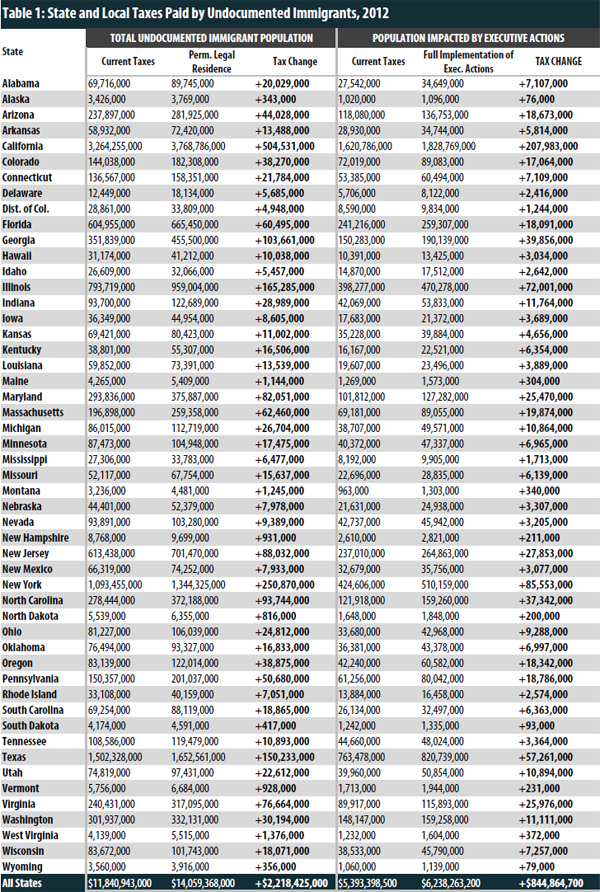

39 2015 tax computation worksheet

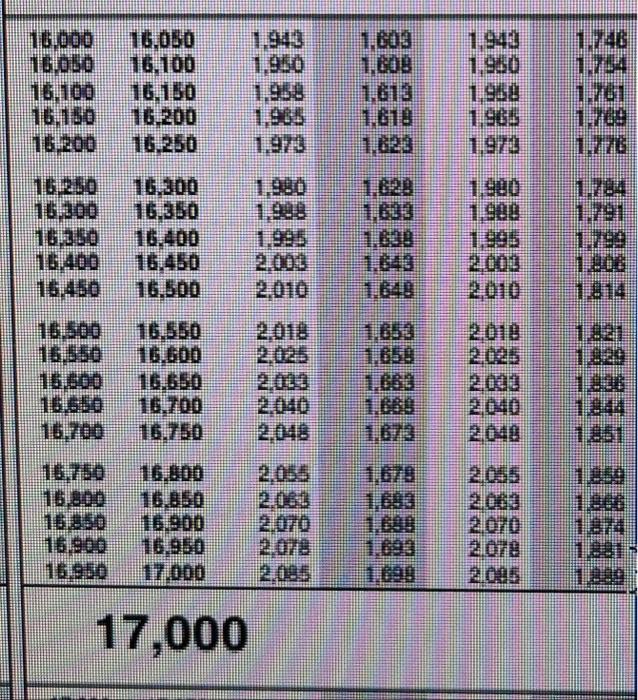

2015 Tax Tables Complete_Layout 1 RHODE ISLAND TAX COMPUTATION WORKSHEET. RHODE ISLAND TAX RATE SCHEDULE. 2015. TAX RATES APPLICABLE TO ALL FILING STATUS TYPES. Taxable Income (line 7). 2015 TAX TABLES - Arkansas.gov You can not use this table if you take the standard deduction or if you itemize your deductions in calculating your net taxable income. Regular Tax Table. This ...

Vermont Rate Schedules and Tax Tables Tax Year 2020. 2020 VT Rate Schedules · 2020 VT Tax Tables · 2021 Income Tax Withholding Instructions, Tables, and Charts. Tax Year 2019 ...

2015 tax computation worksheet

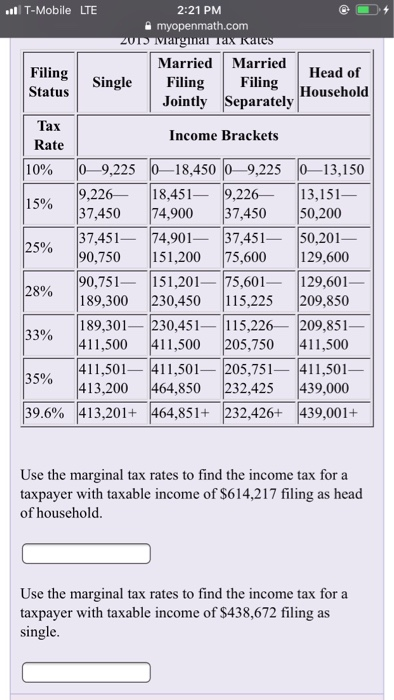

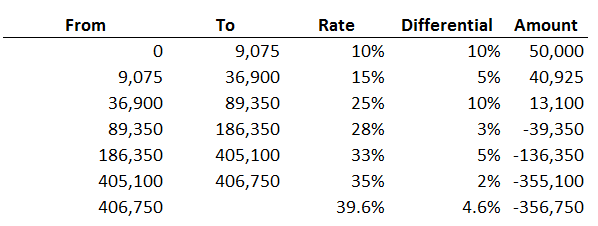

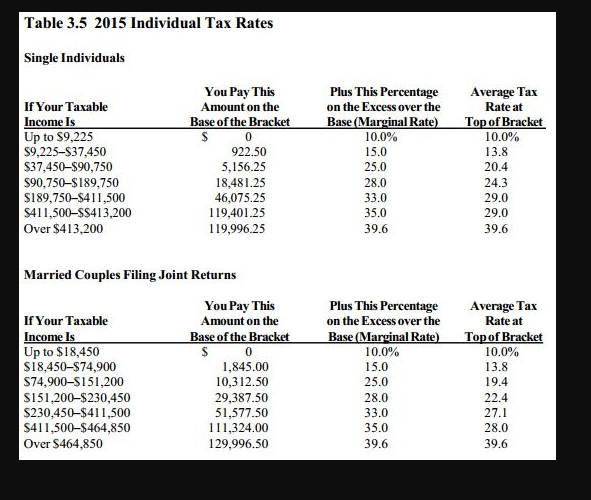

2015 TAX CHART - MO.gov if more than $9,000, use worksheet below or use the online tax calculator at ... A separate tax must be computed for you and your spouse. FIGURING TAX. NONRESIDENT INCOME TAX CALCULATION - Marylandtaxes.gov CALCULATION. ATTACH TO YOUR TAX RETURN. MARYLAND. FORM. 505NR. 2015. Print Using ... Enter tax from Tax Table or Computation Worksheet Schedules I or II. IRS Announces 2015 Tax Brackets, Standard Deduction Amounts ... Oct 30, 2014 ... You'll find the updated post - which includes the tax tables and other information below - here. These are the 2015 rates.

2015 tax computation worksheet. 2015 Tax Brackets | Tax Brackets and Rates - Tax Foundation Oct 2, 2014 ... and $464,850 and higher for married filers. Table 1. 2015 Taxable Income Brackets and Rates. Rate, Single Filers, Married Joint Filers, Head of ... 2015 Instruction 1040 (Tax Tables) - IRS TAX TABLES. 2015. Department of the Treasury Internal Revenue Service ... 2015. Tax Table. CAUTION ! See the instructions for line 44 to see if you must. 2015 I-117 Forms 1A and WI-Z Instructions Wisconsin Income Tax revenue.wi.gov. 2015. Forms 1A and WI-Z Instructions. NEW IN 2015 ... more, use the Tax Computation Worksheet on page 30 to. 2015 Instruction 1040 - IRS Jan 5, 2016 ... See the instructions for line 44 to see which tax computation method applies. (Do not use a second Foreign Earned Income Tax Worksheet to ...

IRS Announces 2015 Tax Brackets, Standard Deduction Amounts ... Oct 30, 2014 ... You'll find the updated post - which includes the tax tables and other information below - here. These are the 2015 rates. NONRESIDENT INCOME TAX CALCULATION - Marylandtaxes.gov CALCULATION. ATTACH TO YOUR TAX RETURN. MARYLAND. FORM. 505NR. 2015. Print Using ... Enter tax from Tax Table or Computation Worksheet Schedules I or II. 2015 TAX CHART - MO.gov if more than $9,000, use worksheet below or use the online tax calculator at ... A separate tax must be computed for you and your spouse. FIGURING TAX.

0 Response to "39 2015 tax computation worksheet"

Post a Comment