44 1031 exchange calculation worksheet

1031 exchange worksheet 2020 33 Capital Gains Tax Worksheet - Worksheet Source 2021 dontyou79534.blogspot.com. gains tax calculate. 1031 Exchange Worksheet And 2nd Grade Health Worksheets Nara Colors | Tagua . 1031 tagua. Foreign Exchange Rate Project Class 12 . 1031 Exchange Real Estate [Ultimate Guide] | Real Estate, Exchange XLS 1031 Corporation Exchange Professionals - Qualified Intermediary for ... We have developed the enclosed worksheets for use in calculating the information used to report 1031 Exchanges on Form 8824. We hope that this worksheet ...

PDF WorkSheets & Forms - 1031 Exchange Experts WorkSheet #s 2 & 3 - Calculation of Exchange Expenses - Information About Your Old Property WorkSheet #s 4, 5 & 6 ... Line 26-38 Not applicable to 1031 exchanges WorkSheet #10 for Buy-Down only. WorkSheet #10 - Calculation of Recapture for Form 8824, Line 21

1031 exchange calculation worksheet

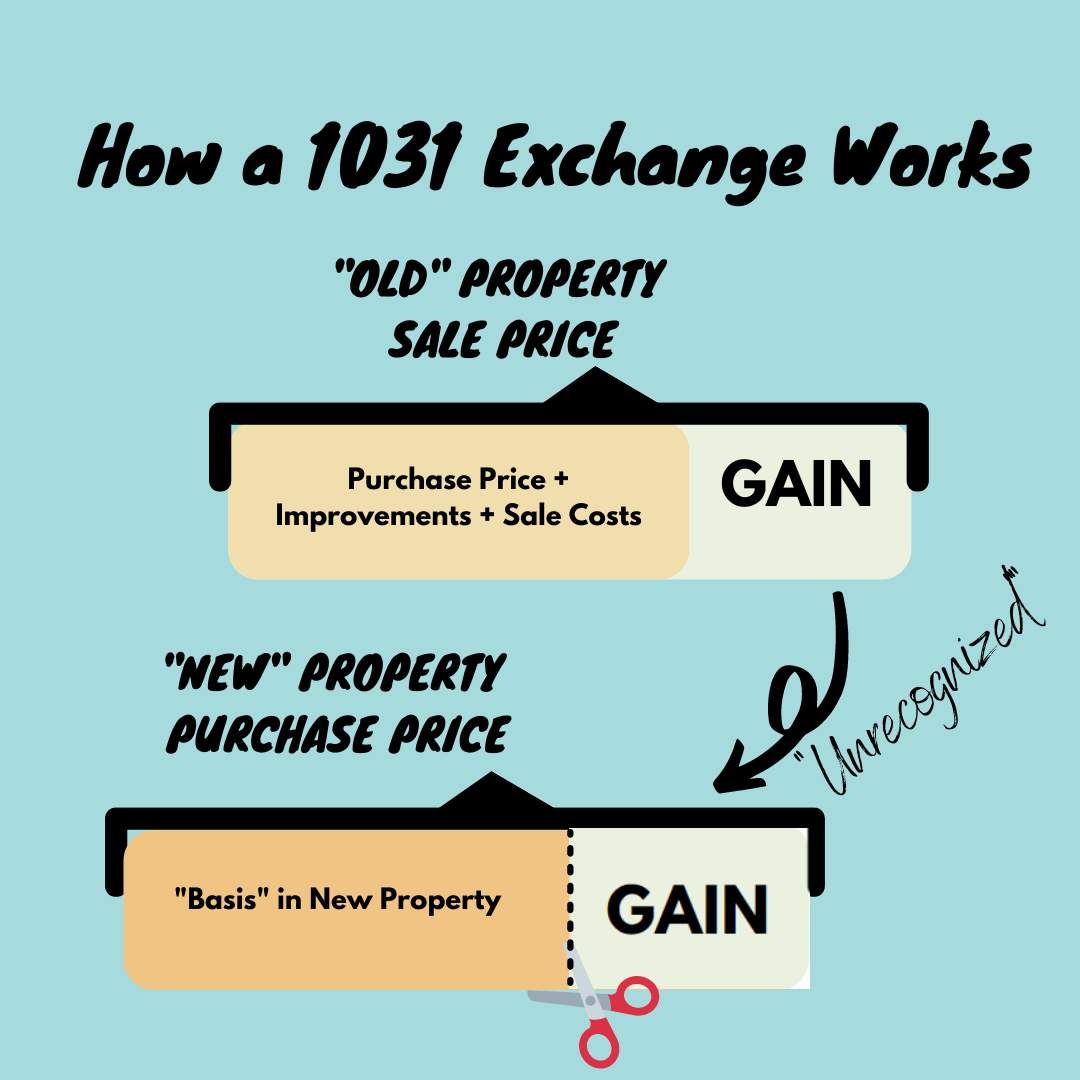

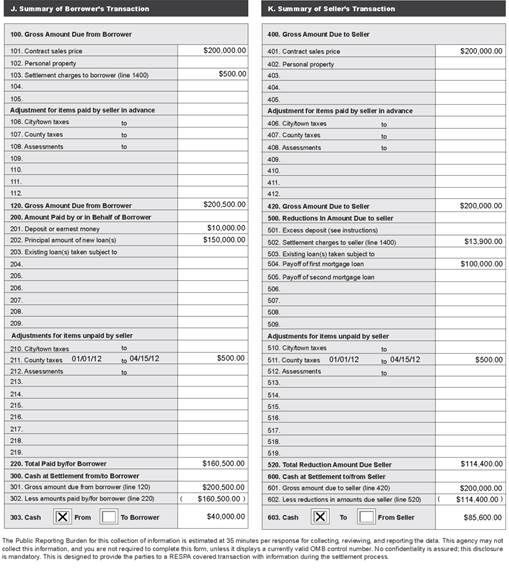

PDF Like-Kind Exchanges Under IRC Section 1031 - IRS tax forms type of Section 1031 exchange is a simultaneous swap of one property for another. Deferred exchanges are more complex but allow flexibility. They allow you to dispose of property and subsequently acquire one or more other like-kind replacement properties. To qualify as a Section 1031 exchange, a deferred exchange must be distinguished from the case 1031 Exchange Calculator | Calculate Your Capital Gains If you need immediate assistance, call Bill at (571) 327-1031 Capital Gains Calculator Realty Exchange Corporation has created this simple Capital Gain Analysis Form and Calculator to estimate the tax impact if a property is sold and not exchanged, and to calculate the reinvestment requirements for a tax-free exchange. 1031 Tool Kit - TM 1031 Exchange Purchase 1031 Exchange Books Suggested Books on 1031 Exchanges Get a Free Property List & Consultation For specific questions about 1031 Exchanges call 1-877-486-1031 or click here to EMail. Informed Decisions Make the Best Investments Thousands of Properties Rated Each Month. Only the Worthiest Investments Make it Into Your Vault.

1031 exchange calculation worksheet. PDF WorkSheets & Forms - 1031 Exchange Experts WorkSheet #1 - Calculation of Basis WorkSheet #2 & 3 - Calculation of Exchange Expenses - Information About Your Old Property WorkSheet #4, 5 & 6 ... Line 26-38 Not applicable to 1031 exchanges WorkSheet #10 for Buy-Down only. WorkSheet #10 - Calculation of Recapture for Form 8824, Line 21 1031 Like Kind Exchange Calculator - Excel Worksheet That's why we're giving you the same 1031 exchange calculator our exchange experts use to help investors find smarter investments. Requires only 10 inputs into a simple Excel spreadsheet. Calculate the taxes you can defer when selling a property Includes state taxes and depreciation recapture Immediately download the 1031 exchange calculator Form 8824 - 1031 Corporation Exchange Professionals We have developed the enclosed worksheets for use in calculating the information used to report 1031 Exchanges on Form 8824 and herein enclose a copy. We hope that this worksheet will help with these reporting issues that present difficulties in reporting 1031 Exchanges. All Related 1031 Exchange Calculation Images| Qstion.co "Search Results from "1031 Exchange Calculation" that we found in this site. Check all the posts below. Or use another query like : coloring pages, paint colors ideas, hairstyle ideas, " 1031 exchange worksheet — 11 Oct 2022. 1031 Exchange Worksheet Excel. The 1031 exchange worksheet is often used in financial and accounting applications ...

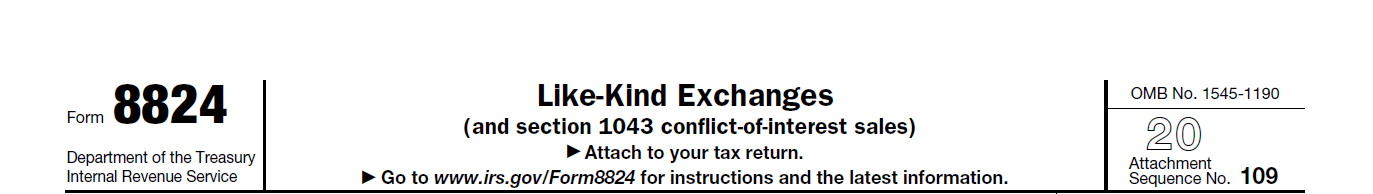

Like Kind Exchange Calculator - CCH Site Builder If you exchange either business or investment property that is of the same nature or character, the IRS won't recognize it as a gain or loss. This calculator is ... PDF FORM 8824 WORKSHEET Worksheet 1 Tax Deferred Exchanges Under IRC § 1031 Before preparing Worksheet 1, read the attached Instructions for Preparation Of Form 8824 Worksheets. Then, prepare Worksheet 1 after you have finished the preparation of worksheets 2 and 3. _____ 1031 Corporation - Longmont/Boulder, CO 303-402-1031 (Local) 888-367-1031 (Toll Free) How Do You Calculate Basis for a 1031 Exchange? These calculations are being done on the property being sold, also called the relinquished property. 1.) Add closing costs to the purchase price. + $2,000 = $302,000 Any loan costs are not included in the basis calculation. 2.) Add any capital improvements such as replacing the roof, driveway, or a bathroom renovation. PDF Reporting the Like-Kind Exchange of Real Estate Using IRS Form 8824 - 1031 The following example is used throughout this workbook, and a completed Worksheet using this example is included. EXAMPLE: To show the use of the Worksheet, we will use the following example of an exchange transaction. In this example, the exchanger will buy down in value and receive excess exchange escrow funds. 1. Basis.

PDF Calculation Worksheet - 1031 Corporation Exchange Professionals LIKE-KIND EXCHANGE REPLACEMENT PROPERTY ANALYSIS OF TAX BASIS FOR DEPRECIATION UNDER REG. 1.168(i)-6T ... Phone: (888) 367-1031 Fax: (303) 684-6899 1707 North Main Street, Longmont, CO 80501. Corporation Exchange Professionals . Title: MACRS Like-Kind Basis Calculation Worksheet.xls Author: kdlacert Created Date: Instructions for Form 8824 (2021) | Internal Revenue Service Fill out only lines 15 through 25 of each worksheet Form 8824. On the worksheet Form 8824 for the part of the property used as a home, follow steps (1) through (3) above, except that instead of following step (2), enter the amount from line 19 on line 20. LIKE-KIND EXCHANGE WORKSHEET LIKE-KIND EXCHANGE WORKSHEET. A. Realized Gain. 1. + FMV of all property received. 2. + Total cash received. 3. + Liabilities transferred. 1031 Exchange Calculator - The 1031 Investor This 1031 Exchange calculator will estimate the taxable impact of your proposed sale and purchase. To pay no tax when executing a 1031 Exchange, you must purchase at least as much as you sell (Net Sale) AND you must use all of the cash received (Net Cash Received).

PDF WorkSheets & Forms - 1031 Exchange Experts WorkSheets 2 & 3 - Calculation of Exchange Expenses - Information About Your Old Property WorkSheets 4, 5 & 6 ... WorkSheet #8 - Calculation of Basis of New Property for Form 8824, Line 18 ... Lines 26-38 Not applicable to 1031 exchanges WorkSheet #10 for Buy-Down only. WorkSheet #10 - Calculation of Recapture for Form 8824, Line 21 ...

1031 Exchange Calculator This 1031 Exchange calculator will estimate the taxable impact of your proposed sale and purchase. To pay no tax when executing a 1031 Exchange, ...

1031 Exchange Analysis Calculator - Inland Investments 1031 Exchange Analysis Calculator. This calculator is designed to assist when exchanging into multiple real estate options with potentially different ...

1031 Exchange Calculator - cchwebsites.com This 1031 Exchange calculator will estimate the taxable impact of your proposed sale and purchase. To pay no tax when executing a 1031 Exchange, you must purchase at least as much as you sell (Net Sale) AND you must use all of the cash received (Net Cash Received).

1031 Exchange Calculator | Estimate Tax Savings & Reinvestment The 1031 Exchange Calculator above provides a simple estimation of potential taxes related to the sale of investment property and net sales proceeds available for reinvestment. These calculations are estimates for the purpose of demonstration. Many factors are involved in calculating taxes, including factors unique to each taxpayer.

1031 Exchange Calculator - Penn's Grant Realty Corporation We'll be happy to help you with calculating your 1031 Exchange, ... In no way should the completion of this worksheet be construed as tax advice or used in ...

1031 Exchange Worksheet 2019 - Fill Online, Printable, Fillable, Blank Fill 1031 Exchange Worksheet 2019, Edit online. Sign, fax and printable from PC, iPad, tablet or mobile with pdfFiller ✓ Instantly. Try Now!

IRC 1031 Like-Kind Exchange Calculator This calculator will help you to determine how much tax deferment you can realize by performing a 1031 tax exchange instead of a taxable sale. We also offer a 1031 deadline calculator. For your convenience we list current Boydton mortgage rates to help real estate investors estimate monthly loan payments & find local lenders. Calculator Rates

PDF WorkSheets & Forms - 1031 Exchange Experts WorkSheet #2 - Calculation of Exchange Expenses A. Exchange expenses from sale of Old Property Commissions $_____ Loan fees for seller _____ Title charges _____ ... Line 26-38 Not applicable to 1031 exchanges WorkSheet #10 for Buy-Down only. WorkSheet #10 - Calculation of Recapture for Form 8824, Line 21

1031 Tool Kit - TM 1031 Exchange Purchase 1031 Exchange Books Suggested Books on 1031 Exchanges Get a Free Property List & Consultation For specific questions about 1031 Exchanges call 1-877-486-1031 or click here to EMail. Informed Decisions Make the Best Investments Thousands of Properties Rated Each Month. Only the Worthiest Investments Make it Into Your Vault.

1031 Exchange Calculator | Calculate Your Capital Gains If you need immediate assistance, call Bill at (571) 327-1031 Capital Gains Calculator Realty Exchange Corporation has created this simple Capital Gain Analysis Form and Calculator to estimate the tax impact if a property is sold and not exchanged, and to calculate the reinvestment requirements for a tax-free exchange.

PDF Like-Kind Exchanges Under IRC Section 1031 - IRS tax forms type of Section 1031 exchange is a simultaneous swap of one property for another. Deferred exchanges are more complex but allow flexibility. They allow you to dispose of property and subsequently acquire one or more other like-kind replacement properties. To qualify as a Section 1031 exchange, a deferred exchange must be distinguished from the case

![2022 Rental Property Analysis Spreadsheet [Free Template]](https://wp-assets.stessa.com/wp-content/uploads/2021/06/13170845/Property_Analysis_Spreadsheet__Stessa_.png)

0 Response to "44 1031 exchange calculation worksheet"

Post a Comment