42 understanding a credit card statement worksheet answers

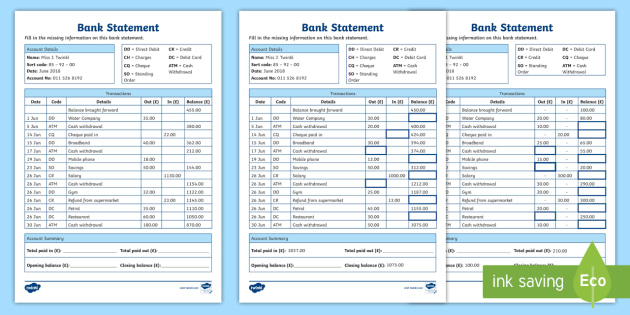

16 Free Banking Worksheets PDF (Teach Kids how to Use Banks) Very important banking life skill! 2. TD's How to Balance a Checkbook. Suggested Age: 6-8 grades. Use this TD lesson plan and worksheet to teach students how to balance a checkbook. They'll then be given a case study of someone's spending, and need to balance that person's checkbook with the provided worksheet. 3. Understanding a Credit Card Information Sheet 1.4.1 - Quia A credit card is pre‐approved credit which can be used for the purchase of goods and services now and payment of them later. In the case of credit cards, individuals may con nue to borrow as long as they do not exceed the credit limit, which is the maximum dollar amount that can be charged on the card. The

PDF Semester Course: Answer Key Document SC-5.3 Young People & Credit Cards - Sample Completed Student Activity Packet 5 THE FINE PRINT: Credit Card Statement Resource # SC-5.4 Select a Credit Card - Sample Completed Student Activity Packet 4 COMPARE: Select a Credit Card* *No Answer Key available - assignment is open-ended. B ack to Top Last updated: 3/27/20 9

Understanding a credit card statement worksheet answers

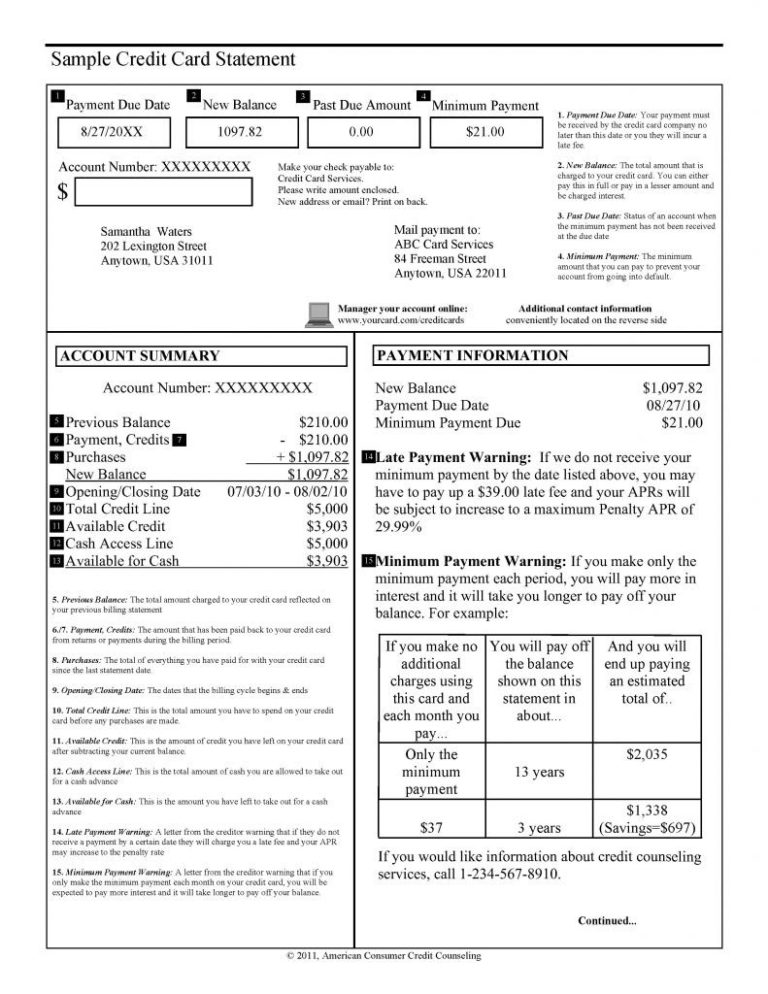

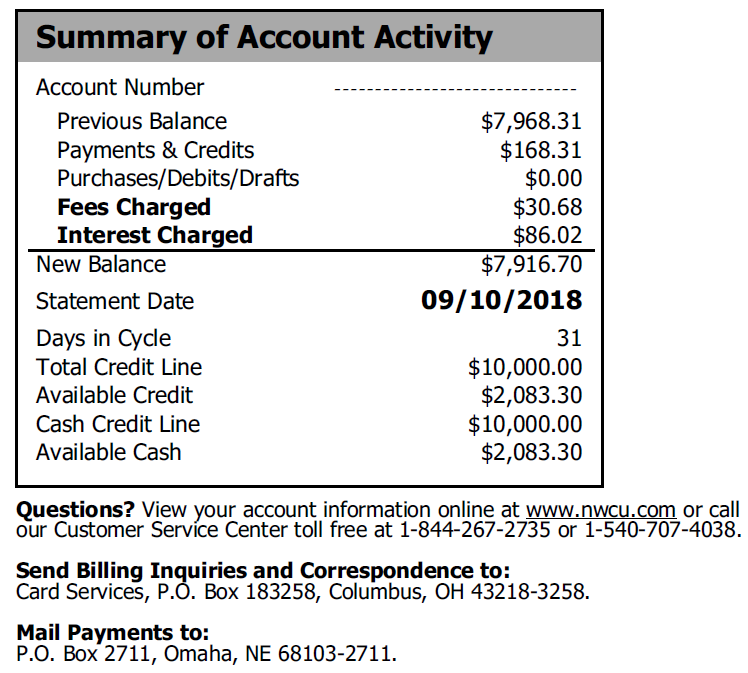

4.3.a Understanding a Credit Card Statement_Sierra Slade Sierra SladeFinancial Literacy Understanding a Credit Card Statement - 15 points Directions: Refer to the provided credit card statement to answer the following questions. Once you answer the questions submit a screenshot in the submit area. 1. What is the current APR for purchases, balance transfers, and cash advances? (3 points) 16.99% 16. 99 % PDF Understanding a Credit Card Statement - personal finance Directions: Refer to the credit card statement to answer the following questions. Section What type of information is in this section? Why is this section important to review/understand? Summary of Account Activity Payment Information Late Payment Warning Minimum Payment Warning Notice of Changes to Your Interest Rates How to Read a Credit Card Statement | Discover Nov 24, 2021 · Understanding Your Credit Card Statement Balance Your credit card statement balance reflects what you owe your card issuer as of the account closing date, which is when one billing cycle ends and your balance is reported to credit bureaus. Remember: a credit card statement balance is just a snapshot of one billing cycle.

Understanding a credit card statement worksheet answers. PDF Analyzing credit card statements - Consumer Financial Protection Bureau Analying credit card statements ˚˝ BUILDING BLOCKS STUDENT WORKSHEET. Analyzing credit card statements Winter 2020 Understanding what's on a credit card statement can help you to remain financially responsible while paying your bills on time, paying the appropriate amount, and using a credit card as a tool to manage your money. Instructions reading_a_credit_card_statement_wkst (1).pdf - 7.4.2.A2 Worksheet ... How will this affect future purchases? (2 points) 6. The cardholder pays the minimum payment of $53.00 this month and makes no new purchases during the next billing cycle. What will be the new credit card balance during the next billing cycle if the cardholder has a $10.27 interest charge for the month? (1 point) 7. PDF Student Activities - Practical Money Skills understanding credit student activity 7-4b cont. the credit card statement name: date: SEND PAYMENT TO Box 1234 Anytown, USA CREDIT CARD STATEMENT ACCOUNT NUMBER NAME STATEMENT DUE PAYMENT DUE DATE 4125-239-412 John Doe 2/13/19 3/09/19 PDF Understanding a Credit Card Statement - mybusinessed.com Understanding a Credit Card Statement Total Points Earned Name 15 Total Points Possible Date Percentage Class Directions: Refer to the provided credit card statement to answer the following questions. 1. What is the current APR for purchases, balance transfers, and cash advances?

PDF Consumer.gov Lesson Plan: Using Credit Show that they understand how credit cards work and that they carry different types of fees • Give a simple explanation of the difference between a loan and a credit card • List two or more ways that a credit card is like a secured credit card, and two ways that they differ • Talk about the differences between secured credit cards and ... PDF Understanding A Credit Card - wa-appliedmath.org CreditCreditCredit is when goods, services, or money is received in exchange for a promise to pay a definite sum of money at a future date. The lender "trusts" the borrower to repay the money. A lenderlenderlender is the person or organization who has the re sources to provide the individual with a loan. Credit Cards: Quiz & Worksheet for Kids | Study.com Worksheet 1. When you buy something using a credit card, which of the following usually happens? You will receive a monthly bill and statement. You will immediately receive a bill and statement.... PDF 2.6.3.F1 Understanding Credit Cards - Loudoun County Public Schools Credit Card vs. Debit Card: A debit card is a plas cardc (which looks like a credit card) that is electronically connected to the cardholder's depository ins tuon account. Charges to a credit card are paid back at a later me. Charges to a debit card are paid for immediately.

PDF Financial Literacy Credit Basics Worksheet Answer Key a credit card they can use at virtually any location. 2. Some people do it for the convenience of not carrying cash, while others ... Understanding Credit Cards 15. Most cards are similar in nature, although there might be some differences. 16. For instance, while most credit cards and debit cards have 16-digit account ... CEV80256_Worksheet ... Understanding Credit Flashcards | Quizlet A good credit history makes borrowing easier. Lois bought clothing at a store. She did not have enough in her bank account to pay for the purchase. After receiving the bill and paying off the balance, she realized that she paid $9.69 in interest. Which statement is true about her method of payment. PDF Understanding Credit Cards Note Guide - Weebly Understanding Credit Cards Note Taking Guide Total Points Earned Name Total Points Possible Date Percentage Class Identify four positive credit card behaviors: What are three ways a credit card is a convenient payment tool? A credit card is: The cost of credit is expressed as: Monthly Credit Card Statement Walkthrough - The Balance credit card issuers have a legal requirement to send your monthly credit card statement at least 21 days before your minimum payment due date. 1 billing statements usually consist of one or two pages containing a good deal of information about what you've charged, how much you paid last month, what payment you need to make, and the date by which …

PDF Analyzing credit card statements - Consumer Financial Protection Bureau This answer guide provides possible answers for the "Analyzing credit card statements" worksheet. Keep in mind that students' answers may vary for some of the questions, as there may not be only one right answer. The important thing is for students to have reasonable justification for their answer. Answer guide Section 1.

PDF Lesson Seven Understanding Credit - Practical Money Skills for their teenagers' credit cards. Divide students into teams. Guide teams in using the Internet and credit application forms to compare features of two credit cards: a major credit card and a department store credit card. Have students research answers to specific questions and enter the information onto a chart. (activity 7-4a)

PDF Take Charge of Credit Cards Answer Key 1.6.1.C1 (1) • Pay the amount charged to a credit card in full every month • Pay credit card payments on time • Keep track of all charges by keeping receipts • Check the monthly credit card statement for errors • Make late credit card payments • Pay only the minimum payment due • Go over the card's credit limit

PDF Understanding a Credit Card Statement - WordPress at LPS Directions: Refer to the provided credit card statement to answer the following questions. 1. What is the current APR for purchases, balance transfers, and cash advances? (3 points) 2. What was the total amount of interest charged for this billing cycle? How much of this interest was charged to purchases?

Understanding Credit Cards Flashcards | Quizlet The act of transferring debt from one credit card account to another. Credit Limit The maximum dollar amount that can be charged to a credit card. Interest The price of money. Introductory Rate The APR charged during the credit card"s introductory period after a credit card account is opened. Late-payment Fee

Credit and Credit Card Lesson Plans, Consumer Credit ... - Money Instructor CREDIT AND Credit Cards. This section includes lessons on consumer credit cards, credit, and paying interest. Learn about credit with an introduction to credit cards, reading a credit card statement, and advanced lessons regarding incorrect credit card transactions. Also, see our spending money category for more consumer related material.

How to Read a Credit Card Statement | 101 Guide - finder CA Key features on your credit card statement We've outlined the major features of your credit card statement below. We've numbered each feature to match the attached example statement to help you find these details on your own statements. 1. The statement period Your statement period is usually listed in the top left-hand corner of your statement.

0 Response to "42 understanding a credit card statement worksheet answers"

Post a Comment