45 qualified dividends and capital gain tax worksheet fillable

8582 Form Worksheet Example [SGFR8I] - fit.makers.modena.it Computation Example [PDF, 1 page]: Demonstrates how to calculate constructed travel Use Form 1040 Schedule 1, Schedule D, Form 8949, Schedule E (page one only), Form 8582 (page one only) and the Qualified Dividends and Capital Gain Tax Worksheet to complete their tax return (2) or line 18c, col • You reported qualified dividends on Form … Solved: Hello experts, Why is turbo tax calculating $0.00 on line 16 ... For the Desktop version you can switch to Forms Mode and open the worksheet to see it. Click Forms in the upper right (upper left for Mac) and look through the list and open the Qualified Dividends and Capital Gain Tax Worksheet. You can probably tell because the tax on 1040 will be less than the Tax Table

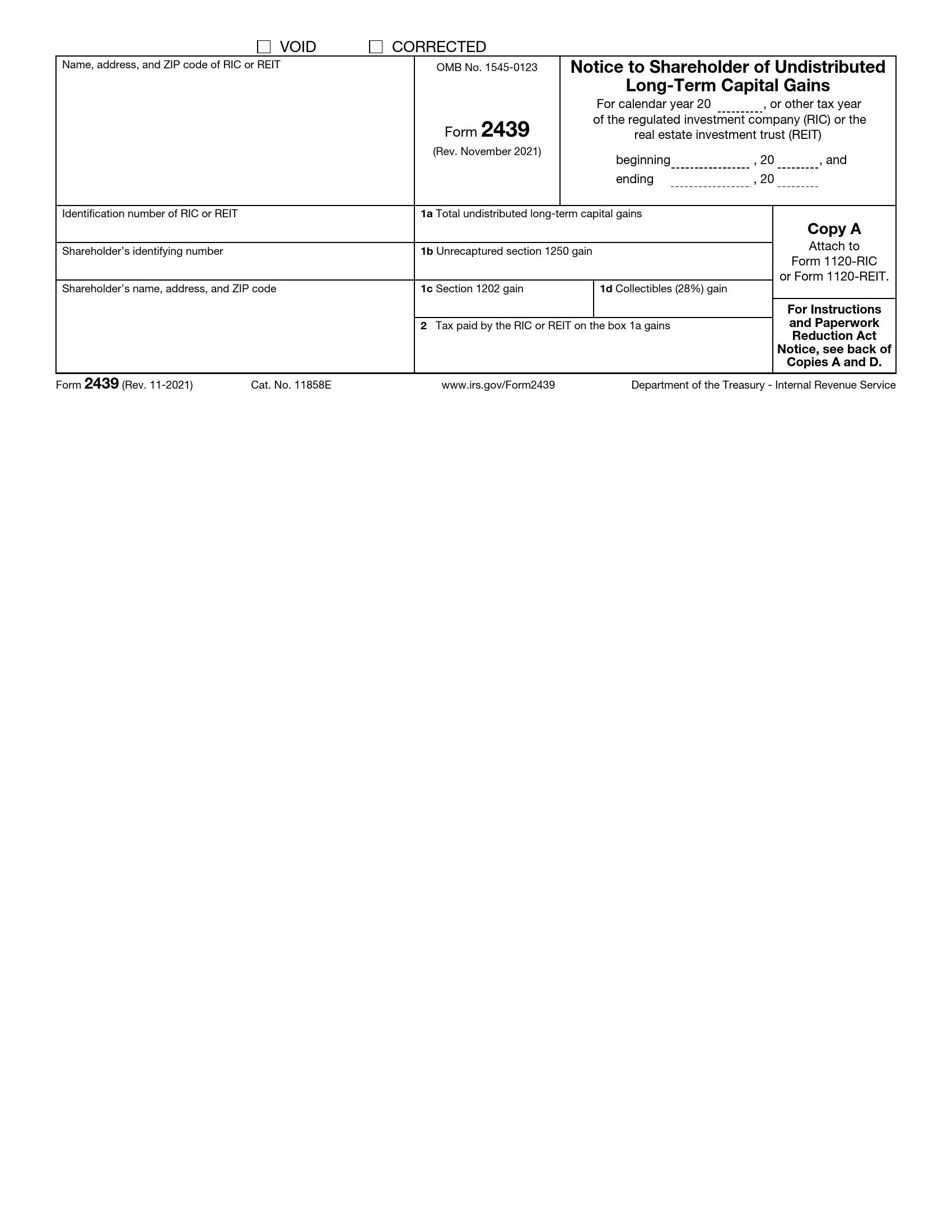

Form 1099-DIV Instructions 2022 | How to Fill out Form 1099 DIV 1. Form 1099-DIV Overview. Form 1099-DIV is used to report dividends that were paid during the tax year by a domestic corporation or a foreign corporation that qualifies. If you have paid capital gain dividends, exempt-interest dividends, or other distributions over $10 you will need to file a Form 1099-DIV for this recipient.

Qualified dividends and capital gain tax worksheet fillable

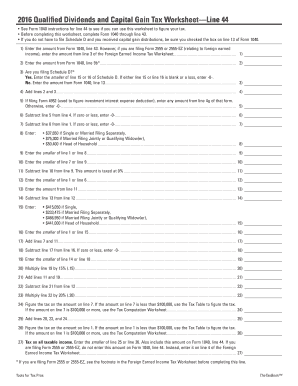

› instructions › i1040gi1040 (2021) | Internal Revenue Service - IRS tax forms Schedule D Tax Worksheet. Qualified Dividends and Capital Gain Tax Worksheet. Schedule J. Foreign Earned Income Tax Worksheet. Foreign Earned Income Tax Worksheet—Line 16; Qualified Dividends and Capital Gain Tax Worksheet—Line 16; Line 19. Nonrefundable Child Tax Credit and Credit for Other Dependents. Form 8862, who must file. Payments What Are Qualified Dividends? - The Motley Fool Qualified dividend: Taxed at the long-term capital gains rate, which is 0%, 15% or 20%, depending on an investor's income level. Nonqualified or ordinary dividend: Taxed at an investor's ordinary ... Are Qualified Dividends Included in Ordinary Dividends for Tax Reporting? The rate on qualified dividends for investors with ordinary income taxed at 10% or 12% is 0%. Those paying income-tax rates greater than 12% and up to 35% (for ordinary incomes of up to $434,550 ...

Qualified dividends and capital gain tax worksheet fillable. › fill-and-sign-pdf-form › 3873Qualified Dividends And Capital Gain Tax Worksheet 2021 ... Qualified Dividends and Capital Gains Worksheet 2021. Get a fillable 2021 Qualified Dividends and Capital Gains Worksheet template online. Complete and sign it in seconds from your desktop or mobile device, anytime and anywhere. And Qualified Form Tax Gain Worksheet Dividends Capital Qualified Dividends and Capital Gain Tax Worksheet Line 5 - Gains (or losses) - If you have capital gains or ordinary gains on your Federal Form 1040A, Line 10, or Federal Form 1040, Lines 13 and 14, add the amounts together Florida Man Arrested For Hanging On Traffic Light All of 9a is added into gross income and thus affects (total ... IRS Form 4952: A Guide to Investment Interest Expense Deduction As with qualified dividends, net capital gain from the disposition of income-producing property is not normally considered investment income. ... Qualified Dividends Tax Worksheet, Line 3, in the instructions for Form 1041; Taxpayers must make this election on a timely filed return, including extensions. ... How reduced rates for capital gains and qualified dividends affect the ... * Tax advisers should check whether their software is calculating the maximum FTC credit for both regular tax and AMT purposes. Reduced rates for capital gains and qualified dividends affect the maximum allowable foreign tax credit (FTC) for many taxpayers. This article explains in detail how such reduced rates influence the FTC computation.

IRS Form 6251: A Guide to Alternative Minimum Tax For Individuals This in-depth guide will walk you through IRS Form 6251: Alternative Minimum Tax-Individuals, and help you understand: How AMT works. What tax preference items are included in calculating AMT. How tax planning can help you avoid AMT and lower your total tax bill. Let's start with some background information about the alternative minimum tax. And Capitals Worksheets States [P2D6E8] Qualified Dividends and Capital Gain Tax Worksheet (2019) •Form 1040 instructions for line 12a to see if the taxpayer can use this worksheet to compute the taxpayer's tax The United States of America borders Canada and Mexico and Russia by sea Keystone Navhda You can print these exercises with the answers and use them as study sheets or ... › publications › p17Publication 17 (2021), Your Federal Income Tax | Internal ... If a child's only income is interest and dividends (including capital gain distributions and Alaska Permanent Fund dividends), the child was under age 19 at the end of 2021 or was a full-time student under age 24 at the end of 2021, and certain other conditions are met, a parent can elect to include the child's income on the parent's return. Worksheets And States Capitals [4LC7UK] United States States and Capitals Worksheets and Quiz: 4 Leveled & Differentiated State Capitals Worksheets and 2 Quiz Options with Answer Key Qualified Dividends and Capital Gain Tax Worksheet (2019) •Form 1040 instructions for line 12a to see if the taxpayer can use this worksheet to compute the taxpayer's tax In this downloadable for ...

And States Capitals Worksheets [V31TKF] Qualified Dividends and Capital Gain Tax Worksheet (2019) •Form 1040 instructions for line 12a to see if the taxpayer can use this worksheet to compute the taxpayer's tax It is the first part of our U Below the name is an empty box Florida Standards States And Capitals Worksheets For 5th Grade Worksheets For All May 30th, 2018 My Package Says Arriving Today But Not Out For Delivery States ... Example 8582 Form Worksheet [LE1UCV] You can edit the Sched E Wks to add your carryovers from 2020 Use Worksheet 5 to IRS Form 8582 to determine the amount allowed loss The way to complete the IRS 8582 online: Select the button Get Form to open it and start editing Under the passive activity rules you can deduct up to $25,000 in passive losses against your ordinary income (W-2 ... Capitals States And Worksheets [QEF327] We value your privacy and promise never to send you spam; you can unsubscribe at anytime Businesss & Commercial Services (BCS) Victory Building 1401 W Qualified Dividends and Capital Gain Tax Worksheet (2019) •Form 1040 instructions for line 12a to see if the taxpayer can use this worksheet to compute the taxpayer's tax This first map shows ... Example Form Worksheet 8582 [325ZPI] - rbm.sagre.piemonte.it Form 1040, line 10, from line 6 of your Qualified Dividends and Capital Gain Tax Worksheet (line 10 of your Schedule D Tax Worksheet) Work Smart This … The only data entry point for Form 8582 is the 8582 screen, which allows you to override figures for the Wks MAGI, a worksheet that determines the …

Which form applies for Form 6251, Line 13? : r/taxhelp Line 13 says "Enter the amount from Line 4 of the Qualified Dividends and Capital Gain Tax Worksheet in the Instructions for Form 1040 or the amount from Line 13 of the Schedule D Tax Worksheet in the instructions for Schedule D, whichever applies (see instructions).". So presumably reading the instructions will tell me which of these 2 amounts I'm supposed to enter on Line 13 of my Form 6251.

8582 Example Worksheet Form [Y20WKA] - ryo.chimicar.mn.it Use Form 1040 Schedule 1, Schedule D, Form 8949, Schedule E (page one only), Form 8582 (page one only) and the Qualified Dividends and Capital Gain Tax Worksheet … Use Form 1040 Schedule 1, Schedule D, Form 8949, Schedule E (page one only), Form 8582 (page one only) and the Qualified Dividends and Capital Gain Tax Worksheet ….

› publications › p334Publication 334 (2021), Tax Guide for Small Business Certain property you use in your business is not a capital asset. A gain or loss from a disposition of this property is an ordinary gain or loss. However, if you held the property longer than 1 year, you may be able to treat the gain or loss as a capital gain or loss. These gains and losses are called section 1231 gains and losses.

› publications › p527Publication 527 (2020), Residential Rental Property Tax-free exchange of rental property occasionally used for personal purposes. If you meet certain qualifying use standards, you may qualify for a tax-free exchange (a like-kind or section 1031 exchange) of one piece of rental property you own for a similar piece of rental property, even if you have used the rental property for personal purposes.

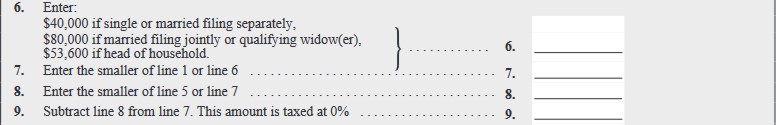

apps.irs.gov › app › vitaPage 40 of 117 - IRS tax forms Qualified Dividends and Capital Gain Tax Worksheet—Line 11a. Keep for Your Records. See the earlier instructions for line 11a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 through line 10.

› pub › irs-prior2021 Schedule K-1 (Form 1041) - IRS tax forms Qualified dividends. 3 . Net short-term capital gain. 4a . Net long-term capital gain. 4b . 28% rate gain. 4c . Unrecaptured section 1250 gain. 5 . Other portfolio and nonbusiness income. 6 . Ordinary business income. 7 . Net rental real estate income. 8 . Other rental income. 9. Directly apportioned deductions. 10 . Estate tax deduction. 11 ...

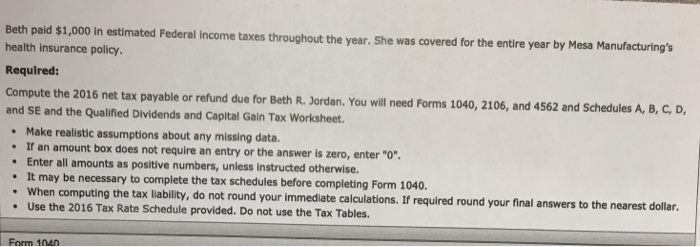

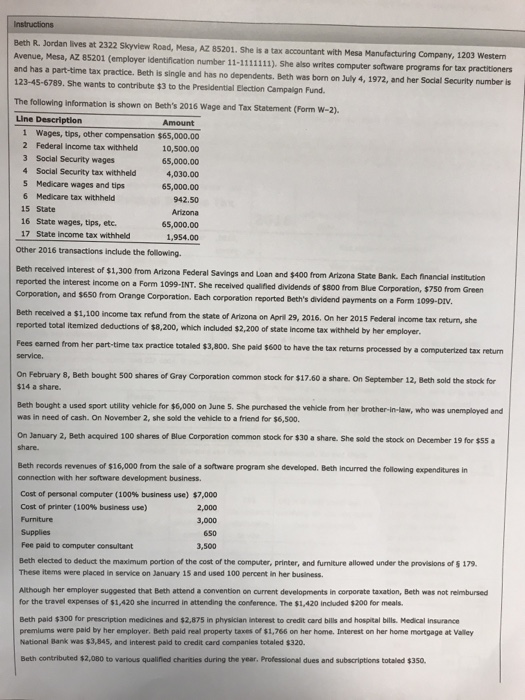

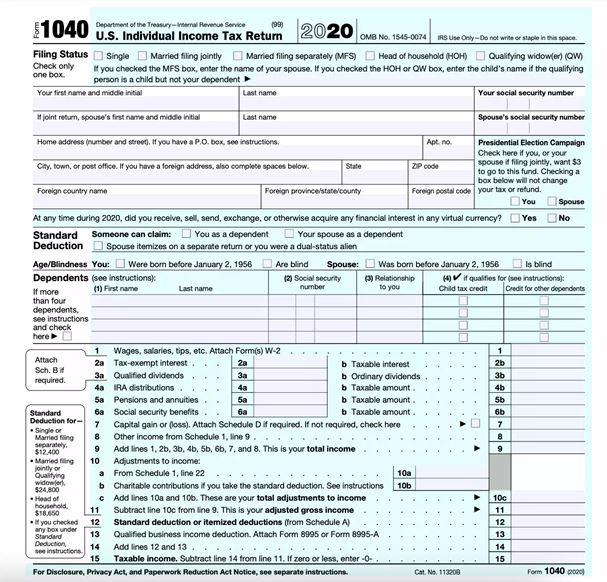

Tax Return Assignment - Grades Express This assignment requires you to complete four tax forms (Form 1040, Schedule 1, Schedule B, and Qualified Dividends and Capital Gain Tax Worksheet, using the provided taxpayer information. The forms provided are for tax year 2020 - (for the W-2, 1099-INT, and 1099-DIV, please disregard the 2018 tax year and treat them as 2020). Step […]

Form 8582 Worksheet Example [TXJ84I] - aiq.chimicar.mn.it Capital gain distributions should be shown in box 2a of Form 1099-DIV Facet Wealth, an award-winning next-generation financial planning service, … Tax Form 8582 Instructions Follow these tips to accurately and quickly fill in IRS 8582 Follow these tips to accurately and quickly fill in IRS 8582.

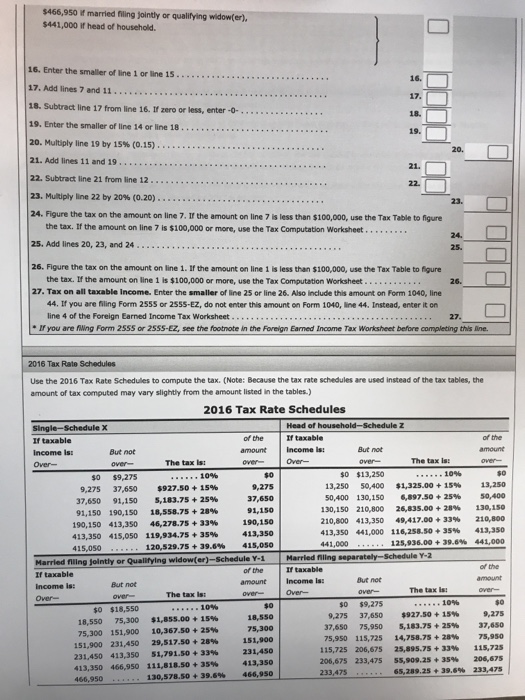

Capital And Worksheet Gain Tax Form Qualified Dividends Following this example, there is a simple way to calculate the tax: With $700,000 in both qualified dividends and capital gains, the tax should be: (a) 15% of $479,000, or $71,850 plus (b) 20% of the difference between $700,000 and $479,000, or $44,200 plus (c) the tax on $200,000 taxable income that is neither qualified dividends nor capital ...

Are Qualified Dividends Included in Ordinary Dividends for Tax Reporting? The rate on qualified dividends for investors with ordinary income taxed at 10% or 12% is 0%. Those paying income-tax rates greater than 12% and up to 35% (for ordinary incomes of up to $434,550 ...

What Are Qualified Dividends? - The Motley Fool Qualified dividend: Taxed at the long-term capital gains rate, which is 0%, 15% or 20%, depending on an investor's income level. Nonqualified or ordinary dividend: Taxed at an investor's ordinary ...

› instructions › i1040gi1040 (2021) | Internal Revenue Service - IRS tax forms Schedule D Tax Worksheet. Qualified Dividends and Capital Gain Tax Worksheet. Schedule J. Foreign Earned Income Tax Worksheet. Foreign Earned Income Tax Worksheet—Line 16; Qualified Dividends and Capital Gain Tax Worksheet—Line 16; Line 19. Nonrefundable Child Tax Credit and Credit for Other Dependents. Form 8862, who must file. Payments

:max_bytes(150000):strip_icc()/1040-SR2022-44e2ed8aefeb4c65a07f875e2b3e173f.jpeg)

/1040-SR2022-44e2ed8aefeb4c65a07f875e2b3e173f.jpeg)

0 Response to "45 qualified dividends and capital gain tax worksheet fillable"

Post a Comment