39 social security benefits worksheet lines 20a and 20b

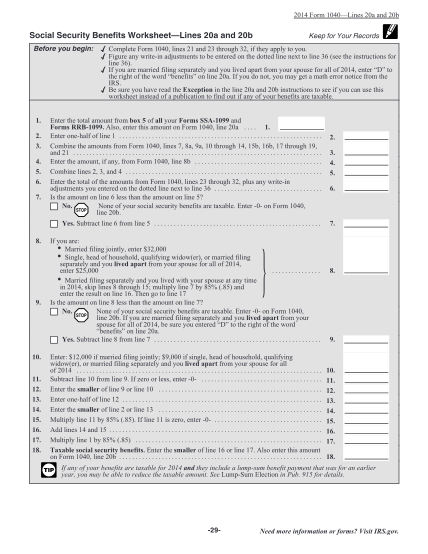

social_security_benefits_worksheet_1040i - 2013 Form ... September 16, 2013 DRAFT AS OF 2013 Form 1040—Lines 20a and 20b Social Security Benefits Worksheet—Lines 20a and 20b Keep for Your Records Complete Form 1040, lines 21 and 23 through 32, if they apply to you. Figure any write-in adjustments to be entered on the dotted line next to line 36 (see the instructions for line 36). Ss Benefits 2021 For Lines 6a And 6b Form Worksheets - K12 ... Displaying all worksheets related to - Ss Benefits 2021 For Lines 6a And 6b Form. Worksheets are Social security benefits work pdf, Notice 703 october 2021, 2021 estimated tax work line 6a phaseout of itemized, 2021 taxable social security bene ts, 915 such as legislation enacted after it was, 2020 social security taxable benefits work, Income social security benefits, Social security benefits ...

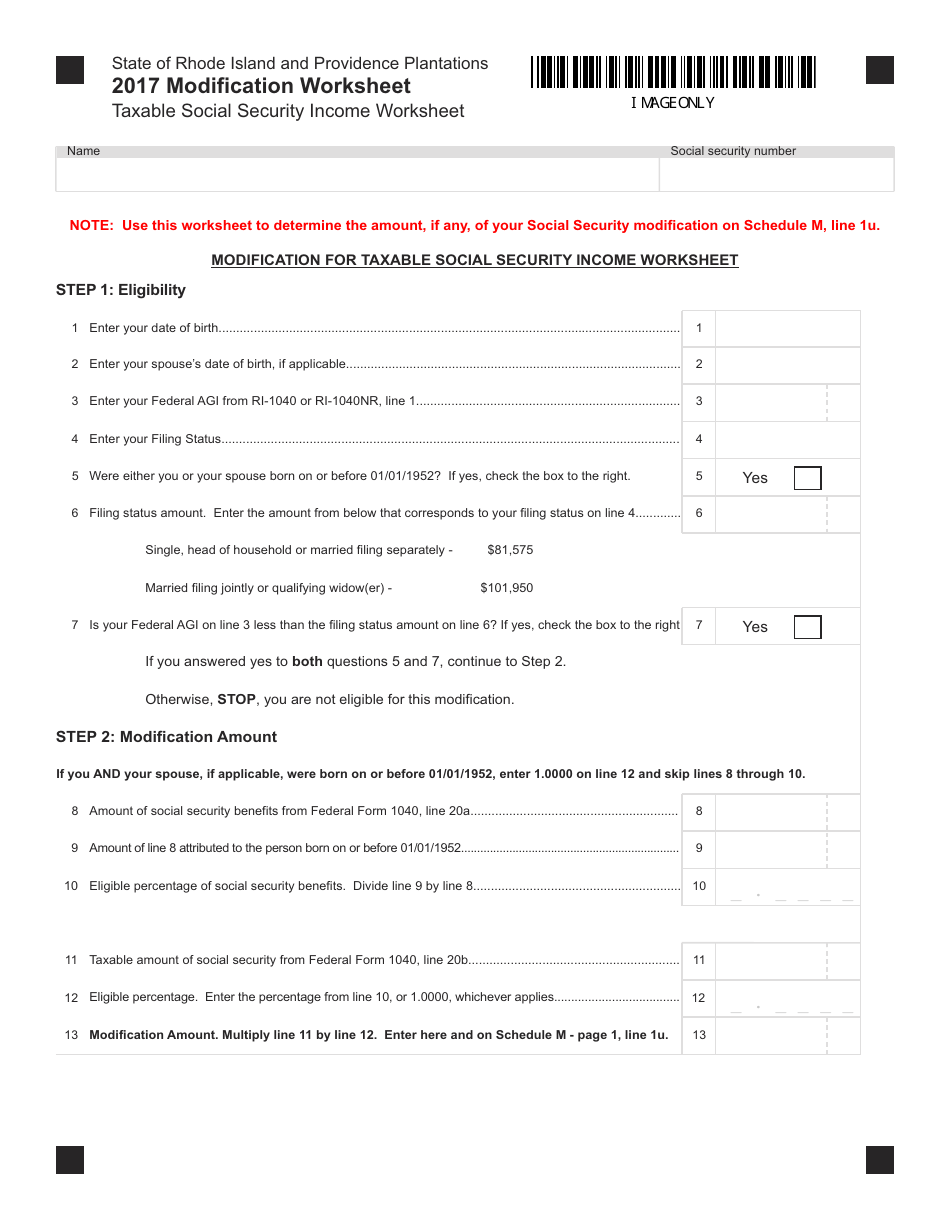

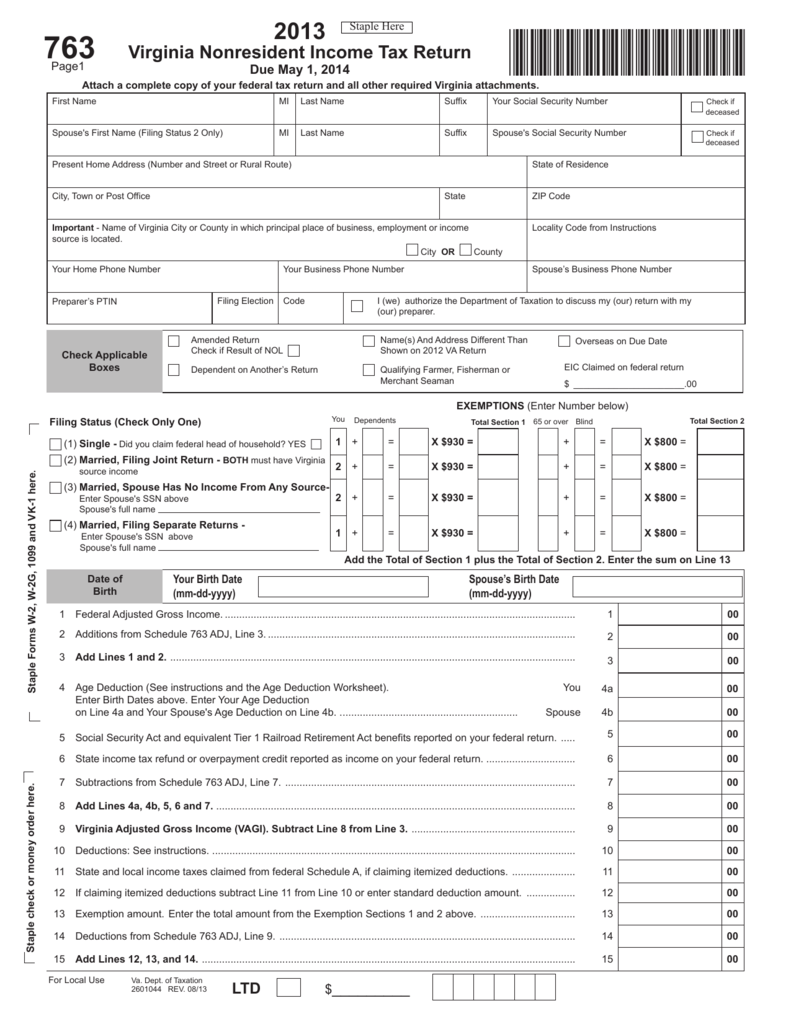

Alabama Form 40 Instructions - eSmart Tax Federal Social Security benefits. State income tax refunds. Unemployment compensation. ... Use your 2013 federal income tax return and the worksheet on page 9 to determine your federal income tax deduction. ... on lines 20a or 20b. Each individual may contribute $1 to either party. If a joint return is filed, each spouse may contribute $1 to ...

Social security benefits worksheet lines 20a and 20b

Social Security Benefits Worksheet 2021 Ideas ... Social Security Benefits Worksheet 2021. * social security benefits received in ffy21 cannot be calculated from the 2020 monthly benefit because of the inconsistent medicare part b premiums and medicare perscription costs to enrollees. 2021 social security benefits worksheet.Source : Ad the most comprehensive library of free printable worksheets & digital games for kids. irs social security worksheet 2021 | Social Security ... Are Social Security benefits taxable in 2020? None of your social security benefits are taxable. Enter -0- on Form 1040 or 1040-SR, line 6b. If you are married filing separately and you lived apart from your spouse for all of 2020, be sure you entered "D" to the right of the word "benefits" on line 6a. 2021 - portal.ct.gov 41. Social Security benefit adjustment: See Social Security Benefit Adjustment Worksheet instructions. 41. .00 42. Refunds of state and local income taxes 42. .00 43. Tier 1 and Tier 2 railroad retirement benefits and supplemental annuities 43. …

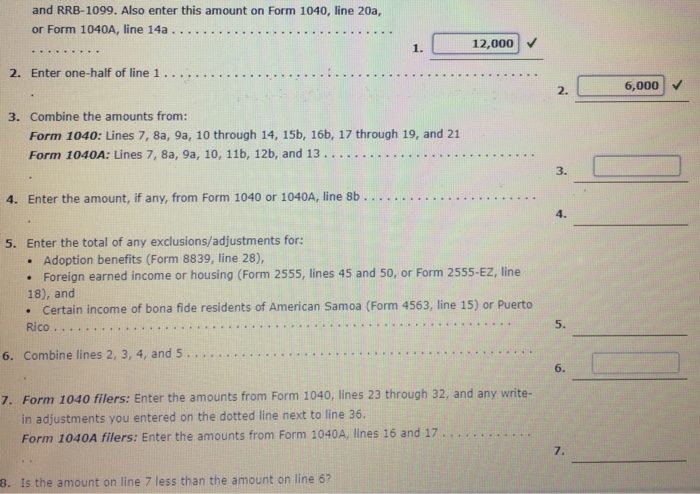

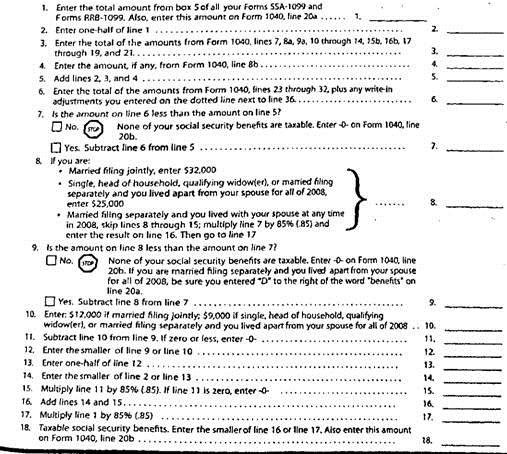

Social security benefits worksheet lines 20a and 20b. PDF Social Security Benefits WorksheetLines 14a and 14b Keep ... Form 1040—Lines 20a and 20b Need more information or forms? See page 9. Social Security Benefits Worksheet—Lines 20a and 20b Keep for Your Records 1. Enter the total amount from box 5 of all your Forms SSA-1099 and RRB-1099 Add the amounts on Form 1040, lines 7, 8a, 9 through 14, 15b, 16b, 17 through 19, and 21. Schedule A Schedule A Section 1: Income or Loss Enclosure ... Name(s) shown on Form IT-40PNR Your Social Security Number Section 1: Income or (Loss) Enter in Column A the same income or loss you reported on your 2021 federal income tax return, Form 1040, Form 1040-SR, and Form 1040 Schedule 1 (except for line 19B and/or a net operating loss carryforward on line 20B; see instructions). Form 1040 - Social Security Benefits Worksheet - Lines 20a ... Social Security Benefits Worksheet—Lines 20a and 20b Keep for Your Records Before you begin: Complete Form 1040, lines 21 and 23 through 32, if they apply to you. Figure any write-in adjustments to be entered on the dotted line next to line 36 (see the instructions for line 36). Social Security Benefits Worksheet 2020 Instructions This spreadsheet and instructions are now located at the social security retirement benefits. Social security benefits worksheet—lines 20a and 20b keep for your records 1. You might use the very same worksheet for a lot of of your students. The very best thing regarding these social security benefits worksheet is they may also be used by teachers.

Irs Social Security Worksheet 2014-2021: Fillable ... Start on editing, signing and sharing your Irs social security worksheet 2014-2021 online with the help of these easy steps: Push the Get Form or Get Form Now button on the current page to jump to the PDF editor. Wait for a moment before the Irs social security worksheet 2014-2021 is loaded. Use the tools in the top toolbar to edit the file ... Awesome Social Security Benefits Worksheet 2014 - Goal ... Social Security Benefits WorksheetLines 20a and 20b Keep for Your Records 1. Taxable Social Security Benefits 2014 Worksheet Author. Age 62 full retirement age and age 70. SSDI benefits are intended to provide financial assistance to disabled workers and their eligible dependents. Social Security Benefits Worksheet 2020 Fillable 2021 ... Social security benefits worksheet—lines 5a and 5b.Social security taxable benets worksheet (2020) on average this form takes 5 minutes to complete.Start a free trial now to save yourself time and money!Submit instantly to the receiver. Take full advantage of a digital solution to create, edit and sign documents in pdf or word format online. PDF Social Security Benefits Worksheet—Lines 20a and 20b Social Security Benefits Worksheet—Lines 20a and 20b Keep for Your Records TIP 2011 Form 1040—Lines 20a and 20b Complete Form 1040, lines 21 and 23 through 32, if they apply to you. Figure any write-in adjustments to be entered on the dotted line next to line 36 (see the instructions for line 36).

39 social security benefits worksheet lines 20a and 20b ... Apr 02, 2020 · Report the total amount of Social Security income received on line 20a of the IRS' Form 1040, and on line 20b, report the taxable portion of Social Security income, as U.S. Tax Center explains. The total amount of Social Security benefits and income a taxpayer receives determines how taxpayers report Social Security benefits. SSBEN - 2013 Form 1040Lines 20a and 20b Social Security ... 2013 Form 1040—Lines 20a and 20b Social Security Benefits Worksheet—Lines 20a and 20b Keep for Your Records Complete Form 1040, lines 21 and 23 through 32, if they apply to you. Figure any write-in adjustments to be entered on the dotted line next to line 36 (see the instructions for line 36). Awesome 1040 Social Security Worksheet - Labelco Social Security Benefits WorksheetLines 20a and 20b Keep for Your Records 1. 915 Social Security and Equivalent Rail- road Retirement Benefits. Enter the percentage from line 10 or 10000 whichever applies. When figuring the taxable portion of Social Security benefits two options are available for lump-sum benefit. 2013 Instructions for Form 1040-ALL Social Security Benefits Worksheet—Lines 20a and 20b 2013 Form 1040—Lines 20a and 20bKeep for Your Records Complete Form 1040, lines 21 and 23 through 32, if they apply to you. Figure any write-in adjustments to be entered on the dotted line next to line 36 (see the instructions for line 36).

Social Security Benefits Worksheet Form 2014 - Fill Out ... Social Security Benefits Worksheet 2014-2022 Form. Use the taxable social security worksheet 2021 2014 template to simplify high-volume document management. Benefits are taxable. If you are married filing separately and you lived apart from your spouse for all of 2014 be sure you entered D to the right of the word benefits on line 20a.

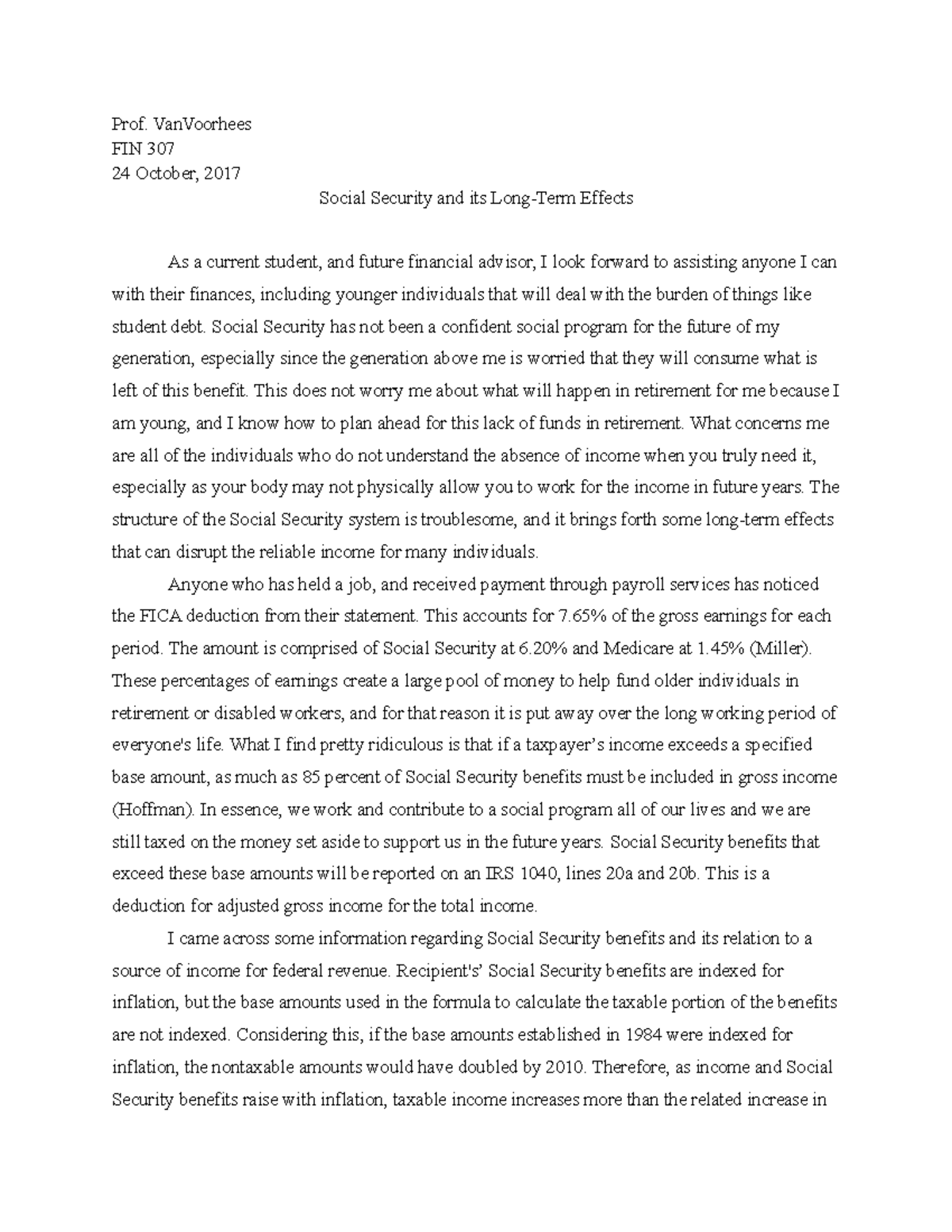

1040 (2021) | Internal Revenue Service - IRS tax forms If (a) or (b) applies, see the instructions for lines 6a and 6b to figure the taxable part of social security benefits you must include in gross income. Gross income includes gains, but not losses, reported on Form 8949 or Schedule D. Gross income from a business means, for example, the amount on Schedule C, line 7, or Schedule F, line 9.

Worksheet 1 - Taxable Social Security Benefits Worksheet 1 - Taxable Social Security Benefits Calculation for Form 1040, Lines 20a and 20b If you are married filing separately and you lived apart from your spouse for all of 2010, enter 'D' to the right of the word 'benefits' on Form 1040, line 20a.

Lines 20A 20B ≡ Fill Out Printable PDF Forms Online It will show you the time it will take to complete lines 20a 20b, exactly what parts you need to fill in and a few further specific facts. How to Edit Lines 20A 20B It is possible to fill in the social security benefits worksheet 2020 document with this PDF editor. The next actions can help you immediately create your document.

Form CT-1040NR/PY 2021 Connecticut Nonresident and Part ... Add amounts in Column C, Lines 20a, 20b, 20c, 20d, 20e, and 20f, and enter here. 21. All 2021 estimated tax payments and any overpayments applied from a prior year 21. .00 22. Payments made with Form CT‑1040 EXT (request for extension of time to file) 22..00 22a. Claim of right credit: From Form CT‑1040 CRC, Line 6. 22a. .00 22b.

Worksheet 1 Social Security Benefits - Studying Worksheets Social Security Benefits WorksheetLines 20a and 20b 2013 Form 1040Lines 20a and 20bKeep for Your Records Complete Form 1040 lines 21 and 23 through 32 if they apply to. If you receive social security benefits from Canada or Germany include them on line 1 of Worksheet 1. J If you are married filing separately and you lived apart from your.

2021 1040 Social Security Benefits Worksheet and Similar ... Social Security Benefits Worksheet—Lines 20a and 20b Keep for Your Records 1. Enter the total amount from box 5 of all your Forms SSA-1099 and RRB-1099 Add the amounts on Form 1040, lines 7, 8a, 9 through 14, 15b, 16b, 17 through 19, and 21.

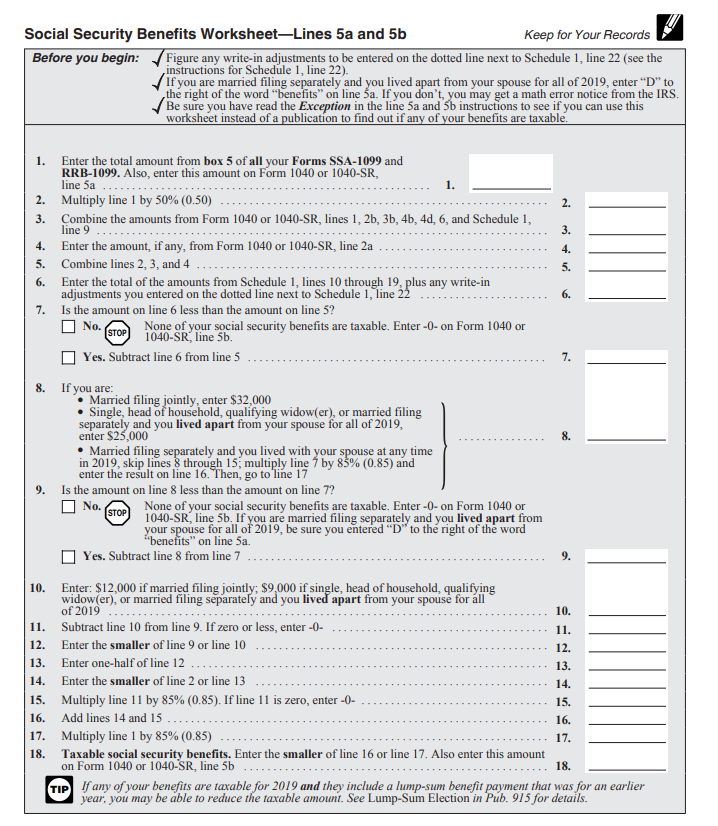

PDF Social Security Benefits Worksheet (PDF) - IRS tax forms Social Security Benefits Worksheet—Lines 5a and 5b. Keep for Your Records. Figure any write-in adjustments to be entered on the dotted line next to Schedule 1, line 36 (see the instructions for Schedule 1, line 36). If you are married filing separately and you lived apart from your spouse for all of 2018, enter "D" to

Form 1040 Ssa 1099 Worksheet - 17 images - 2010 26 form ... [Form 1040 Ssa 1099 Worksheet] - 17 images - publication 915 social security and equivalent railroad, how to report your social security benefits to the irs, 1099 tax forms staples, everything you need to know about the 1099 tax form plus a,

PDF Page 29 of 104 9. Is the amount on line 8 less than the amount on line 7? No. STOP None of your social security benefits are taxable. Enter -0- on Form 1040, line 20b. If you are married filing separately and you lived apart from your spouse for all of 2014, be sure you entered "D" to the right of the word "benefits" on line 20a. Yes.

Social Security Benefits Worksheet - Lines 20a and 20b Lines 20a & 20b - Social Security Benefits Worksheet. ... Social Security Benefits Worksheet - Lines 20a and 20b. This is archived information that pertains only to the 2002 Tax Year. If you are looking for information for the current tax year, go to the Tax Prep Help Area. Previous.

2021 Instruction 1040 - IRS tax forms an extension to le or excess social security tax withheld. Owe alternative minimum tax (AMT) or need to make an excess advance premium tax credit epayment.r Can claim a nonrefundable credit (other than the nonrefundable child tax cedit or the cr edit for other dependents), such as the r

Irs Social Security Benefits Worksheet - Diy Color Burst Social Security Benefits Worksheet Lines 20a 20b Before you begin. Social security benefits and equivalent tier 1 railroad retire-ment benefits. Social Security Benefits Worksheet This document is locked as it has been sent for signing. Irs social security benefits worksheet. We developed this worksheet for you to see if your benefits may be taxable for

Social Security Benefits Worksheet Worksheet 1 Figuring ... Add lines 15 and 16 Multiply line 1 by 85% (.85) Taxable benefits. Enter the smaller of line 17 or line 18. Also enter this amount on Form 1040, line 20b, or Form 1040A, line 14b If you received a lump-sum payment in 2016 that was for an earlier year, also complete Worksheet 2 or 3 and Worksheet 4 to see if you can report a lower taxable benefit.

1040 Ss Benefits 2021 For Lines 6a And 6b Form Worksheets ... Displaying all worksheets related to - 1040 Ss Benefits 2021 For Lines 6a And 6b Form. Worksheets are Social security benefits work pdf, Notice 703 october 2021, 2021 form 1040, 2021 taxable social security bene ts, Income social security benefits, Social security benefits work work 1, 2020 social security taxable benefits work, Social security benefits work 2019.

How Do You Fill Out Lines 20a and 20b on Form 1040? Report the total amount of Social Security income received on line 20a of the IRS' Form 1040, and on line 20b, report the taxable portion of Social Security income, as U.S. Tax Center explains. The total amount of Social Security benefits and income a taxpayer receives determines how taxpayers report Social Security benefits.

2021 - portal.ct.gov 41. Social Security benefit adjustment: See Social Security Benefit Adjustment Worksheet instructions. 41. .00 42. Refunds of state and local income taxes 42. .00 43. Tier 1 and Tier 2 railroad retirement benefits and supplemental annuities 43. …

irs social security worksheet 2021 | Social Security ... Are Social Security benefits taxable in 2020? None of your social security benefits are taxable. Enter -0- on Form 1040 or 1040-SR, line 6b. If you are married filing separately and you lived apart from your spouse for all of 2020, be sure you entered "D" to the right of the word "benefits" on line 6a.

Social Security Benefits Worksheet 2021 Ideas ... Social Security Benefits Worksheet 2021. * social security benefits received in ffy21 cannot be calculated from the 2020 monthly benefit because of the inconsistent medicare part b premiums and medicare perscription costs to enrollees. 2021 social security benefits worksheet.Source : Ad the most comprehensive library of free printable worksheets & digital games for kids.

![Solved] Dominique is single. She is filling out the Social ...](https://s3.amazonaws.com/si.question.images/image/images11/790-L-A-L-S(2005).png)

0 Response to "39 social security benefits worksheet lines 20a and 20b"

Post a Comment