43 interest rate reduction refinance loan worksheet

4 Reasons Your Student Loans May Not Get Canceled Second, Biden could limit student loan cancellation to college student loans only. Graduate school student loans comprise nearly half of the $1.7 trillion of student loan debt outstanding. INTEREST RATE REDUCTION REFINANCING LOAN WORKSHEET VA LOAN NUMBER NOTE - Submit this form when requesting guaranty on an Interest Rate Reduction Refinancing Loan. 18. EXISTING VA LOAN BALANCE (PLUS COST OF ENERGY EFFICIENT IMPROVEMENTS) 2. 3. SUBTOTAL ADD % DISCOUNT BASED ON LINE 4 LINE NO. ITEM AMOUNT 1. SUBTRACT ANY CASH PAYMENT FROM VETERAN 4. 8. SECTION III - FINAL COMPUTATION

Interest Rate Reduction Refinance Loan - MilitaryBenefits.info This option is known as the VA Interest Rate Reduction Refinance Loan, or VA IRRRL for short. It's also known as a VA Streamline Refinance mortgage and has helped many borrowers pay less on their home loans. Veterans Can Buy a Home with $0 Down {Sponsored}The VA Home Loan offers $0 Down with no PMI.

Interest rate reduction refinance loan worksheet

Interest Rate Reduction Refinance Loan | Veterans Affairs Jan 12, 2022 · Interest rate reduction refinance loan If you have an existing VA-backed home loan and you want to reduce your monthly mortgage payments—or make your payments more stable—an interest rate reduction refinance loan (IRRRL) may be right for you. Refinancing lets you replace your current loan with a new one under different terms. PDF Interest Rate Reduction Refinancing Loan Worksheet section ii - preliminary loan amount $ add other allowable closing costs and prepaids. 9. 10. + add % funding fee based on line 4. 11. total € note: * maximum loan amount may be rounded off, but must always be rounded down to avoid cash to the€ veteran. round-off amounts of less than $50 do not require recomputation. _ date. name of lender PDF Interest Rate Reduction Refinancing Loan Worksheet VA LOAN NUMBER. NOTE - Submit this form when requesting guaranty on an Interest Rate Reduction Refinancing Loan. 18. EXISTING VA LOAN BALANCE (PLUS COST OF ENERGY EFFICIENT IMPROVEMENTS) $ 2. 3. SUBTOTAL $ ADD % DISCOUNT BASED ON LINE 4. LINE NO. ITEM. AMOUNT 1. $ SUBTRACT ANY CASH PAYMENT FROM VETERAN. 4. 8. $ SECTION III - FINAL COMPUTATION =

Interest rate reduction refinance loan worksheet. PDF Interest Rate Reduction Refinance Loan Rate Reduction Refinance Loan (IRRRL) generally lowers the interest rate by refinancing an existing VA. home loan. By obtaining a lower interest rate, the monthly mortgage payment should decrease. Eligible borrowers can also refinance an adjustable-rate mort-gage (ARM) into a fixed-rate mortgage. No additional charge is made against the veteran ... Interest Rate Reduction Refinance Loan - VA Home Loans While this can save you money in interest over the life of the loan, you may see a very large increase in your monthly payment if the reduction in the interest rate is not at least one percent (two percent is better). Beware: It could be a bigger increase than you can afford. return to top Refinancing rate loan reduction interest ... What Is an Interest Rate Reduction Refinancing Loan - The Interest Rate Reduction refinancing loan (irrrl) offers current veterans Affairs mortgage holders an excellent opportunity to take advantage of low-interest rates. To be eligible, the IRRRL must be used to refinance a property that already has an eligible VA loan, but before you call your lender, there are a few things you need to know. About VA Form 26-8923 - Veterans Affairs About VA Form 26-8923. Form name: Interest Rate Reduction Refinancing Loan Worksheet. Related to: Housing assistance. Form last updated: January 4, 2022.

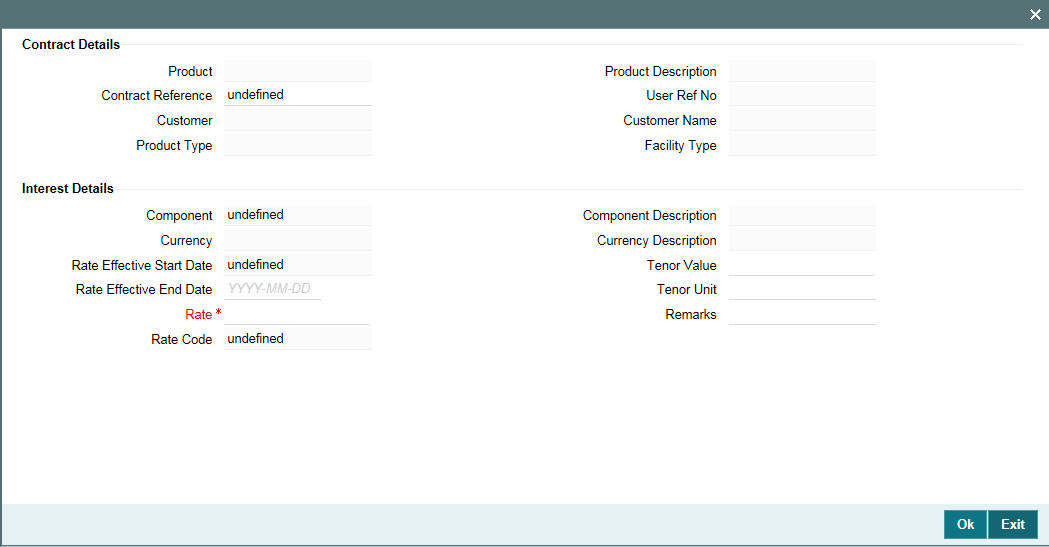

VA IRRRL Worksheet - What is it and How Do I Use It? In order to get VA approval and a VA guarantee for your Interest Rate Reduction Refinance Loan, your lender must fill out and accurately complete a VA IRRRL worksheet. The worksheet is quite simple and shouldn't take more than a few minutes for an experienced VA expert, like those at Low VA Rates, to fill out. Determining the Max Loan Amount Using the VA IRRRL Worksheet Joe will owe $500 in a funding fee and the closing costs equal $900. The total equals $105,400. From this amount, you must figure the actual discount point and funding fee. Taking the $105,400, multiply it by 1% for discount point. This equals $1,054. The funding fee is $105,400 x 0.5%, which equals $527. This total equals $106,981. Agency Information Collection Activity: Interest Rate ... Title: Interest Rate Reduction Refinancing Loan Worksheet (VA 26-8923). OMB Control Number: 2900-0386. Type of Review: Revision. Abstract: VA is revising this information collection to incorporate regulatory collection requirements previously captured under OMB control number 2900-0601. The purpose is to consolidate information collection ... The Best Free Debt-Reduction Spreadsheets Squawkfox Debt-Reduction Spreadsheet . The author of the spreadsheet and the Squawkfox blog, Kerry Taylor, paid off $17,000 in student loans over six months using this downloadable Debt Reduction Spreadsheet.. Start by entering your creditors, current balance, interest rates, and monthly payments to see your current total debt, average interest rate, and average monthly interest paid.

Top 10 VA LOAN COMPARISON FORM Resources • Interest Rate Reduction Refinance Loan Worksheet. (VA Form (10) … Va irrrl comparison form - 5y1.org. VA IRRRL Cost Recoupment Worksheet This worksheet is REQUIRED for all VA Interest Rate Reduction Refinance loans. File Name: Loan Number: MONTHS TO RECOUP The (11) … Best VA Loan Rates of 2022 ; Best Overall · Veterans United. Top 10 VA MAX LOAN AMOUNT WORKSHEET 2021 Resources Worksheet To Figure Your. Qualified Loan Limit and. Deductible Home Mortgage. Interest For the Current Year . . . 12. How To Get Tax Help . (35) … VA Form 22-8923 is used by lenders for completing the funding fee and maximum permissible loan amounts for interest rate reduction refinancing loans to (36) … Excerpt Links (1). PDF Interest Rate Reduction Refinance Loan Worksheet regarding the completion of VA Form 26-8923, Interest Rate Reduction Refinancing Loan Worksheet, effective for all Interest Rate Reduction Refinance L oan (IRRRL) applications originated (initial Fannie Mae Form 1003 application date) on or after July 2, 2017. 2. Background. VA has received many inquiries from mortgage lenders on the proper ... Paying off a mortgage? Here's how the RBA interest rate ... Mortgage rates . But if the cash rate rises to 2% by May next year, as predicted by Westpac, RateCity said repayments for the average borrower with a $500,000 debt would rise by about $511.

PDF Deduction Interest Mortgage - IRS tax forms Home mortgage interest. You can deduct home mortgage interest on the first $750,000 ($375,000 if married filing separately) of indebt-edness. However, higher limitations ($1 million ($500,000 if married filing separately)) apply if you are deducting mortgage interest from in-debtedness incurred before December 16, 2017. Future developments.

PDF Refinances - USDA Rural Development • Mortgage must have closed 12 months prior to loan application • Mortgage must be paid as agreed for 12 months prior to loan application • Interest rate must be at or below current rate • $50 net tangible benefit must be achieved • Borrowers may be added, but not deleted 15 Guaranteed Loan Program Technical Handbook HB‐1‐3555

Interest Rate Reduction Refinancing Loan Tips - Military.com An Interest Rate Reduction Refinancing Loan (IRRRL) can be done only when the veteran already has his or her entitlement used for a VA loan on the property to be refinanced. In other words, it must...

Supporting Dtatement for Va Form 26-8923 2. Lenders are required to complete VA Form 26-8923, Interest Rate Reduction Refinancing Loan Worksheet, on all interest rate reduction refinancing loans and submit the form in the loan file when selected by VA for quality review.

Publication 936 (2021), Home Mortgage Interest Deduction ... In 2021, you took out a $100,000 home mortgage loan payable over 20 years. The terms of the loan are the same as for other 20-year loans offered in your area. You paid $4,800 in points. You made 3 monthly payments on the loan in 2021. You can deduct $60 [ ($4,800 ÷ 240 months) x 3 payments] in 2021.

Loan Comparison Worksheet | Chambersagency Lenders must include with every Interest Rate Reduction Refinance loan, a statement signed by the borrowers showing they understand the effects of the refinance. In most cases this statement must also show the effects of the refinance through a summary of. In comparison, the energy company's share price today is around CA$0.98.

0 Response to "43 interest rate reduction refinance loan worksheet"

Post a Comment