45 social security worksheet for 1040a

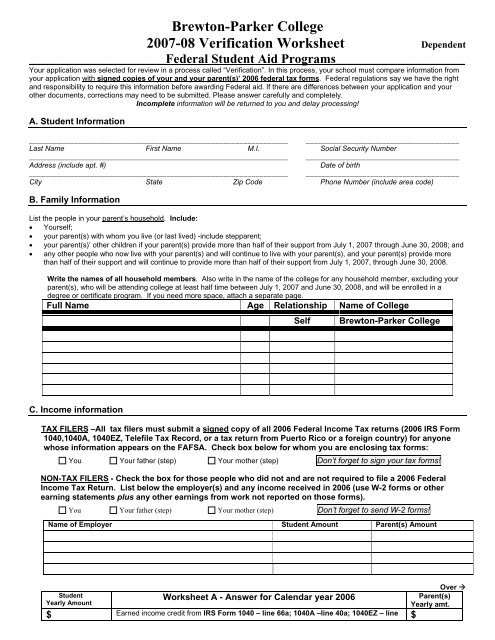

PDF Appendix B. Worksheets for Social Security Recipients Who Contribute to ... Use Worksheet 1 to figure your modified adjusted gross income. This amount is needed in the computation of your IRA deduction, if any, which is figured using Worksheet 2. The IRA deduction figured using Worksheet 2 is entered on your tax return. Worksheet 1 Computation of Modified AGI (For use only by taxpayers who receive social security benefits) 1040 (2021) | Internal Revenue Service - IRS tax forms Social Security Benefits Worksheet—Lines 6a and 6b; Line 7. Capital Gain or (Loss) Exception 1. Exception 2. Total Income and Adjusted Gross Income. Line 10; ... Don't include any social security benefits unless (a) you are married filing a separate return and you lived with your spouse at any time in 2021, or (b) one-half of your social ...

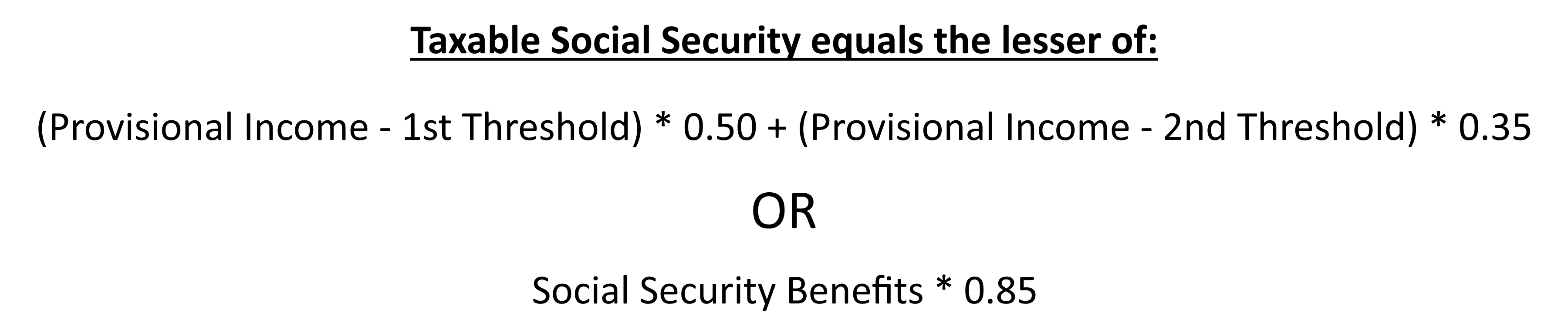

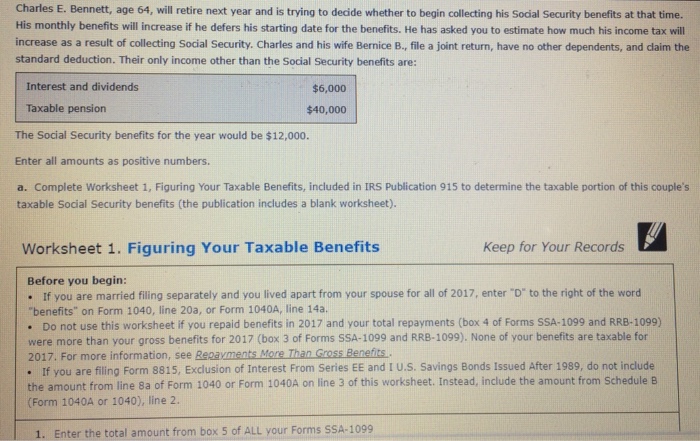

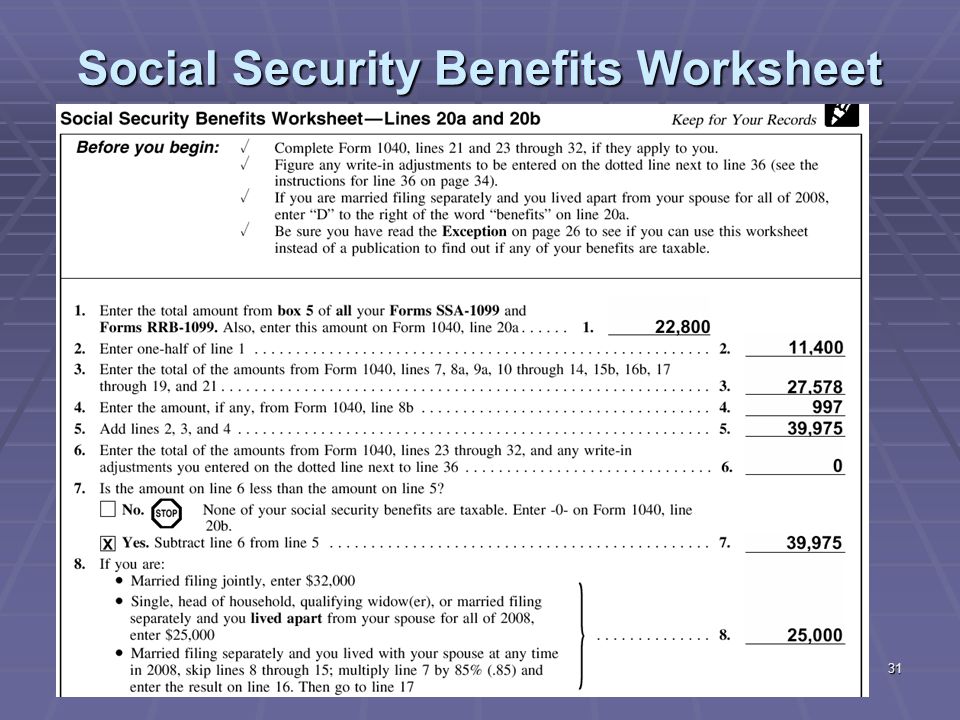

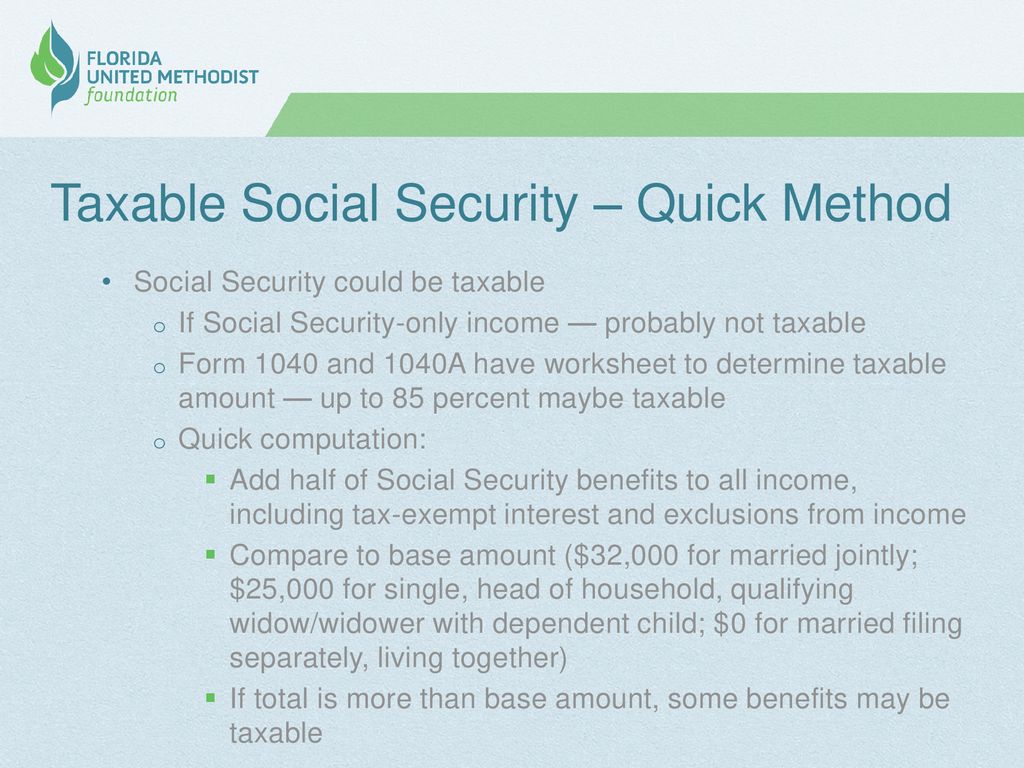

Worksheet to Figure Taxable Social Security Benefits Many of those who receive Social Security retirement benefits will have to pay income tax on some or all of those payments. More specifically, if your total taxable income (wages, pensions, interest, dividends, etc.) plus any tax-exempt income, plus half of your Social Security benefits exceed $25,000 for singles, $32,000 for marrieds filing jointly, and $0 for marrieds filing …

Social security worksheet for 1040a

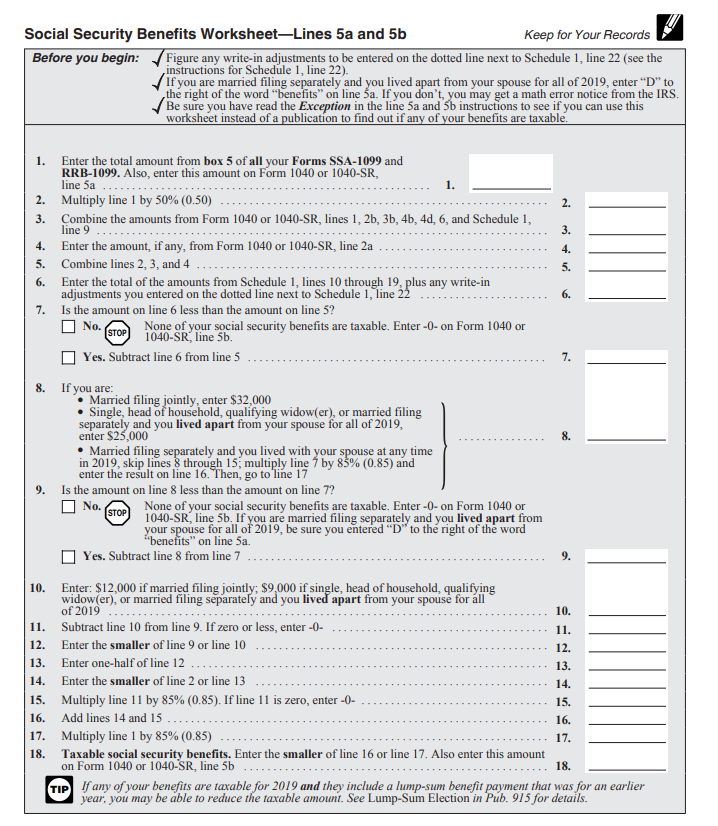

1040 Social Security Worksheets - K12 Workbook Worksheets are 30 of 107, Social security benefits work work 1, Social security benefits work 2018, Social security benefits work forms 1040 1040a, 2013 social security benefits work lines 20a and 20b, Introduction objectives topics, 450 columbus blvd ste 1 hartford ct 06103 1837, 2018 schedule se form 1040. *Click on Open button to open and print to worksheet. Instructions for Form 1040-SS (2021) | Internal Revenue Service Maximum income subject to social security tax for 2022. Estimated tax payments. Schedule LEP (Form 1040). Disaster tax relief. Automatic 60-day extension for taxpayers affected by federally declared disasters. Identity Protection PIN (IP PIN) for spouse. Taxpayer identification number (TIN) required to claim the RCTC. PDF Social Security Benefits Worksheet - IRS tax forms Social Security Benefits Worksheet—Lines 5a and 5b. Keep for Your Records. Figure any write-in adjustments to be entered on the dotted line next to Schedule 1, line 36 (see the instructions for Schedule 1, line 36). If you are married filing separately and you lived apart from your spouse for all of 2018, enter "D" to

Social security worksheet for 1040a. Taxable Social Security Benefits - Iowa Social Security Worksheet; 1. Enter the amount from Box 5 of form(s) SSA-1099. If you filed a joint federal return, enter the totals for both spouses. ... If filing federal 1040A, use lines 7, 8a, 9a, 10, 11b, 12b, and 13, plus one-half of any Railroad Retirement Social Security benefits from RRB-1099. Include any bonus depreciation / section ... 2022 Form 1040-ES - IRS tax forms Social security tax. For 2022, the maximum amount of earned income (wages and net earnings from self-employment) subject to the social security tax is $147,000. Adoption credit or exclusion. For 2022, the maximum adoption credit or exclusion for employer-provided . CAUTION! adoption benefits has increased to $14,890. In order to 3.11.3 Individual Income Tax Returns | Internal Revenue Service Instructions in this manual are for Form 1040 / 1040-SR, Form 1040A, Form 1040EZ and attachments to the return. 3.11.3.1.2 (11-29-2019) ... Edit SPCs vertically in the right margin next to the spouse’s social security number. Refer to the table in Exhibit 3.11.3-6 for an explanation of each SPC. 3.11.3.3.7.6 (11-17-2017) Reportable Social Security Benefits - Iowa The rest of the form is then completed with the amounts normally used to complete the worksheet from the federal 1040 or 1040A. Include the following incomes or adjustments to income on line 3 if applicable (these were excluded from federal AGI): foreign-earned income income excluded by residents of Puerto Rico or American Samoa

PDF 2021 Schedule A (Form 1040) - IRS tax forms SCHEDULE A (Form 1040) Department of the Treasury Internal Revenue Service (99) Itemized Deductions Go to for instructions and the latest ... Credit Limit Worksheet Form - signNow Credit Limit Worksheet. ... you are free to contact us direct; (571) 305-4056. If you have a social security number, you can find information about Soldiers online at Caution- ... Form 1040A will no longer be available beginning with tax year 2018. ... The lifetime learning credit MAGI limit increases to $134,000 if you ... 1040 Social Security 2017 Worksheets - K12 Workbook Worksheets are 30 of 107, Social security benefits work work 1, 2017 form 1040, 2017 modification work, Sc1040 instructions 2017 1617, Social security benefits work 2018, Social security benefits work forms 1040 1040a, 2013 social security benefits work lines 20a and 20b. *Click on Open button to open and print to worksheet. 1. Page 30 of 107 2. Pay and Personnel Center (PPC), Retiree and Annuitant Services You will use it instead of your social security number when requesting changes be made to your Direct Access account. Once the self-service portion of the pay system is established (usually after you receive your first retired or annuitant pay), you will be able to use your Employee ID number to log onto the system and make the changes to many transaction types yourself with …

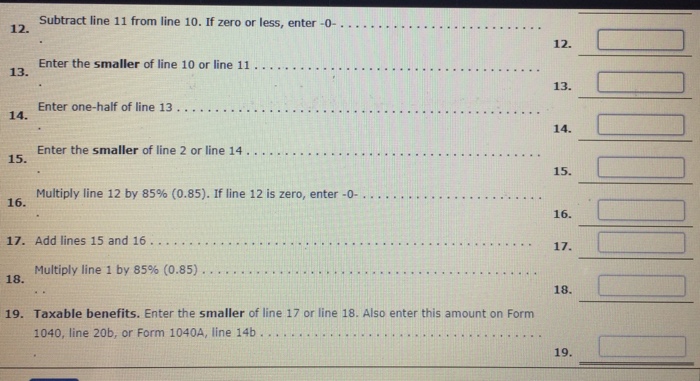

1040 Social Security Benefits Worksheets - K12 Workbook 1040 Social Security Benefits Displaying all worksheets related to - 1040 Social Security Benefits . Worksheets are 33 of 117, Social security benefits work 2018, Social security benefits work work 1, 2013 social security benefits work lines 20a and 20b, Social security benefits work forms 1040 1040a, Income social security benefits, Notice 703 october 2019, Social security benefits work lines 14a and 14b keep. Irs Form 1040 Social Security Benefits - K12 Workbook Worksheets are 30 of 107, Benefits retirement reminders railroad equivalent 1, Social security benefits work forms 1040 1040a, 2018 form 1040, Social security benefits work 2018, 2013 social security benefits work lines 20a and 20b, Income social security benefits, Social security benefits work work 1. PDF Social Security Benefits Worksheet Worksheet 1 Figuring Your Taxable ... the amount from line 8a of Form 1040 or Form 1040A on line 3 of this worksheet. Instead, include the amount from Schedule B (Form 1040A or 1040), line 2. Enter the total amount from box 5 of ALL your Forms SSA-1099 and RRB-1099. Also enter this amount on Form 1040, line 20a, or Form 1040A, line 14a Enter one-half of line 1 Combine the amounts from: Social Security Benefits Worksheet 2021 Pdf - pdfFiller Fill Social Security Benefits Worksheet 2021 Pdf, Edit online. Sign, fax and printable from PC, iPad, tablet or mobile with pdfFiller Instantly. Try Now!

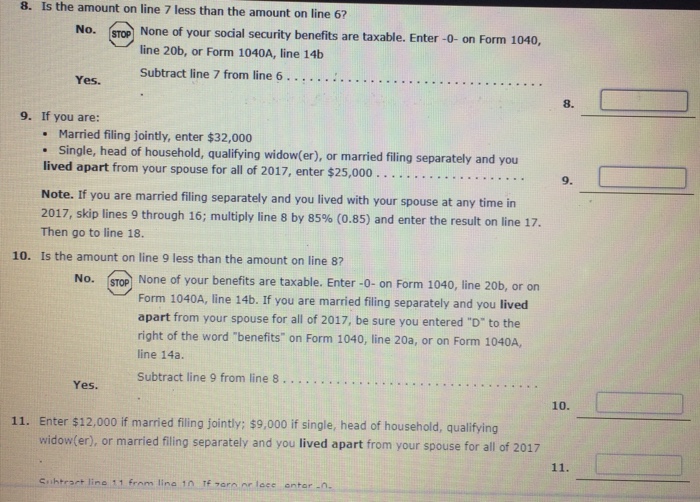

PDF Social Security Benefits Worksheet—Lines 14a and - Taxes Are Easy Social Security Benefits Worksheet—Lines 14a and 14b Keep for Your Records Complete Form 1040A, lines 16 and 17, if they apply to you. If you are married filing separately and you lived apart from your spouse for all of 2016, enter "D" to the right of the word "benefits" on line 14a.

Social Security Benefits Worksheet and Schedule 1 (Form 1040) - Intuit Download it from this link. Instructions for Form 1040 and 1040-SR. Go to page 31, Social Security Benefits Worksheet. Line 6 of the worksheet says "Enter the total of the amounts from Form 1040 or 1040-SR, line 10b, Schedule 1, lines 10 through 19, plus any write-in adjustments you entered on the dotted line next to Schedule 1, line 22."

2021 1040 Form and Instructions (Long Form) - Income Tax Pro For the 2021 tax year, federal tax form 1040, US Individual Income Tax Return, must be postmarked by April 18, 2022 . Federal income taxes due are based on the calendar year January 1, 2021 through December 31, 2021. Prior year federal tax forms, instructions, and schedules are also available, and should be mailed as soon as possible if late.

Publication 525 (2021), Taxable and Nontaxable Income Forms 1040A and 1040EZ no longer available. ... Use the following worksheet to figure the amount to include in your income. If you pay any part of the cost of the insurance, your entire payment reduces, dollar for dollar, ... Social security and Medicare taxes.

Social Security Forms | Social Security Administration If you can't find the form you need, or you need help completing a form, please call us at 1-800-772-1213 (TTY 1-800-325-0778) or contact your local Social Security office and we will help you. If you download, print and complete a paper form, please mail or take it to your local Social Security office or the office that requested it from you.

Social Security Benefits Worksheet - Taxable Amount - TaxAct If your income is modest, it is likely that none of your Social Security benefits are taxable. As your gross income increases, a higher percentage of your ...

SCHEDULE 8812 Credits for Qualifying Children 1040 1040-SR … Withheld social security, Medicare, and Additional Medicare taxes from Form(s) W-2, boxes 4 and 6. If married filing jointly, include your spouse’s amounts with yours.

form 1040 social security worksheet form 8615 tax for certain children who have investment income of more. 16 pictures about form 8615 tax for certain children who have investment income of more : 29 social security worksheet for 1040a - notutahituq worksheet information, social security benefits worksheet 2015 yooob — db-excel.com and also social security benefits worksheet 2016 | …

PDF Social Security Benefits WorksheetLines 14a and 14b Keep for Your Records or 14b of Form 1040A. But if you are married filing separately and you lived apart from your spouse for all of 2002, enter -0- on line 14b. Be sure you entered"D"to the right of the word "benefits"on line 14a. Social Security Benefits Worksheet—Lines 14a and 14b

social security worksheet 1040 Publication 517: Social Security and Other Info for Members of the. 17 Images about Publication 517: Social Security and Other Info for Members of the : 29 Social Security Worksheet For 1040a - Notutahituq Worksheet Information, 34 Social Security Disability Worksheet - Free Worksheet Spreadsheet and also Form 8615 Tax for Certain Children Who Have Investment Income of More.

Form 1040 Social Security Benefits Worksheet IRS 2018 - Fill Once completed you can sign your fillable form or send for signing. All forms are printable and downloadable. Form 1040 Social Security Benefits Worksheet IRS 2018. On average this form takes 5 minutes to complete. The Form 1040 Social Security Benefits Worksheet IRS 2018 form is 1 page long and contains: 0 signatures. 4 check-boxes.

1040a Worksheet - Fill and Sign Printable Template Online - US Legal Forms Find the 1040a Worksheet you require. Open it up with online editor and start adjusting. Complete the empty fields; involved parties names, addresses and numbers etc. Customize the blanks with unique fillable fields. Add the day/time and place your e-signature. Click on Done following twice-checking everything.

2021 Publication 915 - IRS 6 Jan 2022 — They complete Worksheet 1, shown below, entering $29,750 ($15,500 + $14,000 +. $250) on line 3. They find none of Ray's social security benefits ...

Social Security Benefits 1040a Lines 14a - K12 Workbook Displaying all worksheets related to - Social Security Benefits 1040a Lines 14a. Worksheets are Social security benefits work lines 14a and 14b keep, Social security benefits work forms 1040 1040a, Benefits retirement reminders railroad equivalent 1, Social security benefits work work 1 figuring, 2016 modification work, Marketplace coverage affordability work, Social security benefits work lines 20a and 20b, Box.

PDF 2017 Form 1040A - IRS tax forms 1040A U.S. Individual Income Tax Return (99) 2017 Department of the Treasury—Internal Revenue Service . OMB No. 1545-0074 IRS Use Only—Do not write or staple in this space. Your first name and initial . Last name Your social security number . If a joint return, spouse's first name and initial . Last name . Spouse's social security number

All State Tax Forms 2022 - Tax-Rates.org Form 40ES is an estimated tax worksheet that will allow you to calculate your estimated quarterly income tax ... including places for reporting income from sources including social security and various interest-bearing investments. Nonresidents or part ... Form 1040A; Form 1040A Instructions; Form 1040ES; Form 2210; Schedule A; Schedule A ...

Social Security Benefits 5a And 5b Worksheets - K12 Workbook Worksheets are Social security benefits work 2018, 30 of 107, Social security benefits work forms 1040 1040a, 2018 modification work, Social security and taxes, Social security benefits work lines 14a and, Social security benefits work lines 14a and 14b keep, Child support work csf 020910. *Click on Open button to open and print to worksheet. 1.

Publication 915 (2021), Social Security and Equivalent Railroad ... In 2020, she applied for social security disability benefits but was told she was ineligible. She appealed the decision and won. In 2021, she received a lump-sum payment of $6,000, of which $2,000 was for 2020 and $4,000 was for 2021. Jane also received $5,000 in social security benefits in 2021, so her total benefits in 2021 were $11,000.

worksheet for social security tax Social Security Worksheet 1040a Print 2017 | Printable Worksheets And . 1040a. Fillable Form 1040 (2017) In 2021 | Tax Return, Irs Forms, Investment . 2021 form tax 1040 forms irs return. Fillable Online Social Security Benefits Worksheet Lines 14a And

Line-by-Line Help Free File Fillable Forms - IRS tax forms Enter your name and Social Security Number in the Primary taxpayer area Enter your spouse's first and last name in the two spaces provided, just above the Primary last name area. Enter your spouse Social Security Number in the area provided for couples filing jointly. Do not enter your spouse's name in the Married Filing Joint name area.

PDF Social Security Benefits Worksheet—Lines 14a and 2013 Form 1040A—Lines 14a and 14b Social Security Benefits Worksheet—Lines 14a and 14b Keep for Your Records Complete Form 1040A, lines 16 and 17, if they apply to you. If you are married filing separately and you lived apart from your spouse for all of 2013, enter "D" to the right of the word "benefits" on line 14a.

Fillable Social Security Benefits Worksheet Form - signNow Follow the step-by-step instructions below to eSign your 2021 fillable social security benefits worksheet: Select the document you want to sign and click Upload. Choose My Signature. Decide on what kind of eSignature to create. There are three variants; a typed, drawn or uploaded signature. Create your eSignature and click Ok. Press Done.

PDF Social Security Benefits Worksheet - IRS tax forms Social Security Benefits Worksheet—Lines 5a and 5b. Keep for Your Records. Figure any write-in adjustments to be entered on the dotted line next to Schedule 1, line 36 (see the instructions for Schedule 1, line 36). If you are married filing separately and you lived apart from your spouse for all of 2018, enter "D" to

Instructions for Form 1040-SS (2021) | Internal Revenue Service Maximum income subject to social security tax for 2022. Estimated tax payments. Schedule LEP (Form 1040). Disaster tax relief. Automatic 60-day extension for taxpayers affected by federally declared disasters. Identity Protection PIN (IP PIN) for spouse. Taxpayer identification number (TIN) required to claim the RCTC.

1040 Social Security Worksheets - K12 Workbook Worksheets are 30 of 107, Social security benefits work work 1, Social security benefits work 2018, Social security benefits work forms 1040 1040a, 2013 social security benefits work lines 20a and 20b, Introduction objectives topics, 450 columbus blvd ste 1 hartford ct 06103 1837, 2018 schedule se form 1040. *Click on Open button to open and print to worksheet.

0 Response to "45 social security worksheet for 1040a"

Post a Comment