39 rental income calculation worksheet

Income Calculations - Freddie Mac Form 91 is to be used to document the Seller's calculation of the income for a self-employed Borrower. This form is a tool to help the Seller calculate the income for a self-employed Borrower; the Seller's calculations ... 1Refer to Form 92 for net rental income calculations using IRS Schedule E 7. Schedule F - Profit or Loss from Farming ... Cash Flow Analysis (Form 1084) - Fannie Mae Schedule E – Supplemental Income and . Loss. Note: Use Fannie Mae Rental Income Worksheets (Form 1037 or Form 1038) to evaluate individual rental income (loss) reported on Schedule E. Refer to . Selling Guide, B3-3.1-08, Rental Income, for additional details. Partnerships and S corporation income (loss) reported on Schedule E is addressed below.

PDF Rental Income Schedule E Calculation Worksheet 2018 2019. 2015 federal income tax forms form 1040. child support guidelines worksheet case no. alabama form 40 instructions esmart tax. rental income schedule e calculation worksheet. child support guidelines judiciary of virginia. general income tax and benefit guide federal tax and. rental income canada ca. irs forms instructions and ...

Rental income calculation worksheet

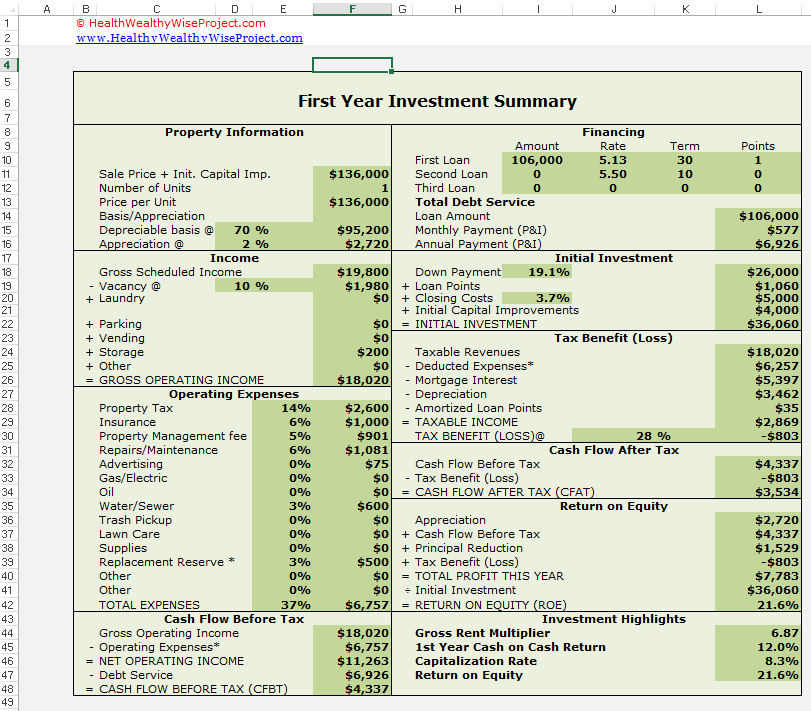

Cash Flow Analysis Worksheet for Rental Property Aug 18, 2021 · This spreadsheet is for people who are thinking about purchasing rental property for the purpose of cash flow and leverage. It is a fairly basic worksheet for doing a rental property valuation, including calculation of net operating income, capitalization rate, cash flow, and cash on cash return. Income Analysis Worksheet | Essent Guaranty Our income analysis tools are designed to help you evaluate qualifying income quickly and easily. Use our PDF worksheets to total numbers by hand or let our Excel calculators do the work for you. Rental Property - Investment (Schedule E) Determine the average monthly income/loss for a non-owner occupied investment property. Download Worksheet (PDF) Form 92 - Freddie Mac 1 Refer to Section 5306.1(c)(i) for net rental Income calculation requirements 2 Refer to Chapter 5304 and Form 91 for the treatment of all rental real estate income or loss reported on IRS Form 8825, regardless of Borrower's percentage of ownership interest in the business or whether the Borrower is

Rental income calculation worksheet. PDF Rental Income Calculator - Genworth Financial Rental Income Calculation 2019 2018 NOTES 1 Gross Rents (Line 3) *Check applicable guidelines if not using 12 months. **Net rental losses are typically included with liabilities when calculating 5 the debt ratio. 2 Expenses (Line 20) - 3 Depreciation (Line 18) + 4 Amortization/Casualty Loss/Nonrecurring Expenses (Line 19) + Insurance (Line 9) Fannie Mae Income Calculation Worksheet - Fill Online, … Rental Income Worksheet Individual Rental Income from Investment Property s Monthly Qualifying Rental Income or Loss Investment Investment Property Documentation Required Property Address Address Schedule E IRS Form 1040 OR Enter Lease Agreement or Fannie Mae Form 1007 or Form 1025 Step 1. PDF Income & Resident Rent Calculation Worksheet - HUD Exchange 6) Net income from operation of a business or profession. $0 . 7) Interest, dividends, and other net income of any kind from real or personal property. Where net family assets are in excess of $5,000, annual income shall include the . greater of actual income derived from net family assets or a percentage of the value Form 91 Income Calculator - Genworth Financial Form 8829 or the Simplified Method Worksheet) + Business Miles (Page 2, Part IV, Line 44a or Related 4562, ... Refer to Form 92 for net rental income calculations using IRS : Total expenses (Line 20) – Schedule E: Depletion ... Seller’s Calculation of Stable Monthly Income 2019: 2018 NOTES: Sum of combined subtotals $ $

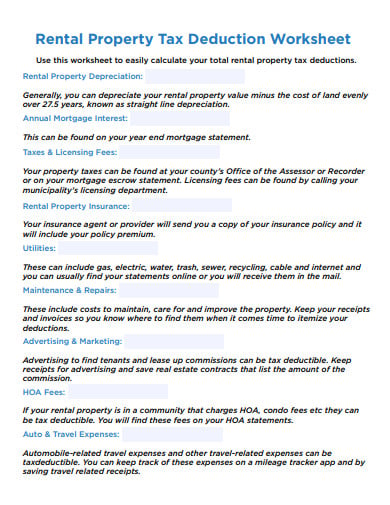

B3-3.1-08, Rental Income (05/04/2022) - Fannie Mae Fannie Mae publishes four worksheets that lenders may use to calculate rental income. Use of these worksheets is optional. The worksheets are: Rental Income Worksheet - Principal Residence, 2- to 4-unit Property ( Form 1037 ), Rental Income Worksheet - Individual Rental Income from Investment Property (s) (up to 4 properties) ( Form 1038 ), PDF Rental Income Schedule E Calculation Worksheet rental income schedule e calculation worksheet each filing individual entity must include copies of all. child support guidelines worksheet case no. general income tax and benefit guide federal tax and. 2017 income tax return form for trusts and ct 1041 estates. b3 3 1 08 rental income 02 28 2017 fannie mae. Rental Income and Expense Worksheet - PropertyManagement.com 1 Income and expenses are an essential part of effectively managing your rental. 2 Personalize your expenses with this worksheet. 3 Totals are automatically calculated as you enter data. 4 This sheet will also track late fees and any maintenance costs. Work out your rental income when you let property - GOV.UK Your profit is the amount left once you've added together your rental income and taken away the expenses or allowances you can claim. If you rent out more than one property, the profits and losses...

Fannie Mae Income Calculation Worksheet - Fill Online ... Rental Income Worksheet Individual Rental Income from Investment Property s Monthly Qualifying Rental Income or Loss Investment Investment Property Documentation Required Property Address Address Schedule E IRS Form 1040 OR Enter Lease Agreement or Fannie Mae Form 1007 or Form 1025 Step 1. HOPWA Income Resident Rent Calculation - HUD Exchange With the exception of persons in short-term supported housing, persons receiving rental assistance under the HOPWA program must pay rent. According to the HOPWA regulations, tenants must pay the higher of: (1) 30 percent of the family's monthly adjusted income; (2) 10 percent of the family's monthly gross income; or (3) The portion of any ... PDF Fha Reo Net Rental Income Calculation Worksheet Job Aid FHA REO NET RENTAL INCOME CALCULATION WORKSHEET JOB AID WHOLESALE LENDING Sheet 2 - Subject Property The second worksheet is specific to rental income calculated from the subject property. This is limited to 2-4 unit property and can be either a Purchase or Refinance of the subject. PDF INCOME CALCULATION WORKSHEET - LoanSafe.org INCOME CALCULATION CHECKLIST Page 4 Definition: Derived from the Schedule of Real Estate Owned on page 3 of the application. Must be supported by a current lease on the property or copies of the past two year's tax returns. You can also refer to PMI's Income Analysis Worksheet when calculating rental income from the tax return: Subtotal Total

How to calculate rental property | free rental property calculator estimates irr, capitalization

PDF Net Rental Income Calculations - Schedule E - Freddie Mac Refer to Section 5306.1(c)(iii) for net rental Income calculation requirements . 2 . Refer to Chapter 5304 and Form 91 for the treatment of all rental real estate income or loss reported on IRS Form 8825, regardless of Borrower's percentage of ownership interest in the buisiness or whether the Borrower is personally obligated on

Fuel tax credits calculation worksheet | Australian Taxation Office Example of a completed fuel tax credits calculation worksheet – BAS period 01/04/2021 to 30/06/2021; Eligible fuel type. Fuel acquired for eligible business use (litres or kilograms) (Step 1) Business fuel use. Date fuel acquired. Fuel tax credit rate when you acquired the fuel (cents per litre / kilogram) Use the rates (Step 2) Fuel tax ...

Self-employed borrower and income analysis worksheets - MGIC Updated for the 2021 tax year, our editable and auto-calculating cash flow analysis worksheets are fitted specifically for loan officers and mortgage pros. MGIC's self-employed borrower worksheets are uniquely suited for analyzing: Cash flow and YTD profit and loss (P&L) Comparative income Liquidity ratios Rental income Get the worksheets

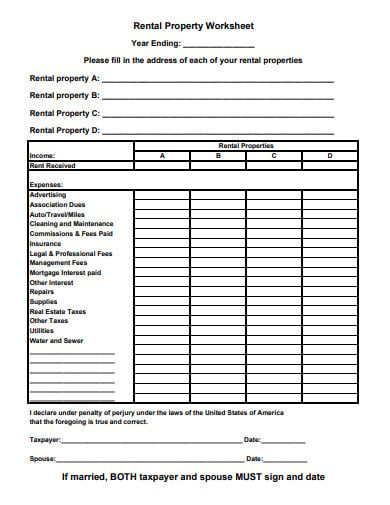

18+ Rental Property Worksheet Templates in PDF The expenditure is made on your property like paying off the electricity, Gas, Heat, a bill needs to be mentioned by you in the template of the Sample Rental Property Worksheet. This is a type of property inventory where you can write the income and expense both in a systematic manner. 9. Rental Property Calculation Worksheet Template

0 Response to "39 rental income calculation worksheet"

Post a Comment