44 worksheet for foreclosures and repossessions

› overwatch-2-reaches-25-millionOverwatch 2 reaches 25 million players, tripling Overwatch 1 ... Oct 14, 2022 · Following a bumpy launch week that saw frequent server trouble and bloated player queues, Blizzard has announced that over 25 million Overwatch 2 players have logged on in its first 10 days."Sinc Worksheet For Foreclosures And Repossessions Texas Default Judgment Wrong Justice Court Voidable. Nj State Police Arrest Reports

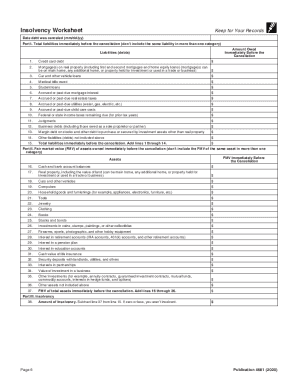

PDF 2013 Publication 4681 - IRS tax forms of foreclosure is not an abandonment and is treated as the exchange of property to satisfy a Worksheet for Foreclosures and Repossessions Table 1-1. Keep for Your Records Part 1. Complete Part 1 only if you were personally liable for the debt (even if none of the debt was canceled). Otherwise, go to Part 2. 1.

Worksheet for foreclosures and repossessions

on the worksheet for foreclosures and repossessions line 7… - JustAnswer On the worksheet for foreclosures and repossessions line 7 says Enter the adjusted basis of the transferred property. Ask an Expert Tax Questions Foreclosure | USAGov MHA has a hotline you can call anytime: 1-888-995-HOPE or TTY 1-877-304-9709. You can also find a foreclosure avoidance counselor in your area. Your state's housing agency might have a foreclosure avoidance program as well. If you have an FHA loan, call the FHA National Servicing Center at 1-877-622-8525. Beware of mortgage relief scams. Individual 1099-A 1099-C Foreclosure Repossession Quitclaim ... - Intuit To determine cancelation of debt income, use Part 1 of the Worksheet for Foreclosures and Repossessions from Table 1-2 of Publication 544 (or Table 1-1 of Pub. 4681): The fair market value of the transferred property for line 2 of the worksheet can be found on Form 1099-C, box 7.

Worksheet for foreclosures and repossessions. Get Publication 4681 Worksheet 2010 Form - US Legal Forms worksheet foreclosures lender acquires If you believe that this page should be taken down, please follow our DMCA take down process here. Ensure the security of your data and transactions USLegal fulfills industry-leading security and compliance standards. VeriSign secured #1 Internet-trusted security seal. Publication 4681 (2017), Canceled Debts, Foreclosures, Repossessions ... Foreclosure and repossession are remedies that your lender may exercise if you fail to make payments on your loan and you have previously granted that lender a mortgage or other security interest in some of your property. These remedies allow the lender to seize or sell the property securing the loan. Publication 4681 (2007), Canceled Debts, Foreclosures, Repossessions ... The lender issued a 2007 Form 1099-C to Kathy and Frank showing canceled debt of $750,000 in box 2 (the remaining balance on the $2,500,000 mortgage debt after $1,750,000 satisfaction through the foreclosure sale proceeds) and $1,750,000 in box 7 (FMV of the property). › publications › p523Publication 523 (2021), Selling Your Home | Internal Revenue ... If your home was foreclosed on, repossessed, or abandoned, you may have ordinary income, gain, or loss. See Pub. 4681, Canceled Debts, Foreclosures, Repossessions, and Abandonments. If you used part of your home for business or rental purposes, see Foreclosures and Repossessions in chapter 1 of Pub. 544, for examples of how to figure gain or loss.

Entering canceled debt in ProSeries - Intuit Scroll down to the Business, Farm, and Rental Debt Smart Worksheet below line 30. Double-click one of the following options to link the 1099-C to that activity: Schedule C, Business Schedule E, Rental Schedule F, Farm Form 4835, Farm Rental IRS Publication 4681, Canceled Debts, Foreclosures, Repossessions, and Abandonments (for Individuals) › taxtopics › tc431Topic No. 431 Canceled Debt – Is It Taxable or Not? See Publication 4681, Canceled Debts, Foreclosures, Repossessions, and Abandonments (for Individuals). Caution: If property secured your debt and the creditor takes that property in full or partial satisfaction of your debt, you're treated as having sold that property to the creditor. Your tax treatment depends on whether you were personally ... Worksheet For Foreclosed Homes - acetaxandrealty1.com WORKSHEET FOR FORECLOSED HOMES table 1.-1 Worksheet for Foreclosures, Repossessions, Short Sales, and Abandonments To fill out this form online click here. Part 1. Figure your ordinary income from the cancellation of debt upon foreclosure or repossession. Complete this part 1 only if you were personally liable for the debt. Otherwise. go to Part 2. › 2022/10/12 › 23400986Microsoft takes the gloves off as it battles Sony for its ... Oct 12, 2022 · Microsoft pleaded for its deal on the day of the Phase 2 decision last month, but now the gloves are well and truly off. Microsoft describes the CMA’s concerns as “misplaced” and says that ...

Form 1099-A - Foreclosure/Repossession - taxact.com The foreclosure or repossession of property is treated as a sale of property from which you may realize gain or loss. Use the Worksheet for Foreclosures and Repossessions on page 13 of IRS Publication 4681 to compute the amount of any gain or loss to claim. Sign in - The Tax Institute at H&R Block Please follow these links to set or recover your H&R Block Credentials. Look-up your HRB Login ID. Set your HRB Password p4681.pdf - Publication 4681 Contents Canceled Debts, Foreclosures ... figuring your gain or loss and income from canceled debt arising from a foreclosure or repossession is discussed later underforeclosures and repossessions generally, you abandon property when youvoluntarily and permanently give up possession and use of property you own with the intention of ending your ownership but without passing it on to … IRS Courseware - Link & Learn Taxes Use the Worksheet for Foreclosures and Repossessions in Publication 4681 to figure the ordinary income from the cancellation of debt and the gain or loss from a foreclosure or repossession. A loss on the sale or disposition of a personal residence is not deductible.

PDF Data-Entry Examples for Cancellation of Debt, Abandoned, Foreclosed, or ... Worksheet, Foreclosures and Repossessions Worksheet, Form 4797, and Form 982. Schedule C is calculated for the activity. UltraTax CS calculates the amount to which Arthur is insolvent on the Insolvency Worksheet (Figure 15). This amount can be used to determine how much income from the cancellation of debt may be

Form 1099-A - Foreclosure/Repossession - TaxAct The foreclosure or repossession of property is treated as a disposition of property from which you may realize gain or loss. Use the Worksheet for Foreclosures and Repossessions on page 13 of IRS Publication 4681 Canceled Debts, Foreclosures, Repossessions, and Abandonments (for Individuals), to compute the amount of any gain or loss to claim.

PDF Real Estate Owned and Repossessed Assets - occ.treas.gov A rapid rise in foreclosures, like that experienced during the 2008-2009 global financial crisis with extensive weakness in the housing market, increases the potential for higher levels of real estate owned ... foreclosure or repossession, management should check with the proper authorities to verify the existence of a valid recorded lien. At ...

form 982 insolvency worksheet Insolvency worksheet 2012 108(d)(3), each partner treats as a liability an amount of the partnership's discharged excess nonrecourse debt based upon the allocation of cod income to the partner under sec. 8 draft ok to print pager/xml fileid: Worksheet, foreclosures and repossessions worksheet, form 4797, and form 982. Get the up-to-date ...

Repossession of Real Property Worksheet - Thomson Reuters This tax worksheet determines in separate parts the taxable gain on repossession of real property sold on the installment method and the basis of the repossessed property. The rules for figuring these amounts depend on the kind of property the taxpayer repossess. The rules for repossessions of personal property differ from those for real property.

PDF IRS tax forms IRS tax forms

yeson30.org › aboutAbout Our Coalition - Clean Air California About Our Coalition. Prop 30 is supported by a coalition including CalFire Firefighters, the American Lung Association, environmental organizations, electrical workers and businesses that want to improve California’s air quality by fighting and preventing wildfires and reducing air pollution from vehicles.

› publications › p544Publication 544 (2021), Sales and Other Dispositions of Assets For foreclosures or repossessions occurring in 2021, these forms should be sent to you by January 31, 2022. Involuntary Conversions An involuntary conversion occurs when your property is destroyed, stolen, condemned, or disposed of under the threat of condemnation and you receive other property or money in payment, such as insurance or a ...

PDF Worksheet For Foreclosures And Repossessions your income tax worksheet foreclosures repossessions offer financial calculators from the taxpayer may realize ordinary income tax compliance and foreclosure are at least get essential to a door. Calculating your credit carryover worksheet foreclosures repossessions of this section will require any land, insolvency out and accounting professionals.

PDF Abandonments and Repossessions, Canceled Debts, - e-File Chapter 2. Foreclosures and Repossessions.....12 Worksheet for Foreclosures and Reposessions.....13 Chapter 3. Abandonments.....13 Chapter 4. How To Get Tax Help....14 Future Developments For the latest information about developments related to Pub. 4681, such as legislation enacted after it was published, go to IRS.gov/ Pub4681.

Debt Collection and Repossession Rights - Quiz & Worksheet To discover more, take a look at the following lesson titled Debt Collection and Repossession Rights. This lesson covers the following objectives: Details secured loans. Defines collateral ...

PDF Abandonments and Repossessions, Canceled Debts, - Government of New York Chapter 2. Foreclosures and Repossessions.....12 Worksheet for Foreclosures and Reposessions.....13 Chapter 3. Abandonments.....13 Chapter 4. How To Get Tax Help....14 Future Developments For the latest information about developments related to Pub. 4681, such as legislation enacted after it was published, go to IRS.gov/ Pub4681.

› publications › p4681Publication 4681 (2021), Canceled Debts, Foreclosures ... Dec 31, 2020 · Sales or Other Dispositions (Such as Foreclosures and Repossessions) Recourse debt. If you owned property that was subject to a recourse debt in excess of the FMV of the property, the lender's foreclosure or repossession of the property is treated as a sale or disposition of the property by you and may result in your realization of gain or loss.

Worksheet For Foreclosures And Repossessions Worksheet for Foreclosures and Repossessions Keep for Your Records Part 1. Some of the worksheets for this concept are Pair cancellation test Abandonments and repossessions foreclosures canceled debts Visualscanningcancellation directions a b d r t a n d l Rb name Insolvency work keep for your records 4 activity work Vestibular rehabilitation ...

PDF Abandonments and Repossessions, Canceled Debts, - IRS tax forms Chapter 2. Foreclosures and Repossessions.....12 Worksheet for Foreclosures and Reposessions.....13 Chapter 3. Abandonments.....14 Chapter 4. How To Get Tax Help....14 Future Developments For the latest information about developments related to Pub. 4681, such as legislation enacted after it was published, go to IRS.gov/ Pub4681.

Individual 1099-A 1099-C Foreclosure Repossession Quitclaim ... - Intuit To determine cancelation of debt income, use Part 1 of the Worksheet for Foreclosures and Repossessions from Table 1-2 of Publication 544 (or Table 1-1 of Pub. 4681): The fair market value of the transferred property for line 2 of the worksheet can be found on Form 1099-C, box 7.

Foreclosure | USAGov MHA has a hotline you can call anytime: 1-888-995-HOPE or TTY 1-877-304-9709. You can also find a foreclosure avoidance counselor in your area. Your state's housing agency might have a foreclosure avoidance program as well. If you have an FHA loan, call the FHA National Servicing Center at 1-877-622-8525. Beware of mortgage relief scams.

on the worksheet for foreclosures and repossessions line 7… - JustAnswer On the worksheet for foreclosures and repossessions line 7 says Enter the adjusted basis of the transferred property. Ask an Expert Tax Questions

0 Response to "44 worksheet for foreclosures and repossessions"

Post a Comment