44 itemized deductions worksheet 2015

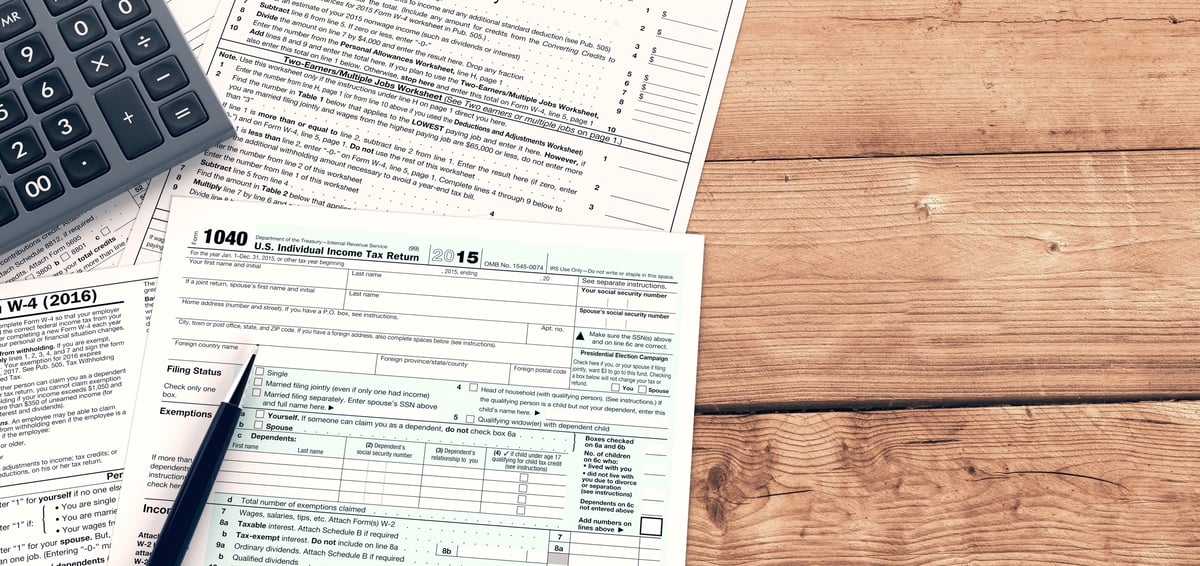

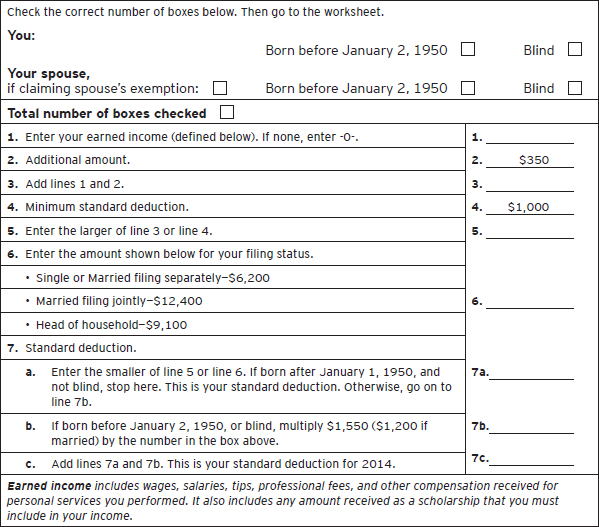

1040 (2021) | Internal Revenue Service - IRS tax forms Line 12a Itemized Deductions or Standard Deduction. Itemized Deductions; Standard Deduction. Exception 1—Dependent. Exception 2—Born before January 2, 1957, or blind. Exception 3—Separate return or dual-status alien. Exception 4—Increased standard deduction for net qualified disaster loss. Standard Deduction Worksheet for Dependents—Line 12a; Line … Publication 587 (2021), Business Use of Your Home If you are itemizing your deductions, when completing line 17 of this worksheet version of Form 4684, enter 10% of your adjusted gross income excluding the gross income and deductions attributable to the business use of the home. Do not file this worksheet version of Form 4684; instead, keep it for your records. You will complete a separate Form 4684 to attach to your …

2021 Schedule A (Form 1040) - IRS tax forms Itemized Deductions . 16. Other—from list in instructions. List type and amount .

Itemized deductions worksheet 2015

Publication 501 (2021), Dependents, Standard Deduction, and ... The standard deduction for taxpayers who don't itemize their deductions on Schedule A of Form 1040 or 1040-SR is higher for 2021 than it was for 2020. The amount depends on your filing status. You can use the 2021 Standard Deduction Tables near the end of this publication to figure your standard deduction. Charitable contribution deduction. Publication 535 (2021), Business Expenses | Internal Revenue … Under this method, you claim your allowable mortgage interest, real estate taxes, and casualty losses on the home as itemized deductions on Schedule A (Form 1040). You are not required to allocate these deductions between personal and business use, as is required under the regular method. If you use the optional method, you cannot depreciate the portion of your home used … Publication 590-A (2021), Contributions to Individual Retirement ... Enter your compensation minus any deductions on Schedule 1 (Form 1040), line 15 (deductible part of self-employment tax), and Schedule 1 (Form 1040), line 16 (self-employed SEP, SIMPLE, and qualified plans). If you are filing a joint return and your compensation is less than your spouse's, include your spouse's compensation reduced by his or her traditional IRA and Roth …

Itemized deductions worksheet 2015. Publication 17 (2021), Your Federal Income Tax - IRS tax forms Part Three - Standard Deduction, Itemized Deductions, and Other Deductions; Part Four - Figuring Your Taxes, and Refundable and Nonrefundable Credits ; Publication 17 - Additional Material. Tax Tables; Your Rights as a Taxpayer. The Taxpayer Bill of Rights. 1. The Right to Be Informed. 2. The Right to Quality Service. 3. The Right to Pay No More than the Correct … 2021 Instructions for Schedule A - IRS tax forms 2021 Instructions for Schedule AItemized Deductions Use Schedule A (Form 1040) to figure your itemized deductions. In most cases, your federal income tax will be less if you take the larger of your itemized deductions or your standard deduction. If you itemize, you can deduct a part of your medical and dental expenses, and amounts you paid for certain taxes, interest, … Publication 529 (12/2020), Miscellaneous Deductions The excess deductions retain their character as an adjustment to arrive at adjusted gross income on Schedule 1 (Form 1040), as a non-miscellaneous itemized deduction reported on Schedule A (Form 1040), or as a miscellaneous itemized deduction. For more information on excess deductions of an estate or trust, see the Instructions for Schedule K-1 (Form 1041) for a … Publication 505 (2022), Tax Withholding and Estimated Tax Don’t use either worksheet if you will itemize deductions or claim tax credits on your 2022 return. Instead, see Itemizing deductions or claiming credits next.. Itemizing deductions or claiming credits. If you had no tax liability for 2021, and you will: Itemize deductions, or. Claim a tax credit, use Worksheet 2-1 (also, see chapter 2) to figure your 2022 expected tax liability. …

Publication 3 (2021), Armed Forces' Tax Guide Publication 3 - Introductory Material What's New Reminders Introduction. Due date of return. File Form 1040 or 1040-SR by April 18, 2022. The due date is April 18, instead of April 15, because of the Emancipation Day holiday in the District of Columbia—even if you don’t live in the District of Columbia. Publication 590-A (2021), Contributions to Individual Retirement ... Enter your compensation minus any deductions on Schedule 1 (Form 1040), line 15 (deductible part of self-employment tax), and Schedule 1 (Form 1040), line 16 (self-employed SEP, SIMPLE, and qualified plans). If you are filing a joint return and your compensation is less than your spouse's, include your spouse's compensation reduced by his or her traditional IRA and Roth … Publication 535 (2021), Business Expenses | Internal Revenue … Under this method, you claim your allowable mortgage interest, real estate taxes, and casualty losses on the home as itemized deductions on Schedule A (Form 1040). You are not required to allocate these deductions between personal and business use, as is required under the regular method. If you use the optional method, you cannot depreciate the portion of your home used … Publication 501 (2021), Dependents, Standard Deduction, and ... The standard deduction for taxpayers who don't itemize their deductions on Schedule A of Form 1040 or 1040-SR is higher for 2021 than it was for 2020. The amount depends on your filing status. You can use the 2021 Standard Deduction Tables near the end of this publication to figure your standard deduction. Charitable contribution deduction.

0 Response to "44 itemized deductions worksheet 2015"

Post a Comment