40 airline pilot tax deduction worksheet

Air Crew Tax Specialist for Pilots and Crew Members Amended Tax Returns If your previous years' tax return returns were not prepared by someone specializing in airline taxation you may be able to claim an additional refund for those years. We can amend your previous years' tax returns to capture the pilot deductions that may have been overlooked resulting in an increased refund due. Air Crew Tax Specialist for Pilots and Crew Members 9. Aircrew Taxes e-files client tax return. Please note: 1. New Clients may send tax returns from up to three previous tax years for a missed deductions review. 2. Send copy of tax documents as listed in the tax organizer, no originals please. 3.

Air Crew Tax Specialist for Pilots and Crew Members Individual income tax preparation specializing in deductions for aircrews Call Today Main: 678-797-1040 or 678-332-6905 Tax Specialist for Pilots and Crew Members

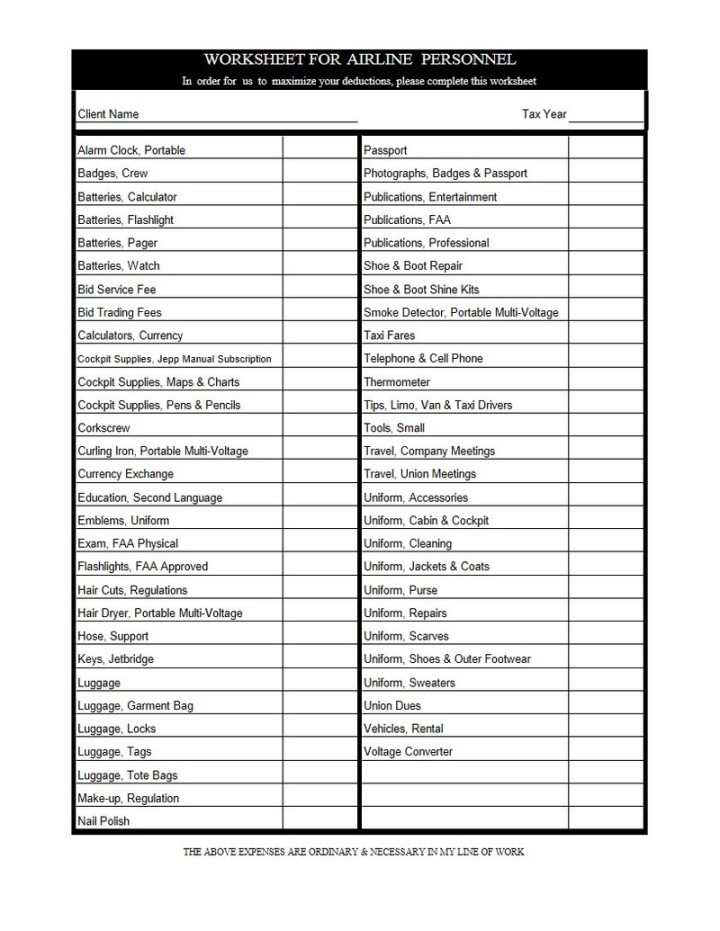

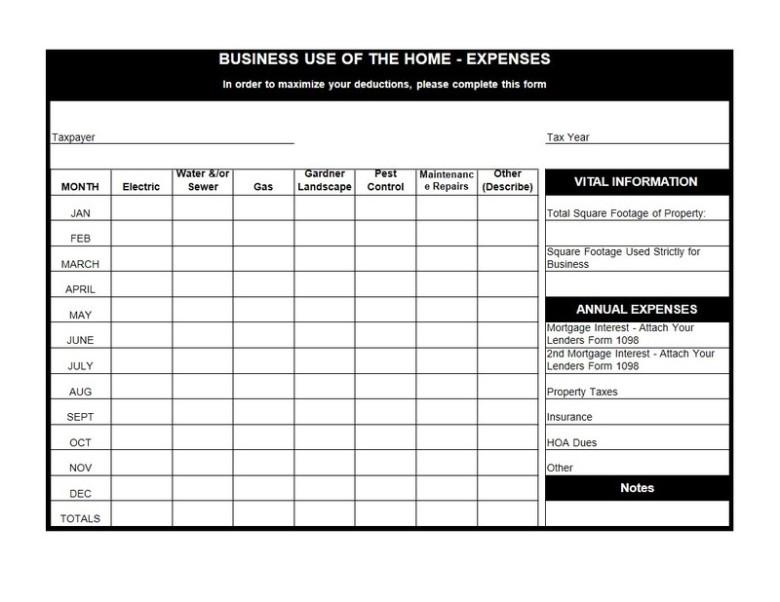

Airline pilot tax deduction worksheet

FDX-FX Cal Per Diem Information - Page 3 - Airline Pilot ... It is specifically for the meal and entertainment expenses only. If you paid $500 out of pocket to cover a deviation airline ticket due to a low travel bank, 100% of that expense is deductible (still subject to the 2% AGI rule). This expense would also have nothing to do with "offsetting" per-diem payments by FedEx. PDF Flight Crew Expense Report and Per Diem Information can access our online submit forms and submit this worksheet electronically here- . There are two types of deductions for pilots and flight attendants. First is out of pocket expenses such as uniforms, cell phone, union dues, etc. The second is the per diem allowance and deduction. We need both to prepare your tax returns. Instructions for Form 2106 (2021) - IRS tax forms The first-year limit on depreciation, special depreciation allowance, and section 179 deduction for vehicles acquired after September 27, 2017, and placed in service during 2020 remains $18,100. If you elect not to claim a special depreciation allowance for a vehicle placed in service in 2020, the amount remains $10,100.

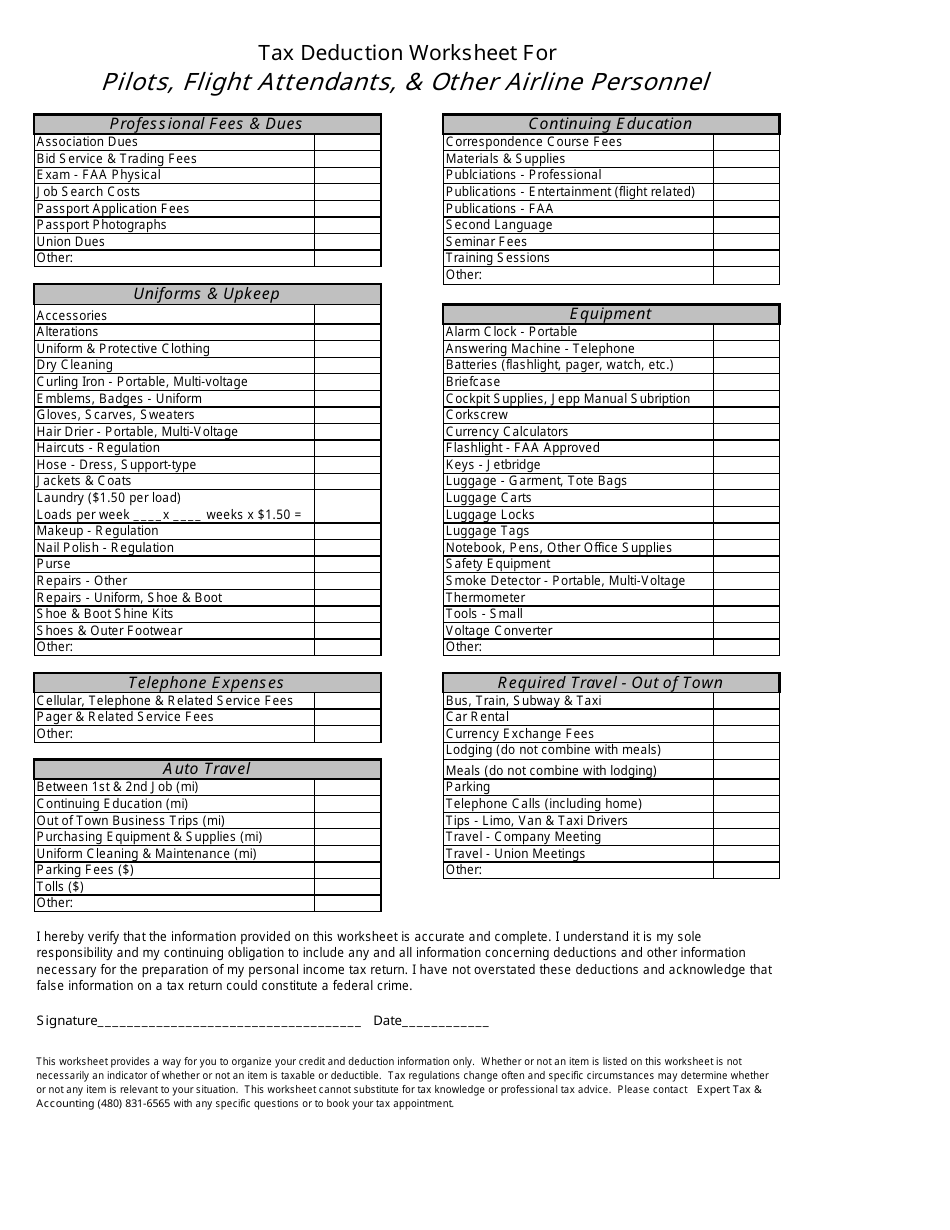

Airline pilot tax deduction worksheet. PDF 2018 Tax Year - Pilot-Tax - Your Tax Professionals Tax Address: The current state to which you pay tax and the address we use on your tax return. Note: Must be able to receive mail. Mailing Address: The address where we mail your documents if different from your tax address. Occupation Airline Base Employee # Date of Hire Preferred Name/Nickname Taxpayer: Spouse: Tax Deduction Worksheet for Pilots, Flight Attendants ... Download, Fill In And Print Tax Deduction Worksheet For Pilots, Flight Attendants, & Other Airline Personnel Pdf Online Here For Free. Tax Deduction Worksheet For Pilots, Flight Attendants, & Other Airline Personnel Is Often Used In Tax Worksheet Template, Tax Forms And Tax. Tax Forms - Diamond Financial Tax Forms. New Clients: Complete Tax Organizer and applicable forms. Existing Clients: Use Tax Organizer as a reference and to make changes to current records. Where Is My Refund? Click here to contact us or call 847-884-8500 and schedule your tax appointment. Downloads - Pilot-Tax Full Client Organizer for both Pilots and Non-Flight clients. Dependent Worksheet. If you are claiming a dependent or you are Head of Household and claiming a dependent, you must complete this form and list each dependent. Flight Deductions. If you live in AL, AR, CA, HI, NY, MN or PA, your state will allow Flight Deductions.

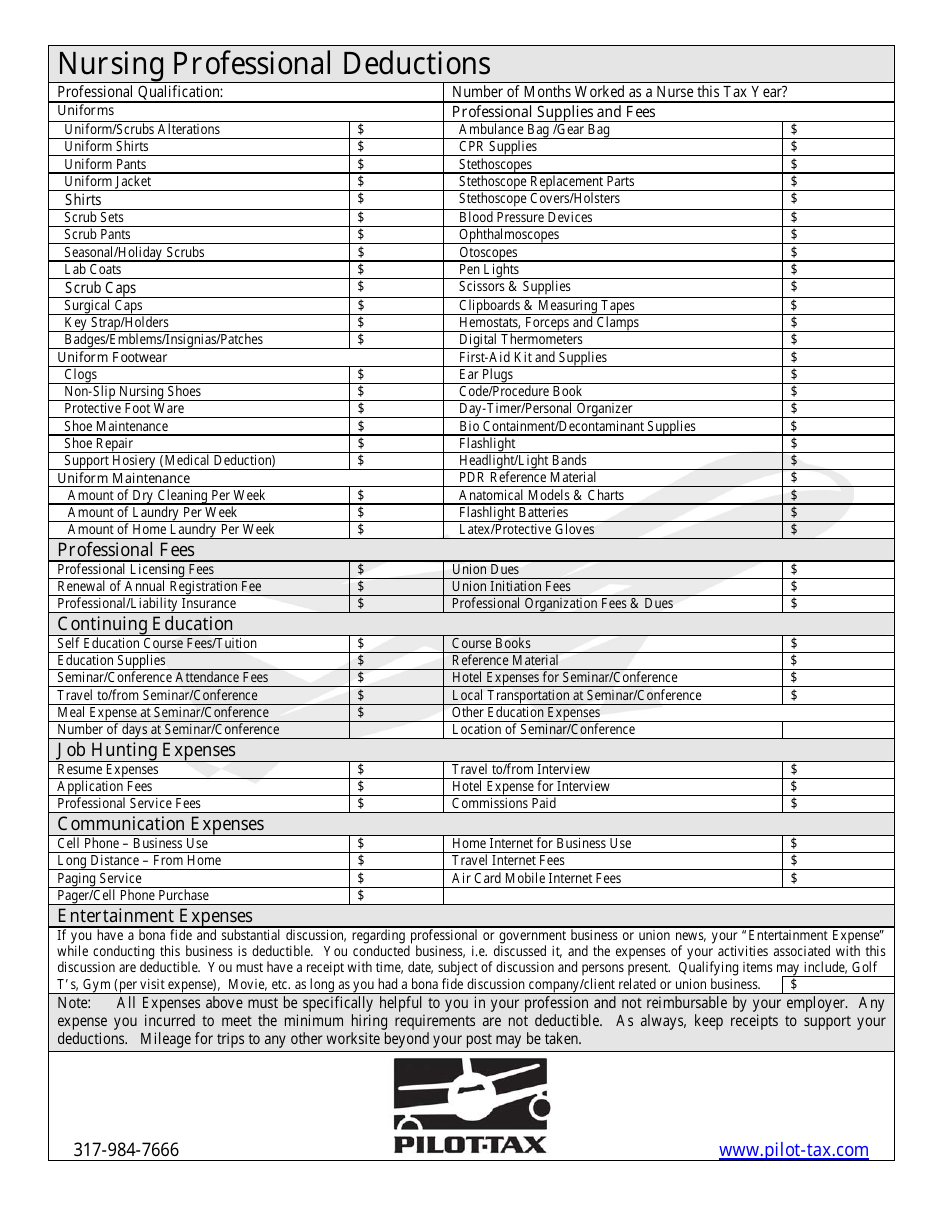

CEO of the Cockpit #5:Bring Lawyers, Guns, and Money - AVweb The CEO's Thinking On Tax Deductions. Jerry pulled up another recliner and looked on as I revealed my tax worksheet. Last year was bad for airline pilots in general and this airline pilot specifically. First, our careers came to a screeching halt in September - that is if we still have a career. 39 realtor tax deduction worksheet - Worksheet Master Itemized Deductions Worksheet You will need: Tax information documents (Receipts, Statements, Invoices, Vouchers) for your own records. Otherwise, reporting total figures on this form indicates your acknowledgement that such figures are accurate and that you vouch for their accuracy as reported on your Federal and/or State return. PDF PROFESSIONAL DEDUCTIONS - TNT Tax Service | Income Tax ... a per diem deduction for each day that you spend in training. For example, if you have training in Atlanta, you are allowed a deduction of $52 for each day you are in Atlanta for training. We are, however, required to subtract the amount of per diem that your airline paid you for your time in training. Pilot-Tax - Your Tax Professionals Pilot-Tax - Your Tax Professionals. Home Kristen Baker 2021-06-23T18:55:43+00:00. Update: We are open Monday thru Thursday, 9am-5pm EST. Reach us by phone at 317-984-7666 or by email at info@pilot-tax.com.

flightax.com Brett Morrow and Pilot Tax, for the past 8 years have been solid in handling my taxes. They certainly know how to handle airline crew taxes from US airlines as well when I was an Ex-Pat, flying for a foreign airline. They knew the process. I have been impressed each year working with Brett Morrow and Pilot Tax. Airline Crew Taxes Bigger Refunds - Maximizing all deductions, tax credits, and write-offs available. Faster Refunds - With electronic filing and direct deposit, money in 14 to 21 days from filing date. Low Fees - Competent, professional service at half the cost of comparable tax firms. If you do your own taxes, you could be costing yourself $100s or even $1000s. Airline Professional - Tax Deduction Worksheet Tax Deduction Worksheet For Pilots, Flight Attendants, & Other Airline Personnel Dry Cleaning Curling Iron - Portable, Multi-voltage Continuing Education Correspondence Course Fees Materials & Supplies Equipment Publications - FAA Luggage Carts Luggage Locks Luggage Tags Publications - Entertainment (flight related) Alarm Clock - Portable ... Flight Crew Expense Report - Blue Skies Tax Service There are two types of deductions for pilots and flight attendants. First is out of pocket expenses such as uniforms, cell phone, union dues, etc. The second is the per diem allowance and deduction. We need both to prepare your tax returns. Please use this online submit form to detail your flight attendant and pilot tax deductions.

39 airline pilot tax deduction worksheet - Worksheet Live Jan 08, 2022 · Airline pilot tax deduction worksheet. Client Number Column Restore to Consecutive Numbering. Sorting the display screen by client number has been practical and useful for many years. The 2021 program seems to have been changed. Client numbering is no lo... read more. housecallstax Level 1. Ease of Use. posted Dec 17, 2021.

Free Occupation Worksheet - Pacific Tax & Financial Group Receive A Free Occupation Tax Deductions Worksheet Airline PilotAutomobile SalespersonArtistBusiness ProfessionalClergyConstruction WorkerDay Care

39 flight attendant tax deductions worksheet - Worksheet ... Tax Deduction Worksheet For Pilots, Flight Attendants, & Other Airline Personnel Is Often Used In Tax Worksheet Template, Tax Forms And Tax. TNT Tax Service. 2929 N 44th Street Suite 202. Phoenix AZ 85018. Phone: 602-246-0721 Fax: 602-246-0720. Email: beth@tnttaxserviceaz.com Jan 08, 2022 · Tax Deduction Worksheet For Pilots, Flight Attendants ...

Certificate Programs Arizona - TUTORE.ORG Certificate Programs Arizona Monday December 20 2021. Registration for the program is now open with the first cohort starting on March 7. Minimum Admission Requirements for Graduate Certificate Programs.

PROFESSIONAL DEDUCTIONS - Pilot-Tax Bryant, U.S. Ct. App. 3rd cir. 74 AFTR2d 94-5440) disallowing a deduction for home computers. Although they are a huge asset to our jobs, the airline does not require that we have a personal computer or laptop as a condition of employment.

PDF Aircrew Taxes Flight Attendant Worksheet Flight Attendant Professional Deductions Receipts are not required for travel expenses under $75 if entered into your logbook, including item, date & cost. Do not send receipts; keep them for your records. TOTAL BLOCKS will be completed by Tax Preparer Married Pilots - If both you and your spouse fly, use an additional Professional Deduction ...

38 realtor tax deduction worksheet - Worksheet Was Here Your tax strategy starts from day #1. Keep is simple and keep every single receipt for transactions starting today! Real estate taxes reported on line 7. Enter the smaller of line 6 or line 8 here and in column (a) of line 7 of the Worksheet To Figure the Deduction for Business Use of Your Home: 9. 10. Excess real estate taxes reported on line 15.

AIRLINE PILOT WORKSHEET - Shoemake, CPA Signature is required to process this tax deduction I understand that to deduct these expenses, my employer would agree that these non-reimbursed expenses were needed to perform my job. You should retain all original receipts, checks, bank statement and mileage logs to support these deductions. I declare that the

Filing taxes as an airline pilot - Airline Pilot Central ... My company pays me between $9000 and $10,000. With a difference of about $9000, I take 80% of that and end up with a deduction of roughly $7,000. A domestic flyer is going to see smaller numbers, for sure. However, even if you ended up with a $3000 deficit, that's still going to be a ~$2400 deduction.

25 examples! What can flight crews write off? Why or why not? Pilots and flight attendants can write of many expenses from their taxes. To determine whether or not an expense is deductible, consider four tests for the expense. The four deductibility tests are: TEST 1: Is the expense "ordinary"? TEST 2: Is the expense "necessary"? TEST 3: Is the expense "personal"? TEST 4: Is the expense "prohibited"?

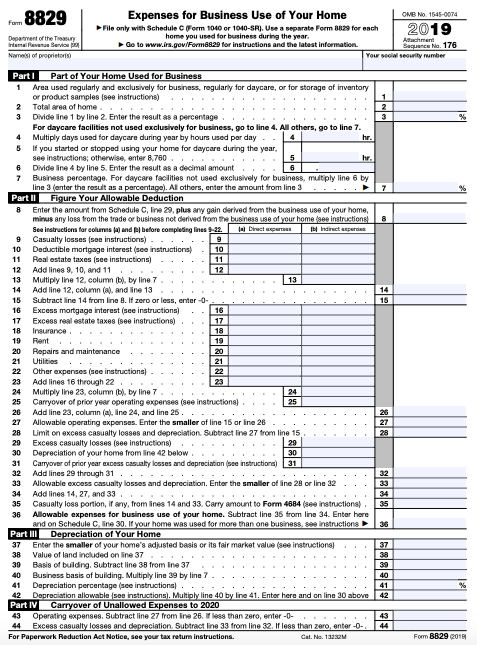

Instructions for Form 2106 (2021) - IRS tax forms The first-year limit on depreciation, special depreciation allowance, and section 179 deduction for vehicles acquired after September 27, 2017, and placed in service during 2020 remains $18,100. If you elect not to claim a special depreciation allowance for a vehicle placed in service in 2020, the amount remains $10,100.

PDF Flight Crew Expense Report and Per Diem Information can access our online submit forms and submit this worksheet electronically here- . There are two types of deductions for pilots and flight attendants. First is out of pocket expenses such as uniforms, cell phone, union dues, etc. The second is the per diem allowance and deduction. We need both to prepare your tax returns.

FDX-FX Cal Per Diem Information - Page 3 - Airline Pilot ... It is specifically for the meal and entertainment expenses only. If you paid $500 out of pocket to cover a deviation airline ticket due to a low travel bank, 100% of that expense is deductible (still subject to the 2% AGI rule). This expense would also have nothing to do with "offsetting" per-diem payments by FedEx.

0 Response to "40 airline pilot tax deduction worksheet"

Post a Comment