40 funding 401ks and roth iras worksheet

Funding 401(K)S And Roth Iras Worksheet Answers Chapter 8 ... Funding 401 (K)S And Roth Iras Worksheet Answers Chapter 8 A gold IRA or protected metals IRA is a Self-Directed IRA where the owner maintains ownership of the accounts receivable and the value of the accounts balance. The IRA owns shares in a company, also referred to as "protocol shares." 401(k) and IRA Contributions: You Can Do Both Learn about our editorial policies. You can still contribute to a Roth IRA and/or traditional IRA even if you participate in a 401 (k) plan at work—as long as you meet the IRA's eligibility ...

Funding 401K And Roth Ira Worksheet - Free Gold IRA ... Oct 23, 2021 · Overview. Funding 401K And Roth Ira Worksheet A gold IRA or protected metals IRA is a Self-Directed IRA where the owner maintains ownership of the accounts receivable and the value of the accounts balance. The IRA owns shares in a company, also referred to as “protocol shares.”.

Funding 401ks and roth iras worksheet

Funding a 401 K and Roth - financial lit Flashcards | Quizlet 401 (K) defined contribution plan offered by a corporation to its employees, which allows employees to set aside tax-deferred income for retirement purposes; in some cases, employers will match their contributions. 403b. same as 401k but is used for nonprofit organizations such as schools, hospitals, and churches. Funding 401ks And Roth Iras Worksheet - Studying Worksheets Feb 06, 2022 · Funding 401KS And Roth Iras Worksheet Quizlet Overview Funding 401KS And Roth Iras Worksheet Quizlet A gold IRA or protected metals IRA is a Self-Directed IRA where the owner maintains ownership of the accounts receivable and the value of the accounts balance. View Complete Funding 401ks and Roth IRAs Worksheetjpg from AA 1NAME. Who Can Open a Roth IRA? Roth IRA Contribution Limits . When you're ready to make a contribution to a Roth IRA, you will find you can only contribute so much. The Internal Revenue Service (IRS) sets rules each year to limit how much you can invest in all of your IRAs—not just your Roth IRA. For example, in 2022, you can only contribute up to $6,000 into IRAs if you're 49 years old or younger.

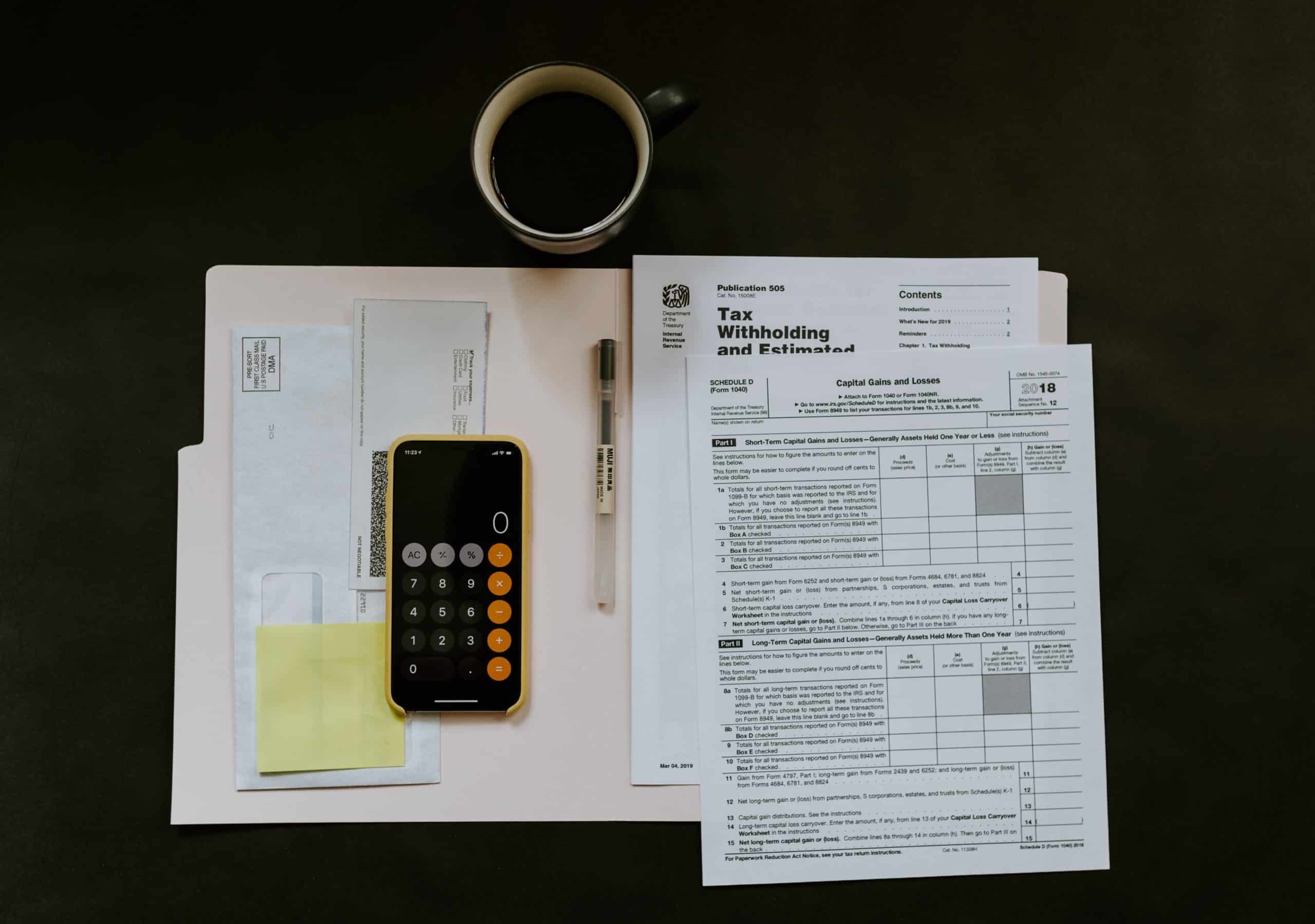

Funding 401ks and roth iras worksheet. PDF Roth vs. Traditional 401(k) Worksheet - Morningstar p Roth 401(k): Multiply the maximum allowable amount by 1 plus your tax rate (for example, 1.24 if you're in the 24% tax bracket). Then divide that amount by your total salary to arrive at your ... PDF NAME: DATE: Funding 401(k)s and Roth IRAs - Weebly Melissa will fund the 401(k) up to the match and put the remainder in her Roth IRA. Tyler and Megan can each fund a Roth IRA then put the remainder in the 401(k). With no match, fund the Roth first (based on 2013 contribution of $5,500 per individual). Adrian is not eligible to open a Roth IRA because he makes too much money. Roth IRAs: Explore Your Roth IRA Options | T. Rowe Price *In order to contribute to a Roth IRA, single filers must have a modified adjusted gross income (MAGI) under $139K for tax year 2020 and $140K for tax year 2021. Married couples filing jointly must have a MAGI under $206K for tax year 2020 and $208K for tax year 2021. Amount of Roth IRA Contributions That You Can Make For ... Amount of your reduced Roth IRA contribution. If the amount you can contribute must be reduced, figure your reduced contribution limit as follows. Start with your modified AGI. $125,000 for all other individuals. Divide the result in (2) by $15,000 ($10,000 if filing a joint return, qualifying widow (er), or married filing a separate return and ...

Funding 401 Ks And Roth Iras Worksheet Answers - Worksheet ... Funding 401 Ks And Roth Iras Worksheet Answers Youngsters take pleasure in locating remedies to problems. Single-digit reproduction is the primary focus of this worksheet. There are advanced steps for children to learn after mastering enhancement. Backdoor Roth IRA 2022: What Is It & How to Do It | Facet ... Enter the backdoor Roth IRA. How a Regular Roth IRA Works. With a Roth IRA, you contribute after-tax dollars as opposed to before-tax dollars like you would contribute to a traditional IRA or 401(k). You elect to pay taxes today so you don't have to pay them in the future. Once your money is in the Roth IRA, you can invest it however you choose. Roth IRA vs. 401(k): Which Is Better for You ... Then, you max out your Roth IRA. You can only contribute $6,000 in 2022, so that leaves you with $1,200. Return to your 401(k) and invest the remaining $1,200. Remember, if you're older than 50 and behind on your retirement savings, you can make catch-up contributions to max out your Roth IRA at $7,000 and your 401(k) at $27,000 in 2022. Complete Funding 401ks and Roth IRAs Worksheet.jpg - NAME ... View Complete Funding 401ks and Roth IRAs Worksheet.jpg from AA 1NAME: DATE: Funding 401(k)s and Roth IRAs Directions Complete the investment chart based on the facts given for each situation. Assume

Funding a 3-Year-Old's Roth IRA - Marotta On Money 2. Open a Custodial Roth IRA. Once your child has earned the income, then your child is eligible for an amount of Roth IRA funding. The first step is to open the Roth IRA. I opened my daughter's Custodial Roth IRA at Charles Schwab, because that is where my other finances are held. PDF Mr. Powell's Classes - Home It provides financial services to banks. term investing for Baby Step 1 is Baby Step 2 is Baby Step 3 is emergency fund. in the bank. months of expenses in an Baby Step 4 is investing 15% of your household income into Roth IRAs and pre-tax retirement plans. Invest % of your household income into Roth IRAs and pre-tax retirement plans. PDF Roth 401(k) Contributions Questions and answers to help ... The new Roth 401(k) feature in your plan allows you to invest after-tax dollars (allowing them to grow on a tax- deferred basis) and take qualifying distributions tax-free. The following questions and answers will help you decide if Roth 401(k) contributions are right for you. Copy of Funding 401(k)'s and Roth IRA's - WORKSHEET ... View Copy of Funding 401(k)'s and Roth IRA's - WORKSHEET from MATH 12345 at New Life Academy, Woodbury. Investment Joe Melissa Tyler & Megan Adrian David & Britney Brandon Chelsea Annual

Roth IRA Contribution Rules: The 2022 Guide Only earned income can be contributed to a Roth IRA. 2. Most people can contribute up to $6,000 to a Roth IRA in 2021 and 2022. If you are more than 50 years old, the limit is $7,000. 3. There are ...

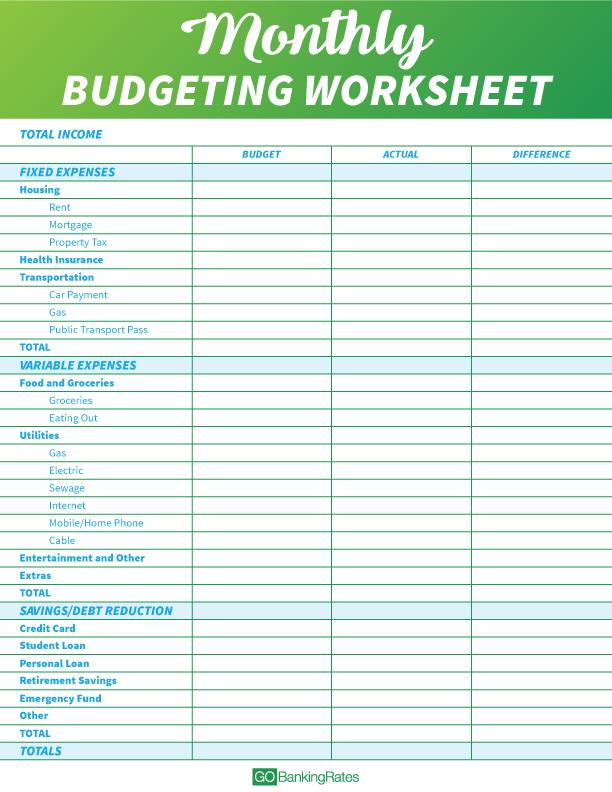

PDF Funding 401ks and roth iras worksheet answers Free Printables Funding 401 K S and Roth Iras Worksheet Worksheet We have found some images about financing 401 K S and Roth Iras Worksheet replies: Here it is. 1. Calculate the target value to invest (15%) 2. Fun of our 401 (k) to start 3.

401(k) and roth ira Flashcards | Quizlet 1. calculate target amount to invest (15%) 2. fund our 401(k) up to the match 3. Above the match, fund roth ira 4. complete 15% of income by going back to 401(k)

Funding 401ks and Roth Iras Worksheet - Semesprit Let's start with the most common forms of funding. 401ks and Roth IRAs have similar requirements, but there are a few key differences. Roth IRA contributions are tax deductible. You are allowed a certain amount of Roth IRA money at retirement, but withdrawals are taxed.

Roth IRAs and 401(k)s: Answers to Readers' Questions - WSJ Roth IRAs and 401(k)s: Answers to Readers' Questions By Laura Saunders. Updated Jan. 7, 2015 8:42 am ET A recent Weekend Investor cover story asked, "Is a Roth Account ...

Quiz & Worksheet - Roth IRA Rules & Benefits | Study.com In order to pass the quiz, you will need to know characteristics of Roth IRAs and different publication numbers that should be reviewed prior to funding a Roth IRA. Quiz & Worksheet Goals Use this ...

Instructions for Form 8606 (2021) | Internal Revenue Service If you took a Roth IRA distribution (other than an amount rolled over or recharacterized or a returned contribution) before 2021 in excess of your basis in regular Roth IRA contributions, see the Basis in Roth IRA Conversions and Rollovers From Qualified Retirement Plans to Roth IRAs chart to figure the amount to enter on line 24.

Funding 401ks And Roth Iras Worksheet Answers - Nidecmege Funding 401ks and iras worksheet and best 25 retirement savings amp. We think it bring interesting things for funding 401 k s and roth iras worksheet answers along with assignment create a roth ira assignment create a. Excel 2007 along with the newest 2010 improve break the previous hurdles about the range of columns and rows available.

Funding 401 K S and Roth IRAs Worksheet Answers Funding 401 K S and Roth Iras Worksheet Answers and 218 Best 401k Images On Pinterest Your contributions could be tax-deductible, lowering your present tax invoice. Non-deductible IRA contributions are. The most important advantage of the 401 (k) plan is the sum of money you may add to the plan.

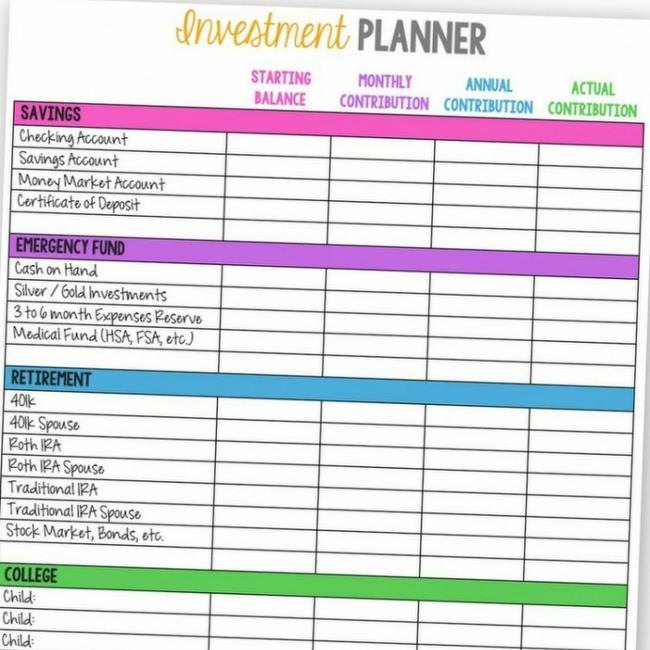

Solved Activity: Funding 401(k)s and Roth IRAs Objective ... Activity: Funding 401 (k)s and Roth IRAs. Objective: The purpose of this activity is to learn to calculate 15% of an income to save for retirement and to understand how to fund retirement investments. Directions: Complete the investment chart based on the facts given for each situation. Assume each person is following Dave's advice of ...

Who Can Open a Roth IRA? Roth IRA Contribution Limits . When you're ready to make a contribution to a Roth IRA, you will find you can only contribute so much. The Internal Revenue Service (IRS) sets rules each year to limit how much you can invest in all of your IRAs—not just your Roth IRA. For example, in 2022, you can only contribute up to $6,000 into IRAs if you're 49 years old or younger.

Funding 401ks And Roth Iras Worksheet - Studying Worksheets Feb 06, 2022 · Funding 401KS And Roth Iras Worksheet Quizlet Overview Funding 401KS And Roth Iras Worksheet Quizlet A gold IRA or protected metals IRA is a Self-Directed IRA where the owner maintains ownership of the accounts receivable and the value of the accounts balance. View Complete Funding 401ks and Roth IRAs Worksheetjpg from AA 1NAME.

Funding a 401 K and Roth - financial lit Flashcards | Quizlet 401 (K) defined contribution plan offered by a corporation to its employees, which allows employees to set aside tax-deferred income for retirement purposes; in some cases, employers will match their contributions. 403b. same as 401k but is used for nonprofit organizations such as schools, hospitals, and churches.

/roth_ira_-5bfc325dc9e77c0051810a80.jpg)

![How To Do A Backdoor Roth IRA [Step-by-Step Guide] | White ...](https://www.whitecoatinvestor.com/wp-content/uploads/2018/09/Backdoor-Roth-IRA-part-2-3.png)

/GettyImages-137513511-572b9ffb5f9b58c34c6a8244.jpg)

![Asset Allocation Spreadsheet [Excel Template] | White Coat ...](https://www.whitecoatinvestor.com/wp-content/uploads/2020/12/Screen-Shot-2020-12-03-at-8.18.51-AM.png)

![How To Do A Backdoor Roth IRA [Step-by-Step Guide] | White ...](https://www.whitecoatinvestor.com/wp-content/uploads/2018/09/Late-Backdoor-Roth-IRA-Contributions-2020.png)

:max_bytes(150000):strip_icc()/building-complete-financial-portfolio-357968-color-FINAL2-86933638b6844aa296049011de61d7fb.png)

0 Response to "40 funding 401ks and roth iras worksheet"

Post a Comment