41 self employed expenses worksheet

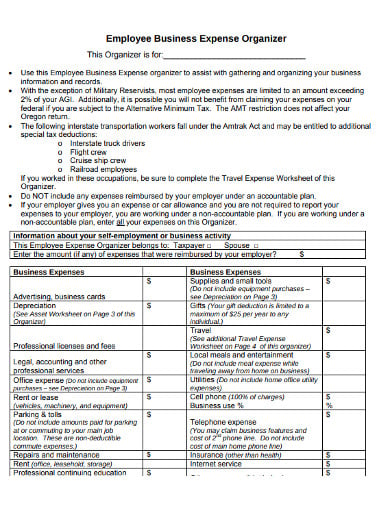

PDF Self-employed Tax Organizer Part 12: SELF-EMPLOYED BUSINESS EXPENSES A deductible business expense is one that is ordinary (commonly accepted in your industry) and necessary (helpful and appropriate even if not indispensable) for a particular business. Keep bank and credit card statements, but note these are not enough to verify expenses in case of audit. PDF 2017 Self-employment Income and Expense Worksheet All expenses should be totaled from actual receipts that can be presented to the CRA in the event of an audit. Need more info? Call or email us, or visit our website at lorennancke.com. Title: Microsoft Word - Worksheet - Self employment income and expenses 2017 (brand typeface).docx

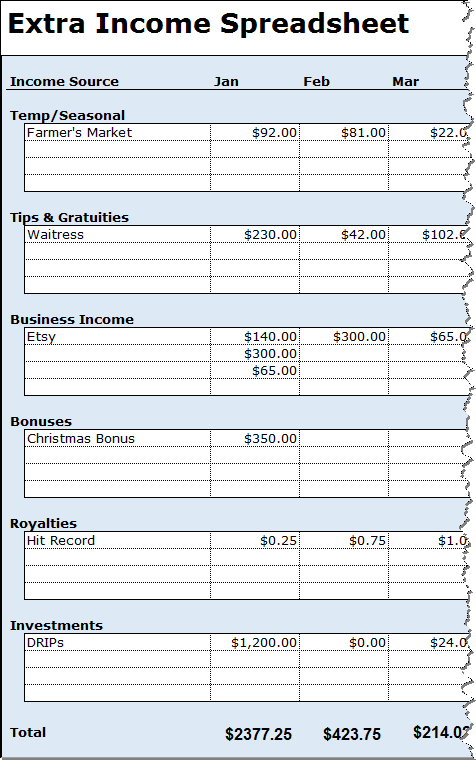

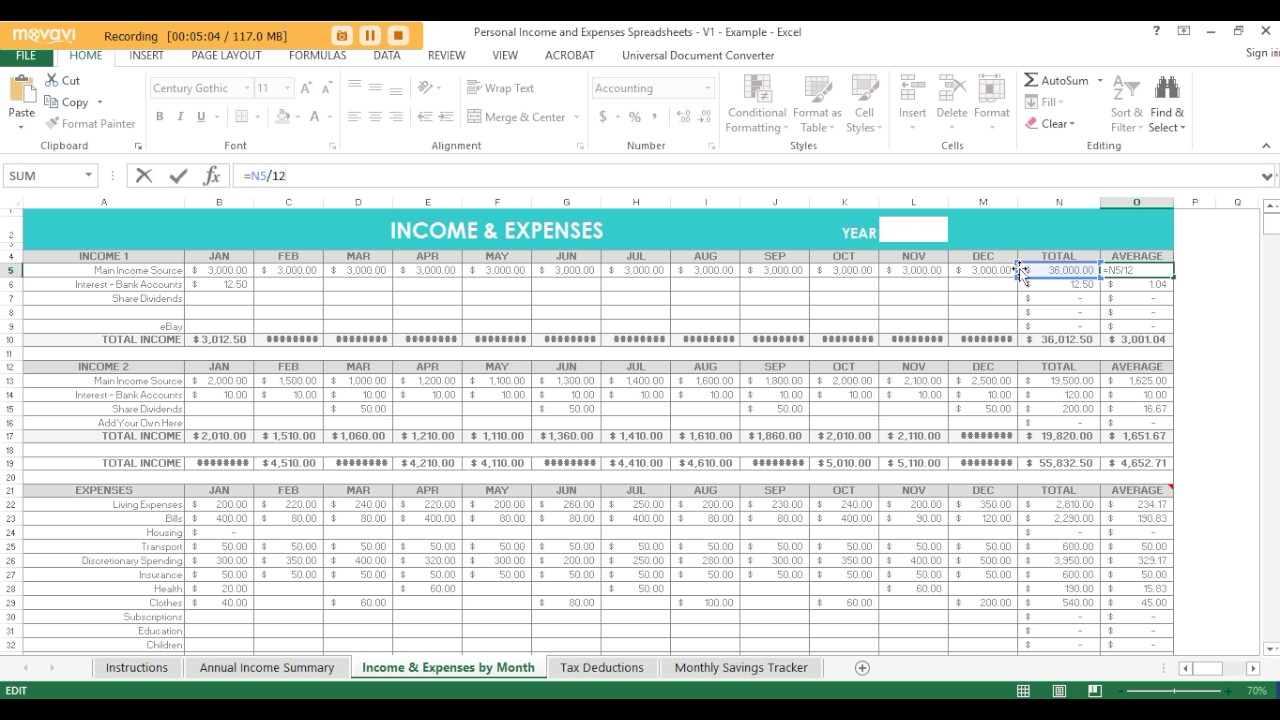

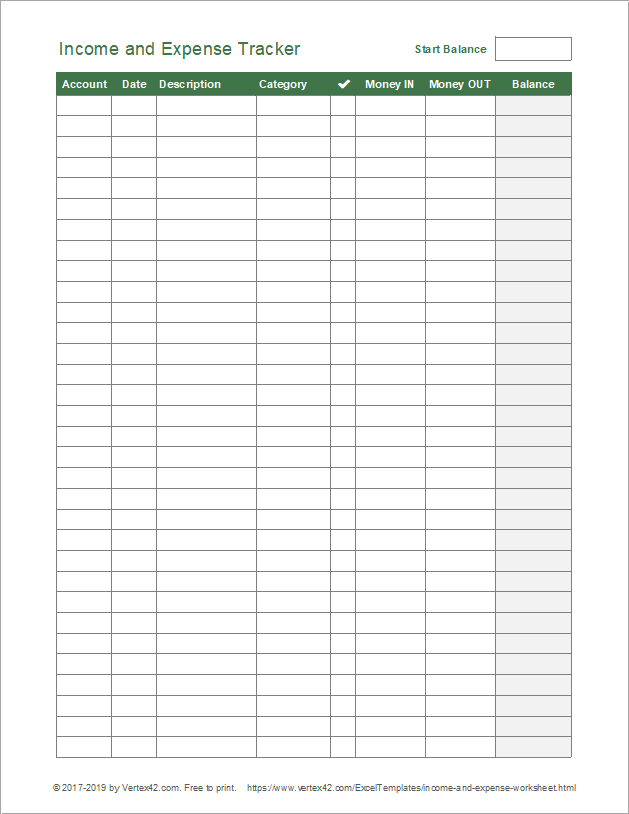

Free expenses spreadsheet for self-employed Expenses Spreadsheet for Self-Employed Whether it's for your own accounting or to manage your billable expenses, an expenses spreadsheet can help you stay organized and maximize your tax deductions in preparation for your self employment taxes. We've built it to help you get peace of mind and get on with your work.

Self employed expenses worksheet

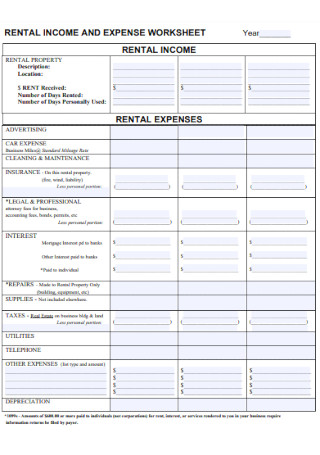

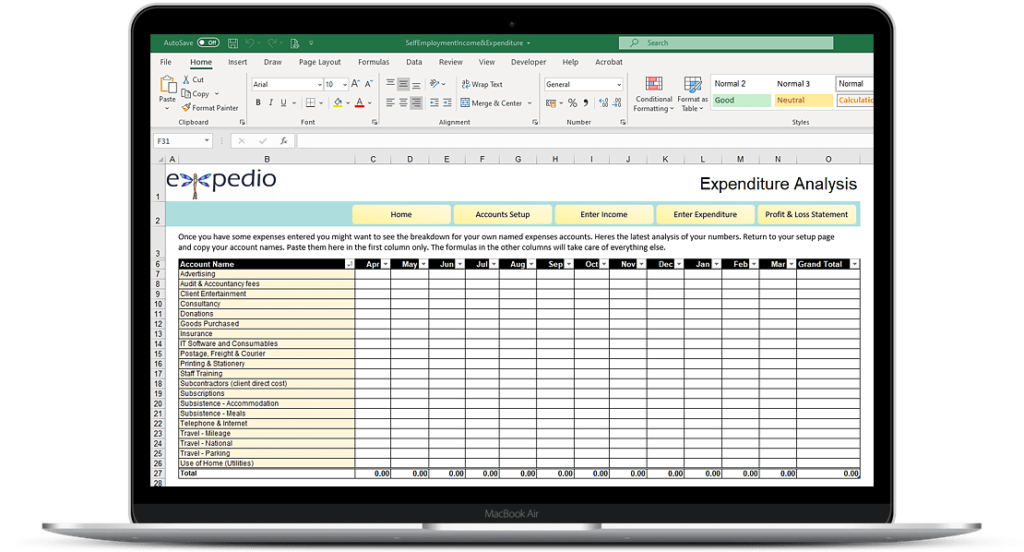

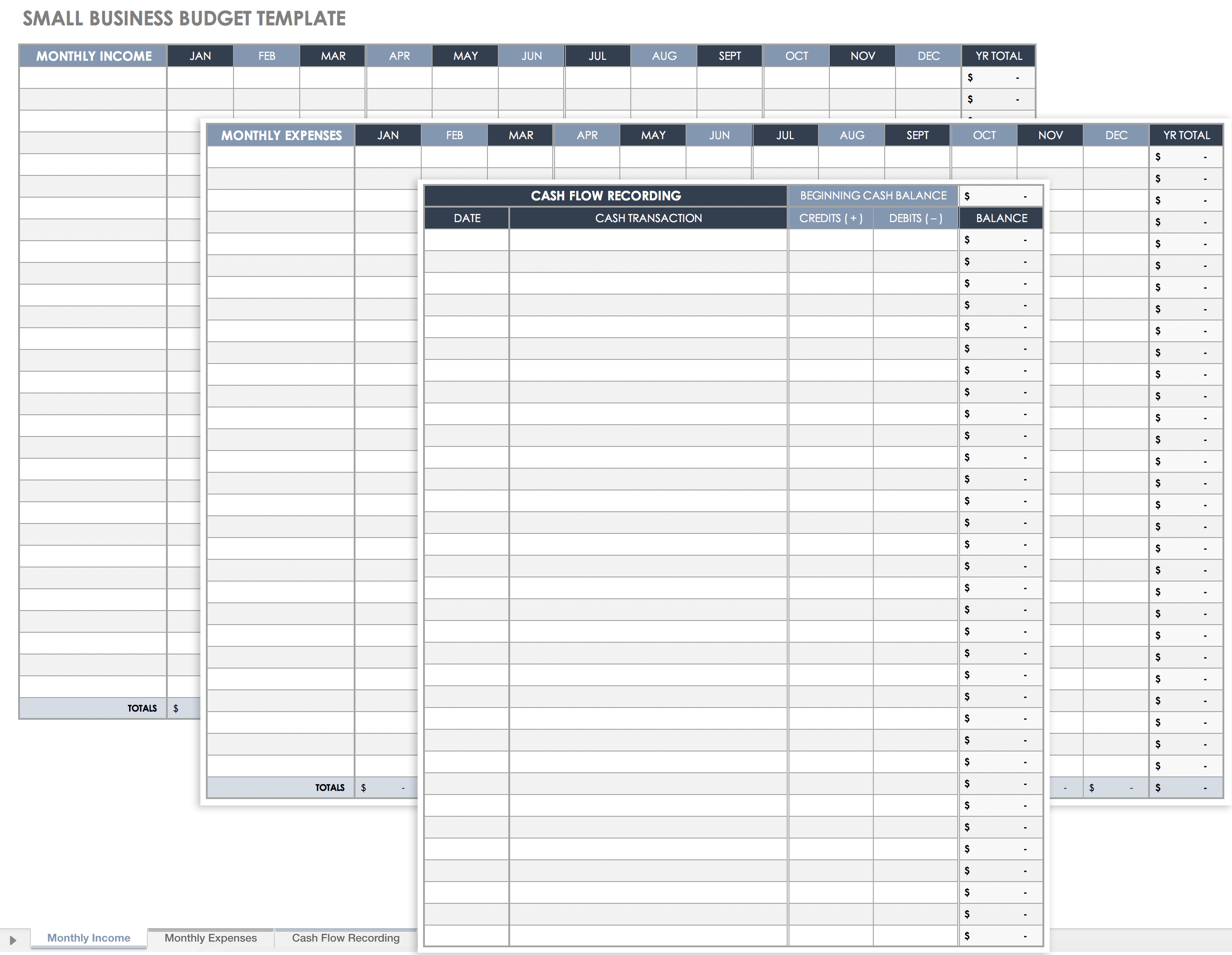

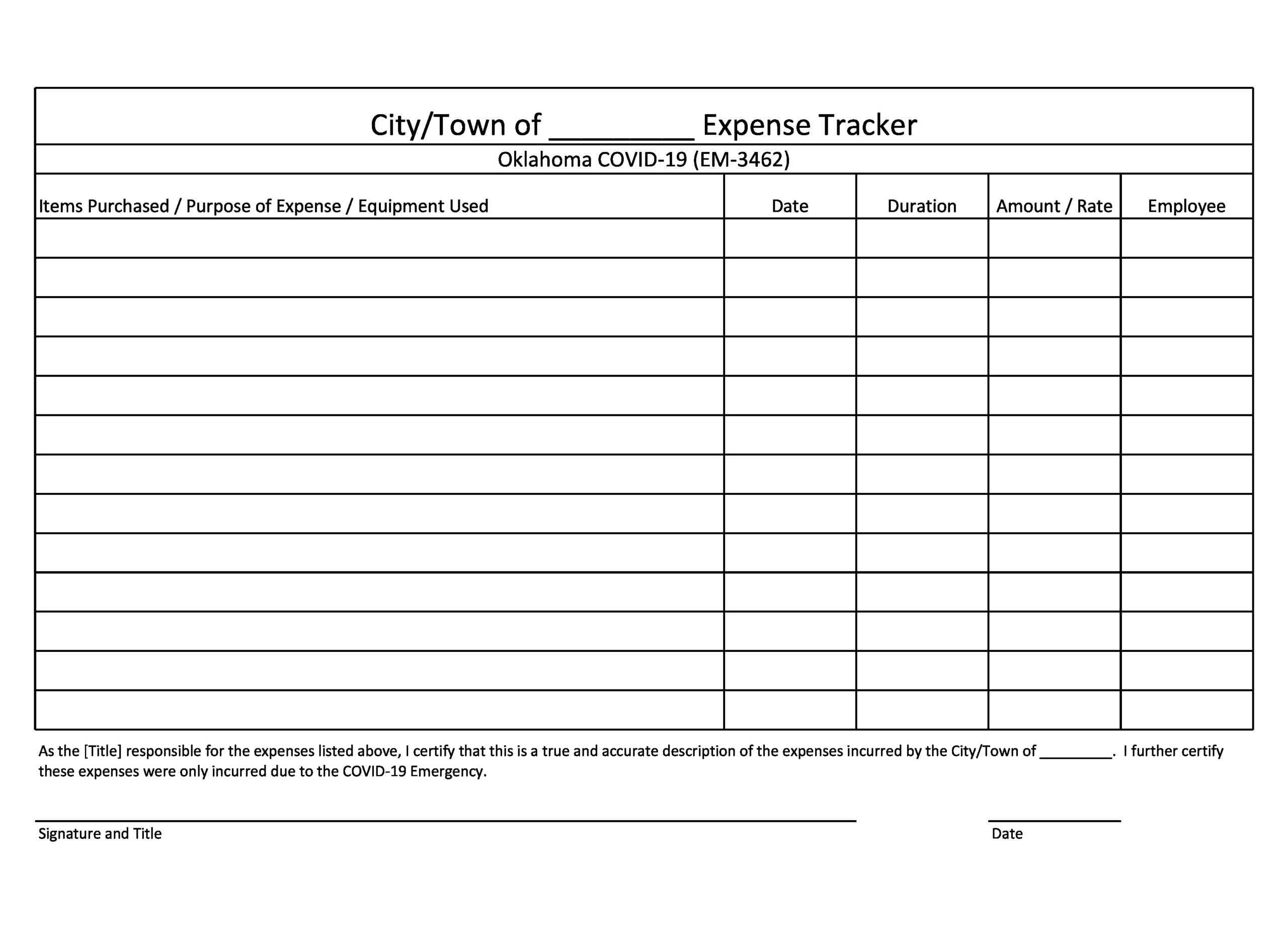

PDF SELF-EMPLOYMENT WORKSHEET Please provide 3 months of all ... ELF-EMPLOYMENT WORKSHEET . Please provide 3 months of all self -employment gross monthly income and expenses: Applicant Name (First & Last Name) Date of Birth Type of Work: Month Annual . Gross Income Total $ $ $ $ Deductible Expense: Advertising Car/Truck Expenses Commissions/Fees Contract Labor Depletion Depreciation Employee Benefit Programs ... Self-Employed Individuals Tax Center | Internal Revenue ... Self-employed individuals generally must pay self-employment tax (SE tax) as well as income tax. SE tax is a Social Security and Medicare tax primarily for individuals who work for themselves. It is similar to the Social Security and Medicare taxes withheld from the pay of most wage earners. In general, anytime the wording "self-employment tax ... PDF Self-Employed/Business Monthly Worksheet - Mirto CPA Self-Employed/Business Name of Proprietor Social Security Number Monthly Worksheet Principal Business or Profession, Including Product or Service Income January February March April May June July August Sept October Nov Dec TOTALS Gross Sales Expenses January February March April May June July August Sept October Nov Dec TOTALS Accounting Advertising

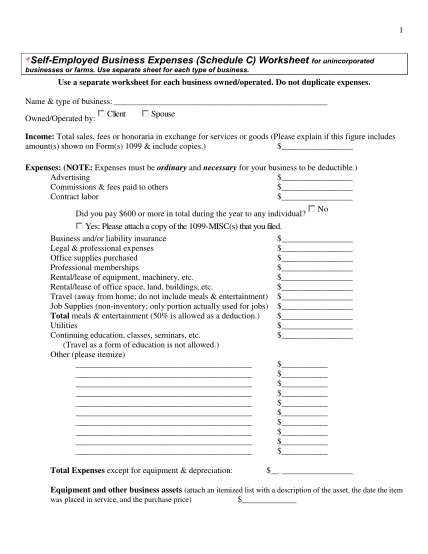

Self employed expenses worksheet. PDF SELF-EMPLOYED TAX ORGANIZER - GetNetSet.com Part 12: SELF-EMPLOYED BUSINESS EXPENSES A deductible business expense is one that is ordinary (commonly accepted in your industry) and necessary (helpful and appropriate even if not indispensable) for a particular business. Keep bank and credit card statements, but note these are not enough to verify expenses in case of audit. PDF Self-employed Income and Expense Worksheet SELF-EMPLOYED INCOME AND EXPENSE WORKSHEET TAXPAYER NAME SSN PRINCIPAL BUSINESS OR PROFESSION BUSINESS NAME EMPLOYER ID NUMBER BUSINESS ADDRESS BUSINESS ENTITY (CIRCLE ONE) INDIVIDUAL SPOUSE JOINT BUSINESS CITY, STATE, ZIP CODE INCOME EXPENSES $ GROSS RECEIPTS OR SALES $ ADVERTISING $ RETURNS & ALLOWANCES AUTO & TRAVEL $ PDF Self-Employed Business Expenses (Schedule C) Worksheet Self-Employed Business Expenses (Schedule C) Worksheet 1 Self-Employed Business Expenses (Schedule C) Worksheet for unincorporated businesses or farms. Use separate sheet for each type of business. Use a separate worksheet for each business owned/operated. Do not duplicate expenses. Self-Employed Tax Deductions Worksheet (Download FREE) The team at Bonsai organized this self-employed tax deductions worksheet (copy and download here) to organize your deductible business expenses for free. Simply follow the instructions on this sheet and start lowering your Social Security and Medicare taxes.

PDF Self Employment Income Worksheet SELF EMPLOYMENT INCOME WORKSHEET NOTE: Month # 1 Month # 2 Month # 3 $0 $0 $0 > Expenses may onlybe deducted from Income if a copy of the receipt is included. > The Low Income Home Energy Assistance Program (LIHEAP) does not allow the same business deductions as the IRS Federal Income Tax. Tracking your self-employed income and expenses - Viviane ... Download the appropriate "Self-employed income and expense worksheet" in PDF or Excel format. Add up your self-employed income and enter in the income section of the worksheet. Add up your expenses using the categories in the worksheet and enter the amounts in the appropriate section of the worksheet. Spreadsheet Software PDF Tax Worksheet for Self-employed, Independent contractors ... Tax Worksheet for Self-employed, Independent contractors, Sole proprietors, Single LLC LLCs & 1099-MISC with box 7 income listed. Try your best to fill this out. If you're not sure where something goes don't worry, every expense on here, except for meals, is deducted at the same rate. PDF Sole Proprietorship/ Self-employed Worksheet Automobile Deductions worksheet for self-employment or unreimbursed employee business expenses (Standard Mileage Deduction) Car and Truck Expenses: Vehicle 1: Year/make/model of vehicle_____ Total miles for the year_____ Business miles for the year_____

PDF Schedule C Worksheet Schedule C Worksheet Hickman & Hickman, PLLC. Page 1 Schedule C Worksheet (Self-Employed) Provide all 1099's (MISC & NEC) received and issued by your company, including all 1099-K's (i.e.; Square, PayPal, etc.) PDF Schedule C Worksheet for Self Employed Businesses and/or ... Schedule C Worksheet for Self Employed Businesses and/or Independent Contractors ... I certify that I have listed all income, all expenses, and I have documentation to back up the figures entered on this worksheet. For tax year _____ Printed Name_____ Signature_____ Date _____ ... Mgic Self Employed Worksheet - XpCourse Mgic rental Income Worksheet fannie Mae Self employed Worksheet Mgic sam Worksheet 2019. EMPLOYEE BUSINESS EXPENSES 9 Total Expenses. Our cash flow analysis worksheets promote ease and accuracy in determining self-employed borrowers income. Result Step 2 Calculate the monthly qualifying rental income using Step 2A. Gross Royalties Received. PDF Self-employment Expense Worksheet Revised 10/2018 SELF-EMPLOYMENT EXPENSE WORKSHEET Applicant's name: _____ Name of self-employed person: _____

PDF 2021 Self-Employed (Sch C) Worksheet 2021 Self-Employed (Sch C) Worksheet (type-in fillable) (Complete a separate worksheet for each business) Business owner's name: _____ If you checked any of the above, please stop here and speak with one of our Counselors. If you checked none of these above, please continue by completing the worksheet below for each business.

Cash Flow Analysis (Form 1084) - Fannie Mae This worksheet may be used to prepare a written evaluation of the analysis of income related to self-employment. The ... A self-employed borrower's share of Partnership or S Corporation earnings can only be considered if the lender obtains ... expense associated with nonrecurring casualty loss.- Line 8f - Mortgage or Notes Payable in Less ...

DOCX c101374920.preview.getnetset.com SPECIALTY WORKSHEET for the SELF-EMPLOYED. To maximize your deductions, please complete this form. Client_____Tax Year _____

PDF Self Employment Income Worksheet Self Employment Income Worksheet . Self Employed Applicants Name: _____ Home Address: _____ ... Allowable expenses that can be deducted from income are listed below within the worksheet. Tacoma Public Utilities does not allow the same business deductions as the IRS.

Self Employed Tax Deductions Worksheet - SignNow The way to complete the Self employment income expense tracking worksheet form online: To start the blank, use the Fill & Sign Online button or tick the preview image of the form. The advanced tools of the editor will direct you through the editable PDF template. Enter your official contact and identification details.

PDF small business/self-employed income and expense worksheet business name federal id # or ssn income gross receipts refunds/returns cost of goods sold -inventory boy / eoy -purchases, labor, materials and supplies other income total gross income expenses advertising car & truck expenses commissions & fees contract labor

Employment Income Calculation Worksheet and Similar ... Self-Employed Borrower Tools by Enact MI best enactmi.com. Self-Employed Borrower Tools by Enact MI. We get it, mental math is hard. That's why Enact provides a collection of downloadable calculators and reference guides to help you analyze a self-employed borrower's average monthly income and expenses. Please note that these tools offer suggested guidance, they don't replace instructions or ...

DOC Self Employment Monthly Sales and Expense Worksheet Monthly Total Self Employment Income $ Deducting Business Expenses If you want to claim business expenses, you must list the expenses on the following page and give us documentation of the expense. (WAC 388-450-0085, 182-512-0840) For cash and food only: I choose to take the 50% standard deduction instead of listing my expenses on the next page.

PDF (Schedule C) Self-Employed Business Expenses Worksheet for ... (Schedule C) Self-Employed Business Expenses Worksheet for Single member LLC and sole proprietors. Use separate sheet for each business. Use a separate worksheet for each business owned/operated. Do not duplicate expenses. Name & type of business: _____ Owned/Operated by: Client Spouse Income: Total ...

PDF Self-Employed Worksheet - MB Tax Pro - Home Self-Employed Worksheet Client: _____ Tax Year: _____ Did you make any payments that would require you to file Form 1099? YES_____ NO_____ Income: Office Expense Office Supplies Outside Services Parking & Tolls Expenses: Postage Accounting Printing

PDF SELF EMPLOYED INCOME/EXPENSE SHEET - CPA Accounting SELF EMPLOYED INCOME/EXPENSE SHEET NAME OF PROPRIETOR BUSINESS ADDRESS BUSINESS NAME FEDERAL I.D. NUMBER Automobile Mileage (Adequate records required) COST OF GOODS SOLD (If Applicable) Beginning of the Year Inventory End of Year Inventory Purchases Other:

PDF Self-Employed/Business Monthly Worksheet - Mirto CPA Self-Employed/Business Name of Proprietor Social Security Number Monthly Worksheet Principal Business or Profession, Including Product or Service Income January February March April May June July August Sept October Nov Dec TOTALS Gross Sales Expenses January February March April May June July August Sept October Nov Dec TOTALS Accounting Advertising

Self-Employed Individuals Tax Center | Internal Revenue ... Self-employed individuals generally must pay self-employment tax (SE tax) as well as income tax. SE tax is a Social Security and Medicare tax primarily for individuals who work for themselves. It is similar to the Social Security and Medicare taxes withheld from the pay of most wage earners. In general, anytime the wording "self-employment tax ...

PDF SELF-EMPLOYMENT WORKSHEET Please provide 3 months of all ... ELF-EMPLOYMENT WORKSHEET . Please provide 3 months of all self -employment gross monthly income and expenses: Applicant Name (First & Last Name) Date of Birth Type of Work: Month Annual . Gross Income Total $ $ $ $ Deductible Expense: Advertising Car/Truck Expenses Commissions/Fees Contract Labor Depletion Depreciation Employee Benefit Programs ...

0 Response to "41 self employed expenses worksheet"

Post a Comment