43 non cash charitable contributions worksheet

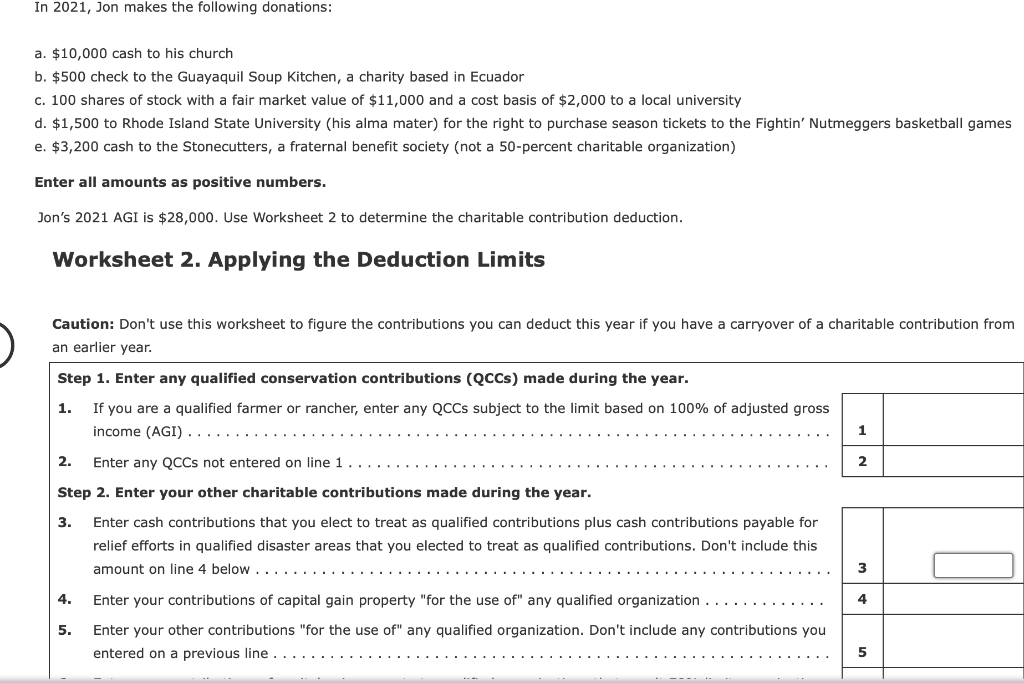

Publication 526 (2021), Charitable Contributions - IRS tax forms Part that is a charitable contribution. Step 1. Step 2. Step 3. Penalty 20% penalty. 40% penalty. Time of making contribution. Checks. Text message. Credit card. Pay-by-phone account. Stock certificate. Promissory note. Option. Borrowed funds. Conditional gift. Limits on Deductions Out-of-pocket expenses. Limits Exception. Carryover rule. Publication 970 (2021), Tax Benefits for Education | Internal … Cash in savings bonds for education costs without having to pay tax on the interest; ... You can set up and make contributions to an IRA if you receive taxable compensation. A scholarship or fellowship grant is generally taxable compensation only if it is shown in box 1 of your Form W-2, Wage and Tax Statement. However, for tax years beginning after 2019, certain non-tuition …

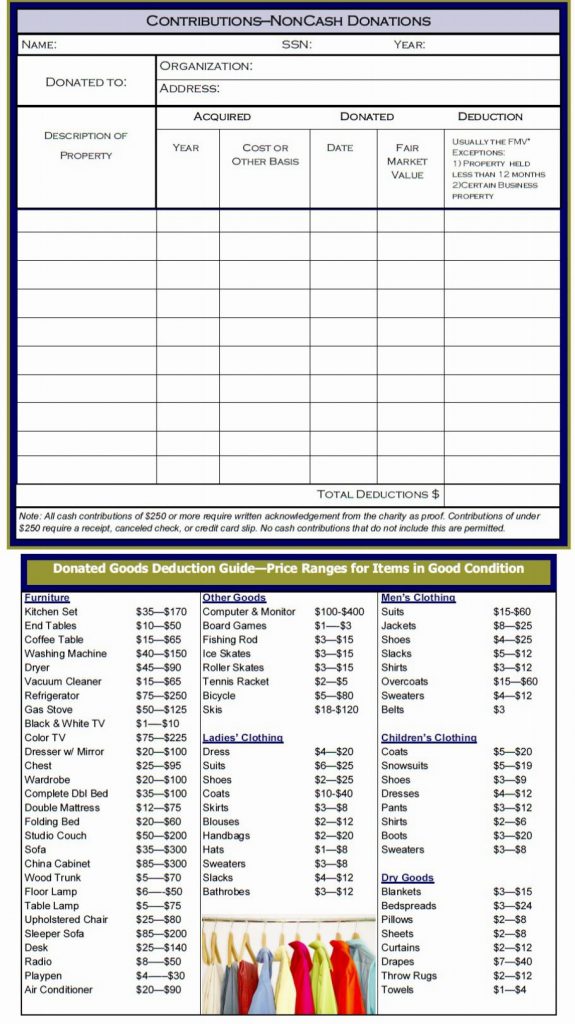

PDF Non-Cash Charitable Contribution Worksheet Use One Worksheet per ... Non-Cash Charitable Contribution Worksheet The following tables are estimates only. Actual FMV could vary significantly. ... Non-cash Contributions, updated 1-2-2015 Item Qty Amount Qty Amount Subtotal Excellent Condition Average Condition End Table 35.00 x = 7.00 x = Floor Lamp 35.50 x = 8.00 x = Folding Bed 60.00 x = 20.00 x =

Non cash charitable contributions worksheet

Claiming Parents as Dependents | H&R Block There is no tuition fee for the H&R Block Income Tax Course; however, you may be required to purchase course materials, which may be non-refundable. State restrictions may apply. The Income Tax Course consists of 62 hours of instruction at the federal level, 68 hours of instruction in Maryland, 80 hours of instruction in California, and 81 hours of instruction in Oregon. … XLSX ATS Advisors - Certified Public Accountants in Plymouth, Michigan - ATS ... non cash charitable contributions / donations worksheet better than good what is your original cost based on reciepts, or your best estimate, of the items donated? the intent of this worksheet is to summarize your non-cash chartable contributions for the purpose of tax preparation and reporting. you the taxpayer, are responsible for maintaining ... About Form 8283, Noncash Charitable Contributions About Form 8283, Noncash Charitable Contributions Individuals, partnerships, and corporations file Form 8283 to report information about noncash charitable contributions when the amount of their deduction for all noncash gifts is more than $500. Current Revision Form 8283 PDF Instructions for Form 8283 (Print Version) PDF Recent Developments

Non cash charitable contributions worksheet. Charitable Contribution Worksheet | STAC Accounting Charitable Contribution Worksheet. Karen. December 20, 2017. Reporting Non Cash Charitable Donations can be extremely beneficial to your bottom line tax liability. Although, pulling it all together can also be painfully arduous. I am providing access to a worksheet built in excel. Download it and open in your 'sheets' app (excel, numbers ... Noncash charitable deductions worksheet. - Woodlynn Tax North 1, NON CASH CHARITABLE CONTRIBUTIONS / DONATIONS WORKSHEET. 2, TAXPAYERS NAME(S):, Insert Tax Year ===>. 3, ENTITY TO WHOM DONATED: Total of Donated Items. non cash charitable contributions/donations worksheet 2007-2022 - Fill ... Stick to these simple actions to get non cash charitable contributions/donations worksheet ready for sending: Get the document you require in the collection of legal forms. Open the template in the online editing tool. Read through the recommendations to discover which details you must give. Click the fillable fields and put the requested data. Non Cash Charitable Donations Worksheets - K12 Workbook *Click on Open button to open and print to worksheet. 1. NON-CASH CHARITABLE CONTRIBUTIONS / DONATIONS WORKSHEET 2. The Salvation Army Valuation Guide for Donated Items ... 3. Thrift Store Valuation Guide 4. NON-CASH DONATION WORKSHEET (Based on Salvation Army ... 5. Anderson Financial Services 6. FAIR MARKET VALUE GUIDE FOR USED ITEMS

Forms & Applications | Charles Schwab Schwab Charitable is the name used for the combined programs and services of Schwab Charitable Fund, an independent nonprofit organization. Schwab Charitable Fund has entered into service agreements with certain affiliates of The Charles Schwab Corporation. 2021 Publication 526 - IRS tax forms cash contributions you made for relief efforts for 2019 and 2020 disasters are not subject to the 60% limit for cash contributions. See Qualified contributions for relief efforts for 2018 and 2019 disasters, later. Virginia Beach Strong Act. A special rule ap-plies to cash contributions made on or after May 31, 2019, and before June 1, 2021 ... PDF NON-CASH DONATION WORKSHEET (Based on Salvation Army average prices for ... NON-CASH DONATION WORKSHEET (Based on Salvation Army average prices for items in Good Condition) DONATED TO: DONATION DATE: MISCELLANEOUS LOW HIGH AVG QTY AMOUNT VALUE Adding Machines 24.00 90.00 57.00 Christmas Trees 18.00 60.00 39.00 Broiler Ovens 18.00 30.00 24.00 Copier 120.00 240.00 180.00 SEP IRA - Simplified Employee Pension Plan | Fidelity Earnings are tax-deferred and contributions are tax-deductible. Who contributes: Funded by employer contributions. Contribution amounts: Must be made by the employer and can vary each year between 0% and 25% of compensation (maximum $58,000 for 2021 and $61,000 for 2022). Each eligible employee must receive the same percentage. Withdrawals: 10% early withdrawal …

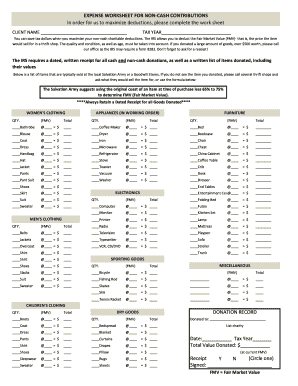

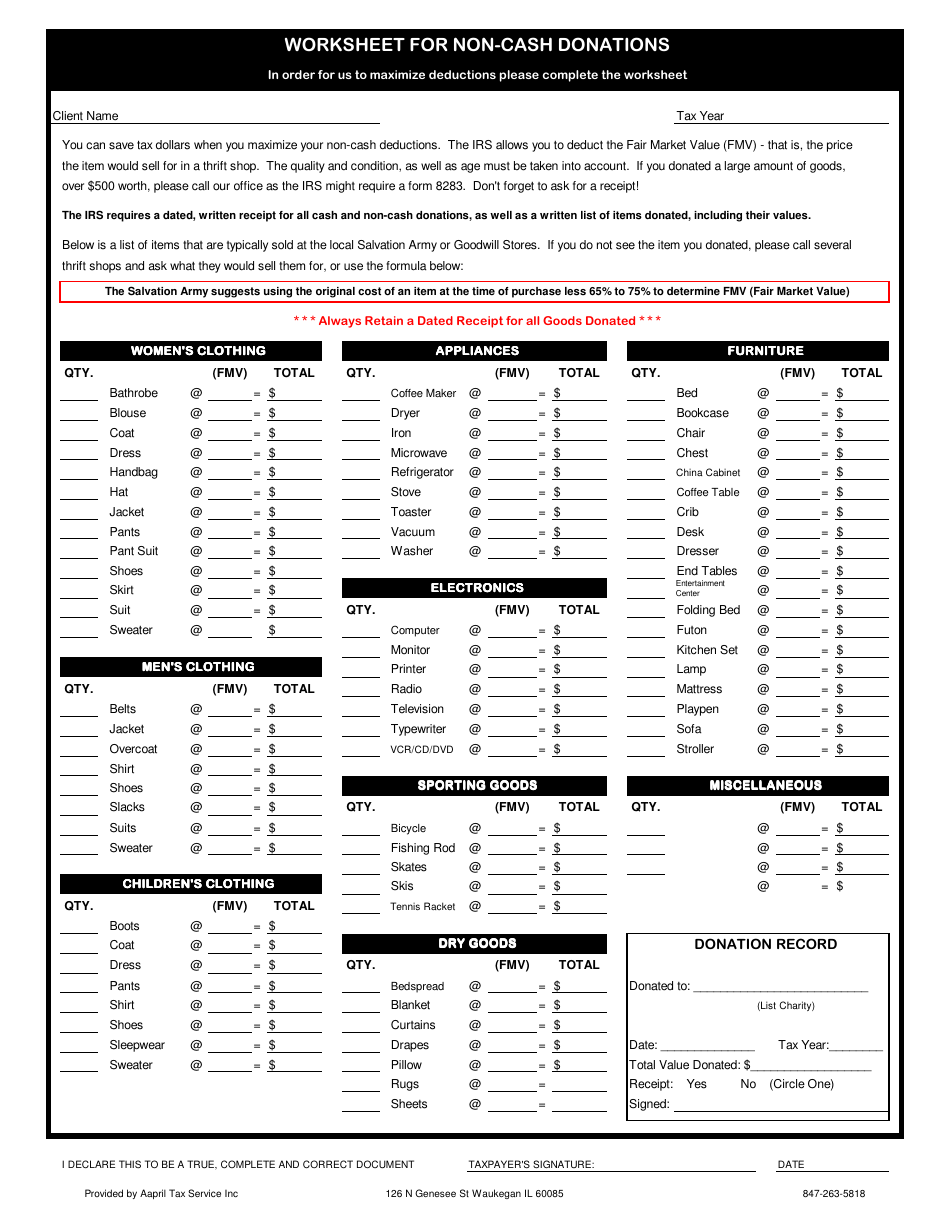

EXPENSE WORKSHEET FOR NON-CASH CONTRIBUTIONS - US Legal Forms Quickly generate a EXPENSE WORKSHEET FOR NON-CASH CONTRIBUTIONS without having to involve experts. We already have over 3 million users making the most of our rich collection of legal documents. ... Mar 20, 2020 — can make deductible charitable contributions and the types of... Learn more Charitable Giving Budget Worksheet. Charitable Giving ... Tax Deductions - ItsDeductible Existing Customers. Sign In. New Customers. Create New Account. Your account allows you to access your information year-round to add or edit your deductions. PDF Non-cash Charitable Contributions / Donations Worksheet Insert Date Given ===> Note: This worksheet is provided as a convenience and aid in calculating most common non-cash charitable donations. The source information used is from a Salvation Army "Valuation Guide" published several years ago and updated for assumed inflation. PDF Non-Cash Charitable Contributions Worksheet - LB Tax Services Missing Information: Non-Cash Charitable Contributions Worksheet Name. Home Telephone: Work Telephone: Tax Year: 2016 Cell: The following is a guideline for valuation of non-cash charitable contributions. When valuing items, take into consideration the condition of the items. If the value of the donated items is $250 or more to one charity in

Non-cash charitable contributions. You gave your clothes to charity. Non-cash charitable contributions. ... Most audited taxpayers lose some or all non-cash contributions due to poor ... Use a worksheet to value the items.

Tax Guide for Churches & Religious Organizations - IRS tax forms search for organizations that are eligible to receive tax-deductible charitable contributions. Note that not every organization that is eligible to receive tax-deductible contributions is listed on Select Check. For example, churches that have not applied for recognition of tax-exempt status are not included in the publication. Only the parent

Donation value guide - Goodwill NNE Furniture should be in gently-used, non-broken condition. Fabric should be free of stains and holes. Coffee Table. $15 – $100. Dresser. $20 – $80. End Table. $10 – $75. Kitchen Set. $35 – $135. Lamp, Floor. $8 – $34. Lamp, Table. $3 – $20. Sofa. $40 – $395. Stuffed Chair. $10 – $75. Computer Equipment. Computer equipment of any condition can be donated to Goodwill. …

XLS Noncash charitable deductions worksheet. NON CASH CHARITABLE CONTRIBUTIONS / DONATIONS WORKSHEET. Insert Tax Year ===> Insert Date Given ===> ENTER ITEMS NOT PROVIDED FOR IN THE ABOVE CATEGORIES. SET YOUR OWN VALUE. WHAT IS YOUR ORIGINAL COST BASED ON RECIEPTS, OR YOUR BEST ESTIMATE, OF THE ITEMS DONATED? Charity's Address Blouse Coats Dresses Evening dresses Handbags WOMEN's CLOTHING

XLS Noncash charitable deductions worksheet. - Lake Stevens Tax Service NON CASH CHARITABLE CONTRIBUTIONS / DONATIONS WORKSHEET. TAXPAYERS NAME(S): Insert Tax Year ===> ENTITY TO WHOM DONATED: Insert Date Given ===> Note: This worksheet is provided as a convenience and aide in calculating most common non cash charitable donations. The source

NON-CASH DONATION WORKSHEET - US Legal Forms Ensure the details you fill in NON-CASH DONATION WORKSHEET is updated and accurate. Add the date to the record with the Date feature. ... Noncash Charitable Contributions applies to deduction claims totaling more than $500 for all contributed items. If a donor is claiming over $5,000 in contribution value, there is a section labeled Donee ...

Non Cash Charitable Contributions Worksheet 2021 - pdfFiller Fill Non Cash Charitable Contributions Worksheet 2021, Edit online. Sign, fax and printable from PC, iPad, tablet or mobile with pdfFiller ✓ Instantly.

Tax-Free Savings Account (TFSA), Guide for Individuals Is this guide for you? This guide is for individuals who have opened or who are considering opening a tax-free savings account (TFSA). It gives general information on this investment opportunity including who is eligible to open a TFSA, what the contribution limits are, possible tax situations, non-resident implications, transfers on marriage or relationship breakdown, what …

Charitable Organizations - Substantiating Noncash Contributions ... For more information, get Publication 561, Determining the Value of Donated Property PDF. Form 8283 For noncash donations over $5,000, the donor must attach Form 8283 to the tax return to support the charitable deduction. The donee must sign Part IV of Section B, Form 8283 unless publicly traded securities are donated.

Non Charitable Donations Worksheets - K12 Workbook *Click on Open button to open and print to worksheet. 1. NON-CASH CHARITABLE CONTRIBUTIONS / DONATIONS WORKSHEET 2. NON-CASH DONATION WORKSHEET (Based on Salvation Army ... 3. Non Cash Charitable Contribution 4. Charitable Donations Worksheets (Non Cash Contributions) 5. Tax e-form Non-Cash Charitable Contribution Worksheet

PDF NON-CASH CHARITABLE CONTRIBUTION WORKSHEET - Holberton Tax non-cash charitable contribution worksheet date _____ organization _____ address_____ the following tables are estimates only. actual fmv may vary significantly. women's clothing qty amount qty amount subtotal bathrobe 12.00 x = 9.00 x =

XLS Noncash charitable deductions worksheet. Note: This worksheet is provided as a convenience and aide in calculating most common non cash charitable donations. The source information used is from a Salvation Army "Valuation Guide" published several years ago and updated for assumed inflation. Although the Retain this worksheet with your receipts in your tax file.

Non Cash Charitable Contributions Worksheet - Excel Version For each noncash contribution, taxpayers are required to retain the following documents: a receipt from the charity, purchase price of the donated items, the ...

Fillable Non cash charitable contributions / donations worksheet Fill ... Jun 3, 2015 - Fill Donation Value Guide 2020 Excel Spreadsheet, Edit online. Sign, fax and printable from PC, iPad, tablet or mobile with pdfFiller ...

PDF 8283 Worksheet Non-Cash Charitable Contributions Date of contribution * Date aquired by donor (mo./year) * How acquired by donor * Donor's cost or adjusted basis Fair Market Value ... less, you do not have to complete these columns 8283 Worksheet - Noncash Charitable Contributions (for donated vehicle, enter VIN, year, make, model, condition & mileage - Form 1098-C required if over $500 ...

Instructions for Form 8283 (Rev. December 2021) - IRS 526, Charitable Contributions. Who Must File. You must file one or more Forms 8283 if the amount of your deduction for each noncash contribution is more ...

PDF Missing Information: Non-Cash Charitable Contributions Worksheet - HMS CPA Missing Information: Non-Cash Charitable Contributions Worksheet (pg 4) Prepared By: HMS CERTIFIED PUBLIC ACCOUNTANTS 09-24-2013 457 Lake Howell Rd. Maitland FL 32751 Tel: (407) 571-4080 Fax: (407) 571-4090 information@hmscpa.com Men's Clothing $$ Guideline Your Cost # Items Value Today Deduction Jackets 7.50 - 25.00 Overcoats 15.00 - 60.00

About Form 8283, Noncash Charitable Contributions About Form 8283, Noncash Charitable Contributions Individuals, partnerships, and corporations file Form 8283 to report information about noncash charitable contributions when the amount of their deduction for all noncash gifts is more than $500. Current Revision Form 8283 PDF Instructions for Form 8283 (Print Version) PDF Recent Developments

XLSX ATS Advisors - Certified Public Accountants in Plymouth, Michigan - ATS ... non cash charitable contributions / donations worksheet better than good what is your original cost based on reciepts, or your best estimate, of the items donated? the intent of this worksheet is to summarize your non-cash chartable contributions for the purpose of tax preparation and reporting. you the taxpayer, are responsible for maintaining ...

Claiming Parents as Dependents | H&R Block There is no tuition fee for the H&R Block Income Tax Course; however, you may be required to purchase course materials, which may be non-refundable. State restrictions may apply. The Income Tax Course consists of 62 hours of instruction at the federal level, 68 hours of instruction in Maryland, 80 hours of instruction in California, and 81 hours of instruction in Oregon. …

0 Response to "43 non cash charitable contributions worksheet"

Post a Comment