41 qualified dividends and capital gain tax worksheet calculator

Qualified dividends and capital gain tax worksheet 2019 pdf: Fill out ... Click on New Document and choose the form importing option: upload 2021 qualified dividends and capital gains worksheet from your device, the cloud, or a protected URL. Make changes to the template. Use the upper and left panel tools to modify 2021 qualified dividends and capital gains worksheet. PDF Qualified Dividends and Capital Gain Tax Worksheet—Line 11a Figure the tax on the amount on line 7. If the amount on line 7 is less than $100,000, use the Tax Table to figure the tax. If the amount on line 7 is $100,000 or more, use the Tax Computation Worksheet..... 24. 25. Add lines 20, 23, and 24..... 25. 26. Figure the tax on the amount on line 1. If the amount on line 1 is less than $100,000, use ...

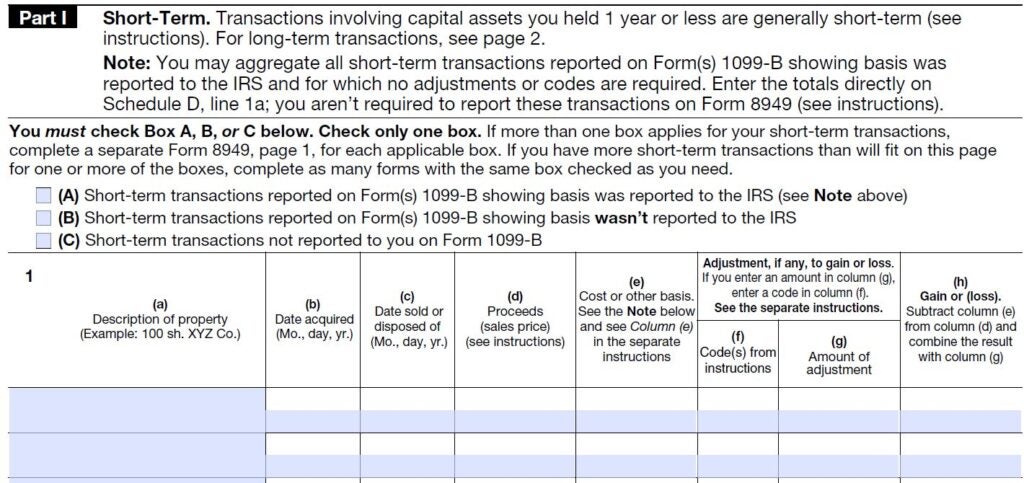

How does IRS know that I calculated tax using worksheet "Qualified ... I am filing 2021 Federal Tax and got long-term capital gains (will also file Schedule D). I calculated tax using "Qualified Dividends and Capital Gain Tax Worksheet" How will IRS know that tax calculation is from "Qualified Dividends and Capital Gain Tax Worksheet" Should I write it next to 1040 line 16?

Qualified dividends and capital gain tax worksheet calculator

1040 Tax Calculator 1040 Tax Calculator. Enter your filing status, income, deductions and credits and we will estimate your total taxes. Based on your projected tax withholding for the year, we can also estimate your tax refund or amount you may owe the IRS next April. ... We encourage you to seek personalized advice from qualified professionals regarding all ... Qualified Dividends And Capital Gain Tax Worksheet Fillable 2019 - Fill ... Complete Qualified Dividends And Capital Gain Tax Worksheet Fillable 2019 in a few minutes following the guidelines listed below: Find the document template you need from our collection of legal form samples. Select the Get form key to open it and start editing. Fill in all of the requested fields (they are marked in yellow). Qualified Dividends and Capital Gain Tax - prd.taxact.com Qualified Dividends and Capital Gain Tax. Information reported to you on Form 1099-DIV and Form 1099-B can be entered in the TaxAct program in the Investment Income section of the Federal Q&A, or directly on the forms where applicable. The Tax Summary screen will indicate if the tax has been computed on the Schedule D Worksheet or the Qualified ...

Qualified dividends and capital gain tax worksheet calculator. How Your Tax Is Calculated: Understanding the Qualified Dividends and ... In those instructions, there is a 27-line worksheet called the Qualified Dividends and Capital Gain Tax Worksheet, which is how you actually calculate your Line 44 tax. The 27 lines, because they are so simplified, end up being difficult to follow what exactly they do. So, for those of you who are curious, here's what they do. 2021 Federal Income Tax Calculator - HighPoint Advisors, LLC Use this calculator to estimate your 2021 federal income tax liability. ... taxable income (as reduced by long-term capital gains and qualified dividends). › taxtopics › tc409Topic No. 409 Capital Gains and Losses - IRS tax forms Nov 25, 2022 · Capital Gain Tax Rates. The tax rate on most net capital gain is no higher than 15% for most individuals. Some or all net capital gain may be taxed at 0% if your taxable income is less than or equal to $40,400 for single or $80,800 for married filing jointly or qualifying widow(er). › taxes › capital-gains-tax-rates2022-2023 Capital Gains Tax Rates & Calculator - NerdWallet Long-term capital gains tax is a tax on profits from the sale of an asset held for more than a year (also known as a long term investment). The long-term capital gains tax rate is 0%, 15% or 20% ...

Where Is The Qualified Dividends And Capital Gain Tax Worksheet ... What is the Qualified Dividends and capital gain Tax Worksheet? The worksheet is for taxpayers with dividend income only or those whose only capital gains are capital gain distributions reported in box 2a or 2b of Form 1099-DIV that were received from mutual funds, other regulated investment companies, or real estate investment trusts. Qualified Dividends and Capital Gains Flowchart - The Tax Adviser The tax is $2,546, consisting of $2,546 tax on the $20,000 of other taxable income ($907.50 plus 15% of the excess over $9,075) and no tax on the adjusted net capital gain. Example 2: The taxpayer has taxable income of $150,000 that consists of adjusted net capital gain of $100,000 and $50,000 of other taxable income. Get the up-to-date qualified dividends and capital gain tax ... - DocHub Edit, sign, and share qualified dividends and capital gain tax worksheet 2021 online. No need to install software, just go to DocHub, and sign up instantly ... How to Download Qualified Dividends and Capital Gain Tax Worksheet ... Qualified Dividends and Capital Gain Tax Worksheet The worksheet is part of Form 1040 which is mandatory for every individual tax filer as well as joint filers. The worksheet has 27 lines, and all fields must be filled according to relevant information. Tax filers with qualified dividends and capital gains have to fill the relevant worksheet.

Qualified Dividends And Capital Gain Worksheet - Martin Lindelof Web the qualified dividends and capital gain tax worksheet can be separated into different lines in order to make it easier for you. This document is locked as it has been sent for signing. Worksheets are 44 of 107, 2017 qualified dividends and capital gain tax work, qualified dividends and. Web irs introduced the qualified dividend and capital ... › publications › p523Publication 523 (2021), Selling Your Home | Internal Revenue ... Comments and suggestions. We welcome your comments about this publication and suggestions for future editions. You can send us comments through IRS.gov/FormComments.Or, you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224. Qualified Dividends and Capital Gain Tax - taxact.com To review the Tax Summary in the TaxAct program, go to our Summary of Return - Tax Summary FAQ. If the tax was calculated on either of these worksheets, you should see "Tax computed on Qualified Dividend Capital Gain WS" as one of the items listed. Go to the IRS Topic No. 409 Capital Gains and Losses webpage for more information. How to Figure the Qualified Dividends on a Tax Return Locate ordinary dividends in Box 1a, qualified dividends in Box 1b and total capital gain distributions in Box 2a. Report your qualified dividends on line 9b of Form 1040 or 1040A. Use...

Capital Gains Tax Calculator 2021 - Forbes Advisor You may have a capital gain or loss when you sell a capital asset, such as real estate, stocks, or bonds. Capital gains and losses are taxed differently from income like wages, interest,...

› publications › p17Publication 17 (2021), Your Federal Income Tax | Internal ... If a child's only income is interest and dividends (including capital gain distributions and Alaska Permanent Fund dividends), the child was under age 19 at the end of 2021 or was a full-time student under age 24 at the end of 2021, and certain other conditions are met, a parent can elect to include the child's income on the parent's return.

Tax Calculator - Estimate Your Income Tax for 2022 - Free! - Moneychimp Tax Calculator - Estimate Your Income Tax for 2022 - Free! Tax Calculator (This is income tax only: Social Security is a separate calculation.) How to Reduce Your Taxes As complicated as the tax code is, it's built around a philosophy that actually makes sense: the government will reward intelligent behavior with a tax break.

› java › 1040-tax-calculator1040 Tax Calculator - Dinkytown.net For common stock dividends to be considered qualified dividends, you need to have owned the stock for at least 60 days during a 121 day period that starts 60 days before the ex-dividend date. The same rule applies for preferred stock for dividends attributable to periods totaling more than 366 days, but the holding period is 90 days during a ...

10++ Qualified Dividends And Capital Gain Tax Worksheet 2019 Worksheets are 2019 form 1041 es, 44 of 107, qualified dividends and capital gain tax work 2018, 2018 form 1041 es, 2018 estimated tax work keep for your records 1 2a, 2018 form 1040. Showing top 8 worksheets in the category 2019 qualified dividends and capital gain tax. If you are required to use this worksheet to figure the tax on an amount ...

Qualified Dividends and Capital Gains Worksheet - StuDocu Qualified Dividends and Capital Gains Worksheet one of the forms due with the final project University Southern New Hampshire University Course Federal Taxation I (ACC330) Academic year2021/2022 Helpful? 85 Comments Please sign inor registerto post comments. Tim5 months ago 2019 - Correct Year Related Studylists ACC 330 Preview text

1040 (2021) | Internal Revenue Service - IRS tax forms Schedule D Tax Worksheet. Qualified Dividends and Capital Gain Tax Worksheet. Schedule J. Foreign Earned Income Tax Worksheet. Foreign Earned Income Tax Worksheet—Line 16; Qualified Dividends and Capital Gain Tax Worksheet—Line 16; Line 19. Nonrefundable Child Tax Credit and Credit for Other Dependents. Form 8862, who must file. Payments

How To Calculate Capital Gains or Losses With a Worksheet - The Balance Worksheet 1: Simple Capital Gains Worksheet Let's say you bought 100 shares of Company XYZ stock on Jan. 3, 2021. You bought the 100 shares at $12 per share, for a total cost of $1,200. Your broker charged you a commission of $25. Over a year later, on March 10, 2022, you decided to sell your 100 shares at $14 per share, for a total of $1,400.

Estimated Income Tax Spreadsheet - Mike Sandrik The estimated ordinary income cell includes your estimate for the sum total of wage income, bonuses, profit sharing, interest, ordinary dividends, and short term capital gains. All of these income sources get taxed at ordinary income tax rates. Next, enter your estimated deduction. If you're not itemizing this is easy.

1040 Income Tax Calculator - Ameriprise Financial Qualified dividends are the portion of your total ordinary dividends subject to the lower capital gains tax rate. Qualified dividends are typically dividends ...

2022 Instructions for Schedule D (2022) - IRS tax forms Use Form 8997 to report each QOF investment you held at the beginning and end of the tax year and the deferred gains associated with each investment. Also, use Form 8997 to report any capital gains you are deferring by investing in a QOF during the tax year and any QOF investment you disposed of during the tax year. Capital Asset

Qualified Dividend and Capital Gains Tax Worksheet? - YouTube Feb 16, 2022 ... The tax rate computed on your Form 1040 must consider any tax-favored items, such as qualified dividends and long-term capital gains, ...

How to Download Qualified Dividends and Capital Gain Tax Worksheet ... Qualified Dividends and Capital Gain Tax Worksheet The worksheet is part of Form 1040 which is mandatory for every individual tax filer as well as joint filers. The worksheet has 27 lines, and all fields must be filled according to relevant information.

How Your Tax Is Calculated: Qualified Dividends and Capital Gains Worksheet For this reason, the first step of the Qualified Dividends and Capital Gain Tax Worksheet is to split those two separate types back out. Lines 1-5: Qualified Income & Ordinary Income Lines 1-5 of this worksheet calculate your total qualified income (line 4) and your total ordinary income (line 5), so they can be taxed at their different rates.

Qualified Dividends and Capital Gain Tax Explained — Taxry In order to figure out how to calculate this tax, it's best to use the qualified dividend and capital gain tax worksheet. What Is the Qualified Dividend and Capital Gain Tax Worksheet? Figuring out the tax on your qualified dividends can be difficult for even the most experienced accountant. There are tax codes to adhere to, numbers to crunch ...

› fill-and-sign-pdf-form › 3873Qualified Dividends And Capital Gain Tax Worksheet 2021 ... Once you’ve finished signing your 2021 qualified dividends and capital gain tax worksheet, decide what you want to do next - download it or share the doc with other people. The signNow extension offers you a selection of features (merging PDFs, adding numerous signers, and many others) for a better signing experience.

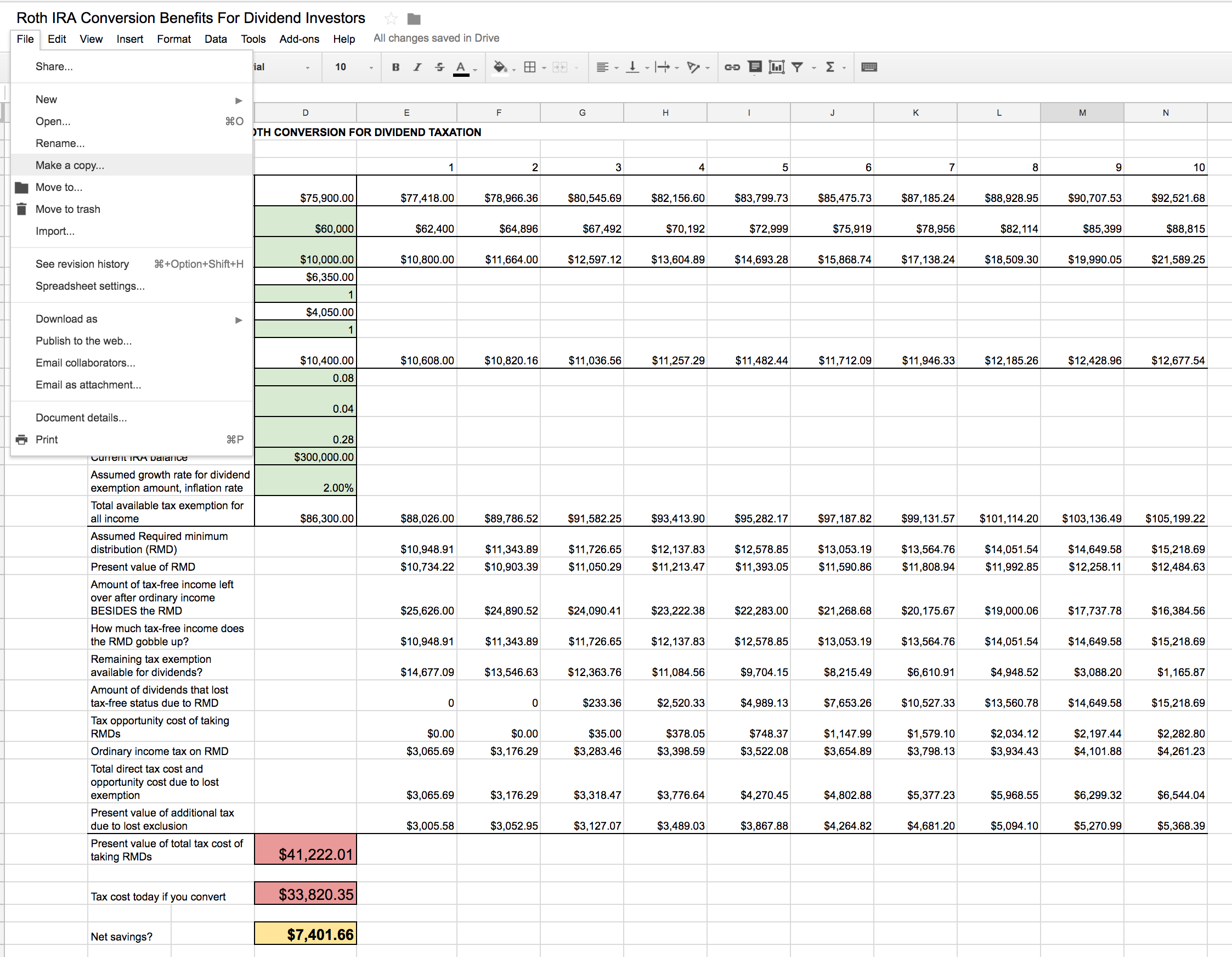

› publications › p590aPublication 590-A (2021), Contributions to Individual ... Sue isn’t covered by an employer plan. Ed contributed $6,000 to his traditional IRA and $6,000 to a traditional IRA for Sue (a Kay Bailey Hutchison Spousal IRA). Their combined modified AGI, which includes $2,000 interest and dividend income and a large capital gain from the sale of stock, is $200,555.

Calculation of the Qualified Dividend Adjustment on Form 1116 ... - Intuit Calculation of the Qualified Dividend Adjustment on Form 1116 Line 1a in Lacerte Basically, the 5% ratio is the amount from the Qualified Dividends & Capital Gain Tax Worksheet, Line 10/Qualified Dividends & Capital Gain Tax Worksheet, Line 6. The 15% ratio is 1 minus the just-calculated 5% ratio as shown in the preceding line.

Fillable Form 1040 Qualified Dividends and Capital Gain Tax Worksheet 2018 All forms are printable and downloadable. Form 1040 Qualified Dividends and Capital Gain Tax Worksheet 2018 On average this form takes 7 minutes to complete The Form 1040 Qualified Dividends and Capital Gain Tax Worksheet 2018 form is 1 page long and contains: 0 signatures 2 check-boxes 29 other fields Country of origin: US File type: PDF

How does Turbo Tax calculate Taxes for Qualified Dividends? - Intuit TurboTax may be using the Qualified Dividends and Capital Gains Worksheet to calculate your tax liability. To be sure of what worksheet you need to check, look at your Form 1040/1040SR Wks. The tax computation is on the Tax Smart Worksheet that is located between Line 15 and Line 16. If A1 is checked, your tax liability came from the tax tables ...

10++ Capital Gains Tax Worksheet - Worksheets Decoomo Qualified dividends and capital gain tax worksheet: Mary kay tax worksheet 2019 worksheet : Complete the rest of form 1040, 1040. If the amount on line 7 is $100,000 or more, use the tax computation. 13 pics about irs form 1041 schedule d download fillable.

Qualified Dividends and Capital Gain Tax - prd.taxact.com Qualified Dividends and Capital Gain Tax. Information reported to you on Form 1099-DIV and Form 1099-B can be entered in the TaxAct program in the Investment Income section of the Federal Q&A, or directly on the forms where applicable. The Tax Summary screen will indicate if the tax has been computed on the Schedule D Worksheet or the Qualified ...

Qualified Dividends And Capital Gain Tax Worksheet Fillable 2019 - Fill ... Complete Qualified Dividends And Capital Gain Tax Worksheet Fillable 2019 in a few minutes following the guidelines listed below: Find the document template you need from our collection of legal form samples. Select the Get form key to open it and start editing. Fill in all of the requested fields (they are marked in yellow).

1040 Tax Calculator 1040 Tax Calculator. Enter your filing status, income, deductions and credits and we will estimate your total taxes. Based on your projected tax withholding for the year, we can also estimate your tax refund or amount you may owe the IRS next April. ... We encourage you to seek personalized advice from qualified professionals regarding all ...

:max_bytes(150000):strip_icc()/TermDefinitions_Qualifieddividend_finalv1-9f7e2ee27e0242fabaade0f962d88d8d.png)

0 Response to "41 qualified dividends and capital gain tax worksheet calculator"

Post a Comment