39 flight attendant tax deductions worksheet

Downloads - flightax.com We will need the completed "Flight Deduction Organizer". 2020 Foreign Domicile Organizer Full Client Organizer for clients who lived and worked in another country in 2019 ACA Worksheet Required Form if not covered by insurance for the entire year. 8879 Only Electronic Filing Signature form for Tax Year 2021. Tax Forms - Diamond Financial Small Business & Self Employed Deduction Fillable Worksheet Pilot Professional Deduction Fillable Worksheet Flight Attendant Professional Deduction Fillable Worksheet United Pilot and Flight Attendant Per Diem Reports (GO TO MY INFO PER DIEM REPORT) Rental Real Estate Deduction Fillable Worksheet Military Deduction Worksheet

MA000009: Hospitality Industry (General) Award 2020 37.6 Deductions for accommodation or accommodation and meals—employees on junior rates [37.6 varied by PR718826 , PR729263 ppc 01Nov21] An employer may deduct from the wages of a junior employee on junior rates,aged as specified in column 2 of Table 16—Employees on junior rates ,the amount specified in column 4 for the service specified ...

Flight attendant tax deductions worksheet

work: Vehicle Expense - Aligaen Accounting & Tax Services Vehicle Mileage and Expense Worksheet. Validate. Year, Make and Model. Start Date for Job, Biz, Rental Use. ... Line 4 Medical Expense Deduction (must go over 7.5% or 10% of income threshold) ... Flight Attendant, Nurse Line 22 Tax Preparation Fees you paid for last year's tax return Line 23 Investment Expenses (custodial fees, safe deposit ... Tax Deduction Worksheet for Pilots, Flight Attendants, & Other Airline ... This worksheet provides a way for you to organize your credit and deduction information only. Whether or not an item is listed on this worksheet is not necessarily an indicator of whether or not an item is taxable or deductible. Tax regulations change often and specific circumstances may determine whether Tax Filing FAQs | Airline Crew Taxes If you're in doubt, list the item on the worksheet and we will help you determine if it is a legitimate deduction. We've been in business for over a decade, and we know what your expenses should look like determining on your position (pilot, flight attendant) and your type of flying (domestic vs. international).

Flight attendant tax deductions worksheet. PDF Flight Crew Expense Report and Per Diem Informaton - Blue Skies Tax Service Flight Crew Expenses Worksheet *If you are married to another crewmember, please complete a form for each individual. Nam : Dat Uniform Purchases Th Tax Court has r p at dly stat d that any r quir d elothing it m that is ith r prot etv in natur sueh as a fight suit or st l-to d boots, OR eannot b eonv rt d to v ryday us may b d duet d as a job ... English-Spanish Glossary | SSA - Social Security Administration additional child tax credit (el) crédito tributario adicional por hijos: Additional principal payment: pago adicional (hacia el capital) additional taxes on qualified plans (including IRAs) and other tax-favored accounts (los) impuestos adicionales sobre planes calificados (incluidos los planes IRA) y otras cuentas favorecidas por los ... 1.32.1 IRS Local Travel Guide | Internal Revenue Service Oct 21, 2021 · Attendant-- An individual who provides personal care and travels with an authorized IRS traveler who has a disability or special need. Automatic teller machine (ATM) travel advance-- Contractor-provided service that allows cash withdrawals from participating ATMs. The cash withdrawal and associated fees are charged to the Standard Travel Card ... Helpful income tax worksheets | TNT Tax Service TNT Tax Service. 2929 N 44th Street Suite 202. Phoenix AZ 85018. Phone: 602-246-0721. Fax: 602-246-0720. Email: beth@tnttaxserviceaz.com.

Instructions for Form 2106 (2021) | Internal Revenue Service Reimbursement Allocation Worksheet (keep for your records) Step 3—Figure Expenses To Deduct Line 9. Generally, you can deduct only 50% of your business meal expenses, including meals incurred while away from home on business. Meals that are not separately stated from entertainment are generally nondeductible. MA000009: Hospitality Industry (General) Award 2020 Kitchen attendant grade 1 Level 2. Clerical grade 1. 742.30. 19.53 Cook grade 1 Door person/security officer grade 1 Food and beverage attendant grade 2 Front office grade 1 Guest service grade 2 Kitchen attendant grade 2 Leisure attendant grade 1 Gardener grade 1 Storeperson grade 1 Level 3. Clerical grade 2. 767.80. 20.21 Cook grade 2 Food ... The Pilot's Guide to Taxes - AOPA - Aircraft Owners and Pilots Association The basic tax question posed by AOPA members who use aircraft for business purposes is whether their aircraft expenses are tax deductible. The types of expenses our members commonly look to deduct are the basic costs associated with aircraft operations, including maintenance, fuel, tie-down or hanger fees, landing fees, insurance, and depreciation. Math Worksheets Grade 8 Printable - Blogger 28 Flight Attendant Tax Deductions Worksheet. Equal Opportunity Notice The Issaquah School District complies with all applicable federal and state rules and regulations and does not discriminate on the basis of sex race creed religion color national origin age honorably discharged veteran or military status sexual orientation including gender ...

The Epic Cheat Sheet to Deductions for Self-Employed Rockstars It's pretty simple- keep track of your business mileage and you get to deduct those miles multipled by the standard rate (usually around 58 cents per mile). If you are taking the standard mileage deduction, there are still a few car related expenses you get to write off: Parking & Tolls Registration fees & licenses What Happens When Cupid Shoots An Arrow Math Worksheet 28 Flight Attendant Tax Deductions Worksheet. Equal Opportunity Notice The Issaquah School District complies with all applicable federal and state rules and regulations and does not discriminate on the basis of sex race creed religion color national origin age honorably discharged veteran or military status sexual orientation including gender ... Everything You Need to Know About Flight Attendant Tax Deductions Flight attendant tax deductions usually fall into one of two areas: out of pocket expenses such as uniforms, cell phone, union dues, etc. per diem allowances and deductions. Both are discussed below. Flight Attendant Tax Deductions - Out of Pocket Expenses… Virtually everyone in the corporate world will incur costs associated with their profession. Occupation and industry specific guides | Australian Taxation ... Fire fighter deductions (PDF, 320KB) This link will download a file. Fitness and sporting industry employees. Fitness employee deductions (PDF, 302KB) This link will download a file. Flight Crew. Flight crew deductions (PDF, 336KB) This link will download a file. Gaming attendants. Gaming attendant deductions (PDF, 296KB) This link will ...

PDF Professional Deductions complete this Professional Deduction Organizer and submit it ith your Organizer. FLIGHTAX PO Box 139, Cicero, IN 46034 ph 317-984-5812 fax 1-800-951-8879 flightax.com 2 Travel/Required Items Your profession requires you to have specific items for travel and to perform your job in areas of service and safety.

PDF Publication 529 (Rev. December 2020) - IRS tax forms Performed services in the performing arts as an em- ployee for at least two employers during the tax year, 2. Received from at least two of the employers wages of $200 or more per employer, 3. Had allowable business expenses attributable to the performing arts of more than 10% of gross income from the performing arts, and 4.

Help and Links - Downey Tax Company Tradesman , Electrician & Plumber Deduction Checklist. Mileage Journal. ... Business Info, Income, and Expense Worksheet. Carpenters & Construction Deductions Checklist. make a ftb payment. Where's my amended return? ... Pilot & Flight Attendant Deduction Checklist

25 examples! What can flight crews write off? Why or why not? - EZPerDiem If you use a reimbursement on a deductible expense, you lose the deduction. Expense example 14: A flight attendant buys food at the airport while on a trip. Sort of. While food expenses are deductible, the per diem calculation is used in line of actual expenses. This creates a much higher deduction for meal expenses with a lot less work.

How To Compare Employer Benefits Packages - The Balance Careers Sep 07, 2022 · The other common option is a defined contribution plan, which includes plans like the 401(k). In this type of plan, employees make regular contributions to the account through their pre-tax paychecks. The money is invested and may grow over time, but there is no guaranteed return, and the employee manages both the investment and the distributions.

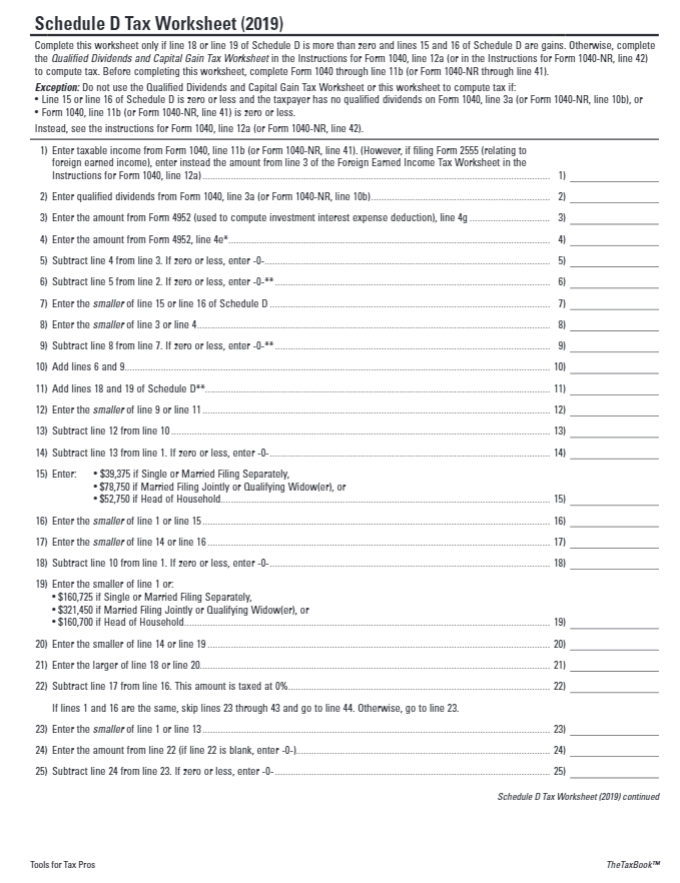

PDF Airline Professional - Tax Deduction Worksheet Tax Deduction Worksheet For Pilots, Flight Attendants, & Other Airline Personnel Dry Cleaning Curling Iron - Portable, Multi-voltage Continuing Education Correspondence Course Fees Materials & Supplies Equipment Publications - FAA Luggage Carts Luggage Locks Luggage Tags Publications - Entertainment (flight related) Alarm Clock - Portable ...

PDF PROFESSIONAL DEDUCTIONS - tnttaxserviceaz.com deduction for training. As in the example above, if you are based in Atlanta, you are not eligible for this deduction. An easy way to determine this deduction, in general, if your airline pays you a per diem for your meal expenses during training, you are able to take the per diem deduction based on the city of training.

Air Crew Tax Specialist for Pilots and Crew Members Download 2015 Flight Attendant Worksheet Download Rental Real Estate Worksheet Download Small Business Worksheet Business Organizer for Corporations, S-Corporations and Partnerships Download Business Return Organizer Send Completed Tax Organizer to: Aircrew Taxes LLC 58 South Park Square Suite D Marietta, GA 30060 Fax (770) 795-9799 Or E-mail

List of Flight Attendant Tax Deductions | Sapling The instructions to Schedule A list all categories of expenses that you can itemize. Therefore, you should evaluate the additional expenses you can deduct in addition to your flight attendant expenses. Once you estimate your Schedule A deductions, compare the total to the standard deduction you are eligible for.

PDF PROFESSIONAL DEDUCTIONS - pilot-tax.com If you are a flight attendant and update your resume or fly to an interview, these expenses are deductible. If you do the same for another position outside of the industry, such as a retail position or professional job, these expenses may not be taken as a deduction.

Zulu Crew Taxes - Tax Preparation and Planning for Flight Crews - Home As a flight attendant living in Hawaii, I knew I wanted to itemize my state return but I didn't know what I could and could not write off. ... Client Information Worksheet. Tax Deduction Worksheet. Overnights Worksheet. Client Testimonials. Blog. NEWSLETTER. Email Address * First Name. Last Name * = required field CONTACT US. Telephone: +1 ...

PDF 2011 Aircrew Taxes Flight Attendant Worksheet Flight Attendant Professional Deductions Receipts are not required for travel expenses under $75 if entered into your logbook, including item, date & cost. Do not send receipts; keep them for your records. TOTAL BLOCKS will be completed by Tax Preparer

work: Flight Crew Expense - Aligaen Accounting & Tax Services There are two types of deductions for pilots and flight attendants. First is out of pocket expenses such as uniforms, cell phone, union dues, etc. The second is the per diem allowance and deduction. We need both to prepare your tax returns. Please use this online submit form to detail your flight attendant and pilot tax deductions.

Airline Crew Taxes Bigger Refunds - Maximizing all deductions, tax credits, and write-offs available. Faster Refunds - With electronic filing and direct deposit, money in 14 to 21 days from filing date. Low Fees - Competent, professional service at half the cost of comparable tax firms. If you do your own taxes, you could be costing yourself $100s or even $1000s.

0 Response to "39 flight attendant tax deductions worksheet"

Post a Comment