43 non cash charitable donations worksheet

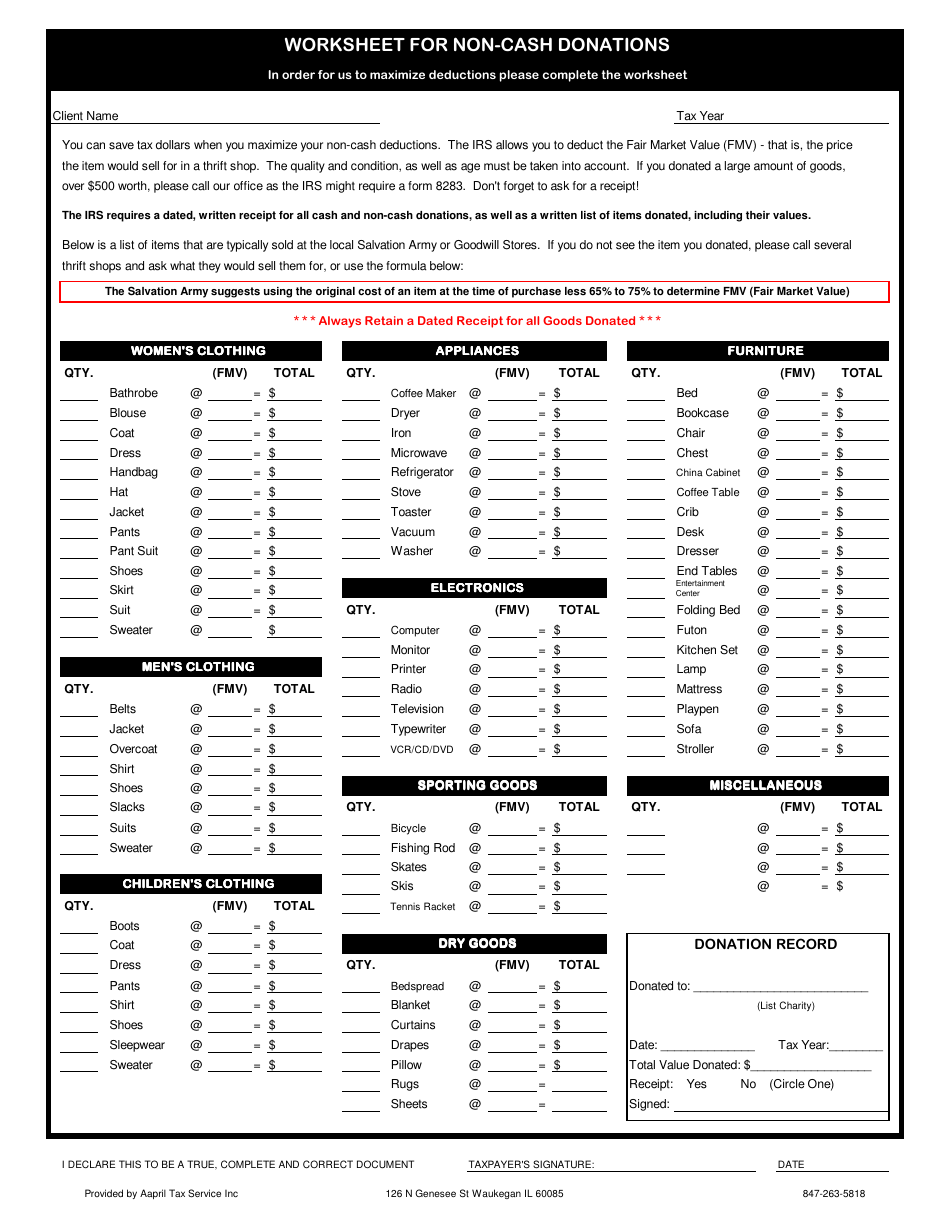

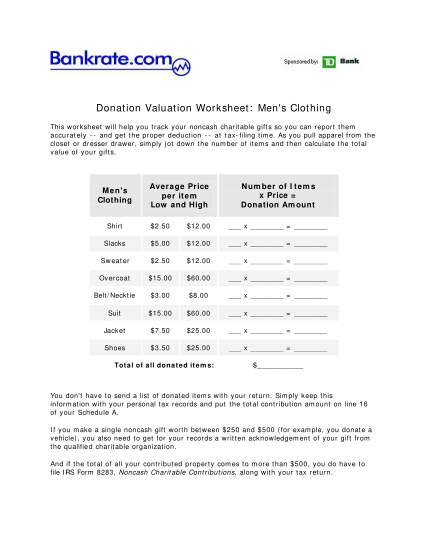

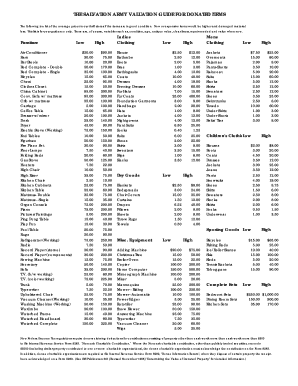

PDF Today - redcpa.com Missi n g lnformation : Non-cash charita ble contri butions worksheet Name: Tax Year: Home Telephone:Work Cell: The following is a guideline for valuation of non-cash charitable contributions.When valuing items, take into consideration the condition of the items, lf the value of the donated items is $250 or more to one charity in one day, you are required to obtain a written receipt from the ... NON-CASH CHARITABLE CONTRIBUTION WORKSHEET non-cash charitable contribution worksheet date _____ organization _____ address_____ the following tables are estimates only. actual fmv may vary significantly. women’s clothing qty amount qty amount subtotal bathrobe 12.00 x = 9.00 x =

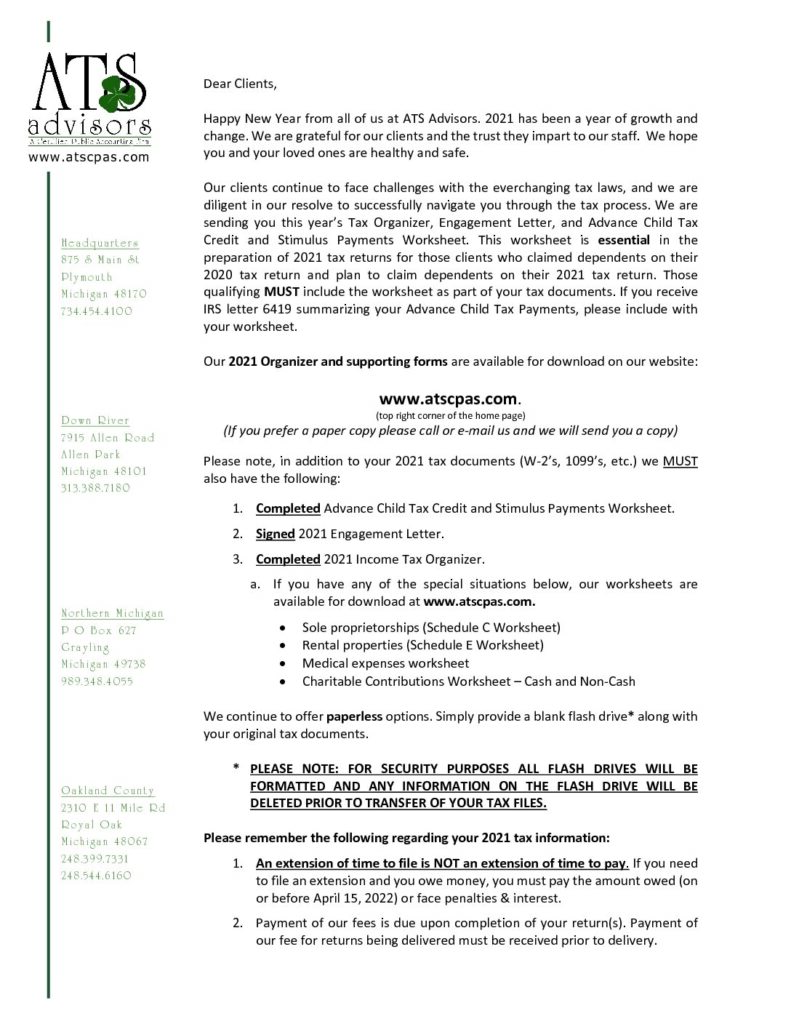

40 non cash charitable donations worksheet - Worksheet Master PDF Non Cash Charitable Contributions / Donations Worksheet the intent of this worksheet is to summarize your non-cash charitable contributions for the purpose of tax preparation and reporting. you the taxpayer, are responsible for maintaining an accurante and complete record of your non-cash charitable contributions. under tax regulations you ...

Non cash charitable donations worksheet

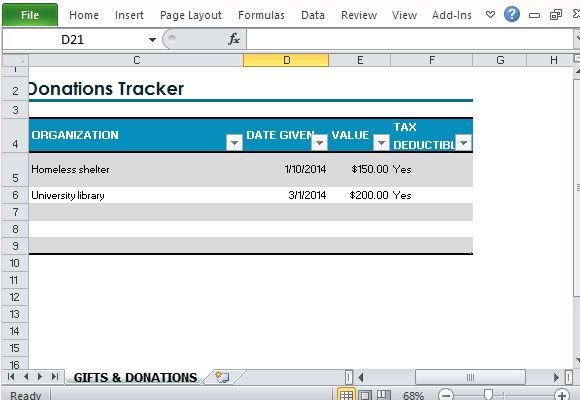

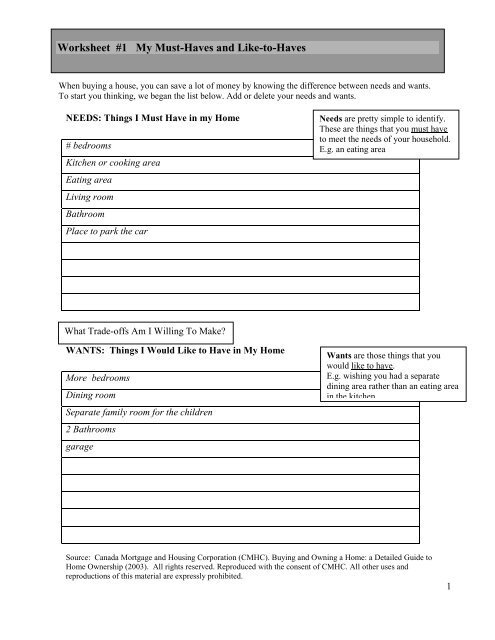

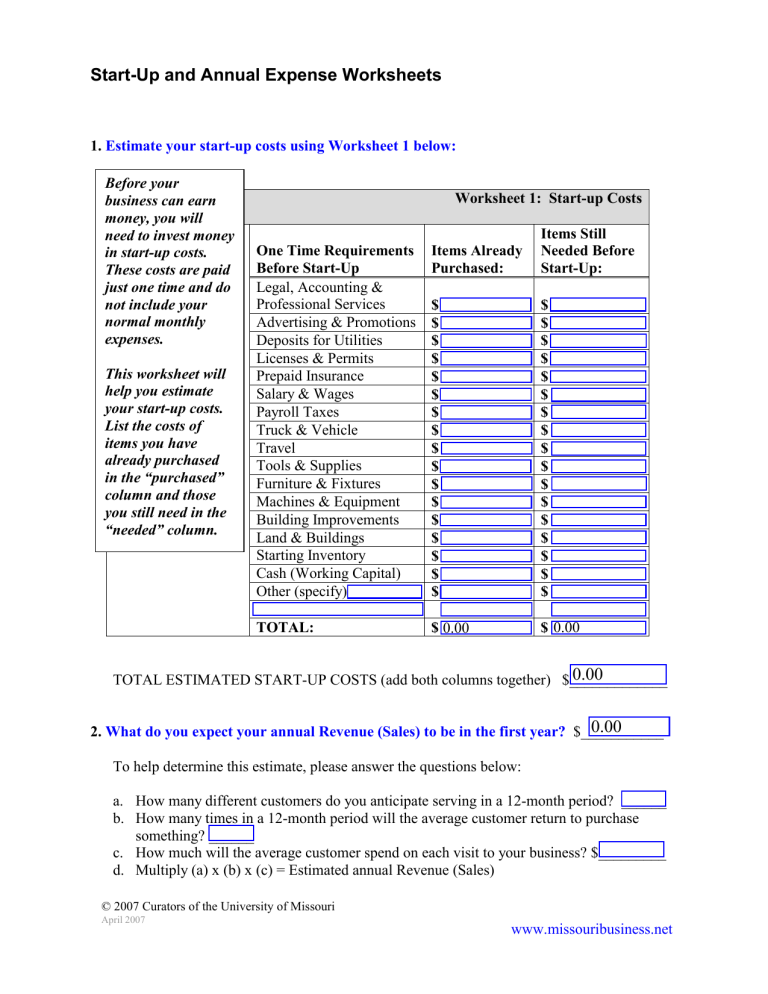

Non-cash Charitable Contributions Excel Worksheet Non cash charitable contributions / donations worksheet. These spreadsheets will help you calculate and track your charitable donations for tax deduction purposes. 20th two separate valuation reports should be made for each date. This worksheet is provided as a convenience and aid in calculating most common non cash charitable donationsthe source. PDF Non Cash Charitable Contributions / Donations Worksheet the intent of this worksheet is to summarize your non-cash charitable contributions for the purpose of tax preparation and reporting. you the taxpayer, are responsible for maintaining an accurante and complete record of your non-cash charitable contributions. under tax regulations you acknowledge that you have NON-CASH DONATION WORKSHEET - US Legal Forms Ensure the details you fill in NON-CASH DONATION WORKSHEET is updated and accurate. Add the date to the record with the Date feature. Click on the Sign tool and create a digital signature. There are 3 available choices; typing, drawing, or uploading one. Be sure that every area has been filled in correctly.

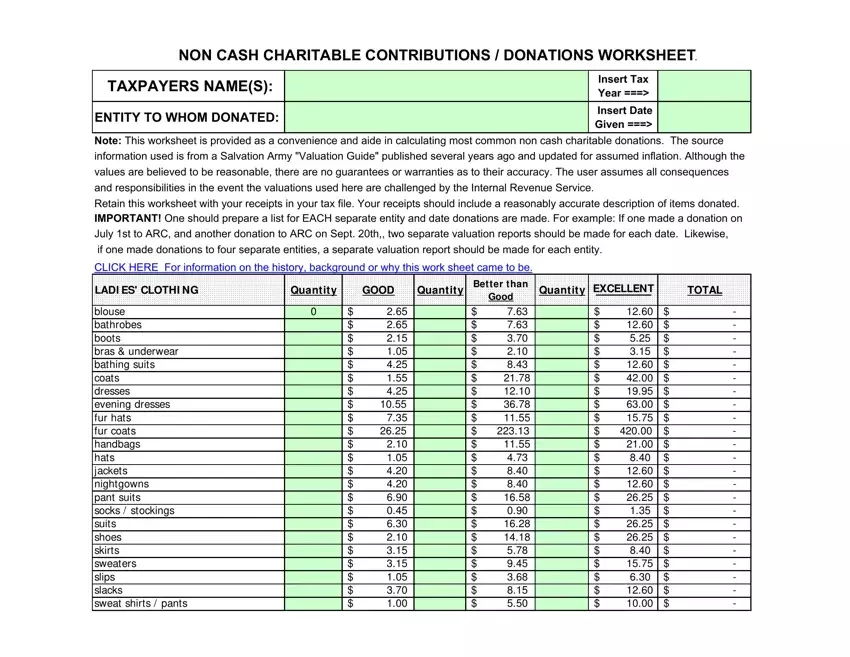

Non cash charitable donations worksheet. Noncash charitable deductions worksheet. noncash recap men's clothing children's clothing quantity good excellent total total of all donated items entity to whom donated: my / our best guess of value non cash charitable contributions / donations worksheet. insert tax year ===> insert date given ===> enter items not provided for in the above categories. set your own value. XLSX John Lebbs CPA, PLLC This worksheet has been provided to help you determine the value of your noncash contributions. The values on this worksheet are based on valuation ranges provided by the Salvation Army 1 and are intended to be used as general guidelines. Amounts should be adjusted upward or downward based on your actual assessment of condition of each item. NON-CASH DONATION WORKSHEET (Based on Salvation Army average ... NON-CASH DONATION WORKSHEET (Based on Salvation Army average prices for items in Good Condition) DONATED TO: DONATION DATE: CHILDREN'S CLOTHING LOW HIGH AVG QTY AMOUNT VALUE Blouses 2.40 9.60 6.00 Boots 3.60 24.00 13.80 Coats 5.40 24.00 14.70 Dresses 4.20 14.40 9.30 Jackets 3.60 30.00 16.80 Jeans 4.20 14.40 9.30 Pants 3.00 14.40 8.70 Snowsuits ... Publication 526 (2021), Charitable Contributions ... Worksheet 1. Donations of Food Inventory: See separate Worksheet instructions. (Keep for your records) 1. Enter fair market value of the donated food _____ 2. Enter basis of the donated food _____ 3. Subtract line 2 from line 1. If the result is zero or less, stop here. Don't complete the rest of this worksheet. Your charitable contribution deduction for food is the amount on line 1 …

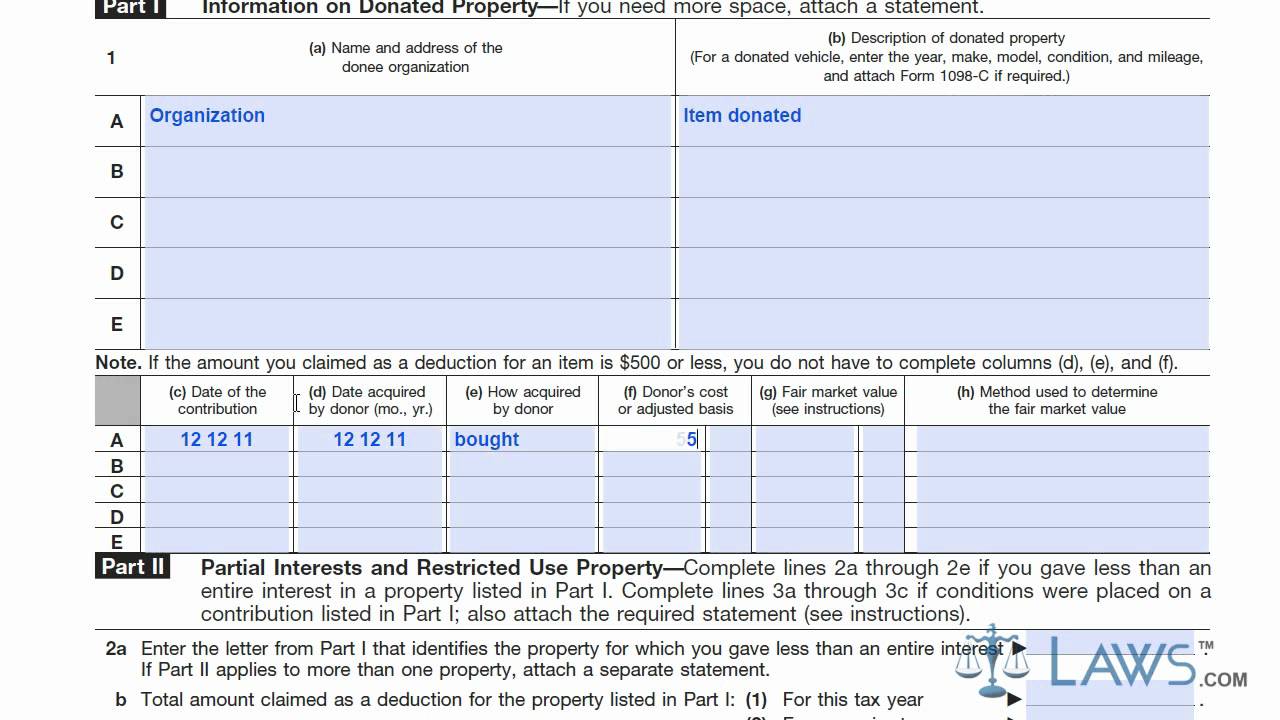

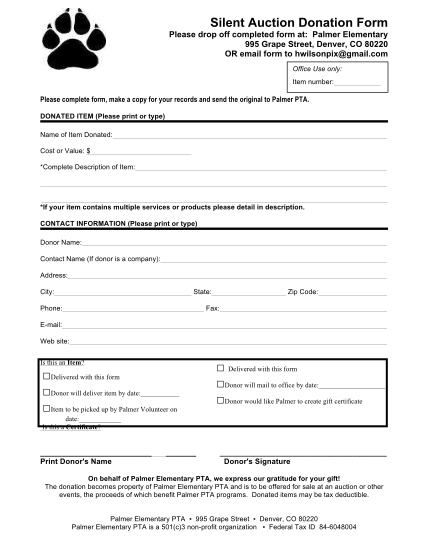

Donations Help.html - Intuit ItsDeductible is a free tool that helps you value charitable donations and track them year round. You can use ItsDeductible to track donations of items, cash, mileage/travel expenses and stock. For non-cash item donations, you can use ItsDeductible to: Help determine estimated fair market value (FMV) as required by the IRS ; Help determine whether your item is of "good … Fountain Essays - Your grades could look better! 2018-02-28 · This ensures all instructions have been followed and the work submitted is original and non-plagiarized. We offer assignment help on any course. We offer assignment help in more than 80 courses. We are also able to handle any complex paper in any course as we have employed professional writers who are specialized in different fields of study. From their … Non Charitable Donations Worksheets - Kiddy Math Non Charitable Donations - Displaying top 8 worksheets found for this concept.. Some of the worksheets for this concept are Non cash charitable contributions donations work, Non cash charitable contributions work, The salvation army valuation guide for donated items, Non cash contribution work, Tax e form non cash charitable contribution work, Nine questions you should ask every nonprofit ... Charitable Donations - H&R Block Non-cash donations of $5,000 or more. If your non-cash single charitable donation for one item or a group of similar items is more than $5,000: The organization must give you a written acknowledgement. You must keep the records required under the rules for donations of more than $500 but less than $5,000.

XLS Noncash charitable deductions worksheet. Title: Noncash charitable deductions worksheet. Author: P. Keokham "adonis" Revised by: P. A. Moore Last modified by: Lynn Created Date: 2/10/2003 7:35:53 AM non cash charitable contributions/donations worksheet 2007 ... Stick to these simple actions to get non cash charitable contributions/donations worksheet ready for sending: Get the document you require in the collection of legal forms. Open the template in the online editing tool. Read through the recommendations to discover which details you must give. Click the fillable fields and put the requested data. PDF 2020 Charitable Contributions Noncash FMV Guide Charitable contributions of property in excess of $5,000. Planning Tip: Most cell phones today can take pictures. Take a picture of all items donated. Keep the electronic pictures for proof the items were in good or better con-dition at the time they were donated. Recordkeeping Rules for Charitable Contributions NON-CASH CHARITABLE CONTRIBUTIONS / DONATIONS WORKSHEET Note: This worksheet is provided as a convenience and aid in calculating most common non-cash charitable donations. The source The source information used is from a Salvation Army "Valuation Guide" published several years ago and updated for assumed inflation.

non cash charitable donations worksheet - nightlight ... 35 Non Cash Charitable Contributions Donations Worksheet - Free Worksheet Spreadsheet. Download Non Cash Charitable Contribution Worksheet for Free | Page 12 - FormTemplate. Donation Sheet Template - 9+Free PDF Documents Download | Free \u0026 Premium Templates. Non Cash Charitable Contributions Worksheet - Promotiontablecovers.

Donation Calculator Use this donation calculator to find, calculate, as well as document the value of non-cash donations. You can look up clothing, household goods furniture and appliances. Using The Spreadsheet. If you are using a tablet or mobile device, you cannot enter any data. However, you can browse the sheet to find values.

Noncash charitable deductions worksheet. Note: This worksheet is provided as a convenience and aide in calculating most common non cash charitable donations. The source information used is from a Salvation Army "Valuation Guide" published several years ago and updated for assumed inflation. Although the Retain this worksheet with your receipts in your tax file.

PDF Non-Cash Charitable Contributions Worksheet Missing Information: Non-Cash Charitable Contributions Worksheet Name. Home Telephone: Work Telephone: Tax Year: 2016 Cell: The following is a guideline for valuation of non-cash charitable contributions. When valuing items, take into consideration the condition of the items. If the value of the donated items is $250 or more to one charity in

The Salvation Army Thrift Stores | Donation Valuation Guide We always appreciate vehicle donations. And although we often accept car donations, boat donations, or other vehicle donations in any condition (running or not). Due to differing regulations and other considerations, not all types of vehicles are accepted at all locations, so it's best to contact us first. For more detailed information on how to donate your vehicle, give us a …

About Form 8283, Noncash Charitable Contributions ... Information about Form 8283, Noncash Charitable Contributions, including recent updates, related forms and instructions on how to file. Form 8283 is used to claim a deduction for a charitable contribution of property or similar items of property, the claimed value of which exceeds $500.

XLS Noncash charitable deductions worksheet. Note: This worksheet is provided as a convenience and aide in calculating most common non cash charitable donations. The source information used is from a Salvation Army "Valuation Guide" published several years ago and updated for assumed inflation.

PDF Missing Information: Non-Cash Charitable Contributions ... Missing Information: Non-Cash Charitable Contributions Worksheet (pg 4) Prepared By: HMS CERTIFIED PUBLIC ACCOUNTANTS 09-24-2013 457 Lake Howell Rd. Maitland FL 32751 Tel: (407) 571-4080 Fax: (407) 571-4090 information@hmscpa.com Men's Clothing $$ Guideline Your Cost # Items Value Today Deduction Jackets 7.50 - 25.00 Overcoats 15.00 - 60.00

Charitable Contribution Worksheet | STAC Accounting Charitable Contribution Worksheet. Karen. December 20, 2017. Reporting Non Cash Charitable Donations can be extremely beneficial to your bottom line tax liability. Although, pulling it all together can also be painfully arduous. I am providing access to a worksheet built in excel. Download it and open in your 'sheets' app (excel, numbers ...

PDF Statement Noncash Charitable Contributions The following is a guideline for valuation of non-cash charitable contributions. When valuing items, take into consideration the condition of the items. If the value of the donated items is $250 or more to one charity in one day, you are required to obtain a written receipt from the charity

Inspiration Non Cash Charitable Contributions Worksheet ... This worksheet is provided as a convenience and aide in calculating most common non cash charitable donations. Sheets 200 800 Throw Rugs 150 1200 Towels 050 400 Total Furniture Low High Qty Total Bed Complete. When valuing items take into consideration the condition of the items.

Small Business Solutions | KeyBank - Key.com Call us at: 888-KEY4BIZ (539-4249). Clients using a TDD/TTY device: 1-800-539-8336. Clients using a relay service: 1-866-821-9126. Find a Local Branch or ATM

NON-CASH DONATION WORKSHEET - US Legal Forms Ensure the details you fill in NON-CASH DONATION WORKSHEET is updated and accurate. Add the date to the record with the Date feature. Click on the Sign tool and create a digital signature. There are 3 available choices; typing, drawing, or uploading one. Be sure that every area has been filled in correctly.

PDF Non Cash Charitable Contributions / Donations Worksheet the intent of this worksheet is to summarize your non-cash charitable contributions for the purpose of tax preparation and reporting. you the taxpayer, are responsible for maintaining an accurante and complete record of your non-cash charitable contributions. under tax regulations you acknowledge that you have

Non-cash Charitable Contributions Excel Worksheet Non cash charitable contributions / donations worksheet. These spreadsheets will help you calculate and track your charitable donations for tax deduction purposes. 20th two separate valuation reports should be made for each date. This worksheet is provided as a convenience and aid in calculating most common non cash charitable donationsthe source.

0 Response to "43 non cash charitable donations worksheet"

Post a Comment