40 foreign earned income tax worksheet

Federal Income Tax Calculator - Go Curry Cracker! Tax on Foreign Earned Income: Calculated tax burden on the excluded income. Total Tax with FEIE: ... Tax is $0, calculated via the Qualified Dividends and Capital Gain Tax Worksheet. The marginal rate is 0%. Total tax = $0. With AGI < $109,250 for MFJ, we can take steps to minimize future taxes. Reply. Go Curry Cracker on April 5, 2022 at 9:27 am . 23+ Credit Limit Worksheet - New Worksheet Idea The foreign tax credit cannot be more than the foreign tax credit limit. ... Earned income credit worksheet & You can also contribute an extra $1,000 if you are 50 or older. credit limit increase worksheet instructions. The maximum credit is $1000 ($2000 for mfj). You must choose either the foreign tax credit or itemized deduction for all ...

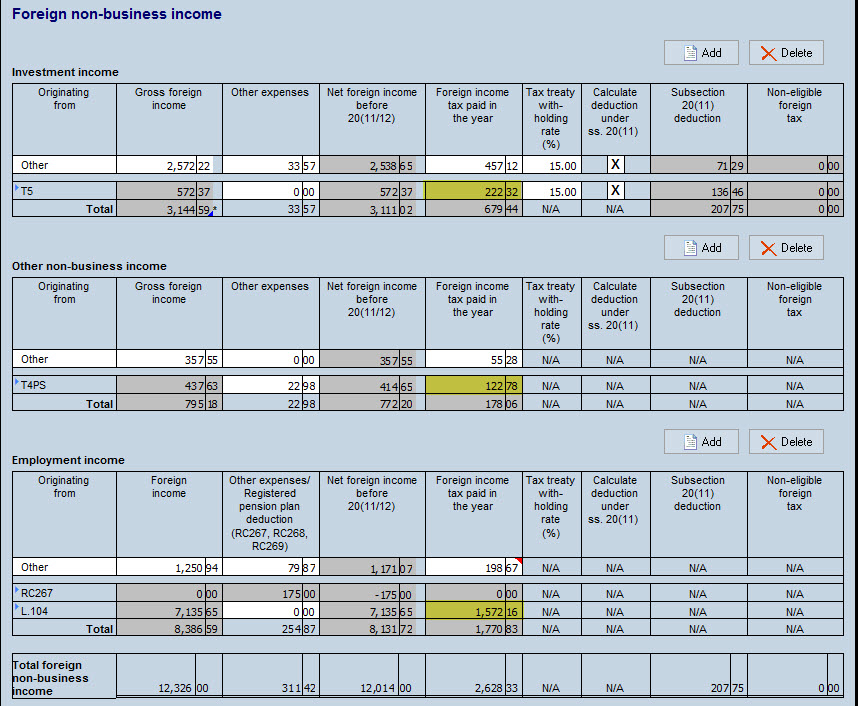

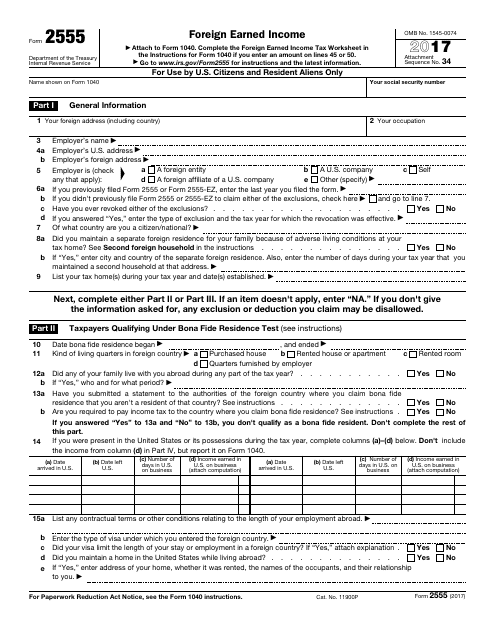

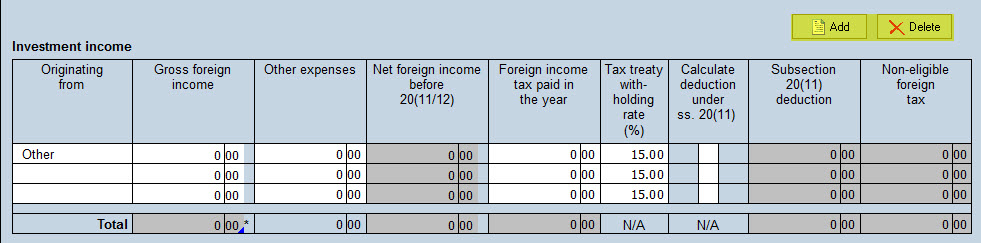

› support › 948Foreign Earned Income Tax Worksheet - TaxAct While the Foreign Earned Income Tax Worksheet is linked to Federal Form 1040, it is only used if there is foreign earned income in the return (if the return is reporting an amount on Form 2555, Line 45 for the Foreign Earned Income Exclusion).

Foreign earned income tax worksheet

Earned Income Credit, EIC Table - National Tax Reports The Earned Income Tax Credit Worksheet can be used to calculate your eligibility and how much credit you qualify for. The worksheet can be found in the instruction booklet for IRS Form 1040. There is also an Earned Income Credit Calculatorto help you figure out your Earned Income Credit amount. Fraudulent Claims What Is Tax Form 6251? - The Balance The AMT rate is 26% on income over the exemption up to $199,900—or just $99,950 if you're married and filing a separate return. 2 The rate can increase to 28% above these thresholds. But there are "phaseout" thresholds as well. These exemptions begin to decrease and eventually disappear at incomes of: 2 › individuals › international-taxpayersFiguring the Foreign Earned Income Exclusion - IRS tax forms In 2021, you received $20,000 for work you did in the foreign country in 2020. You can exclude $7,600 of the $20,000 from your income in 2021. This is the $107,600 maximum foreign earned income exclusion for 2020 minus the $100,000 you already excluded for that year. You must include the remaining $12,400 in income for 2021 ($20,000 - $7,600 ...

Foreign earned income tax worksheet. › support › 948Foreign Earned Income Tax Worksheet - TaxAct Desktop: Start your TaxAct Desktop program. Click the Forms button in the top left corner. Expand the Federal folder, then expand the Worksheets folder. Scroll down and select Form 1040 Foreign Earned Income Tax - Foreign Earned Income Tax Worksheet. Double click the copy you wish to print. Click the Printer icon in the blue toolbar. › support › 948Foreign Earned Income Tax Worksheet - TaxAct The Foreign Earned Income Tax Worksheet figures the applicable tax rate by combining the amounts (line 3) and subtracting from that tax calculation (line 4) the tax that would have been due on the foreign earned income (line 5). This does not apply tax directly on the FEI, but the exclusion does bump the tax rate up. Filing Taxes While Overseas - TurboTax Tax Tips & Videos The remainder—$71,300—is subject to U.S. and U.K. tax. Your income tax rate in the United Kingdom could be 20 percent and your American rate 30 percent. You pay the British tax, and subtract that rate from the American tax, so you pay just 10 percent of the $71,300 in American taxes. Foreign currency gain US Taxes Abroad for Dummies (update for tax year 2021) The US tax on this income is calculated as follows: US tax on $113,000 is $6,835 US tax on $108,700 (amount excluded) would be $5,889 Net US tax payable ($6,835 - $5,889) = $946 While this is only an approximate calculation, it gives you an idea of how the system works.

Expat Tax Services, Preparation, & Consultation - WCG CPAs Expat Worksheet Foreign Earned Income Exclusion There are several small hoops and gotchas that you need to be careful with when considered expat taxes, but the big requirements are- Your tax home must be in a foreign country. ( tax home definition) You must have foreign earned income. ( earned income definition) › foreign-earned-income-exclusionForeign Earned Income Exclusion | Internal Revenue Service Dec 08, 2021 · Figuring the tax: If you qualify for and claim the foreign earned income exclusion, the foreign housing exclusion, or both, must figure the tax on your remaining non-excluded income using the tax rates that would have applied had you not claimed the exclusion(s). Use the Foreign Earned Income Tax Worksheet in the Form 1040 Instructions. Correction to Line 9 in the 2021 Instructions for Form 8615 - IRS tax forms Under the section "Using the Qualified Dividends and Capital Gain Tax Worksheet for line 9 tax," steps 5, 7, and 8 should read as shown below. 5. If the Foreign Earned Income Tax Worksheet was used to figure the parent's tax, go to step 6 below. Otherwise, skip steps 6, 7, and 8 of these instructions below, and go to step 9. 7. Entering foreign income for Individuals in ProSeries - Intuit Follow these steps to enter foreign income reported on a other statement, such as a form or letter: Open the tax return. Press the F6 key to open the Open Forms window. Type WAG to highlight the Wages, etc, Wks. Select the OK button to open the Wages, Salaries & Tips Worksheet. Enter any foreign wages on line 8b for the taxpayer or spouse.

Learn about the income tax paid to another jurisdiction credit The Dominion of Canada or any of its provinces (You must first reduce the taxes you paid by the amount allowed as a federal Foreign Tax Credit on U.S. Form 1116, claimed or not.) New Hampshire Business Profits Tax (considered an income tax) District of Columbia Unincorporated Business Franchise Tax (UBT) This credit is not allowed for: Re: TT not calculating FTC correctly - simple calc... - Intuit It's not that simple. I don't know what you mean by "the IRS' pdf form." Did you use the Foreign Earned Income Tax Worksheet on page 35 of the IRS Instructions for Form 1040, and the other worksheets that it directs you to? Be sure to read all the instructions, and follow them to the letter. Don't a... 5000-D1 Federal Worksheet (for all except non-residents) 5000-D1 Federal Worksheet (for all except non-residents) For best results, download and open this form in Adobe Reader. See General information for details. You can view this form in: PDF 5000-d1-21e.pdf. PDF fillable/saveable 5000-d1-fill-21e.pdf. For people with visual impairments, the following alternate formats are also available: What Is the Earned Income Tax Credit (EITC)? - SmartAsset The earned income tax credit (EITC) reduces taxes for low-to-moderate-income working families. ... Keep in mind that workers cannot claim the EITC if they file Form 2555 for foreign earned income, or Form 2555-EZ for foreign earned income exclusions. ... To estimate the amount of your credit, you can use the worksheets included with the ...

› support › 948Foreign Earned Income Tax Worksheet - TaxAct The Foreign Earned Income Tax Worksheet figures the applicable tax rate by combining the amounts (line 3) and subtracting from that tax calculation (line 4) the tax that would have been due on the foreign earned income (line 5). This does not apply tax directly on the FEI, but the exclusion does bump the tax rate up. The FEC worksheet is not an ...

What is required for foreign income? - Fannie Mae Foreign Income Foreign income is income that is earned by a borrower who is employed by a foreign corporation or a foreign government and is paid in foreign currency. Borrowers may use foreign income to qualify if the following requirements are met. For additional information, see B3-3.1-09, Other Sources of Income.

IRS Tax Forms For US Expats | Tax Forms Information 1 IRS Tax Form 8949 for American Expats. 09/09/2021. All Americans have to fulfill the same annual federal US filing requirements, including those living abroad. This includes reporting certain capital gains. A capital gain is the increase of the value of an asset that you realize when that asset is sold. Capital gains (and losses) are reported ...

Solved: Gross Foreign Source Income additionally, if this is a general category of income (box d is marked above), and there is an entry in the related column in the income excluded on form 2555 smart worksheet on the foreign tax credit computation worksheet, then from the corresponding copy of the foreign tax credit computation worksheet, line 1f of the corresponding column, plus …

› blog › expat-taxesCompleting Form 1040 and the Foreign Earned Income Tax Worksheet Jan 16, 2022 · If you earned more than $100,000, use the tables found on page 77 of the IRS’s Instructions for Form 1040. It is important to note that when you are claiming the Foreign Earned Income Exclusion, there is a special worksheet to complete to calculate your tax due for the year. This can be found on page 35 of the IRS’s Instructions for Form 1040.

Generating Form 2555 in ProSeries - Intuit Complete the Foreign Earned Income Allocation Worksheet . You can find the QuickZoom to this worksheet on Part IV of Form 2555. Complete the Foreign Earned Income Deductions Allocation Worksheet. You can find the QuickZoom to this worksheet on Part IV of Form 2555. The exclusion will flow from Form 2555, line 45 to Form 1040 as Other Income.

Foreign Earned Income Exclusion And US or IRS Tax Returns Gross Income: Includes all income you received throughout the tax year, including goods, money, services, self-employment earnings (reported on Gross Income line of Schedule C, Profit or Loss from Business), and property that is not exempt from taxes. It also includes income you excluded as foreign earned income or foreign housing amounts.

International Taxpayers Interactive Tools - IRS tax forms Interactive Taxpayer Assistance (ITA) The ITA tool is a tax law resource that takes you through a series of questions and provides you with responses to tax law questions. Am I Eligible to Apply for an Individual Taxpayer Identification Number? Can I Exclude Income Earned in a Foreign Country? Am I Required to File a Nonresident Alien U.S ...

IRS Form 2555 and the Foreign Earned Income Exclusion - Cartagena Explorer The income you can take under the foreign earned income exclusion on IRS form 2555 ends up counting as a negative number, adjusting your income for tax purposes downward. Forms to File for the Foreign Earned Income Exclusion (for tax year 2020): Form 1040. See Instructions here. 1040 Schedule 1. (Instructions are in the instructions for the 1040)

› individuals › international-taxpayersFiguring the Foreign Earned Income Exclusion - IRS tax forms In 2021, you received $20,000 for work you did in the foreign country in 2020. You can exclude $7,600 of the $20,000 from your income in 2021. This is the $107,600 maximum foreign earned income exclusion for 2020 minus the $100,000 you already excluded for that year. You must include the remaining $12,400 in income for 2021 ($20,000 - $7,600 ...

What Is Tax Form 6251? - The Balance The AMT rate is 26% on income over the exemption up to $199,900—or just $99,950 if you're married and filing a separate return. 2 The rate can increase to 28% above these thresholds. But there are "phaseout" thresholds as well. These exemptions begin to decrease and eventually disappear at incomes of: 2

Earned Income Credit, EIC Table - National Tax Reports The Earned Income Tax Credit Worksheet can be used to calculate your eligibility and how much credit you qualify for. The worksheet can be found in the instruction booklet for IRS Form 1040. There is also an Earned Income Credit Calculatorto help you figure out your Earned Income Credit amount. Fraudulent Claims

0 Response to "40 foreign earned income tax worksheet"

Post a Comment