43 clergy housing allowance worksheet

Get Clergy Housing Allowance Worksheet 2010-2022 - US Legal Forms From now on, fill out Clergy Housing Allowance Worksheet from your home, workplace, as well as on the move. Get form Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available. Video instructions and help with filling out and completing housing allowance worksheet Clergy Housing Allowance | Wespath Benefits & Investments The housing allowance permits duly ordained, commissioned, or licensed clergy in the exercise of their ministry 1 to exclude a portion of their compensation when reporting gross income for federal income tax purposes. The amount excluded must be used to provide housing. Additionally, there are limits on what can be claimed as housing expense.

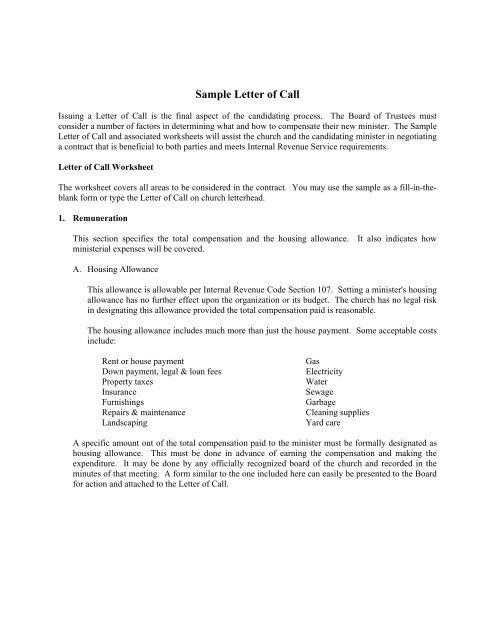

2022 Housing Allowance Form - Clergy Financial Resources The Regulations require that the housing allowance be designated pursuant to official action taken in advance of such payment by the employing church or other qualified organization. Treas. Reg. § 1.107-1 (b). While this Regulation does not require the designation to be in writing, as a practical matter the designation should always be documented in advance of payment by official action of the qualified organization.

Clergy housing allowance worksheet

Ministers' Compensation & Housing Allowance | Internal ... A minister's housing allowance (sometimes called a parsonage allowance or a rental allowance) is excludable from gross income for income tax purposes but not for self-employment tax purposes. If you receive as part of your salary (for services as a minister) an amount officially designated (in advance of payment) as a housing allowance, and the amount isn’t more than reasonable pay for your services, you can exclude from gross income the lesser of the following amounts: CLERGY HOUSING ALLOWANCE WORKSHEET - Indiana-Kentucky Synod CLERGY HOUSING ALLOWANCE WORKSHEET tax return for year 200____ NOTE: This worksheet is provided for educational purposes only. You should discuss your specific situation with your professional advisors, including the individual who assists with preparation of your final tax return. METHOD 1: Amount actually spent for housing this year: CLERGY HOUSING ALLOWANCE WORKSHEET EXCLUDABLE HOUSING ALLOWANCE FOR TAX YEAR 201_____: Your excludable housing allowance will be the smallest of Methods 1, 2 or 3. NOTE: This worksheet is provided for educational and tax preparation purposes only. You should discuss your specific situation with your professional tax advisors. Clergy Financial Resources

Clergy housing allowance worksheet. CLERGY HOUSING ALLOWANCE WORKSHEET EXCLUDABLE HOUSING ALLOWANCE FOR TAX YEAR 201_____: Your excludable housing allowance will be the smallest of Methods 1, 2 or 3. NOTE: This worksheet is provided for educational and tax preparation purposes only. You should discuss your specific situation with your professional tax advisors. Clergy Financial Resources CLERGY HOUSING ALLOWANCE WORKSHEET - Indiana-Kentucky Synod CLERGY HOUSING ALLOWANCE WORKSHEET tax return for year 200____ NOTE: This worksheet is provided for educational purposes only. You should discuss your specific situation with your professional advisors, including the individual who assists with preparation of your final tax return. METHOD 1: Amount actually spent for housing this year: Ministers' Compensation & Housing Allowance | Internal ... A minister's housing allowance (sometimes called a parsonage allowance or a rental allowance) is excludable from gross income for income tax purposes but not for self-employment tax purposes. If you receive as part of your salary (for services as a minister) an amount officially designated (in advance of payment) as a housing allowance, and the amount isn’t more than reasonable pay for your services, you can exclude from gross income the lesser of the following amounts:

0 Response to "43 clergy housing allowance worksheet"

Post a Comment