43 2015 qualified dividends and capital gain tax worksheet

› instructions › i6251Instructions for Form 6251 (2021) | Internal Revenue Service You qualify for the adjustment exception under Qualified Dividends and Capital Gain Tax Worksheet (Individuals) or Adjustments to foreign qualified dividends under Schedule D Filers in the Instructions for Form 1116, and. Line 17 of Form 6251 isn’t more than $199,900 ($99,950 if married filing separately (on Form 1040, 1040-SR, or 1040-NR). My 2015 turbotax online does not show "tax calculation worksheet" - Intuit TB used worksheet to calculate the tax of capital gains and qualified dividends at the rate of 15% ... My 2015 turbotax online does not show "tax calculation worksheet" ... you will see the Qualified Dividends and Capital Gains Worksheet. View solution in original post. 0 153 Reply. 1 Reply Anita01. New Member May 31 ...

PDF Qualified Dividends and Capital Gain Tax Worksheet: An Alternative to ... The worksheet is for taxpayers with dividend income only or those whose only capital gains are capital gain distributions reported in box 2a or 2b of Form 1099-DIV that were received from mutual funds, other regulated investment companies, or real estate investment trusts.

2015 qualified dividends and capital gain tax worksheet

Qualified Dividends and Capital Gains Worksheet - StuDocu Qualified Dividends and Capital Gain Tax Worksheet—Line 12a Keep for Your Records. See the earlier instructions for line 12a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 or 1040-SR through line 11b. PDF and Losses Capital Gains - IRS tax forms To report a gain or loss from a partnership, S corporation, estate or trust, To report capital gain distributions not reported directly on Form 1040, line 13 (or effectively connected capital gain distributions not reported directly on Form 1040NR, line 14), and To report a capital loss carryover from 2014 to 2015. Additional information. › taxes › capital-gains-tax-rates2021-2022 Capital Gains Tax Rates & Calculator - NerdWallet Aug 10, 2022 · In 2021 and 2022, the capital gains tax rate is 0%, 15% or 20% on most assets held for longer than a year. Capital gains taxes on assets held for a year or less correspond to ordinary income tax ...

2015 qualified dividends and capital gain tax worksheet. Qualified Dividends And Capital Gain Tax Worksheet Fillable 2019 - Fill ... Complete Qualified Dividends And Capital Gain Tax Worksheet Fillable 2019 in a few minutes following the guidelines listed below: Find the document template you need from our collection of legal form samples. Select the Get form key to open it and start editing. Fill in all of the requested fields (they are marked in yellow). How to Figure the Qualified Dividends on a Tax Return Locate ordinary dividends in Box 1a, qualified dividends in Box 1b and total capital gain distributions in Box 2a. Report your qualified dividends on line 9b of Form 1040 or 1040A. Use the... PDF Capital Gains and Losses - IRS tax forms Use Form 8949 to list your transactions for lines 1b, 2, 3, 8b, 9, and 10. OMB No. 1545-0074 2015 Attachment Sequence No. 12 Name(s) shown on return Your social security number Part I Short-Term Capital Gains and Losses—Assets Held One Year or Less See instructions for how to figure the amounts to enter on the lines below. capital_gain_tax_worksheet_1040i - 2015 Form 1040Line 44 Qualified ... 2015 form 1040—line 44 qualified dividends and capital gain tax worksheet—line 44 keep for your records see the earlier instructions for line 44 to see if you can use this worksheet to figure your tax.before completing this worksheet, complete form 1040 through line 43.if you do not have to file schedule d and you received capital gain …

Capital Gain Tax Worksheet - 2015 Form 1040Line 44 Qualified Dividends ... 2015 form 1040—line 44 qualified dividends and capital gain tax worksheet—line 44 keep for your records see the earlier instructions for line 44 to see if you can use this worksheet to figure your tax.before completing this worksheet, complete form 1040 through line 43.if you do not have to file schedule d and you received capital gain … › instructions › i1040gi1040 (2021) | Internal Revenue Service - IRS tax forms Schedule D Tax Worksheet. Qualified Dividends and Capital Gain Tax Worksheet. Schedule J. Foreign Earned Income Tax Worksheet. Foreign Earned Income Tax Worksheet—Line 16; Qualified Dividends and Capital Gain Tax Worksheet—Line 16; Line 19. Nonrefundable Child Tax Credit and Credit for Other Dependents. Form 8862, who must file. Payments PDF 2015 Form 6251 - IRS tax forms 2015 Form 6251 Form 6251 Department of the Treasury Internal Revenue Service (99) Alternative Minimum Tax—Individuals Information about Form 6251 and its separate instructions is at . Attach to Form 1040 or Form 1040NR. OMB No. 1545-0074 2015 Attachment Sequence No. 32 Name(s) shown on Form 1040 or Form 1040NR How can I view and print a copy of the "Qualified Dividends and Capital ... Community: Discussions: Taxes: After you file: How can I view and print a copy of the "Qualified Dividends and Capital Gains Tax Worksheet" form for my 2017 return?

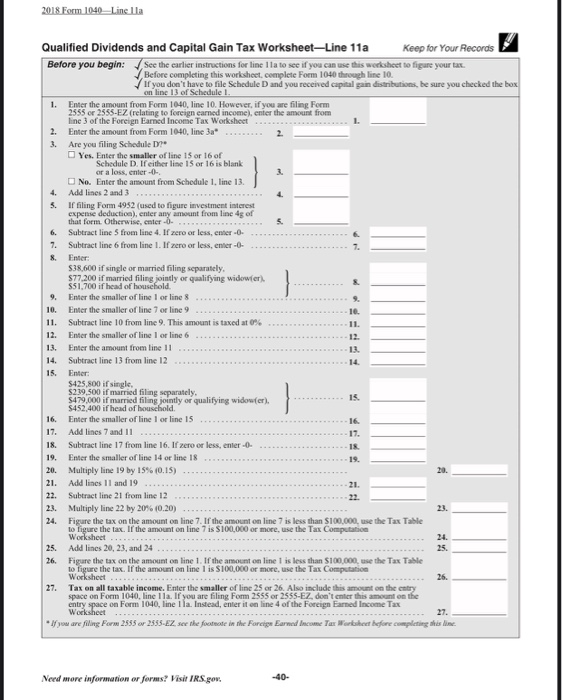

› forms › 20202020 S Corporation Tax Booklet | FTB.ca.gov - California Line 4 – Net capital gain. Enter on this line any net capital gain subject to the 1.5% tax rate (3.5% for financial S corporations) shown on Schedule D (100S), Section B, line 10, and any gains subject to the 8.84% tax rate (10.84% for financial S corporations) shown on Schedule D (100S), Section A, line 13. PDF Page 40 of 117 - IRS tax forms Qualified Dividends and Capital Gain Tax Worksheet—Line 11a. ... complete Form 1040 through line 10. If you don't have to file Schedule D and you received capital gain distributions, be sure you checked the box ... enter the amount from line 3 of the Foreign Earned Income Tax Worksheet .....1. 2. Enter the amount from Form 1040, line 3a ... Use Excel to File 2015 Form 1040 and Related Schedules Form 8962: Premium Tax Credit (PTC) The spreadsheet also includes several worksheets: Schedule D Worksheet; Line 10: State and Local Tax Refund Worksheet; Lines 16a and 16b: Simplified Method Worksheet; Lines 20a and 20b: Social Security Benefits Worksheet; Line 32: IRA Deduction Worksheet; Line 44: Qualified Dividends and Capital Gain Tax ... PDF 2015 Form 8615 - TaxFormFinder If the Qualified Dividends and Capital Gain Tax Worksheet, Schedule D Tax Worksheet, or Schedule J (Form 1040) is used to figure the tax, check here . . . . . . . . . 9 10 Enter the parent's tax from Form 1040, line 44; Form 1040A, line 28, minus any alternative

› taxes › capital-gains-tax-rates2021-2022 Capital Gains Tax Rates & Calculator - NerdWallet Aug 10, 2022 · In 2021 and 2022, the capital gains tax rate is 0%, 15% or 20% on most assets held for longer than a year. Capital gains taxes on assets held for a year or less correspond to ordinary income tax ...

PDF and Losses Capital Gains - IRS tax forms To report a gain or loss from a partnership, S corporation, estate or trust, To report capital gain distributions not reported directly on Form 1040, line 13 (or effectively connected capital gain distributions not reported directly on Form 1040NR, line 14), and To report a capital loss carryover from 2014 to 2015. Additional information.

Qualified Dividends and Capital Gains Worksheet - StuDocu Qualified Dividends and Capital Gain Tax Worksheet—Line 12a Keep for Your Records. See the earlier instructions for line 12a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 or 1040-SR through line 11b.

0 Response to "43 2015 qualified dividends and capital gain tax worksheet"

Post a Comment