45 1023 ez eligibility worksheet

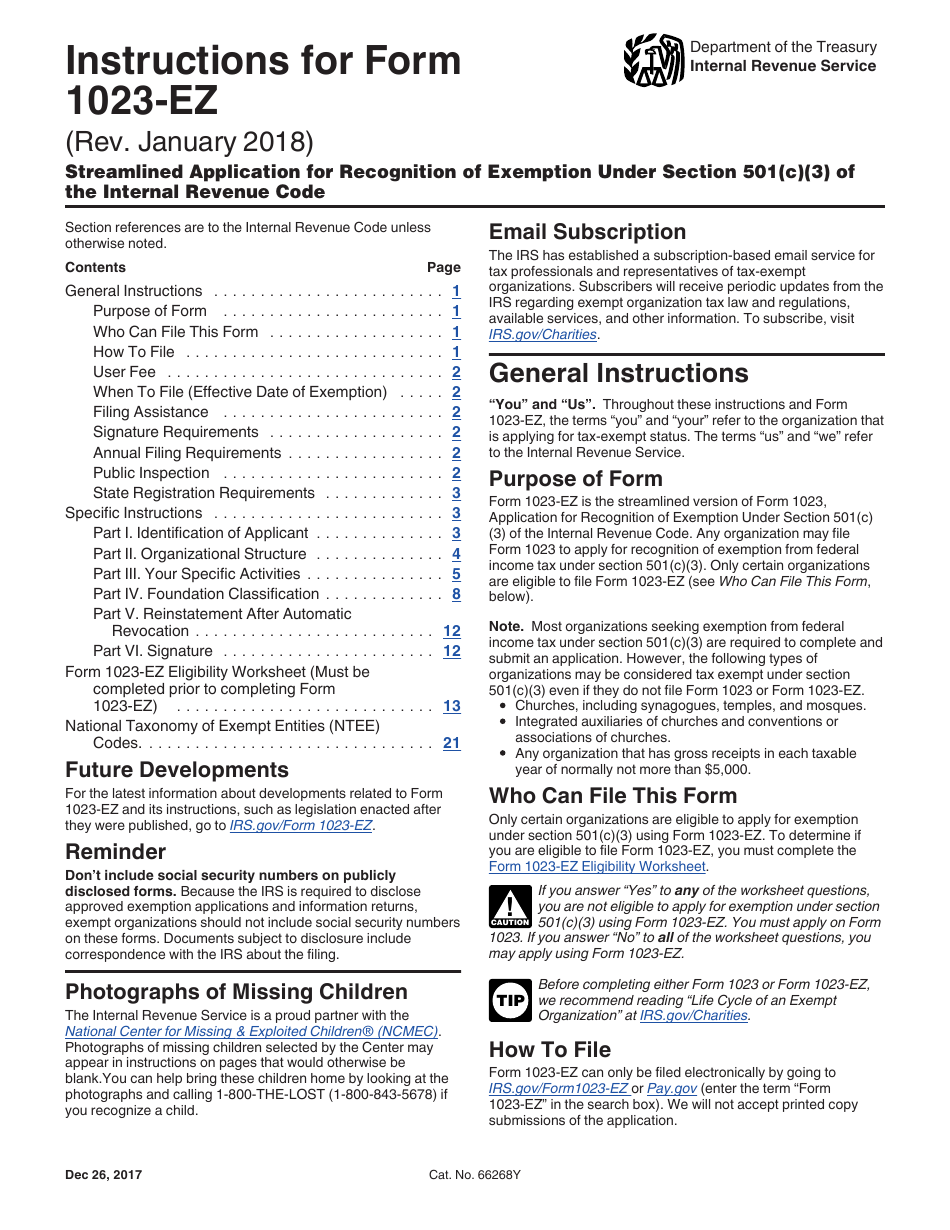

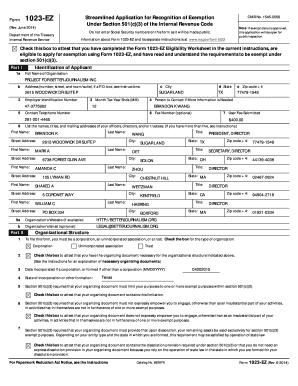

About Form 1023-EZ, Streamlined Application for Recognition ... To submit Form 1023-EZ, you must: Read the Instructions for Form 1023-EZ and complete its Eligibility Worksheet found at the end of the instructions. (If you are not eligible to file Form 1023-EZ, you can still file Form 1023.) If eligible to file Form 1023-EZ, register for an account on Pay.gov. Enter "1023-EZ" in the search box. Complete the ... Form 1023 Ez - Fill Out and Sign Printable PDF Template | signNow Have completed the Form 1023-EZ Eligibility Worksheet in the current instructions, are eligible to apply for exemption using Form 1023-EZ, and have read and understand the requirements to be exempt under section 501(c)(3). Part I 1a Identification of Applicant Full Name of Organization b Mailing Address (number, street, and room/suite).

Pay.gov - Application for Recognition of Exemption Under ... Oct 21, 2022 · You must complete the Form 1023-EZ Eligibility Worksheet in the Instructions for Form 1023-EZ to determine if you are eligible to file that form. If you are not eligible to file Form 1023-EZ, you must file Form 1023 to obtain recognition of exemption under Section 501(c)(3).

1023 ez eligibility worksheet

Form OMB No. 1545-0056 Under Section 501(c)(3) of the ... Check this box to attest that you have completed the Form 1023-EZ Eligibility Worksheet in the current instructions, are eligible to apply for exemption using Form 1023-EZ, and have read and understand the requirements to be exempt under section 501(c)(3). Part I Identification of Applicant 1a Full Name of Organization Instructions for Form 1023-EZ (01/2018) | Internal Revenue ... Dec 20, 2019 · Also see questions 12 through 14 on the Form 1023-EZ Eligibility Worksheet. If you are seeking recognition as a church, school, or hospital, you are not eligible to use Form 1023-EZ and should instead submit Form 1023 if you wish to obtain a determination letter from the IRS. Instructions for Form 1023-EZ (Rev. January 2018) - IRS tax forms Form 1023-EZ Eligibility Worksheet. If you answer “Yes” to any of the worksheet questions, you are not eligible to apply for exemption under section 501(c)(3) using Form 1023-EZ. You must apply on Form 1023. If you answer “No” to all of the worksheet questions, you may apply using Form 1023-EZ.

1023 ez eligibility worksheet. Pay.gov - Streamlined Application for Recognition of ... 2 days ago · Note: You must complete the Form 1023-EZ Eligibility Worksheet in the Instructions for Form 1023-EZ to determine if you are eligible to file Form 1023-EZ. If you are not eligible to file Form 1023-EZ, you must file Form 1023 to obtain recognition of exemption under Section 501(c)(3). Instructions for Form 1023-EZ (Rev. January 2018) - IRS tax forms Form 1023-EZ Eligibility Worksheet. If you answer “Yes” to any of the worksheet questions, you are not eligible to apply for exemption under section 501(c)(3) using Form 1023-EZ. You must apply on Form 1023. If you answer “No” to all of the worksheet questions, you may apply using Form 1023-EZ. Instructions for Form 1023-EZ (01/2018) | Internal Revenue ... Dec 20, 2019 · Also see questions 12 through 14 on the Form 1023-EZ Eligibility Worksheet. If you are seeking recognition as a church, school, or hospital, you are not eligible to use Form 1023-EZ and should instead submit Form 1023 if you wish to obtain a determination letter from the IRS. Form OMB No. 1545-0056 Under Section 501(c)(3) of the ... Check this box to attest that you have completed the Form 1023-EZ Eligibility Worksheet in the current instructions, are eligible to apply for exemption using Form 1023-EZ, and have read and understand the requirements to be exempt under section 501(c)(3). Part I Identification of Applicant 1a Full Name of Organization

0 Response to "45 1023 ez eligibility worksheet"

Post a Comment