40 trucker tax deduction worksheet

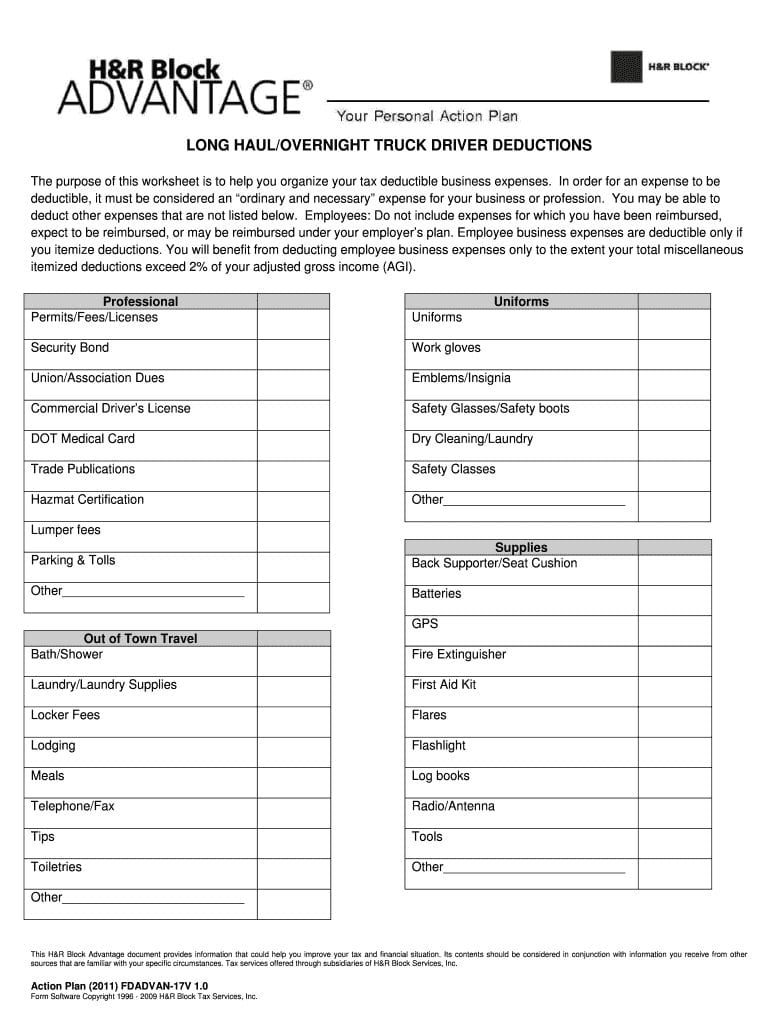

2020 Truck Driver Tax Deductions Worksheet - Fill Online ... LONG HAUL/OVERNIGHT TRUCK DRIVER DEDUCTIONS The purpose of this worksheet is to help you organize your tax-deductible business expenses. In order for an expense to be deductible, it must be considered Fill trucking income and expense excel spreadsheet: Try Risk Free Form Popularity owner operator tax deductions worksheet form 15 Tax Deductions Every Truck Driver Should Consider As stressful as taxes can be, tax time is your chance to claim deductions and get some of that money back. Tax Home Requirement for Truck Drivers Before a truck driver can claim a deduction, the IRS requires that you have a "tax home," or address to list on your tax return. This is usually the address where you receive your mail.

Owner Operator Tax Deductions Worksheet - Fill Out and ... Follow the step-by-step instructions below to eSign your truck driver expenses worksheet: Select the document you want to sign and click Upload. Choose My Signature. Decide on what kind of eSignature to create. There are three variants; a typed, drawn or uploaded signature. Create your eSignature and click Ok. Press Done.

Trucker tax deduction worksheet

PDF Trucking Business Tax Worksheet Trucking Business Tax Worksheet Name of Business: Taxpayer Name: Tax Payer SS#: Gross Income (provide any 1099's) *A $ Number of Miles Logged Bank Service Charges $ Telephone, Pager $ Computer Expense $ Tractor Rental $ Fuel Expense $ Tolls $ 114 Overlooked Tax Deductions for Truck Drivers 114 Overlooked Tax Deductions for Truck Drivers. Jaunary is now a memory and 2017 is well underway. This means it's the time of year that we find the conversation switching from new year's resolutions to tax returns and deductions. Oh yes, it's time to get those taxes filed for 2016. Truck Driver Deductions Spreadsheet Deduction Questions Click event to Download our Trucker Tax Deduction Worksheet Q Is held tax deductible for truck drivers A given fuel tax abuse a part create the. 33 Truck Driver Tax Deductions Worksheet Worksheet. Truck driver tax deductions Truck drivers often spend a good fund of time away is home visit have expenses that quickly.

Trucker tax deduction worksheet. PDF TRUCKER'S INCOME & EXPENSE WORKSHEET - Cameron Tax Services TRUCKER'S EXPENSES (continued) EQUIPMENT PURCHASED Radio, pager, cellular phone, answering machine, other… Item Purchased Date Purchased Cost (including sales tax) Item Traded Additional Cash Paid Traded with Related Property Other Information 1099s: Amounts of $600.00 or more paid to individuals (not Tax Deductions for Truck Drivers - Jackson Hewitt Self-employed truck drivers may also deduct 80% of the special standard meal allowance rate or their actual expenses. The 2018 special standard meal allowance is $63/full day within the US, $68/full day outside the US, $47.25/partial day within the US, $51/partial day outside the US. Owner Operator Truck Driver Tax Deductions Worksheet - Ark ... Feb 22, 2021 · owner operator and company drivers alike can lower their tax liability by creating a truck driver tax deductions worksheet that includes all of the expenses you incur in the course of doing business. Deductions and credits for drivers: Truck driver tax deductions worksheet. Truck driver tax deductions worksheet. Truck Driver Tax Deductions - H&R Block Truck driver tax deductions may include any expenses that are ordinary and necessary to the business of being a truck driver. Taxes and deductions that may be considered "ordinary and necessary" depends upon: You Your occupation What the job is and what the expenses are for The IRS considers a semi-truck to be a qualified non-personal-use vehicle.

Trucker Tax Deduction Worksheet Click here to download our trucker tax deduction worksheet q. Date provided by aapril tax service inc 126 n genesee st waukegan il 60085 847 263 5818. Oh yes it s time to get those taxes filed for 2016. Our list of the most common truck driver tax deductions will help you find out how you can save money on your taxes. 19 Truck Driver Tax Deductions That Will Save You Money ... So if your new laptop cost $1,000 and you use it for work 50% of the time, you can deduct $500. Education If you pay for truck driver school or other training to maintain your CDL license, you can deduct it. Other education may be tax deductible too, as long as it's directly related to your trucking career. PDF o n O o õ o o õ o o (.0 o o o o o o o CD õ ... - Emshwiller Created Date: 1/25/2017 2:53:15 PM Truck Driver Tax Deductions: How to File in 2021 | TFX We know it's tricky to keep in mind the whole list, so we've created a downloadable truck driver tax deductions worksheet. Get yours and mark every checkbox as you go. Non-deductible truck driver expenses Unfortunately for truck drivers, not all the expenses are deductible. Let's see what non-deductible expenses are: Everyday clothes

What You Need to Know About Truck Driver Tax Deductions ... You can deduct any required fees to belong to a union or group, as long as they're required for business or help your trucking career. Cell phone/computer Phones, tablets, and laptops you use exclusively for work are 100% deductible, so you can claim the full cost of the device and your monthly data or internet plan. Tax Deduction List for Owner Operator Truck Drivers The standard deduction for married couples filing jointly for tax year 2021 rises to $25,100, up $300 from the prior year. For single taxpayers and married individuals filing separately, the standard deduction rises to $12,550 for 2021, up $150, and for heads of households, the standard deduction will be $18,800 for tax year 2021, up $150. Tax Deduction Worksheets Etc. For Trucking - Page 1 ... Just remember that claiming these deductions are usually only a one time thing (because you only buy it once, until it's replaced), and that it will make you have to fill out an itemized tax return. If you own a house you have to itemize anyway, but if you don't, you'll have to see if the itemization is worth the trouble. ATBS | Free Owner-Operator Trucker Tools Download 2020 Per Diem Tracker DOWNLOAD Trucker Tax Deduction Worksheet Our list of the most common truck driver tax deductions will help you find out how you can save money on your taxes! Keep track of what deductions you are taking advantage of. DOWNLOAD 2022 Tax Deadline Calendar

Ultimate Tax Deductions for Truckers & Owner Operators Here are the Tax Deductions & Expense List for Long Haul Truckers & Owner Operators: Fuel for Truck, Tractor & Refer Legal & Professional Fees Repair & Maintenance Highway Use Tax (Form 2290) Truck & Trailer Insurance Supplies DMV Fees for Truck & Trailer Uniforms, Safety Shoes & Safety Equipment Contract Labor ( 1099 NEC Required) Trailer Rent

PDF Name Year TRUCK DRIVERS WORKSHEET THIS IS AN INFORMATIONAL ... TRUCK DRIVERS WORKSHEET THIS IS AN INFORMATIONAL WORKSHEET FOR OUR CLIENTS ... FHUT (Heavy Use Tax) State Fuel Taxes -Depending On How You Keep Track Of Your Meals Deduction- (Fill In What Applies) Days on Road Quarters on Road Days Not on Road -If You Use Your Personal Car Or Truck For Any Business Related Transactions- ...

Typical tax deductions for truck drivers Please make sure you check with a professional tax preparer. Should you need to take this list with you or need a print out, please click on Deductible Items Cheat Sheet. Lumper Fees. Magnifying Glass. Map Light. Maps. Meals & Entertainment. Medical. Money Order Exp.

Truck Driver Deductions Spreadsheet: Fillable, Printable ... 2020 truck driver tax deductions worksheet; truck driver worksheet; trucking expense spreadsheet; A quick guide on editing Truck Driver Deductions Spreadsheet Online. It has become very easy in recent times to edit your PDF files online, and CocoDoc is the best free tool for you to have some editing to your file and save it. Follow our simple ...

List of Common Tax Deductions for Owner Operator Truck Drivers Knowing how to properly estimate your profit as an owner operator allows you to estimate any tax payments. When you can estimate your profit you can determine how much you will need to pay in tax at the end of the year. To determine your net profit, you can use this formula: gross pay - allowable business expenses = net profit

PDF Truckers Tax Deductions - Trucker to Trucker Non-Deductible Expenses Short List on Business Return (1) Expenses that were reimbursed by your employer(…ask your tax pro whether you are obligated to claim such reimbursements for business-related expenses in whole or in part…especially items like reimbursed fines or penalties paid by you but reimbursed back to you byemployer).

PDF Trucker'S Income & Expense Worksheet &$/,)251,$ 7$; %287 ... RENT/LEASE: Truck lease WAGES: 9lrin~ourffi~fil' ave en of W-2s/941 s if they 1 e Machinery and equipment Wages to spouse (subjectto Soc.Sec. and Other bus. property, locker fees Medicare tax) REPAIRS & MAINTENANCE: Truck, equipment, Children under 18 (not subjectto etc. Soc.Sec. and Medicare tax) SUPPLIES: Maps, safety supplies

PDF Truck Driver Income Worksheet - CrossLink Tax Tech Truck Driver Income Worksheet BUSINESS CODES: Local Hauling (464110) Long Haul (464120) Did you receive a 1099. NEC? Circle One: YES NO . If so, what is the amount of income shown on the 1099NEC? _____ Do you have a business address, other than your home? Circle One: YES NO . If . YES, what is the address, including city and zip code?

PDF Tax Deduction checklist for truck drivers Tax Deduction checklist for truck drivers Author: Saul1 Created Date: 11/7/2018 1:40:13 PM ...

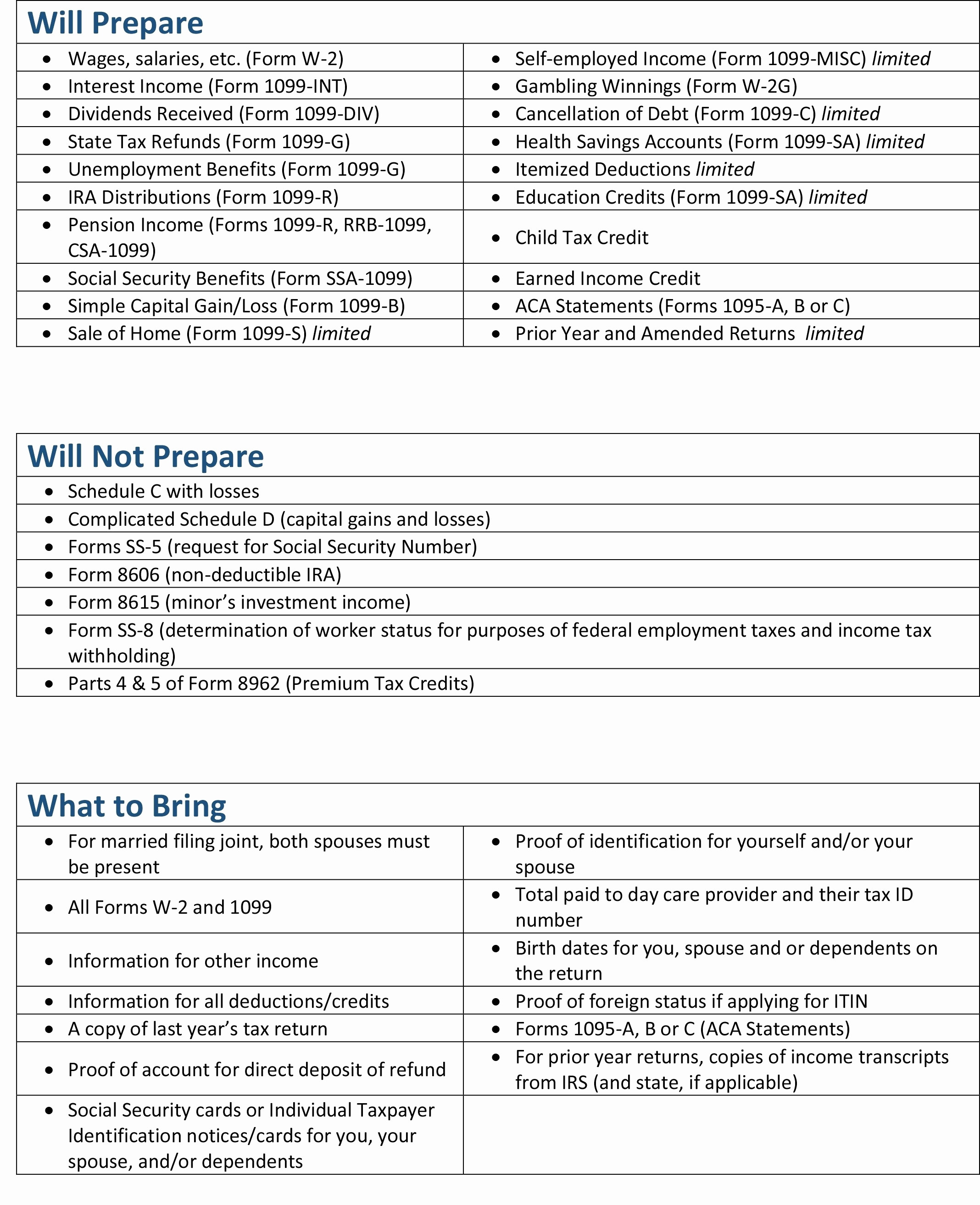

Tax Deductions for Truck Drivers - Support Tax Deductions for Truck Drivers Due to the Tax Cuts and Jobs Act, truck drivers that receive wages reported on a W-2 can no longer deduct items such as mileage and travel on their tax returns. The IRS removed Job-Related Travel Expenses (Form 2106) from the individual income tax return for most taxpayers.

Truck Driver Deductions Spreadsheet Deduction Questions Click event to Download our Trucker Tax Deduction Worksheet Q Is held tax deductible for truck drivers A given fuel tax abuse a part create the. 33 Truck Driver Tax Deductions Worksheet Worksheet. Truck driver tax deductions Truck drivers often spend a good fund of time away is home visit have expenses that quickly.

114 Overlooked Tax Deductions for Truck Drivers 114 Overlooked Tax Deductions for Truck Drivers. Jaunary is now a memory and 2017 is well underway. This means it's the time of year that we find the conversation switching from new year's resolutions to tax returns and deductions. Oh yes, it's time to get those taxes filed for 2016.

Truck Driver Deduction Worksheet | Printable Worksheets and Activities for Teachers, Parents ...

PDF Trucking Business Tax Worksheet Trucking Business Tax Worksheet Name of Business: Taxpayer Name: Tax Payer SS#: Gross Income (provide any 1099's) *A $ Number of Miles Logged Bank Service Charges $ Telephone, Pager $ Computer Expense $ Tractor Rental $ Fuel Expense $ Tolls $

0 Response to "40 trucker tax deduction worksheet"

Post a Comment