the per diem deduction may be deducted. 2020 Truck Driver Tax Deductions Worksheet - Fill Out and ... Quick steps to complete and eSign Truck Driver Tax Deductions Worksheet online: Use Get Form or simply click on the template preview to open it in the editor. Start completing the fillable fields and carefully type in required information. Use the Cross or Check marks in the top toolbar to select your answers in the list boxes. Truck Driver Trucking Spreadsheet Templates Truck driver daily timesheet template is an excel book template that is useful for the time records of the driver it has all details about the time records of the drivers. Spreadsheet templates can also be used for instant budgets such as an instant party budget and etc. The automotive market is one of the largest in united states and. Owner Operator Truck Driver Tax Deductions Worksheet - Ark ... Feb 22, 2021 · owner operator and company drivers alike can lower their tax liability by creating a truck driver tax deductions worksheet that includes all of the expenses you incur in the course of doing business. Deductions and credits for drivers: Truck driver tax deductions worksheet. Truck driver tax deductions worksheet.

PDF Trucker'S Income & Expense Worksheet!!!!!!!!!!!!!! Truck Driver Tax Deductions Visit for more CDL Truck Driver Solutions Cleaning Supplies Misc. Supplies Misc. Supplies Air Freshener Alarm Clock Thermos Bottle Armour-All Fly Swatter First Aid Supplies Broom & Dustpan Bedding Clothing 1 Exceptional Trucking Expenses Spreadsheet Excel ... In this spreadsheet, all expenses including salaries of all driver and owner/members, truck purchases, insurance, office, legal expenses, truck maintenance, devices, and more will be populated automatically from your trucking business report. Back to trucking expenses spreadsheet. Folks aren't likely to acquire. 27 Elegant Truck Driver Expenses Worksheet ... 27 elegant truck driver expenses worksheet incharlottesville com beautiful tax deduction spreadsheet excel unique trucking cost per mile for everyone Owner Operator Truck Driver Tax Deductions Worksheet | My Idea Owner Operator Truck Driver Tax Deductions Worksheet, Owner operator and company drivers alike can lower their tax liability by creating a truck driver tax deductions worksheet that includes all of the expenses you incur in the course of doing business. Download 2020 per diem tracker.

Tax Deductions for Truck Drivers - Jackson Hewitt If you are a driver, such as a bus driver, taxicab driver, or truck driver, you should have received a Form W-2 for your job and none of your job-related expenses are deductible. If you are self-employed you should receive a Form 1099-MISC, Miscellaneous Income and you should report that income, and any expenses, on Schedule C, Profit and Loss from Business.

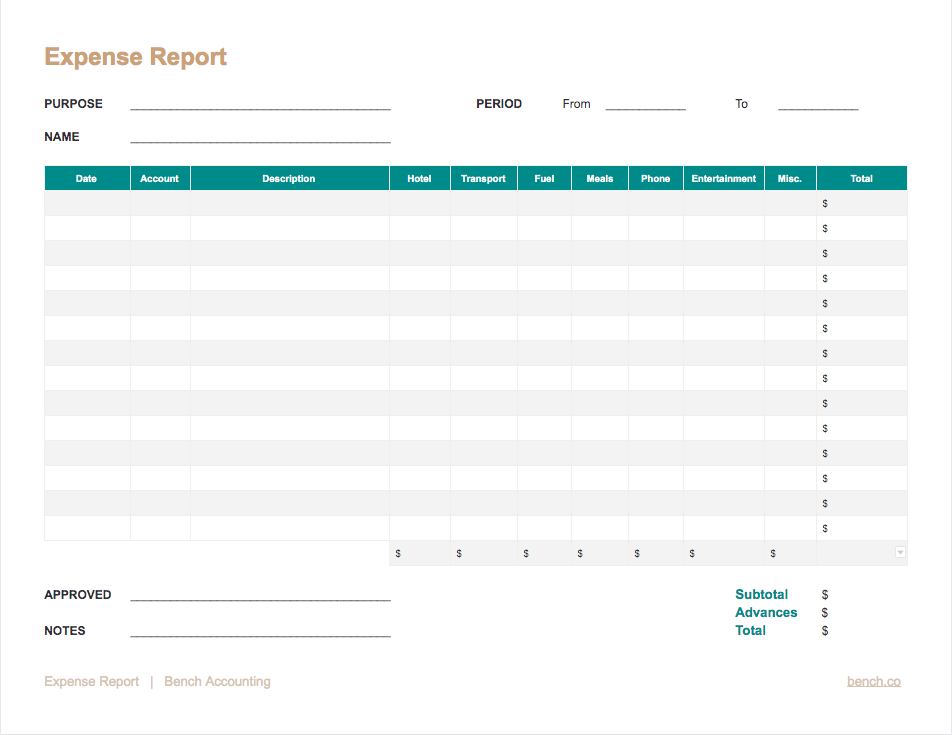

Truck Driver Expenses Worksheet ≡ Fill Out Printable PDF ... This Truck Driver Expenses Worksheet Form can help make the process a little easier. With this form, you can track your mileage, fuel costs, and other expenses. Printing out a copy of this form and keeping it with your receipts can help ensure that you get the most out of your tax return. Here are several facts you might like to review before ...

Truck Expenses Worksheet | Spreadsheet template, Tax ... Truck Expenses Worksheet The Car and Truck Expenses Worksheet is used to determine what the deductible vehicle expenses are, using either the standard mileage rate Vehicle Expense Worksheet. Please use this worksheet to give us your vehicle expenses and mileage information for preparation of your tax returns. Realtor Tax Deduction Worksheet.

PDF SCHEDULE C Use this checklist if you have a side job or ... Meals - subject to 80% (truck drivers or commercial drivers only) Entertainment - parties, movies, sporting events, etc. when you have an employee party or entertaining a potential new client or customer. Not subject to limit. 100% deductible. Utilities - total for the year times the % of sq. ft of office area or 100% if entire building.

2020 Truck Driver Tax Deductions Worksheet - Fill Online ... Comments and Help with trucking expenses spreadsheet meals: Include the cost of the meals in the employee cost column of the W-2. In other words, you are only allowed to deduct the employee meal meal expenses if you are the person who actually paid for the meal.

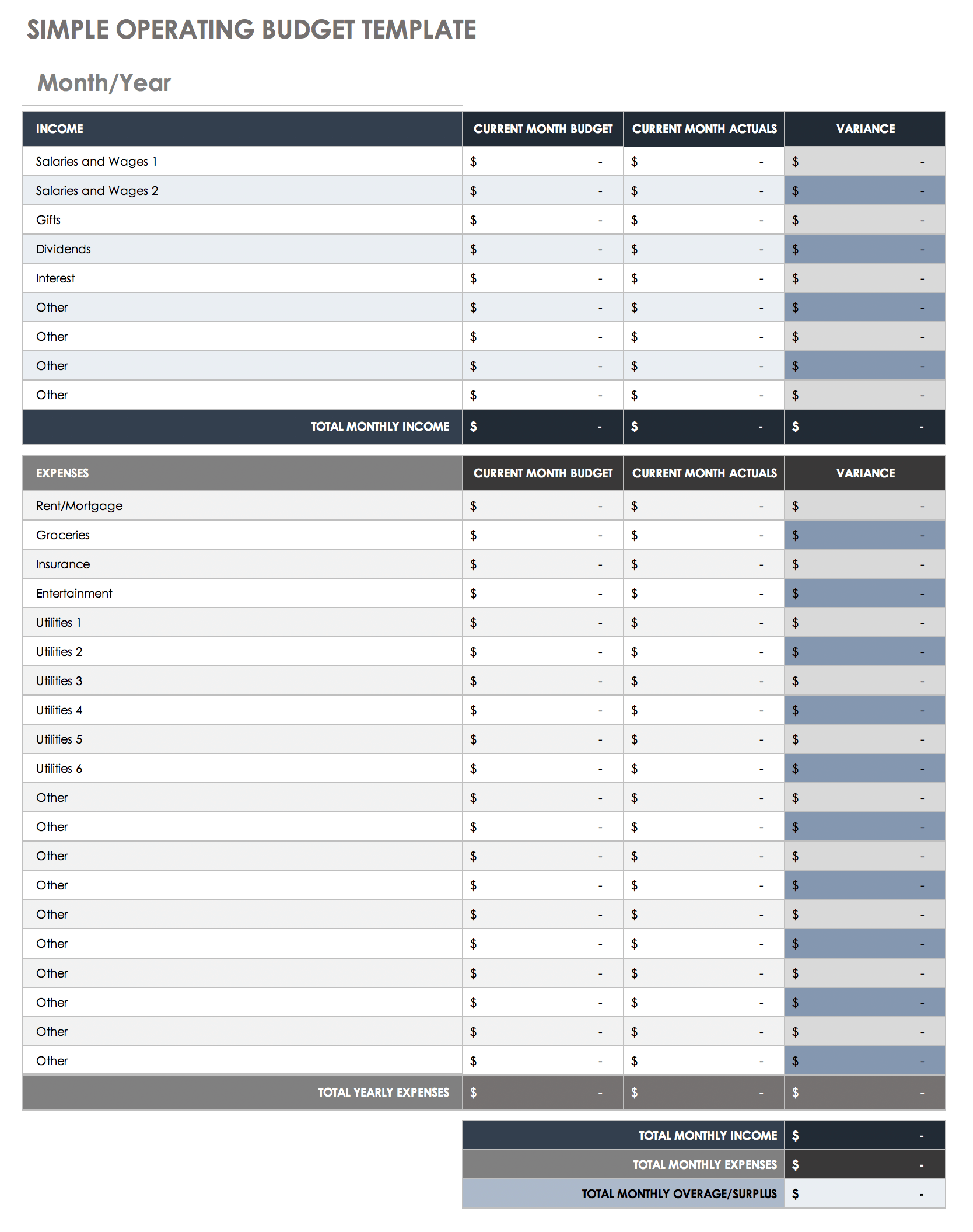

Free Templates Trucking Expenses Spreadsheet ... - Golagoon The budget spreadsheets are little more advanced than the other as they have to undergo higher and tougher calculations and data entries. The common feature among the spreadsheets templates is that they save time and effort and also they make the work and other calculations easier. Planning out things and fast access to data and other ...

PDF Name Year TRUCK DRIVERS WORKSHEET THIS IS AN INFORMATIONAL ... TRUCK DRIVERS WORKSHEET THIS IS AN INFORMATIONAL WORKSHEET FOR OUR CLIENTS CALL IF YOU NEED HELP WITH IT. Total Income (Gross Amount Of All Checks) - Possible Deductions From Checks- Licenses & Permits Bobtail Fees Pager Fees Health Insurance Physical Damage Reserve Withdrawals Truck Washes -Other Deductions-

PDF 2021 Self-Employed (Sch C) Worksheet If you checked none of these above, please continue by completing the worksheet below for each business. Drivers - be sure you have with you today: • All Forms 1099 AND the detail provided by the company (Door Dash, Lyft, Postmates, Uber, ... Car or truck expenses Car loan interest $ Parking, tolls $ Other (specify) $ $ $ $

What You Need to Know About Truck Driver Tax Deductions ... Although the IRS has a per diem rate for lodging in other industries, truck drivers are required to claim actual lodging expenses. They cannot claim the per diem rate the way they can with meal expenses. Medical exams. Many drivers must get regular medical exams as a condition of their work.

PDF Trucker'S Income & Expense Worksheet &$/,)251,$ 7$; %287 ... RENT/LEASE: Truck lease WAGES: 9lrin~ourffi~fil' ave en of W-2s/941 s if they 1 e Machinery and equipment Wages to spouse (subjectto Soc.Sec. and Other bus. property, locker fees Medicare tax) REPAIRS & MAINTENANCE: Truck, equipment, Children under 18 (not subjectto etc. Soc.Sec. and Medicare tax) SUPPLIES: Maps, safety supplies

PDF Truck Driver Income Worksheet - crosslinktaxtech.com Truck Driver Expense Worksheet . VEHICLES FOR HIRE MUST USE ACTUAL EXPENSES. Business Miles Driven Other Than While Hauling Loads: _____ Vehicle Expense: (Standard Mileage Rate) Business Miles Only [From . Mileage Log Worksheet] _____ total business miles x 56¢ per mile = _____ Do you own the tractor trailer/truck that you use to haul loads? ...

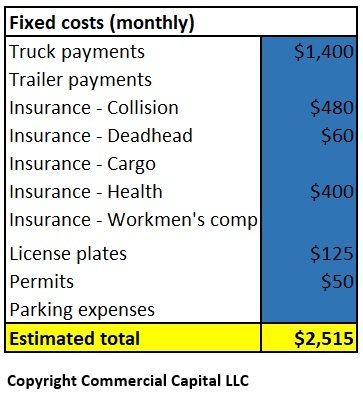

Complete List Of Owner Operator Expenses For Trucking ... The more you can plan for your operating expenses, the smoother things will go and you and your trucking business will thrive as a result. You'll need to itemize all of the costs you are going to incur on the road and at home. These don't just include truck and driving expenditures, but also registrations, office costs and fees.

PDF Car and Truck Expense Deduction Reminders Car and Truck Expense Deduction Reminders . FS-2006-26, October 2006 . The Internal Revenue Service reminds taxpayers to become familiar with the tax law before deducting car- and truck-related business expenses. Overstated adjustments, deductions, exemptions and credits of all types account for more than

Truck Driver Tax Deductions - H&R Block As a truck driver, you must claim your actual expenses for vehicles of this type. So, you can't use the standard mileage method. To deduct actual expenses for the truck, your expenses can include (but aren't limited to): Fuel Oil Repairs Tires Washing Insurance Any other legitimate business expense

Trucking Profit And Loss Spreadsheet - Elcacerolazo Calculating Projected Expenses as a Truck Driver. Using the trucking cost per mile spreadsheet Start by entering your total annual mileage actual or estimated for all the vehicles in your fleet even if its only one. It offers a synopsis of a business or persons financial condition in both brief and long duration.

Tax Deduction List for Owner Operator Truck Drivers Owner Operator and company drivers alike can lower their tax liability by creating a truck driver tax deductions worksheet that includes all of the expenses you incur in the course of doing business. For more trucking industry news, information and high paying trucking jobs, continue to visit CDLjobs.com for up-to-date information and job postings.

.png)

0 Response to "43 Truck Driver Expenses Worksheet"

Post a Comment