41 vanguard retirement expense worksheet

PDF Build your Social Security strategy - The Vanguard Group What will your annual expenses be during your retirement? Use our retirement expenses worksheet Calculate your annual retirement surplus or gap: E F E F C B A D - Enter the higher number = Your retirement savings plus your annual income = could provide this much income each year: Annual Social Security bene˜ts Multiply your monthly estimates ... How to Do a Backdoor Roth IRA - White Coat Investor 04.12.2021 · If your income is below a MAGI of $129,000-$144,000 ($204,000-$214,000 Married Filing Jointly), you can contribute directly to a Roth IRA. If you have a retirement plan offered to you at work and your MAGI is below $68,000-$78,000 ($109,000-$129,000 Married Filing Jointly) you can deduct your traditional IRA contributions. Since most readers of ...

Tools and Calculators Overview | Vanguard Compare the features of a Vanguard-associated 529 savings plan to another state-sponsored 529 plan. Get Started. Tax tools (1) Tax-deferred savings calculator See how the tax deferral you get with a 529 savings plan can add up. Get started. Investment analysis (2) Whether you're a beginner or a seasoned investor, you can make smarter financial decisions with these …

Vanguard retirement expense worksheet

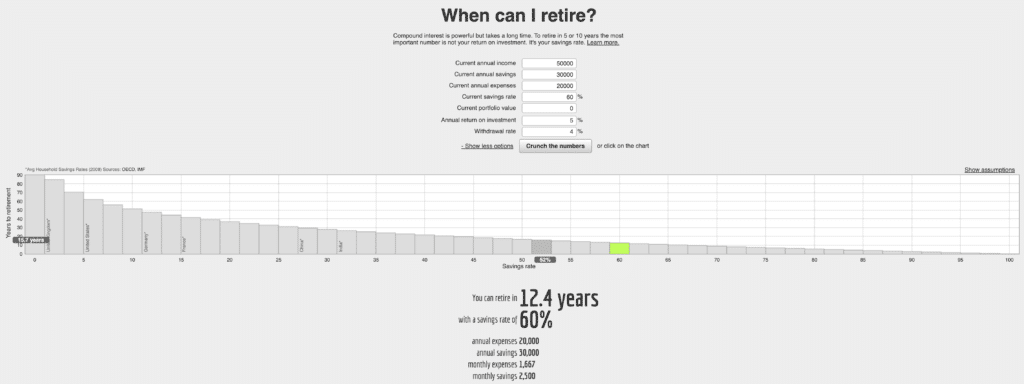

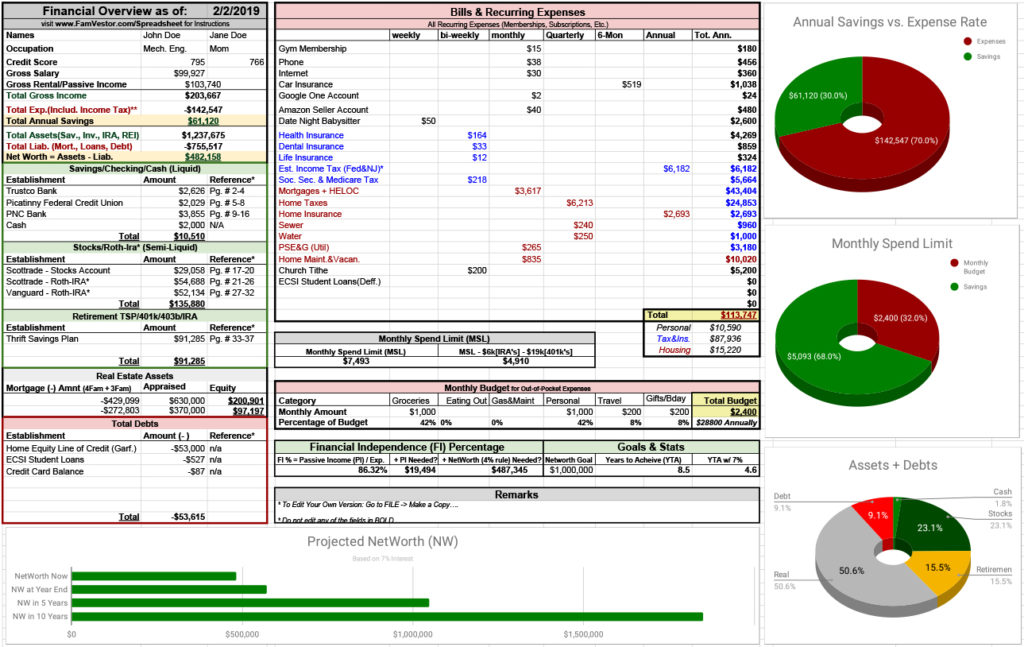

7 Best Free Retirement Planning Spreadsheets for 2022 - Tiller Note: Vanguard provides an easy tool if you simply want to calculate your retirement expenses. Retirement Planning Spreadsheet for Google Sheets The flexible and easy-to-use Retirement Planner spreadsheet estimates the value of your savings and investments into the future. Experiment with growth rate scenarios and project outcomes in real-time. How To Save Money: 35 Ways To Reduce Expenses - Clark Howard If you have any subscriptions or memberships that you aren’t using enough to justify the monthly expense anymore, cancel them! If you aren’t reading all of the magazines you get in the mail or using the online software that you’re paying for, you’re losing money. Cancel any unused subscriptions, streaming services and memberships that aren’t worth it to you anymore. To … › budget-categories18 Essential Budget Categories for Every Household Budget Feb 11, 2022 · Retirement/Savings. A portion of your discretionary income should always go toward savings. Whether you’re saving for an emergency fund or retirement, you should always have liquid savings available. An emergency fund should have 3 to 6 months of expenses in it at a minimum. Your retirement fund should be ongoing and if you have any other ...

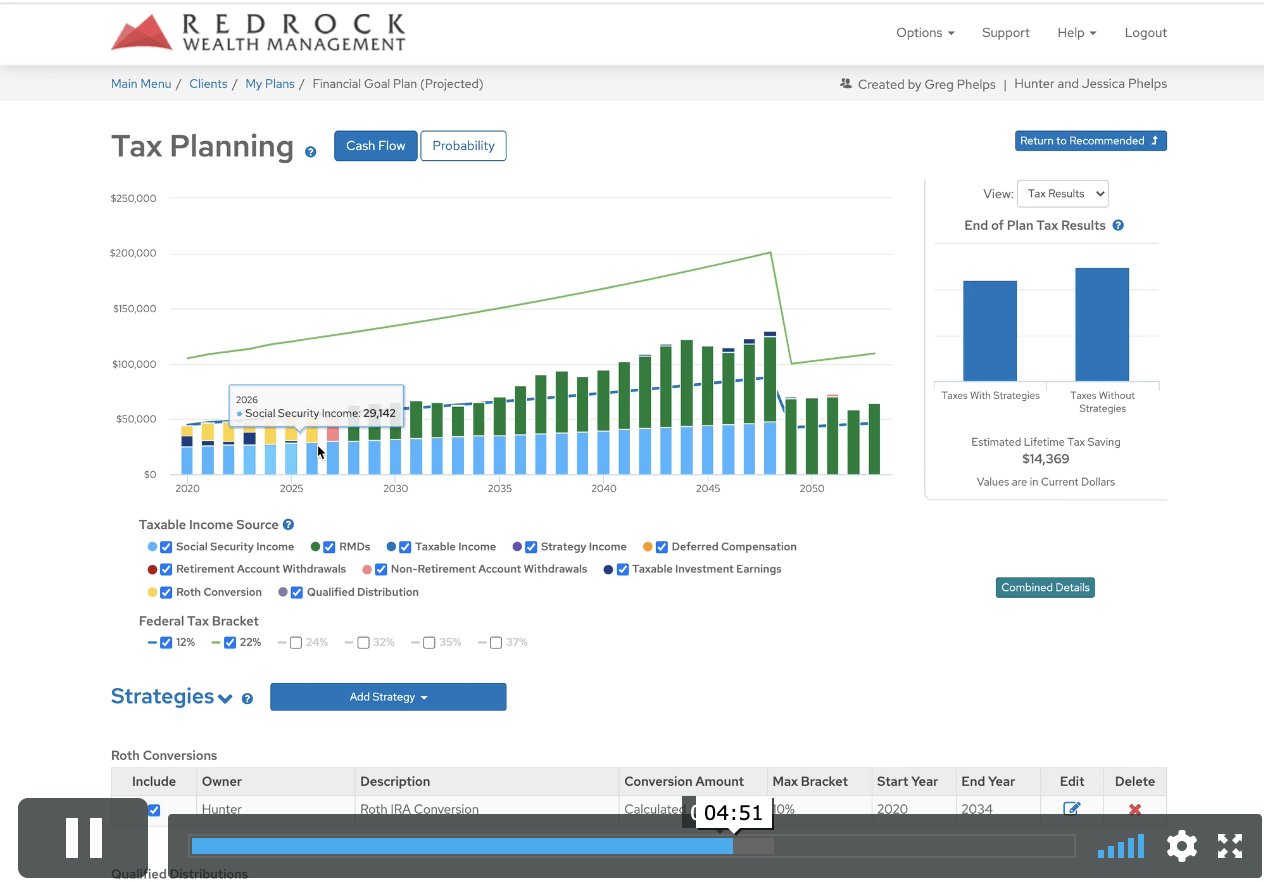

Vanguard retirement expense worksheet. PDF Budgeting & savings guide - The Vanguard Group Income Amount Expenses (annually) Amount Annual salary* $55,000 Rent/mortgage $26,000 Quarterly trust distributions $10,000 Car expenses $6,200 Annual gifts $30,000 Insurance $2,200 Credit card $72,000 (entertainment) $38,000 (clothing) Electric/gas bills $2,400 Savings $3,000 Charitable donations $1,600 Annual total $95,000 Annual total $151,400 SEP IRA for an S Corp: The #1 Contribution Guide for 2022 12.06.2022 · There is a line called “Pension, retirement and other qualified plans”. Just include it there. 2) For a sole proprietor, the employee contributions are on the Schedule C and your contributions are an adjustment to income on the 1040. 3) For a partnership, the employee contributions are included as an expense like the S-Corp above. But for ... Retirement Budget Calculator - Vanguard Retirement Expense Worksheet vs ... 452 views, 4 likes, 0 loves, 2 comments, 2 shares, Facebook Watch Videos from Retirement Budget Calculator: To retire with confidence you will want to understand your spending before you retire, your... Vanguard - See what you spend - The Vanguard Group If you chronically spend more than you earn, try to cut out some frivolous expenses. A luxury item like a new TV is not necessarily a need on the same level as, say, a car repair or a doctor's bill. Prioritize your expenses in this order: Short-term needs (repairs and maintenance). Long-term needs (retirement and education).

How Estimated Taxes Work, Safe Harbor Rule, and Due Dates (2021) 11.01.2022 · The IRS has a worksheet included in the Form 1040-ES package that you can use to ... Jim Wang is a forty-something father of four who is a frequent contributor to Forbes and Vanguard's Blog. He has also been fortunate to have appeared in the New York Times, Baltimore Sun, Entrepreneur, and Marketplace Money. Jim has a B.S. in Computer Science and … Google Sheets: Sign-in Not your computer? Use a private browsing window to sign in. Learn more Vanguard - Retirement Nest Egg calculator How many years should your savings last? 30 years. What is your savings balance today? $1,000,000. How much do you spend each year? $45,000 4.5% of savings. docs.google.com › spreadsheetsGoogle Sheets: Sign-in Not your computer? Use a private browsing window to sign in. Learn more

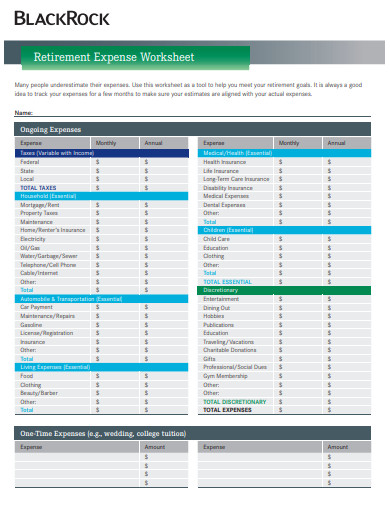

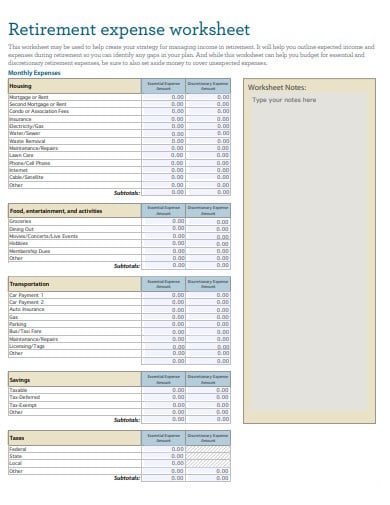

investor.vanguard.com › tools-calculatorsRetirement Expenses Worksheet | Vanguard You'll have important bills and expenses to pay in retirement. Use this interactive worksheet to help you estimate your monthly retirement expenses. Your expenses Choose the way you want to enter your expense Monthly Annually Enter your estimated expenses for each category, then click Calculate at the bottom to see your total. PDF Retirement expense worksheet - Wells Fargo Retirement expense worksheet Monthly Expenses Name: Mortgage or Rent Address: Second Mortgage or Rent Condo or Association Fees Insurance Phone Number: Electricity/Gas Water/Sewer Waste Removal Maintenance/Repairs Clothing ... expenses during retirement so you can identify any gaps in your plan. And while this worksheet can help you budget for ... Vanguard - Tools and calculators Use this calculator to find out how much you need to contribute each pay period to reach the IRS savings limit by year-end. Start Plan savings Use this tool to determine the effect saving more can have on your paycheck and the amount of income you may expect in retirement. Start Rollover questionnaire Retirement income worksheet | Vanguard Retirement income worksheet | Vanguard Retirement income worksheet As your retirement draws closer, it pays to be prepared. Use this interactive worksheet to estimate your total monthly income in retirement and determine if you're on track to meeting your financial needs. Rest assured, your data won't be saved online. Let's get started

Retirement Expenses Worksheet | Vanguard You'll have important bills and expenses to pay in retirement. Use this interactive worksheet to help you estimate your monthly retirement expenses. Still need help? Consider our advisor services. Vanguard Personal Advisor Services® One-on-one expert advice to fit your needs. To get started, call us at 800-523-9447 to speak with an investment professional or click the link …

Use a retirement planning worksheet | Vanguard Debt payments, if you paid off your mortgage or other loans before retiring. Life insurance, if you decide to drop it once you retire. Make your retirement budget Our retirement planning worksheet makes it easy to get a complete picture of your retirement budget. Calculate your retirement expenses We're here to help

› backdoor-roth-ira-tutorialHow to Do a Backdoor Roth IRA - White Coat Investor Dec 04, 2021 · If your income is below a MAGI of $129,000-$144,000 ($204,000-$214,000 Married Filing Jointly), you can contribute directly to a Roth IRA. If you have a retirement plan offered to you at work and your MAGI is below $68,000-$78,000 ($109,000-$129,000 Married Filing Jointly) you can deduct your traditional IRA contributions. Since most readers of ...

Retirement Income Calculator | Vanguard Retirement income calculator. Your retirement is on the horizon, but how far away? You can use this calculator to help you see where you stand in relation to your retirement goal and map out different paths to reach your target. You can print the results for future reference, and rest assured your data will not be saved online.

Duke Benefits Decision Guide by Working Duke - Issuu 15.12.2020 · Financial Security Retirement Plans hr.duke.edu/benefits/ retirement HRIC (919) 684-5600 Voluntary Disability Insurance (Voluntary Short Term Disability and/or Long Term Disability Programs) MGIS ...

issuu.com › workingatduke › docsDuke Benefits Decision Guide by Working Duke - Issuu Dec 15, 2020 · Financial Security Retirement Plans hr.duke.edu/benefits/ retirement HRIC (919) 684-5600 Voluntary Disability Insurance (Voluntary Short Term Disability and/or Long Term Disability Programs) MGIS ...

Vanguard - Retirement Expense Worksheet Retirement plan participants. For people who invest through their employer in a Vanguard 401(k), 403(b), or other retirement plan. Institutional investors. For retirement plan sponsors, consultants, and nonprofit representatives. Financial advisors. For broker-dealers, registered investment advisors, and trust or bank brokerage professionals.

Vanguard - Create your retirement spending plan Start by estimating what your retirement will cost. If you're the kind of person who makes budgets, create a spreadsheet of your expenses today and how you expect them to change in retirement. Otherwise, you can take a back-of-the-envelope approach: Take what you spend today and multiply it by 85% or 90%.

High Dividend Opportunities - Marketplace Checkout - Seeking … 07.04.2017 · To sweeten the opportunity, you can change your retirement outlook for 22% off your first year in our limited time sale! Start Your 2-Week Free Trial* Today! Gather Income, Don't Sell Yourself Short

vanguard retirement expenses worksheet 35 Truck Driver Expenses Worksheet sekrety-serduszka.blogspot.com A Simple Retirement Using Variable Percentage Withdrawals (VPW Forward vpw withdrawals percentage withdrawal 40 Vanguard Retirement Expense Worksheet - Combining Like Terms Worksheet chripchirp.blogspot.com calculator spreadsheet expense pension aarp apps

Thinking about early retirement? | Vanguard Our retirement expenses worksheet can help you visualize where your money goes. Fill it out now as a pre-retiree, and then estimate what your financial situation may look like once you're retired. Plan to replace 85% to 100% of your pre-retirement income in retirement.

› sep-ira-rules-contribution-s-corpSEP IRA for an S Corp: The #1 Contribution Guide for 2022 Jun 12, 2022 · There is a line called “Pension, retirement and other qualified plans”. Just include it there. 2) For a sole proprietor, the employee contributions are on the Schedule C and your contributions are an adjustment to income on the 1040. 3) For a partnership, the employee contributions are included as an expense like the S-Corp above.

additional living expenses worksheet 40 Vanguard Retirement Expense Worksheet - Combining Like Terms Worksheet chripchirp.blogspot.com expense spreadsheet What Does Additional Living Expense Coverage Cover? additional living expense coverage does really Goal worksheet setting charge taking money manager finances publications started getting.

vanguard retirement expense worksheet vanguard retirement expense worksheet 5 Early Retirement Mistakes to Avoid. 10 Images about 5 Early Retirement Mistakes to Avoid : Vanguard Retirement Expense Worksheet - Worksheet List, Fillable Vanguard Retirement Plan Enrollment And Change Form printable and also Vanguard Retirement Expense Worksheet - Worksheet List.

PDF Retirement Expense Worksheet - Capital Advantage Expense 1: $ Expense 2: $ Expense 3: $ Expense 4: $ Totals $ Total Expenses $ | 925.299.1500 Please contact Capital Advantage at 925.299.1500 or email us at info@capitaladvantage.com to find out how we can help you maximize your retirement savings.

18 Essential Budget Categories for Every Household Budget - How … 11.02.2022 · Retirement/Savings. A portion of your discretionary income should always go toward savings. Whether you’re saving for an emergency fund or retirement, you should always have liquid savings available. An emergency fund should have 3 to 6 months of expenses in it at a minimum. Your retirement fund should be ongoing and if you have any other financial goals, …

PDF Retirement income planning worksheet - Merrill Lynch Additional Expenses (including one-time purchases) $ Expected Pay Offs $ After you've documented your expenses in retirement and income sources, your Merrill Lynch Wealth Management Advisor can work with you to create a retirement income plan that seeks to align your portfolio and the income it generates to your individual goals and situation.

investor.vanguard.com › tools-calculatorsTools and Calculators Overview | Vanguard Retirement expense worksheet Create a realistic budget for retirement that includes basic and discretionary expenses. Get started. ... Check to see if your state offers a tax benefit for qualified education expenses and/or Vanguard investments. Get started. College cost projector

Investment Calculators and Tools | Vanguard 5 Retirement income calculator Estimate the potential income you could earn from your investments. Retirement expense worksheet Create a realistic budget for retirement that includes basic and discretionary expenses. Retirement income worksheet Identify your income sources and estimate your monthly income in retirement. Retirement planning

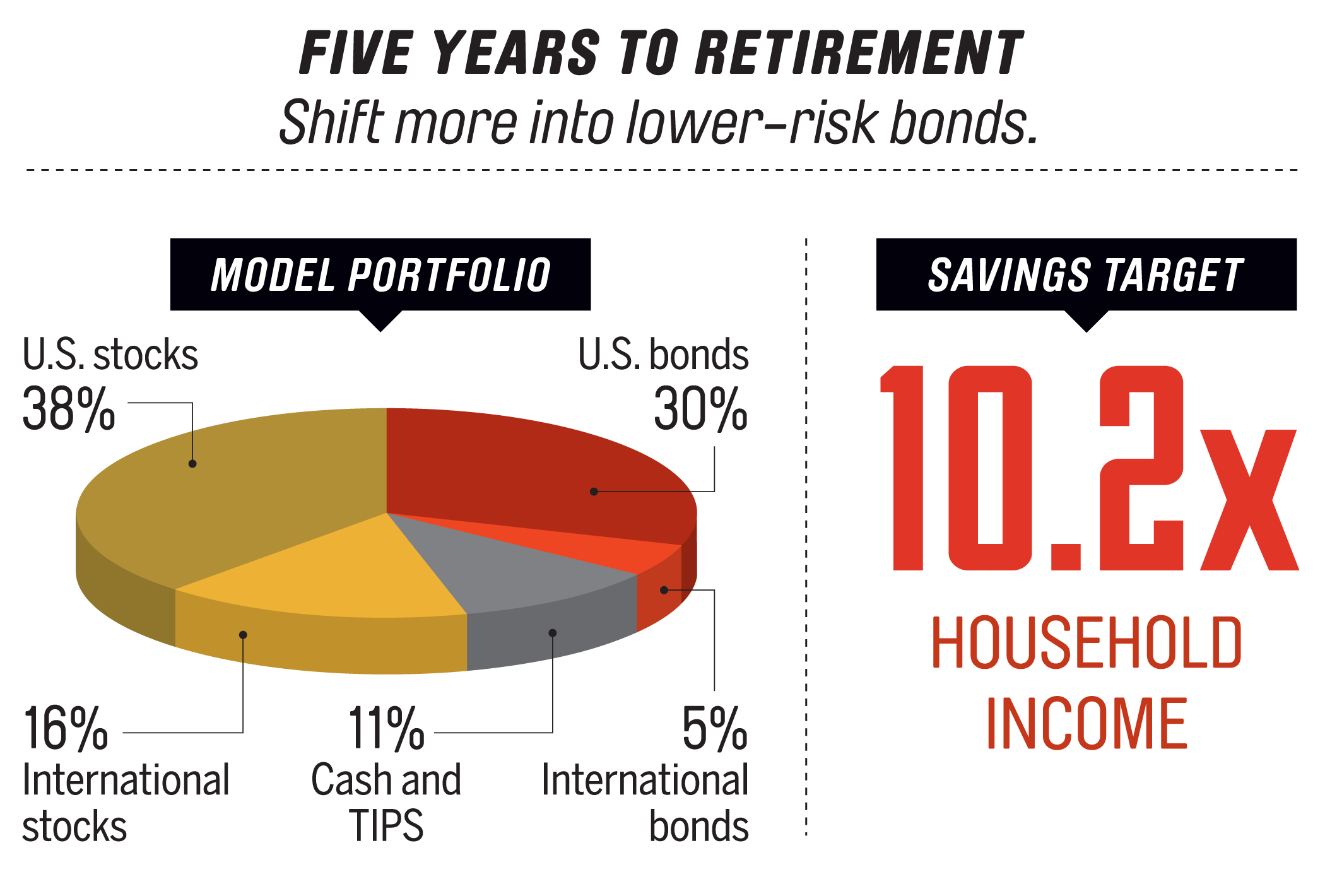

Vanguard - Vanguard Target Retirement 2030 Fund This mutual fund profile of the Target Retirement 2030 provides details such as the fund objective, average annual total returns, after-tax returns, initial minimum investment, expense ratio, style, and manager information. You can also learn who should invest in this mutual fund.

› budget-categories18 Essential Budget Categories for Every Household Budget Feb 11, 2022 · Retirement/Savings. A portion of your discretionary income should always go toward savings. Whether you’re saving for an emergency fund or retirement, you should always have liquid savings available. An emergency fund should have 3 to 6 months of expenses in it at a minimum. Your retirement fund should be ongoing and if you have any other ...

How To Save Money: 35 Ways To Reduce Expenses - Clark Howard If you have any subscriptions or memberships that you aren’t using enough to justify the monthly expense anymore, cancel them! If you aren’t reading all of the magazines you get in the mail or using the online software that you’re paying for, you’re losing money. Cancel any unused subscriptions, streaming services and memberships that aren’t worth it to you anymore. To …

7 Best Free Retirement Planning Spreadsheets for 2022 - Tiller Note: Vanguard provides an easy tool if you simply want to calculate your retirement expenses. Retirement Planning Spreadsheet for Google Sheets The flexible and easy-to-use Retirement Planner spreadsheet estimates the value of your savings and investments into the future. Experiment with growth rate scenarios and project outcomes in real-time.

:max_bytes(150000):strip_icc()/vanguard2-8b51d35f7cd04151bc0678c294eac89a.jpg)

0 Response to "41 vanguard retirement expense worksheet"

Post a Comment