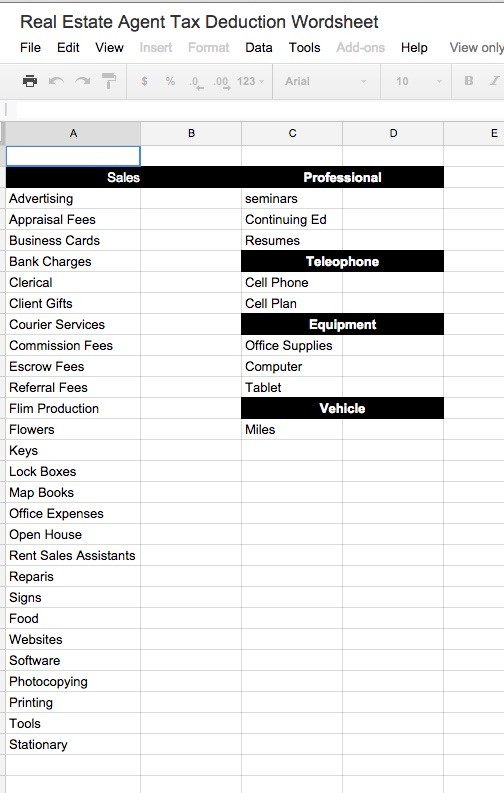

41 realtor tax deduction worksheet

PDF Realtors Tax Deductions Worksheet Realtors Tax Deductions Worksheet AUTO TRAVEL Your auto expense is based on the number of qualified business miles you drive. Expenses for travel between business locations or daily transportation expenses between your residence and temporary work locations are deductible; include them as business miles. Expenses for your trips between home and Realtors Tax Deductions Worksheet | Golfnrealtor Publication 17 - Your Federal Income Tax (For Individuals) - Part D. Figuring and Claiming the EIC. EIC Worksheet B. Use EIC Worksheet B if you were self-employed at any time in 2017 or are a member of the. 16 Real Estate Tax Deductions for 2019 | 2019 Checklist Hurdlr - In fact, nearly all of the real estate agents we polled want to ...

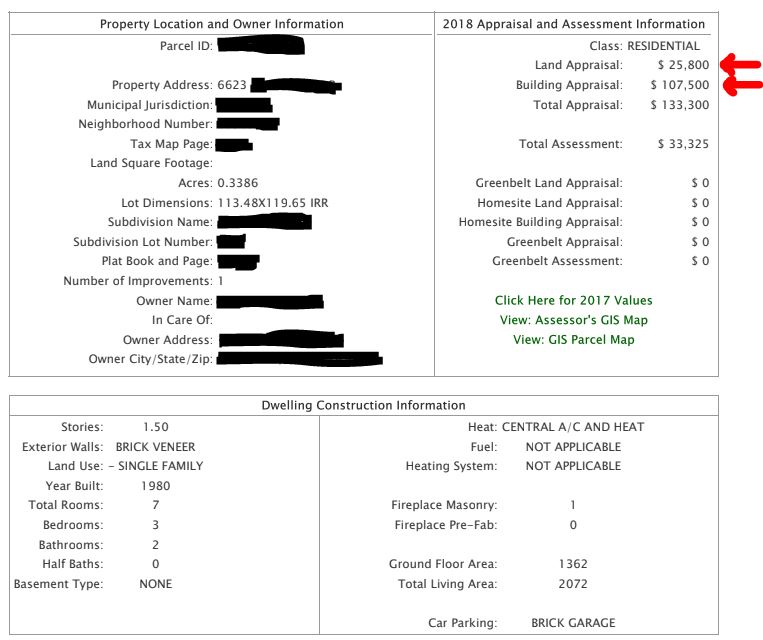

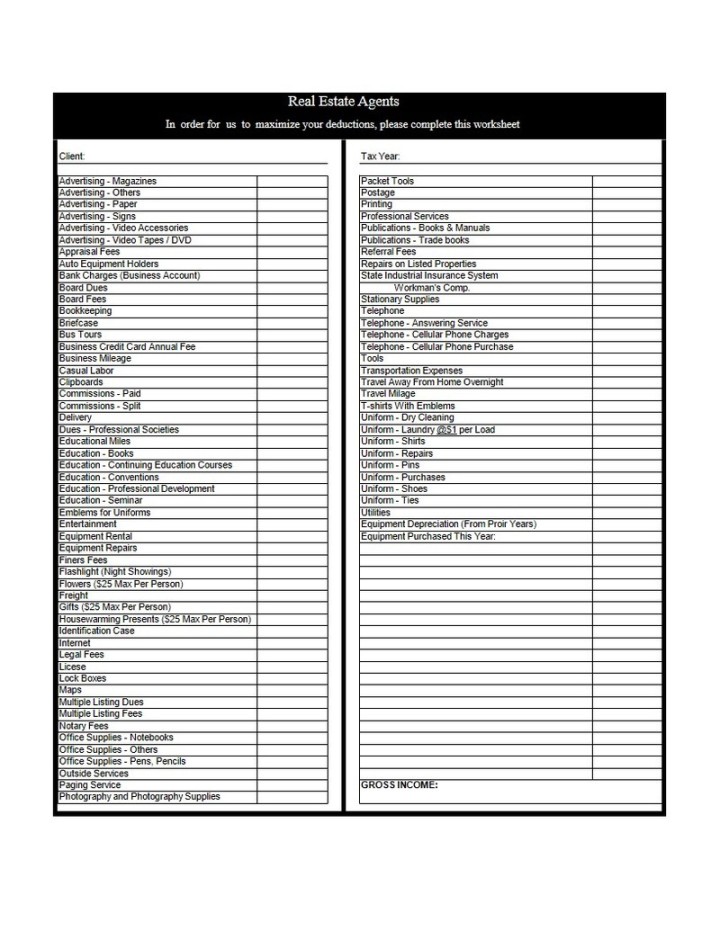

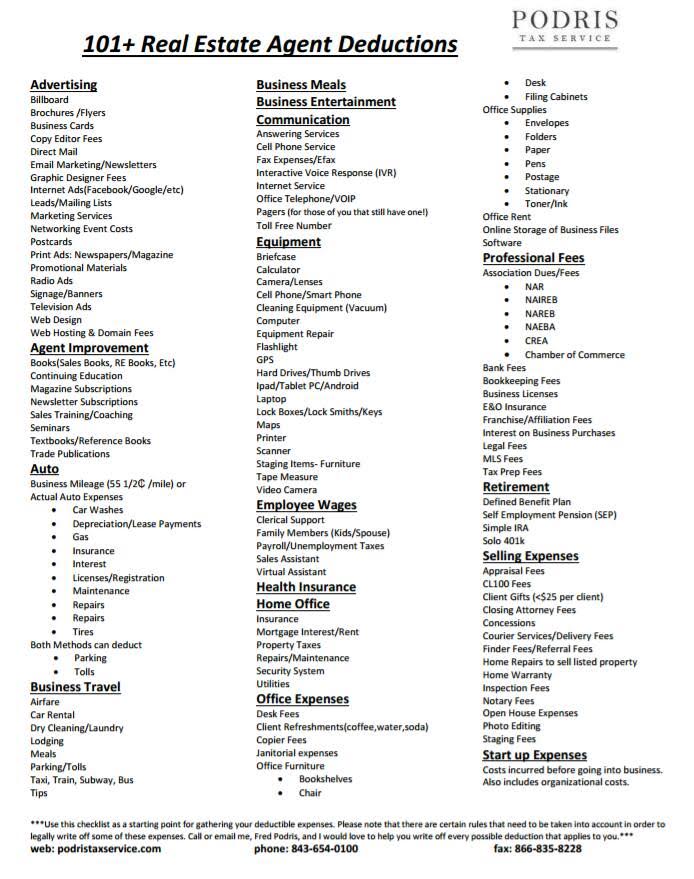

Real Estate Appraisers Tax Deductions 2021-2022 (Ultimate Guide) This is an important Tax Deductions for Real Estate Agents for 2021-2022 as many real estate agents pay for Desk Fee or shared cost of utilities for their office. 11. Business Gifts ($25 Deduction Limit) IRS allows Business Gifts of $25 Per person Per year.

Realtor tax deduction worksheet

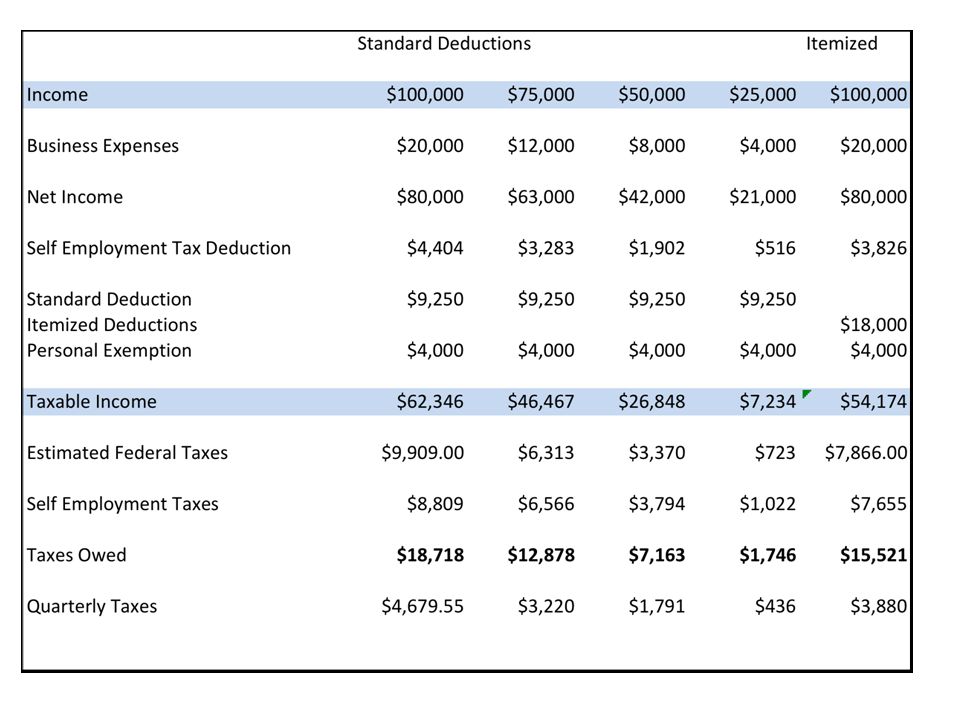

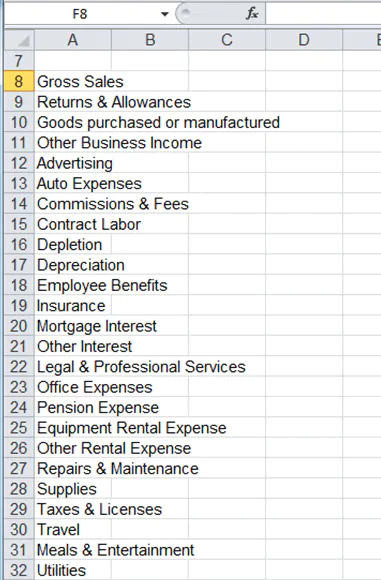

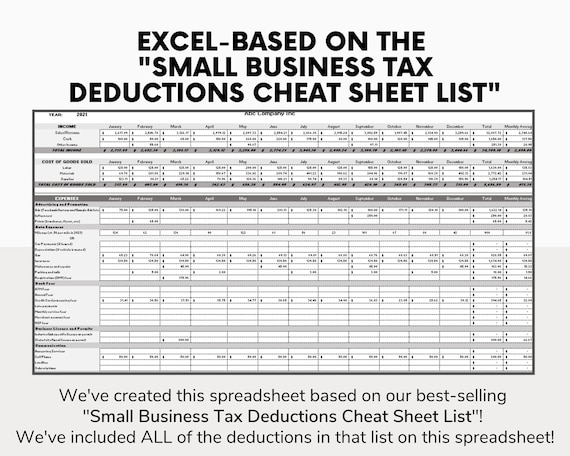

Realtor Tax Deduction Worksheet Form - signNow Realtor Tax Deduction Worksheet Form Create a custom real estate agent tax deductions worksheet 2021 that meets your industry's specifications. Show details How it works Browse for the realtor tax deductions worksheet Customize and eSign realtor tax deduction checklist Send out signed real estate agent tax deductions worksheet or print it Top 20 Real Estate Agent Tax Deductions in 2023 - Bonsai You can claim a vehicle tax deduction using two methods: Standard Mileage Deduction Itemized Deduction Standard mileage deduction involves you taking a cost per mileage driven for business purposes. For the tax year 2021, the standard mileage rate for use of a car (also vans, pickups, or panel trucks) is 56 cents per mile driven. Create a Realtor Expense Spreadsheet (+Template) | Kyle Handy In addition to tax deductions and expenses, there are also spreadsheets for real estate investing, house flipping, rental properties, and more. The type of expense spreadsheet you need depends on the type of expenses that you're tracking. Here are a few types of spreadsheets you might need: Real estate investment.

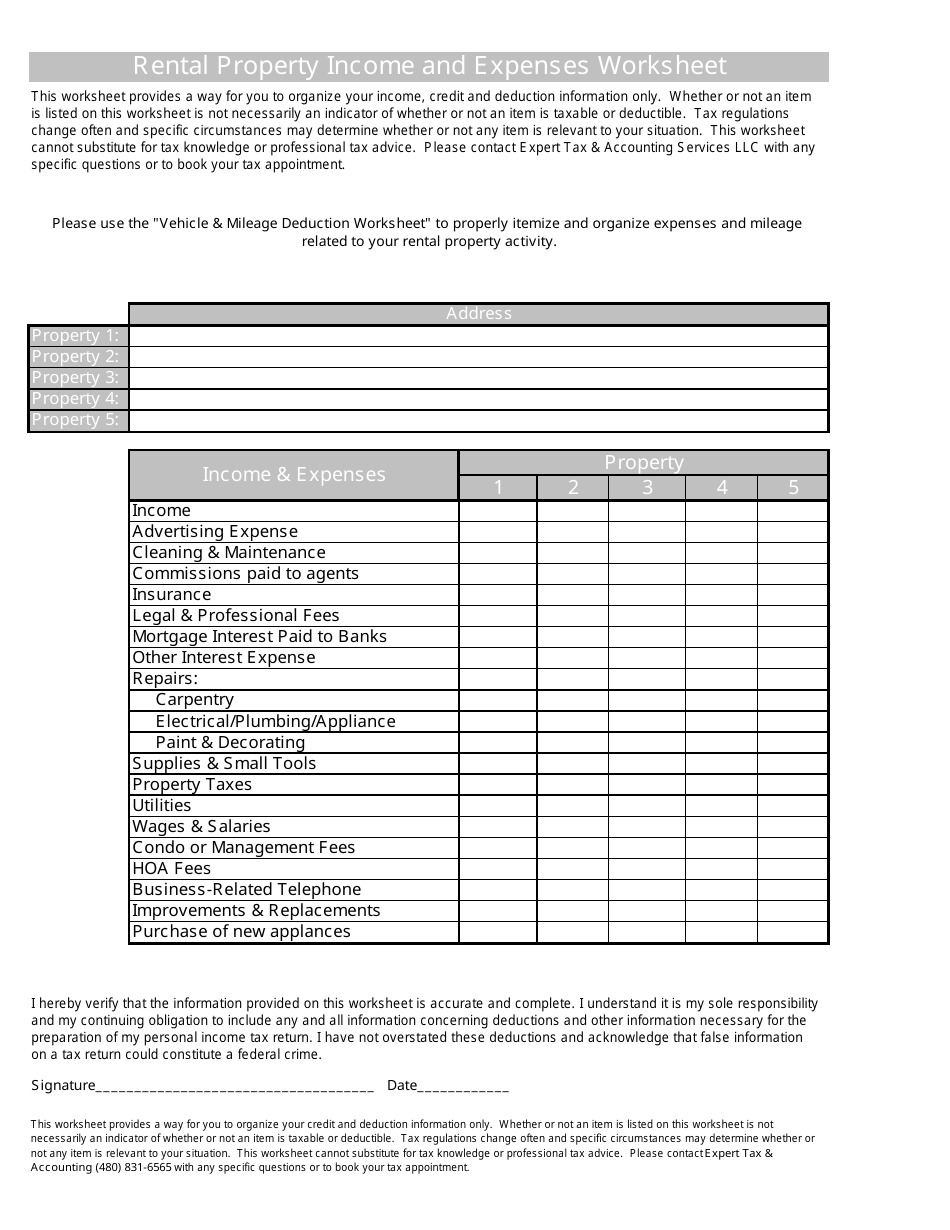

Realtor tax deduction worksheet. Realtors Tax Deductions Worksheet | Grahampaint Some of the worksheets displayed are Realtors tax deductions work, Real estate income expense work, Real estate agentbroker, Realtor deductions, Real estate evaluation work, Rental property work, Real estate agent tax work, Small business work. Once you find your worksheet, click on pop-out icon or print icon to worksheet to print or download. 16 Real Estate Tax Deductions for 2022 | 2022 Checklist Hurdlr Real estate agents can deduct legal and professional fees to the extent they are an ordinary part of and necessary to operations. Deduction #4 Show Detail Advertising Expense The IRS allows you to deduct reasonable advertising expenses that are directly related to your business activities. Deduction #5 Show Detail Home Office Deduction 10 Tax Deductions for Real Estate Agents & Realtors in 2022 As long as it's truly for business purposes, breaking bread is a tax deductions for real estate agents up to 50% of your bill, including tax and tips. 10. Business Items, Tools, and Stationary Expenses. Any material items you use to perform the day-to-day tasks of your job may be deductible or depreciable, such as office supplies, copies and ... 51 Real Estate Agent Tax Deductions You Should Know Marketing tax deductions mean every dollar you spend on growing your real estate business is worth two or more dollars in tax savings. These are fully deductible business expenses you must be aware of. Such deductions include: 1. Open-house signs 2. Listing flyers 3. Business cards 4. Website development and maintenance 5. Direct mail 6.

A Free Home Office Deduction Worksheet to Automate Your Tax Savings The worksheet will automatically calculate your deductible amount for each purchase in Column F. If it's a "Direct Expense," 100% of your payment amount will be tax-deductible. If it's an expense in any other category, the sheet will figure out the deductible amount using your business-use percentage. Dragging down the deductible amount formula Real Estate Agent Tax Deduction Wordsheet - Google Sheets Real Estate Agent Tax Deduction Wordsheet - Google Sheets Some fonts could not be loaded. Try reloading when you're online. Dismiss Something went wrong. Reload. Real Estate Agent Tax Deduction... Self-Employed Tax Deductions Worksheet (Download FREE) - Bonsai If you are concerned with how much you'll owe, don't worry. The team at Bonsai organized this self-employed tax deductions worksheet (copy and download here) to organize your deductible business expenses for free. Simply follow the instructions on this sheet and start lowering your Social Security and Medicare taxes. Realtor Tax Deductions And Tips You Must Know - Easy Agent PRO If a Realtor uses part of their home exclusively and regularly for business, some mortgage, utility, tax and insurance expenses may also be deductible. For the second year, taxpayers can use a new and simpler calculation of $5 per square foot for a maximum of 300 square feet.

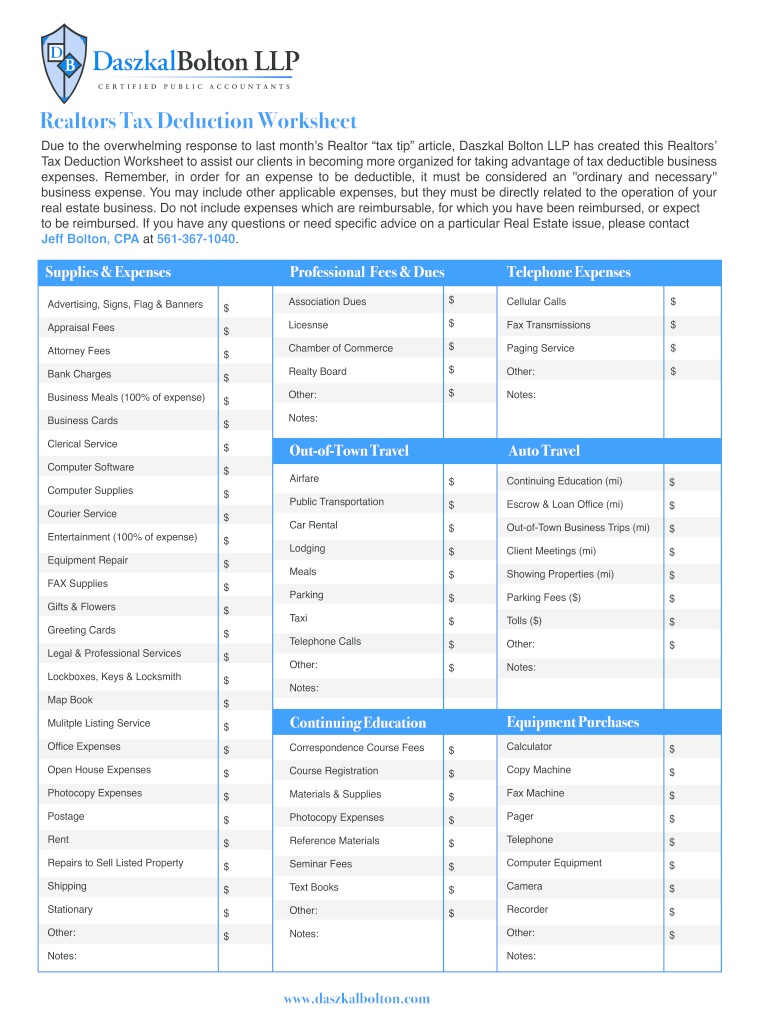

21 Tax Write-Offs for Real Estate Agents - Keeper Tax NAICS code: 531210. You've likely heard the saying: "You need to spend money to make money." This tends to especially apply to real estate agents, who often need to invest a fair chunk of money into their business upfront to attract clients. For instance, paying for social media ads to promote your services, offering bonuses to prospective ... 115 Popular Tax Deductions For Real Estate Agents For 2022 - Kyle Handy Most real estate agent marketing expenses will fall under the category of a tax deduction. Whether it's sales and open house signs and flyers or business cards, these types of marketing materials are all tax deductions for real estate agents. Get Daszkal Bolton Realtors Tax Deduction Worksheet - US Legal Forms Ensure that the info you fill in Daszkal Bolton Realtors Tax Deduction Worksheet is updated and correct. Include the date to the record with the Date feature. Select the Sign icon and create an e-signature. You will find three available alternatives; typing, drawing, or uploading one. Be sure that every field has been filled in properly. tax deduction worksheet for realtors: Fill out & sign online | DocHub Real estate agent tax deductions worksheet 2021. Get the up-to-date real estate agent tax deductions worksheet 2021-2022 now Get Form. 4.6 out of 5. 54 votes. DocHub Reviews. 44 reviews. DocHub Reviews. 23 ratings. 15,005. 10,000,000+ 303. 100,000+ users . Here's how it works. 01. Edit your checklist texas realtor tax deductions tax forms online

Tax Deduction Worksheet for Realtors Form - Fill Out and Sign Printable ... Follow the step-by-step instructions below to design your tax deductions for a rEvaltor form: Select the document you want to sign and click Upload. Choose My Signature. Decide on what kind of signature to create. There are three variants; a typed, drawn or uploaded signature. Create your signature and click Ok. Press Done.

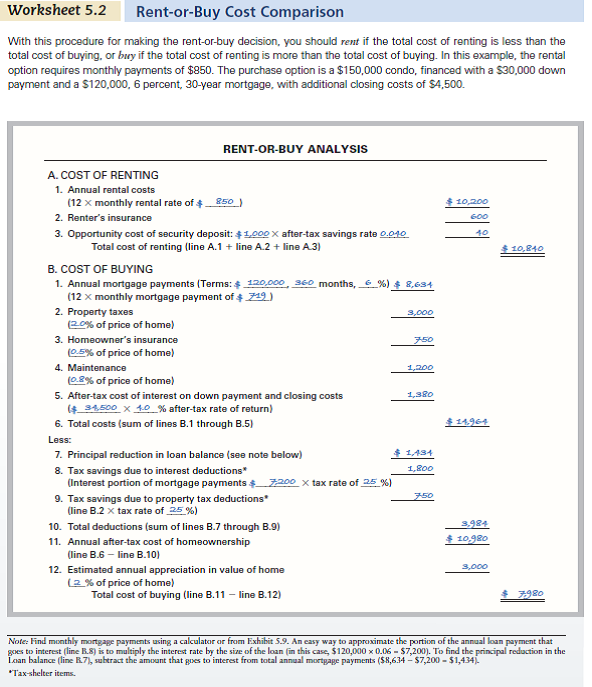

Worksheet Deductions Tax Realtors - Altelainc Homeownership Tax Deductions Publication 936 (2018), Home Mortgage Interest Deduction. - mortgage insurance premiums. The itemized deduction for mortgage insurance premiums expired on December 31, 2017. At the time this publication went to print, Congress was considering legislation to extend the itemized deduction for mortgage insurance ...

Tax Deductions for Real Estate Agents 2022: Ultimate Guide 6 Real Estate Agent Car Tax Deduction 6.1 Simple Method (Standard Mileage Deduction) 6.2 Actual Method 7 Business Travel & Meals 8 Home Office Deduction 8.1 Simplified Method for Realtors 8.2 Detailed Method for Realtors 9 Office Rent And Utilities 10 Business Gifts ($25 Deduction Limit) 11 Expenses Paid on Clients Behalf

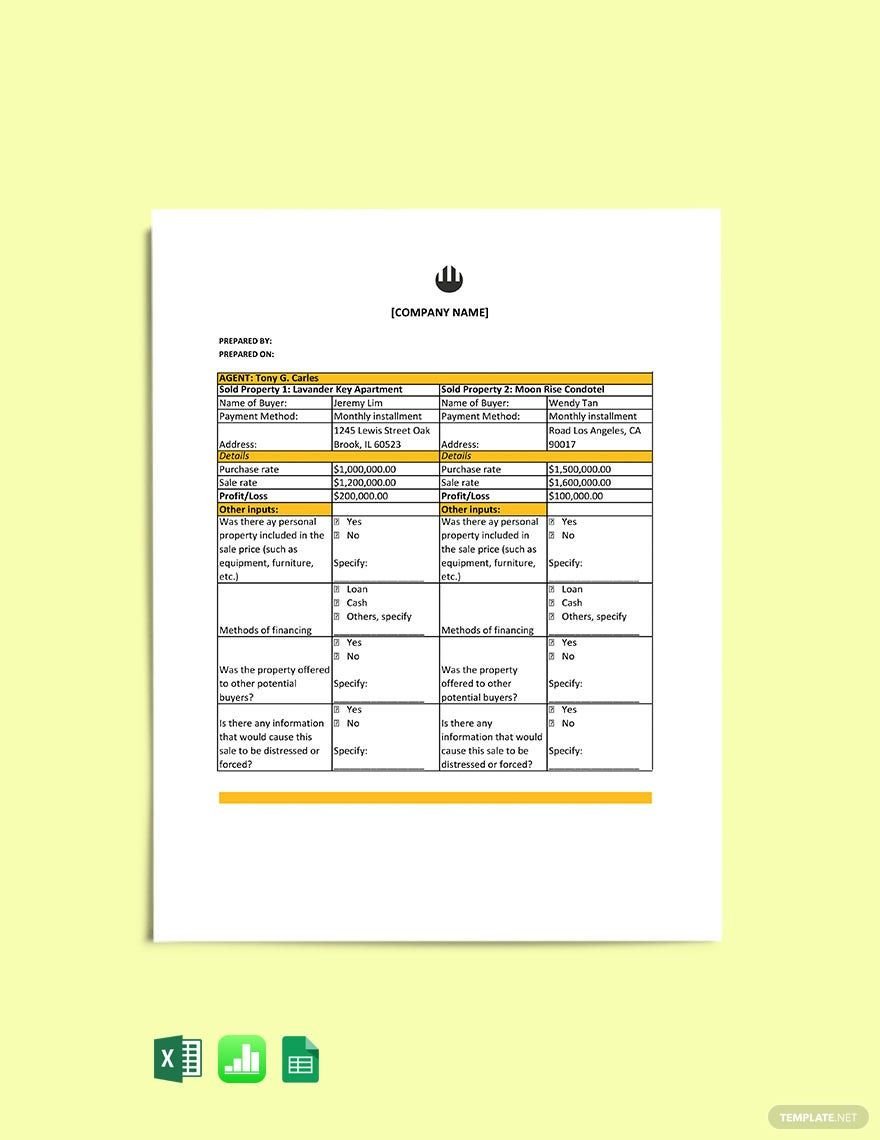

Create a Realtor Expense Spreadsheet (+Template) | Kyle Handy In addition to tax deductions and expenses, there are also spreadsheets for real estate investing, house flipping, rental properties, and more. The type of expense spreadsheet you need depends on the type of expenses that you're tracking. Here are a few types of spreadsheets you might need: Real estate investment.

Top 20 Real Estate Agent Tax Deductions in 2023 - Bonsai You can claim a vehicle tax deduction using two methods: Standard Mileage Deduction Itemized Deduction Standard mileage deduction involves you taking a cost per mileage driven for business purposes. For the tax year 2021, the standard mileage rate for use of a car (also vans, pickups, or panel trucks) is 56 cents per mile driven.

Realtor Tax Deduction Worksheet Form - signNow Realtor Tax Deduction Worksheet Form Create a custom real estate agent tax deductions worksheet 2021 that meets your industry's specifications. Show details How it works Browse for the realtor tax deductions worksheet Customize and eSign realtor tax deduction checklist Send out signed real estate agent tax deductions worksheet or print it

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

![Independent Contractor Expenses Spreadsheet [Free Template]](https://assets-global.website-files.com/5cdcb07b95678db167f2bd86/6238fcf2e45bd9fa5a86e28d_schedule-c-categories.png)

0 Response to "41 realtor tax deduction worksheet"

Post a Comment