38 same day tax payment worksheet

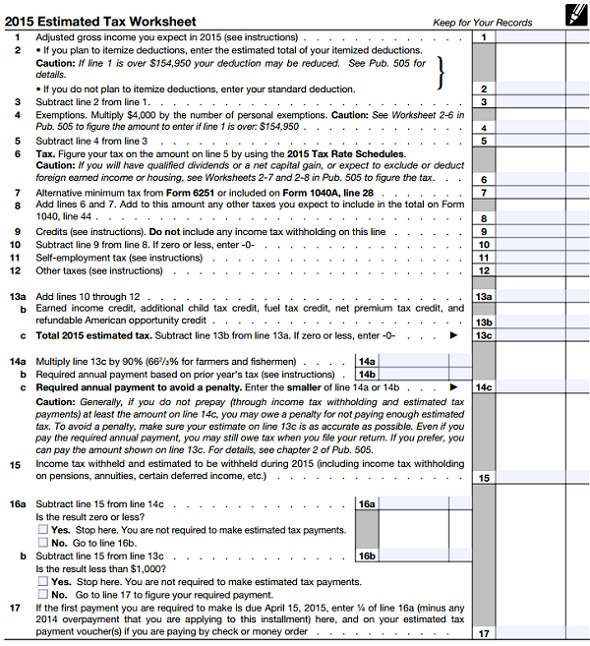

› instructions › i1040sd2021 Instructions for Schedule D (2021) | Internal Revenue ... If the amount on line 1 is less than $100,000, use the Tax Table to figure the tax. If the amount on line 1 is $100,000 or more, use the Tax Computation Worksheet: 46. _____ 47. Tax on all taxable income (including capital gains and qualified dividends). Enter the smaller of line 45 or line 46. Also, include this amount on Form 1040, 1040-SR ... FINANCIAL INSTITUTION HANDBOOK - Bureau of the Fiscal Service Federal Tax Collection Service (same-day wire). International Tax Payments. Trusted Partner Interface. IRS Tax Forms and Tables. Same-Day Taxpayer Worksheet.

› businesses › small-businesses-selfFrequently Asked Questions on Gift Taxes | Internal Revenue ... Oct 24, 2022 · If you have need assistance with using EFTPS contact EFTPS Tax Payment Customer Service at 800-555-4477 (Businesses) or 800-316-6541 (Individuals). Same-Day Wire Payment. What you need to know about making a same day wire payment: You do not need to enroll to make a same-day wire payment, and no PIN is needed.

Same day tax payment worksheet

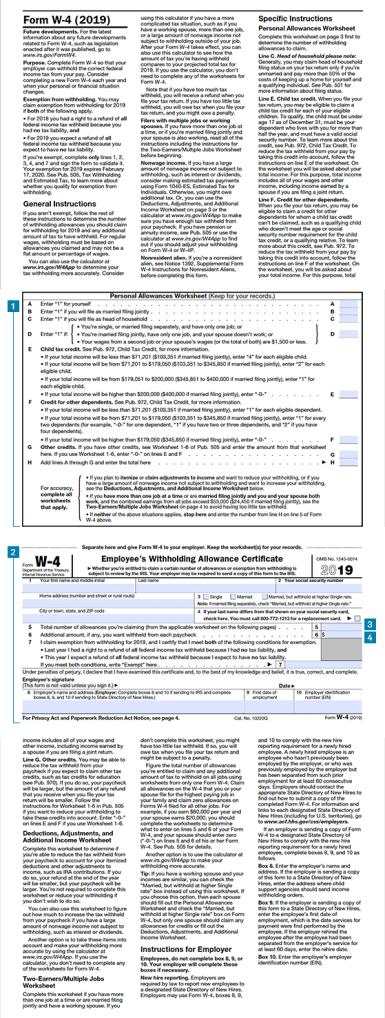

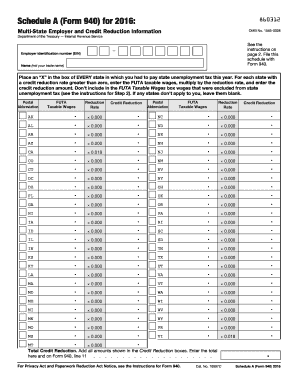

INSTRUCTIONS FOR TAX PAYMENT WORKSHEET APPLICATION ... Line 2 – Estimated tax payments Enter the total amount of Maryland estimated ... tax credits from Form 500CR or 502S or tax paid on the corporation's behalf. EFTPS Same Day Payment Wire Instructions SAME-DAY TAXPAYER WORKSHEET. To arrange an electronic same-day federal tax payment, complete this form and present it at your financial institution. › payments › same-day-wire-federal-taxSame-Day Wire Federal Tax Payments | Internal Revenue Service Jan 12, 2022 · Download the Same-Day Taxpayer Worksheet PDF. Complete it and take it to your financial institution. If you are paying for more than one tax form or tax period, complete a separate worksheet for each payment. Financial institutions can refer to the Financial Institution Handbook PDF for help with formatting and processing information.

Same day tax payment worksheet. eftps worksheet: Fill out & sign online - DocHub fillable same day taxpayer worksheet. same-day eftps payment irs tax type codes ... › publications › p17Publication 17 (2021), Your Federal Income Tax | Internal ... View the amount you owe and a breakdown by tax year. See payment plan details or apply for a new payment plan. Make a payment, view 5 years of payment history and any pending or scheduled payments. Access your tax records, including key data from your most recent tax return, your economic impact payment amounts, and transcripts. › businesses › small-businesses-selfFrequently Asked Questions on Estate Taxes - IRS tax forms Download and complete page 1 of the Same-Day Taxpayer Worksheet, and provide pages 1 and 2 to your financial institution. When completing the Same-Day Taxpayer Worksheet PDF , you will need a two-digit year, a two-digit month, and a five-digit tax type code, depending on the type of payment you are making (use the table of codes listed below). SAME-DAY TAXPAYER WORKSHEET COMMON IRS TAX TYPES ... To arrange an electronic same-day federal tax payment, complete this form and present it at your financial institution. Please type or print clearly. 1 Total ...

same day taxpayer worksheet: Fill out & sign online | DocHub Got questions? · Can I still claim tax relief for working from home 2022? · Can I pay IRS directly from my bank account? · Can you get a one-time tax forgiveness? › publications › p946Publication 946 (2021), How To Depreciate Property Section 179 deduction dollar limits. For tax years beginning in 2022, the maximum section 179 expense deduction is $1,080,000. This limit is reduced by the amount by which the cost of section 179 property placed in service during the tax year exceeds $2,700,000.Also, the maximum section 179 expense deduction for sport utility vehicles placed in service in tax years beginning in 2022 is $27,000. download.eftps.com › SameDayPaymentWorksheetCOMMON IRS TAX TYPES AND SUBTYPES - EFTPS SAME-DAY TAXPAYER WORKSHEET To arrange an electronic same-day federal tax payment, complete this form and present it at your financial institution. Please type or print clearly. 1 Total tax payment: (Include interest and penalty if applicable) 2 Taxpayer identification number: 3 Taxpayer name control: (the first four letters of your business ... Tax Payment Options for Foreign Individuals and Businesses ... To complete a wire transfer the client will need the following information: A completed Same-Day Taxpayer Worksheet; IRS account number – 20092900IRS (optional).

Same Day Taxpayer Worksheet Form - Fill Out and Sign Printable ... Send filled & signed same day payment worksheet irs or save ... Tips on how to complete the SAME-DAY TAXPAYER WORKSHEET COMMON IRS TAX TYPES . › payments › same-day-wire-federal-taxSame-Day Wire Federal Tax Payments | Internal Revenue Service Jan 12, 2022 · Download the Same-Day Taxpayer Worksheet PDF. Complete it and take it to your financial institution. If you are paying for more than one tax form or tax period, complete a separate worksheet for each payment. Financial institutions can refer to the Financial Institution Handbook PDF for help with formatting and processing information. EFTPS Same Day Payment Wire Instructions SAME-DAY TAXPAYER WORKSHEET. To arrange an electronic same-day federal tax payment, complete this form and present it at your financial institution. INSTRUCTIONS FOR TAX PAYMENT WORKSHEET APPLICATION ... Line 2 – Estimated tax payments Enter the total amount of Maryland estimated ... tax credits from Form 500CR or 502S or tax paid on the corporation's behalf.

:max_bytes(150000):strip_icc()/Form1041screenshot-69d9b8c83e054defaa28caefc685c525.png)

0 Response to "38 same day tax payment worksheet"

Post a Comment